Written by Diane Kennedy CPA on January 8 2022. Let me know if you have follow-up questions and Im always around to help you out.

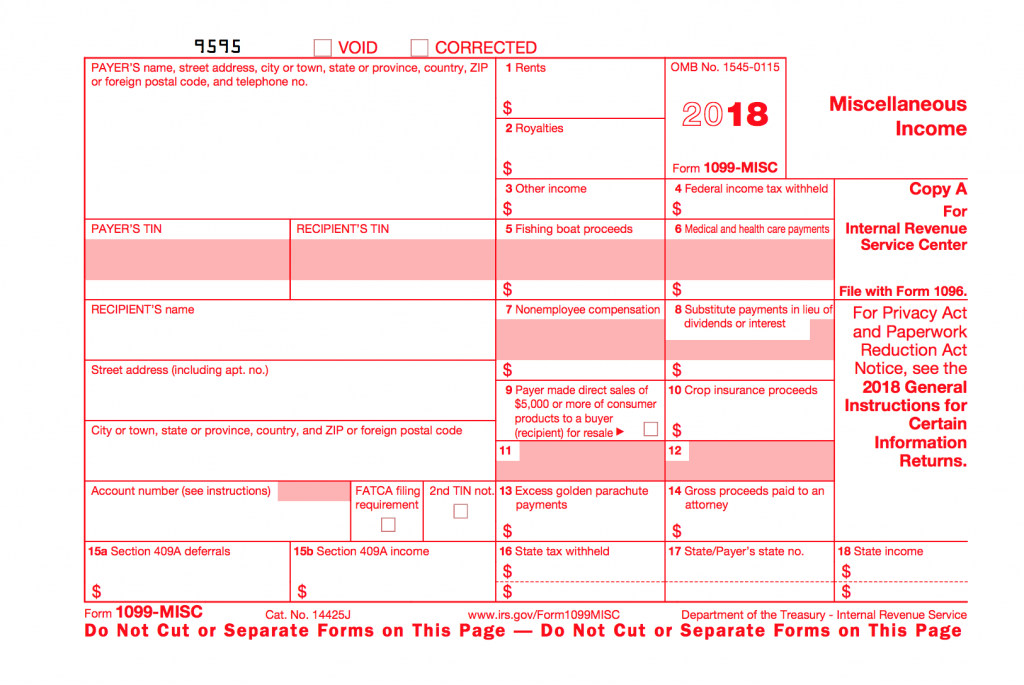

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Business entities can get a 1099-K but not a 1099-MISC but they can.

1099 k form zelle. If a payment processor has a yearly volume of 20000 or more and at least 20000 transactions from your entity then they will send you a Form 1099-K. 1099-K will report 600 income for PayPal eBay Zelle Venmo. Before Form 1099-K taxpayers who provided certain goods or services worth more than 600 were responsible for issuing Form 1099-MISC.

Form 1099 Type 1099 Threshold 2020 2021 1099 Threshold 2022. If payments you receive on the Zelle Network are taxable it is your responsibility to report them to the IRS. Now if you are a Payment Settlement Entity this new update means you are required to file a 1099-K and send a copy of the form to the IRS and the customer for processing transactions amounting to 600 or more in a year.

IRS Reporting Requirements for Third-party Vendor Payments on 1099-K1099-MISC. What is a 1099-K used for. If will be up to the taxpayer to show if 1099-K income is not taxable.

Exceptions to filing Forms 1099-MISC and 1099-NEC. Current tax law requires anyone to pay taxes on income over 600 regardless of where it comes from. This means a few things for business owners.

A change in the tax code has stated that starting in the tax year 2022 payment apps must furnish a Form 1099-K to account users with over. But that doesnt mean youre borrowing additional taxes. A 1099-K can report income for many different types of income and that income must be reported in the proper place for that type of income.

