03 Names shown on Form 1040 1040-SR or 1040-NR Your social security number. If you are claiming a net qualified disaster loss on Form 4684 see the instructions for line 16.

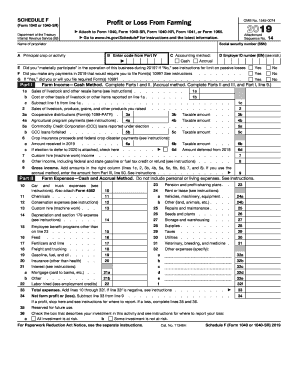

Irs Schedule F 1040 Form Pdffiller

07 Names shown on Form 1040 or 1040-SR Your social security number Medical and Dental Expenses Caution.

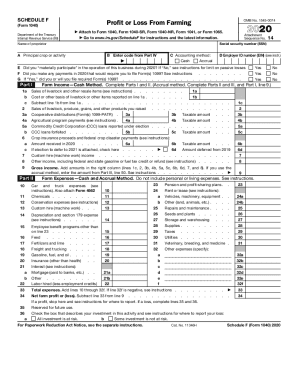

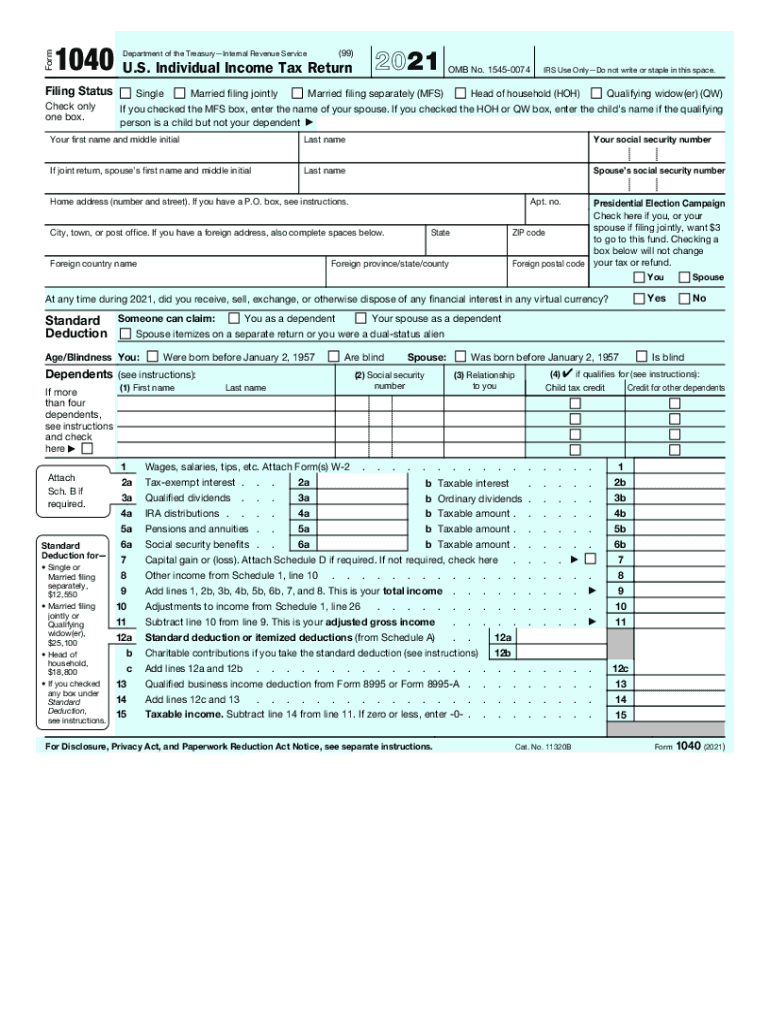

F 1040 form 2020. Your social security number. 12182020 Form 1040 Schedule F Profit or Loss From Farming 2021 12212021 Inst 1040 Schedule F Instructions for Schedule F Form 1040 or Form 1040-SR Profit or Loss From Farming 2021 12232021 Form 1040 Schedule H. Instructions for Form 1040 or Form 1040-SR US.

