1099-G is for certain government payments The ones I got decades ago were for unemployment income. How Does a 1099 Work.

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

1099 FIRE is the system the IRS uses for electronic filing.

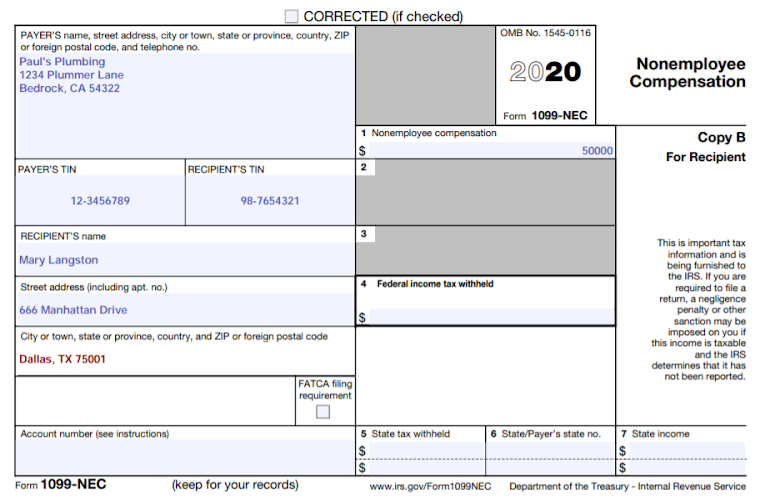

1099 form how does it work. Form 1099-NEC reports nonemployee compensation while Form 1099-MISC reports miscellaneous payments. These forms alert the IRS that this money has changed hands. From earnings made on the sale of stocks or dividends earned to receipts from freelance work 1099s are used by the IRS to keep track of non-wage income.

When you receive the form the type and amount of payments you received from the business you freelanced for will already be filled out. The type of 1099 form that you will use will depend on the type of income that you received. 1099 forms are to document taxable income.

A 1099 form enables the IRS to catch income from sources other than traditional employment wages. If you get any 1099 forms you must file a 1040 tax return even if you dont owe any taxes. Complete your purchase and place your order.

This system can help employers file and report 1099 forms with several advantages. You use your IRS Form 1099-INT to help figure out how much income you received during the year and what kind of income it was. If you miscalculate or dont report all your income you can be called for an audit by the Internal Revenue Service and penalized.

No scan print required. To begin with file form 1099 register one account for any number of Payers and file throughout the year. Forms 1099 are provided by the payer to the IRS with a copy sent to the recipient of the payments.

Since the 1099 also includes the taxpayers social security number SSN the IRS is able to check to see if an income has been reported. FIRE an acronym for Filing Information Returns Electronically is the fastest most accurate way to file any form with the IRS. A 1099-NEC lists how much money an independent contractor earned so they can pay taxes on that income.

The term 1099 refers to certain forms that an individual must complete in order to classify their work and current standing with the company as. Sign up for a free eFile360 account. The 1099 form is a record that someone another entity or person who is not your employer - sent or gave you money.

A 1099 employee is an individual who offers their services to companies and organizations as a freelancer. TRY FOR FREE NOW AND pay when you submit forms. Youll report that income in different places on your tax return.

Files are processed faster and with fewer errors The FIRE system has the ability to accept multiple files for the. The 1099 is another form that is connected to the tax return and serves as evidence that income is paid to a specific taxpayer. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes.

This form lets the IRS know that you need to report non-salary income on your taxes. For some taxpayers this can be things like investments from dividends certain government payments taxable distributions from cooperatives cancellation of debt and more. There are then several different versions of the form but the most popular is the 1099-MISC.

It can come from the bank informing you about your savings interest or from your client reflecting the money they paid for your services. Common Types of 1099 Forms. There are many different types of 1099 forms.

The payer fills out the 1099 form and sends copies to you and the IRS. A 1099 form is proof that you were given or paid money by someone or something other than your job. Who Uses the 1099.

In total the IRS provides around 17 different 1099 forms. Form 1099-MISC is for miscellaneous income. A 1099 form is an information filing form that proves some other entity besides your employer paid you money.

There are different types and sources of the 1099 form. When tax season comes around everyone likes to be prepared to file their tax returns in time and try to ensure that they dont make any mistakes. You can enter data manually or upload a spreadsheet file to complete a form.

For example you may get one if your bank paid you interest or you earned. If you paid an independent contractor more than 600 in a financial year youll need to complete a 1099-NEC. They know you got the money they want their cut or proof they dont get any.

Ad PDF signer to quickly complete and sign any PDF document online. So at the end of the year youll send them a 1099-NEC tax form. The payer completes the 1099 form and delivers it to you as well as the IRS.

A 1099 form is a record that an entity or person other than your employer gave or paid you money. The 1099-NEC will include the name address and tax identification number of the business or client who paid you and your name address and Social Security number. What is a 1099 tax form.

A 1099 employee doesnt receive benefits or have taxes deducted from their paycheck. There are 20 variants of 1099s but the most popular is the 1099-NEC. How Does a 1099 form work.

Let us help. With eFile360 you can file 1099 1098 W2 and Affordable Care Act forms in three steps. The 1099 tax form is one of the many income reporting forms that you can get from the IRS.

Here are seven common types of 1099 forms below. A 1099 tax form is used by freelancers independent contractors and everyday workers to report payments they receive from alternate sources besides a full-time employer. Choose your form type and enter or upload your form details.

Its the contractors responsibility to report their income and pay their taxes. This could be from work you did as a freelancer independent contractor or intern. There are several types of 1099 forms.

Understanding 1099 Form Samples

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Irs Form 1099 Reporting For Small Business Owners In 2020

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is The Difference Between A W 2 And 1099 Aps Payroll

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

No comments:

Post a Comment