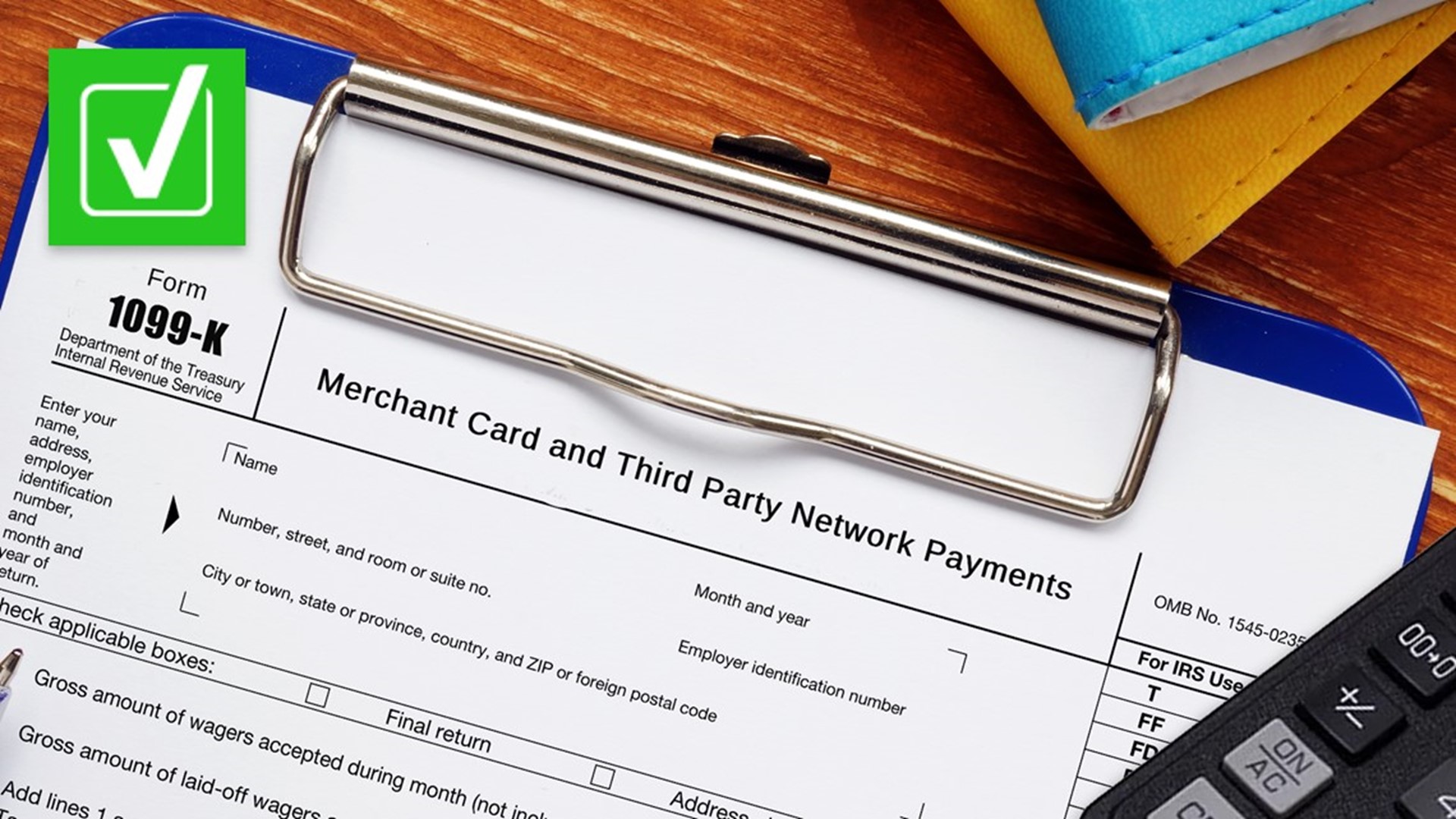

Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will. According to irsgov Form 1099-K Payment Card and Third Party Network Transactions is an IRS information return used to report certain payment transactions to improve voluntary tax compliance. It could be a bank transfer from.