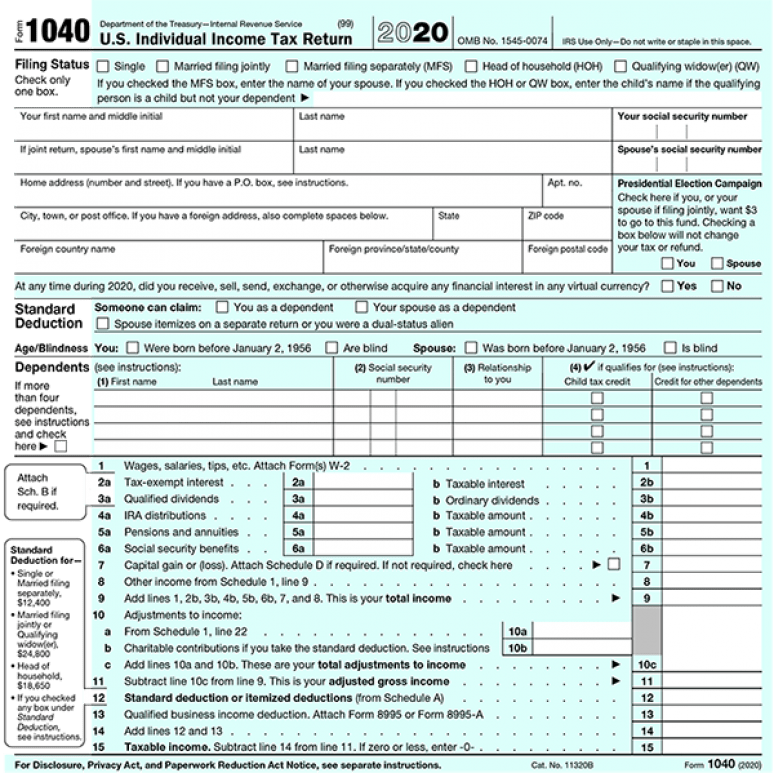

However if your return is more complicated for example you claim certain deductions or credits or owe. For 2020 you will use Form 1040 or if you were born before January 2 1956 you have the option to use Form 1040-SR. Names shown on Form 1040 1040-SR or 1040-NR.

3 Childs year of birth. We already have over 3 million people taking advantage of our unique library of legal forms. Go to wwwirsgovForm1040 for instructions and the latest information.

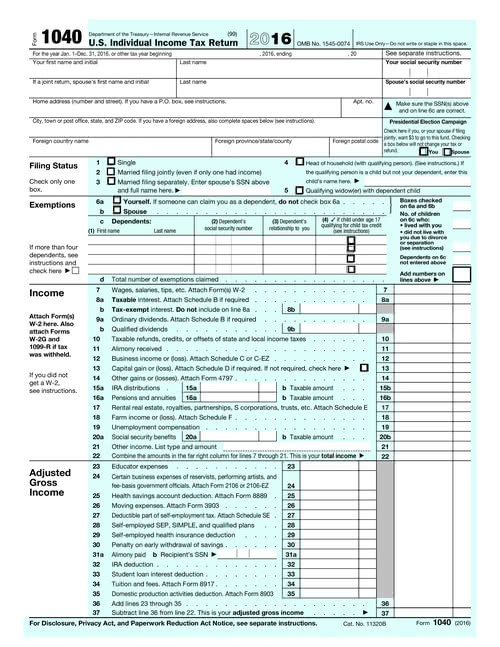

Form 1040 Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040 1040-SR or 1040-NR. Married filing separately MFS Head of household HOH Qualifying widower QW. Page one of IRS Form 1040 and Form 1040NR requires that you attach Schedule F to report a farm income or loss.

1545-0074 2020 Attachment Sequence No. Check only one box. Tax Return for Seniors 2021.

Check only one box. SCHEDULE F Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Farming Attach to Form 1040 Form 1040-SR Form 1040-NR Form 1041 or Form 1065. IRS Use OnlyDo not write or staple in this space.

Individual Income Tax Return. Easily generate a F1040sfpdf - SCHEDULE FForm 1040 Department Of The Treasury. Inst 1040 PR Instructions for Form 1040 PR Federal Self-Employment Contribution Statement for Residents of Puerto Rico.

You can not file Schedule F with one of the shorter IRS forms such as Form 1040A or Form 1040EZ. Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship a Go to wwwirsgovScheduleC for instructions and the latest information. Departing Alien Income Tax Return 2022 01142022 Form 1040-V.

Partial-year resident from 2020 to 2020 attachSchedule III 3 Nonresident attach Schedule III Complete Reverse Side. Individual Income Tax Return 2021 12222021 Form 1040 PR Federal Self-Employment Contribution Statement for Residents of Puerto Rico 2020 02092021. IRS Use OnlyDo not write or staple in this space.

Additional Income and Adjustments to Income. Single Married filing jointly. You may only need to le Form 1040 or 1040-SR and none of the numbered schedules Schedules 1 through 3.

