I have contributed through my S corp. Any downsides to having a solo 401k for relatively small amount of 1099 income if I do this at Fidelity.

Contribution Limit Of 401k Plans.

W2 form 401k contribution. An individual can contribute up to 58000 in each of the two retirement accounts hence allowing them to put aside up to 116000 in 2021. John over contributed 401k in 2021 when he worked for employer A. Where do I report the employer contribution to the individual 401K on my tax forms to get the tax deduction for it.

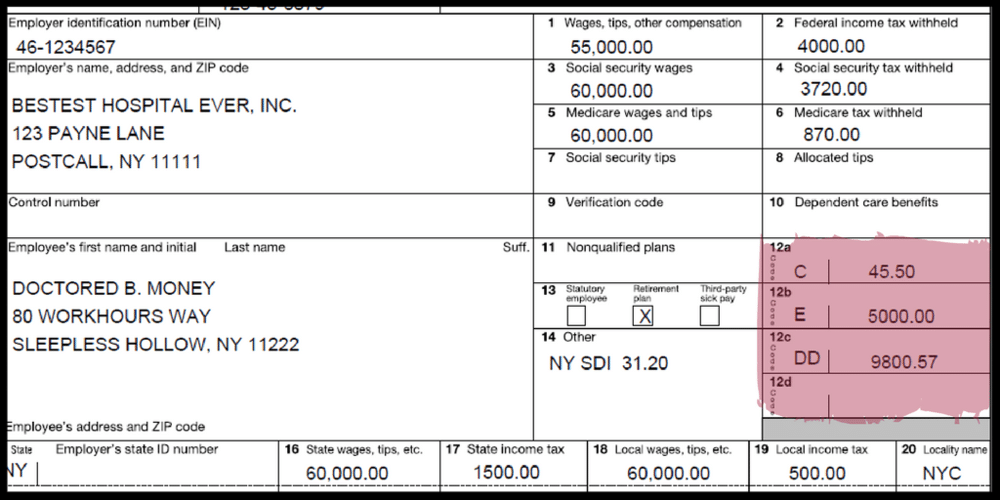

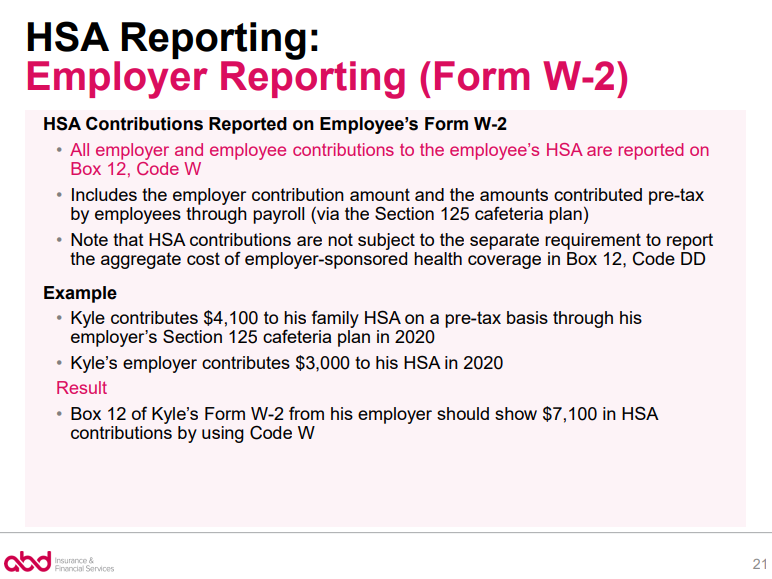

If more than four items need to be reported in box 12 use a separate Form W-2 to report the additional items but enter no more than four items on each Copy A Form W-2. For Solo 401k the contributions have to come from your sponsoring business. 401K investment options for joint contributions by employers and employees is 56000 for this year.

For example my total wages are 48000 on which I pay social security and Medicare. If the excess contributions havent already been claimed in that year the return will. Our current vendor requires them to be reported separately we have two separate deduction codes.

