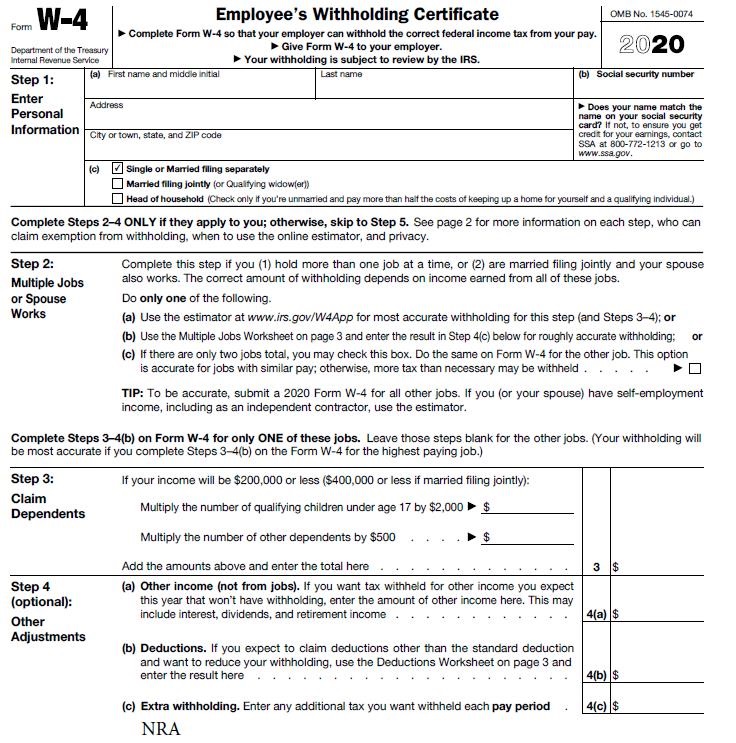

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Complete the NC form as you normally would.

Did You Fill Out Your W 4 Federal Tax Withholding Form Correctly The Mint Hill Times

Citizen who has not passed the green card test or the substantial presence test.

Nc 4 and w4 forms. Special Instructions for Nonresident Aliens Form w-4 and Form nc-4 Special Instructions for Form W-4. If you do not provide an NC-4 to your employer your employer is required to withhold based on the filing status Single with zero allowances. See Publication 519 US.

Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. On the section of the form W-4 where it says on form W-4 line B. Give Form W-4 to your employer.

You can find and update your current withholding forms for federal and state of North Carolina taxesW-4 and NC-4 online using ConnectCarolina. The NC-4EZ is a new simplified form which should suffice for most taxpayers. 1410 Mail Service Center.

When you are hired you will complete the W-4 and NC-4 tax documents through the ConnectCarolina Self Service home page. Enter Personal Information a. Deliver the particular prepared document by way of electronic mail or facsimile art print it out or perhaps reduce the gadget.

Used to estimate income and deductions for 2014. California employees are now required to submit both a federal Form W-4 Employees Withholding Certificate and state Form DE 4 Employees Withholding Allowance Certificate when beginning new employment or changing their state withholding allowances. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

Your withholding is subject to review by the IRS. After the form is fully gone media Completed. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA.

Exempt status or the NC. Your withholding will be most accurate if you complete Steps 34b on the Form W-4 for the highest paying job Step 3. In completing the form nonresident aliens should use the following instructions instead of the instructions on.

Standard deduction and no tax credits or only the credit for children. Your withholding is subject to review by the IRS. Here are the states that have created their own version of the state W-4 form rather than using the IRSs updated version.

Enter Personal Information a. Which form should I use the NC-4EZ or the NC-4. FORM NC-4 BASIC INSTRUCTIONS - Complete the Allowance Worksheet.

PDF editor permits you to help make changes to your Nc 4 Form Online from the internet. Fill them out as indicated on the forms. Withholding Individual Income Tax.

If you do not provide an NC-4 to your employer your employer is required to withhold based on the filing status Single with zero allowances. Form NC-4 Instructions 12-09 General Instructions completed and given to your employer by December 1 to maintain your exempt status for the following tax year. Exempt status or the NC.

Items needed to fill out NC-4. The guidelines below will help you create an eSignature for signing nc 4 in Chrome. Leave those steps blank for the other jobs.

What is the difference between the NC-4EZ and the NC-4. If your total income will be 200000 or less 400000 or less if married filing jointly. Or you can access them directly.

Both are linked from the Payroll Forms page on the Finance Division Web site. Copy of previous year Federal 1040 1040A or 1040 EZ. The NC-4 is the complete form which may result in a more accurate withholding amount but requires historical tax information and will involve estimates.

A nonresident alien subject to wage withholding must give the employer a completed Form W-4 to enable the employer to figure how much income tax to withhold. The NC Department of Revenue has issued a new NC-4 form for use beginning January 1 2010 as well as a 2010 W-4 form. Enter one if you are single wiht one job etcdo not enter one if you have a second job.

2010 W-4 2010 NC-4. Click on the link to the document you want to eSign and select Open in. Leave it blank or enter zero.

These are the states that will continue to use the federal W-4 form. PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. Log in to your registered account.

Action is not required by current University employees unless changes to W-4 or NC-4 tax forms are needed. Delaware employees could use either the federal or Delawares state W-4 form Idaho. If you do not provide a new NC-4 by December 1 the employer is required to withhold based on single status with zero allowances.

Give Form W-4 to your employer. FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the. Tax Guide for Aliens for more information on the green card test and the substantial presence test FORM NC-4 BASIC INSTRUCTIONS -.

Complete Steps 34b on Form W-4 for only ONE of these jobs. Effective January 1 2020 any first-time submission or employee change to the W-4 or NC-4 will need to be submitted on a paper form until ConnectCarolina Self Service is updated to match the new federal W-4 form requirements. NC-4 Web 12-18 Employees Withholding Allowance Certificate PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay.

FORM NC-4 BASIC INSTRUCTIONS - Complete the Allowance Worksheet. Place an electronic digital unique in your Nc 4 Form Online by using Sign Device. You need to check and update the your W-4 and NC-4 following any life.

Find the extension in the Web Store and push Add. PDF 42987 KB - January 04 2021. In general a nonresident alien is an alien not a US.

Standard deduction and no tax credits or only the credit for children. FORM NC-4 EZ - A new form was created for tax year 2014 for taxpayers who intend to claim either. FORM NC-4 EZ - You may use this form if you intend to claim either.

The worksheet will help you figure the number of withholding allowances you.

2014 Form Nc Dor Nc 4 Fill Online Printable Fillable Blank Pdffiller

Withholding Forms Solution I 9 Form Form Jobs For Freshers

Figuring Out Your Form W 4 Under The New Tax Law How Many Allowances Should You Claim In 2018 Pinterest Advice Power Of Attorney Form Allowance

North Carolina State Form W 4 Download

Proposed W 4 Design For 2020 Unveiled Martin Starnes Associates Cpas P A

2021 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

State W 4 Form Detailed Withholding Forms By State Chart

How To Fill Out The New W 4 Form Correctly 2020

State W 4 Form Detailed Withholding Forms By State Chart

Understanding Your W 4 Mission Money

No comments:

Post a Comment