The instructions for Form 1040 or 1040-SR line 27 unless the child was born and died in 2020. A Attach to Form 1040 1040-SR 1040-NR or 1041. If you owed taxes late filing penalties may apply to your tax liability.

Form 1040 PR Schedule H Household Employment Tax Puerto Rico Version 2021. Without needing to involve experts. SSNs must be entered below.

Payment Voucher 2021 12142021 Form 1040-SR sp US. You had until October 15 2021 to e-File 2020 Tax Returns. Internal Revenue Service 99.

Form 1040 Schedule 1 Additional Income and Adjustments to Income. Department of the Treasury. Go to wwwirsgovScheduleF for instructions and the latest information.

If your child was born and died in 2020 and did not have an SSN enter Died on this line and attach a copy of the childs birth certificate death certificate or hospital medical records showing a live birth. Federal Self-Employment Contribution Statement for Residents of Puerto Rico. 2020 Tax Return Forms and Schedules for January 1 - December 31 2020 can be only be paper filed now - FileIT.

Instructions for Form 1040 or Form 1040-SR US. AGo to wwwirsgovForm1040 for instructions and the latest information. Form 1040 2020 Additional Credits and Payments Department of the Treasury Internal Revenue Service aAttach to Form 1040 1040-SR or 1040-NR.

Do not include expenses reimbursed or paid by others. PDF 2020 Schedule F Form 1040 - Internal. Single Married filing jointly.

Partnerships generally must file Form 1065. Taxpayers claiming an overpayment from line 43 of last years individual income tax return Form 1040N should. Nebraska Individual Income Tax Return.

12182020 Form 1040 Schedule F Profit or Loss From Farming 2021 12212021 Inst 1040 Schedule F Instructions for Schedule F Form 1040 or Form 1040-SR Profit or Loss From Farming 2021 12232021 Form 1040 Schedule H. Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. IRS Use OnlyDo not write or staple in this space.

Individual Income Tax Return 2021 12092021 Inst 1040. The end result is the net farm profit or loss amount. Individual Income Tax Return 2021 12222021 Inst 1040 Schedule 8812 sp.

Single Married filing jointly. Social security number SSN. Schedule F is a two page tax form which lists the major sources of farm income and farm expense.

Your 2021 estimated income tax the amount of that overpayment may be applied in full or in part to any installment. Form 1040 PR Federal Self-Employment Contribution Statement for Residents of Puerto Rico. Married filing separately MFS Head of household HOH Qualifying widower QW.

1545-0074 2020 Attachment Sequence No. Individual Income Tax Return 2020 Department of the TreasuryInternal Revenue Service 99 OMB No. Instructions for Form 1040 or Form 1040-SR US.

Form 1040-SR Department of the TreasuryInternal Revenue Service. 1545-0074 Attachment Sequence No. Married filing separately MFS Head of household HOH Qualifying widower QW.

99 Filing Status. A Attach to Form 1040 or 1040-SR. Access state income tax return forms and schedules plus state tax deadlines.

Tax Return for Seniors. Instructions for Form 1040 and Form 1040-SR Spanish version 2020 04212021 Inst 1040. Check only one box.

If you had an overpayment on your 2020 Form 1040N and elected to apply it to. For the taxable year January 1 2020 through December 31 2020 or other taxable year 2020 through FORM 1040N. Overpayment Credit From 2020.

1040 Department of the Treasury Internal Revenue Service. Tax Return for Seniors Spanish Version 2021 12102021 Form 1040-SR.

Irs 1040 Form Template For Free Make Or Get Tax Return Form Sample

Fillable Form 1040 2020 In 2021 Income Tax Return Irs Tax Forms Certificate Of Participation Template

Fillable Form 1040 Individual Income Tax Return Income Tax Income Tax Return Tax Return

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Printable Irs Form 1040 For Tax Year 2020 Cpa Practice Advisor

Printable Irs Form 1040 For Tax Year 2020 Cpa Practice Advisor

2020 Tax Form 1040 U S Government Bookstore

Irs Schedule F 1040 Form Pdffiller

2021 Form Irs 1040 Fill Online Printable Fillable Blank Pdffiller

Generate Tax Form Free Tax Extension In 2021 Irs Extension Tax Extension Tax Forms

1040 Forms Versions And Schedules Pdffiller

Form 12 12a Five Ways On How To Prepare For Form 12 12a Tax Forms Federal Income Tax Income Tax

No comments:

Post a Comment