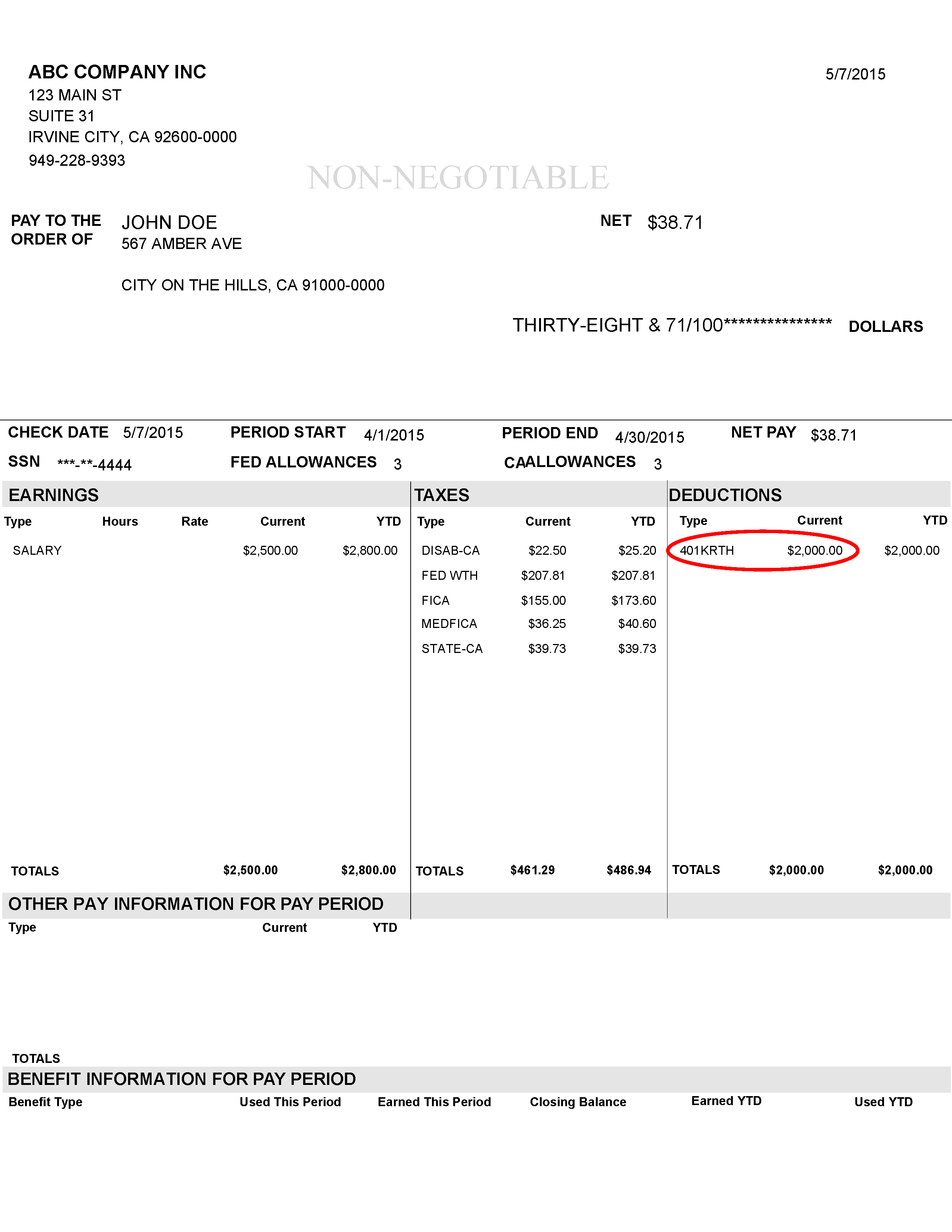

When recording 401k contributions for each employee the employer enters a single letter D followed by the dollar amount of the employees contributionBox 12D also includes deferrals under a SIMPLE 401k retirement account. My w2 132900 and my employee employer contribution is about 36k. Contributions would probably be 1k or so each year unless something changes.