Whether Zelle must issue a 1099-K depends if the IRS considers them to be a PSE. Until now the IRS usually only issued a 1099-K form for a business with at least 200 business transactions or at least 20000 in gross payments but thats changing on January 1. Current tax law requires anyone to pay taxes on income above 600 regardless of where they come from.

The rules changed on January 1 2022 if you receive electronic payments for any reason. First lets answer what is a 1099-K Form 1099-K Payment Card and Third Party Network Transactions is a tax form that should be filed with individual tax return. The taxpayer must enter the payment whether or not a 1099-K was received.

After the rule goes into effect app companies such as Zelle and Venmo might require businesses to submit additional information for the 1099-K. You should receive Form 1099-K by January 31st if in the prior calendar year you received payments. 1099-K will report 600 income for PayPal eBay Zelle Venmo.

Form 1099-K for payments to a participating payee with a foreign address as long as prior to payment the PSE has documentation on which the PSE may rely to treat the payment as made to a foreign person according to Regulations section 11441-1e1ii substituting payer for the term withholding agent and without regard to the. Unlike other varieties of the Form 1099 this form has a special purpose for payments received via a third party network or creditdebit card transaction. What the New 600 Form 1099K Means for Zelle Venmo PayPal.

Because the 1099-K implies all of it is. Yes you will likely receive a 1099-K form if you receive more than 600 on an app. For 2022 companies that previously did not have to issue a 1099-K form will now have to.

I recommend contacting them so they can help prepare these forms. This includes Venmo Cashapp and Zelle. This is way down from the current 200.

The first couple of years of the new 1099-K reporting criteria are probably going to be chaotic and confusing for taxpayers. These 1099-K forms will be filed in early 2023 for the 2022 calendar year. This only applies to income normally reported to the IRS anyway.

Im not saying they are right but there are so many of them saying this that they cant all be wrong. Form 1099-K Requirements 2021. 20000 and 200 transactions.

Venmo Cashapp and Zelle can file 1099s for you. With the advent of Form 1099-K Form 1099-MISC was not to be issued if payments were made with a credit card or payment card and certain other types of payments including third-party network transactions. Companies like Venmo Zelle and Cash App will send users Form 1099-K for transactions done either by electronic means or mail Forbes reported.

This only applies for income that would normally be reported to the IRS anyway. Im not sure if that is true if you google this 1099-k and zelle it will come up with lots of news sites saying zelle will issue you a 1099-k for over 600. What is a 1099 K.

Per the IRS instructions for a 1099-K. The form 1099-K is sent to both individuals and corporations to report payments via the processors portal. The law requiring certain payment networks to provide forms 1099K for information reporting on the sale of goods and services does not apply to the Zelle Network.

Starting in 2022 online selling and micropayment platforms will report yearly total income of more than 600 on form 1099-K. But that doesnt mean you owe any additional taxes. You can also refer to this article for more details.

Yes if you receive more than 600 in your app you may receive a 1099-K form. The change will mostly impact businesses according. The transaction amount has been lowered from 20000 to 600.

Do I Need To File 1099s Deb Evans Tax Company

Merchants Using Payment Apps Will See 2022 Tax Changes Infintech

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

Venmo Paypal And Zelle Now Reporting 600 Transactions To Irs Baller Alert

New Rule To Require Irs Tax On Cash App Business Transactions Woai

What Cash App Users Need To Know About New Tax Form Proposals Cbs8 Com

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/KDDFV3EA2JBJFDL3KCMEYOZ3MY.jpg)

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Kiro 7 News Seattle

How Does Paypal Venmo Zelle Stripe And Square Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2019 By Steph Wynne Medium

Major Changes To Form 1099 K For Contractors Molen Associates Tax Services Accounting Financial Consulting

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

No comments:

Post a Comment