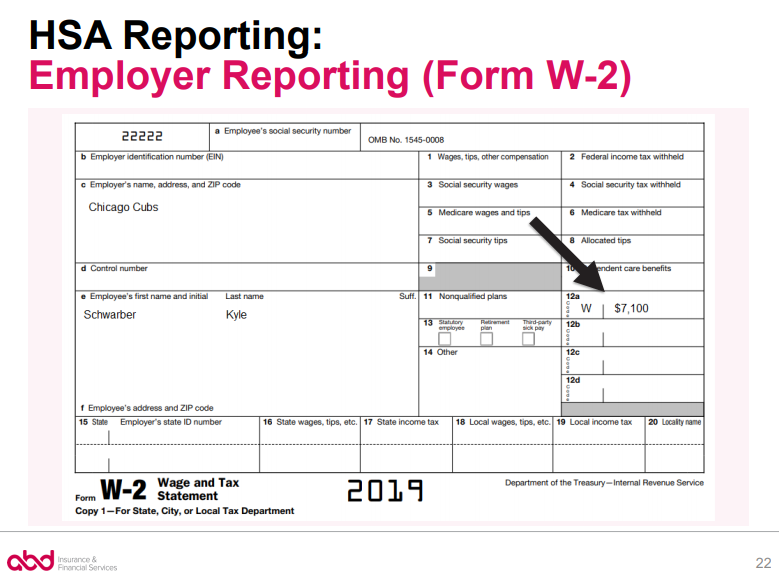

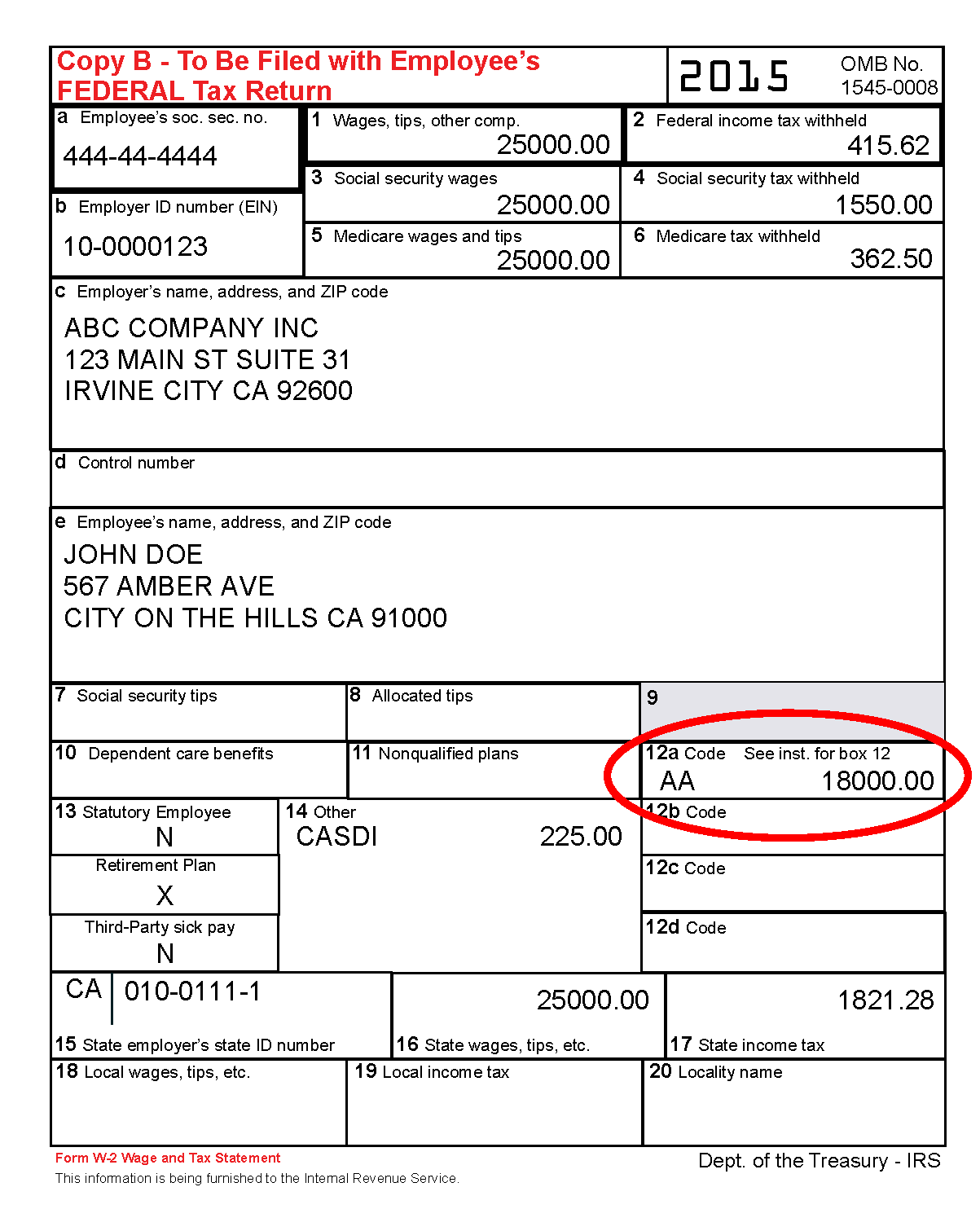

401k contributions are recorded in box 12 of the W-2 tax form under the letter code D. He was advised to reach out to his former employer to make w2 and distribution changes. Excess contributions must be included as income for the year in which the contributions were made.

For 2021 the max contribution is 58000 and 64500 if you are 50 years old or older. Reporting Solo 401k After-Tax Contributions non Roth for an S-corp or C-corp Form W-2. Im employed with w2 income and a 1099 side gig I started a solo 401K for my solo LLC last year and Im trying to file the taxes my CPA is not familiar with it.

I have a S corp. 18000 - is the Employer contribution elective. If your age is 50 or above this contribution is raised to 62000.

Making contributions to both a traditional 401k and a Solo 401k allows you to increase the cumulative contributions to almost double. The separate coding discussions are typically generated by your 401k vendor. Code P indicates that the taxpayer contributed more than allowed to a 401k IRA etc.

Your 401K contributions yours and the employer match will not show in your W-2 Box 1 wages but will show in Box 12 with a Code D. 12000 - is employee contribution profit sharing and. 313k 16 16 gold badges 99 99 silver badges 183 183 bronze badges.

The IRS 401k Excess Deferral Project has found reported in Box 12 of Form W-2 significant errors in elective 401k salary deferrals in excess of the annual contribution limit. I have a W2 form. Follow edited Apr 12 20 at 1402.

On all other copies of Form W-2 Copies B C etc you may enter more than four items in box 12 when using an approved substitute Form W-2. Box 12 - Code D for Catchup and Deferral. They cant come from your W2 job pensions rental income or other sources not considered to be self employment income.

You will also note that your Box 3 social security income will include your 401K contributions. Our prior vendor wanted them both taken by the same deduction and we programmed calculations to keep the limits. You can get to the W-2 section in TurboTax by searching for W-2 upper- or lower-case with or without the dash and then.

Pros of Having a Regular 401k and a Solo 401k Accelerate savings. Box 12 of W-2 tax form applies to deferred contributions. 30000 - Elective deferral Solo 401K of which.

Generally contributions to your 401 k or TSP plan will show up in box 12 of your W-2 form with the letter code D. I contributed the max 19500 to my W2 job. Now John realized he over contributed.

The contribution is based on the amount listed in Box 1 of your w-2 from the S-corporation plus any pre-tax employee contributions not in Box 1. Solo 401k and its effect on w2 1120S and 941. If your self-employed business is an S-Corp or C-Corp that sponsors a solo 401k plan and you elect to make after-tax contributions to the solo 401k plan you may report these contribution on Form W-2 line 14.

Can you share how to find my employer contribution towards my 401K each year. The employee pretax and Roth contributions but NOT the voluntary after-tax. This part in particular is a key factor in the growth of the 401k plan and alternative to a defined benefit plan.

United-states 401k contribution form-w-2 employer-match. Form 1099-R - Excess 401k Contributions. Over contribution on 401k but former employer is not available to correct w2 and deferAsked the first part but there is an additional question to follow up.

It would be ok to make the entire solo 401k contribution as an employer. Note that you must have the applicable W-2 wages from your self-employed corporation to justify the solo 401k contribution amount.

The Main Differences Between Forms W 2 And W 4 Chamber Of Commerce

What Do The Codes In Box 12 On My W 2 Mean And Should I Care

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Fidelity Solo 401k Contribution Form Fill Online Printable Fillable Blank Pdffiller

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Index Of Wp Content Uploads 2017 02

How To Read Your Form W 2 Taxgirl

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

W 2 Tax Forms Answers To Common Questions

Understanding Your W2 Employer Employee Reporting Form For Tax Filing Aving To Invest

No comments:

Post a Comment