How to Calculate W-2 Allowances. If you were to have claimed zero allowances your employer would have withheld the.

A 2022 Employer S Guide To The W 2 Form The Blueprint

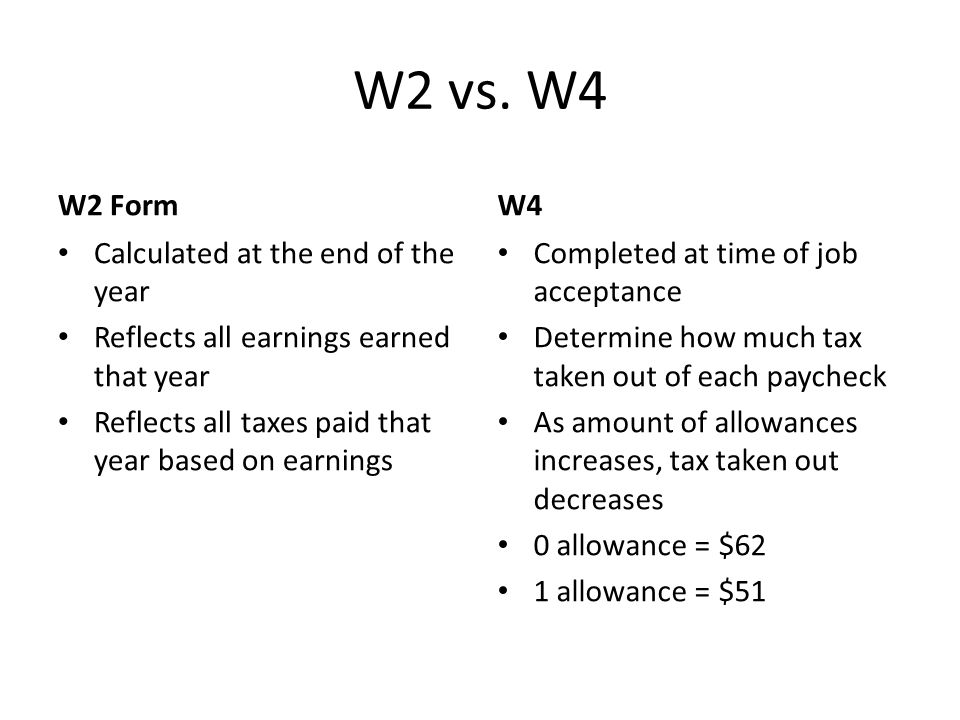

The higher the allowances you claim on Form W4 the less tax they withhold.

W2 form allowances. The number of allowances depends on the employees marital status and the number of dependents they have. 2021 Form W-2 and the General Instructions for Forms W-2 and W-3 updated for section 9632 of the American Rescue Plan Act of 2021-- 24-NOV-2021. If you want to get close to withholding your exact tax obligation then claim 2 allowances for both you and your spouse and then claim allowances for however many dependents you have so if you have 2 dependents youd want to claim 4 allowances.

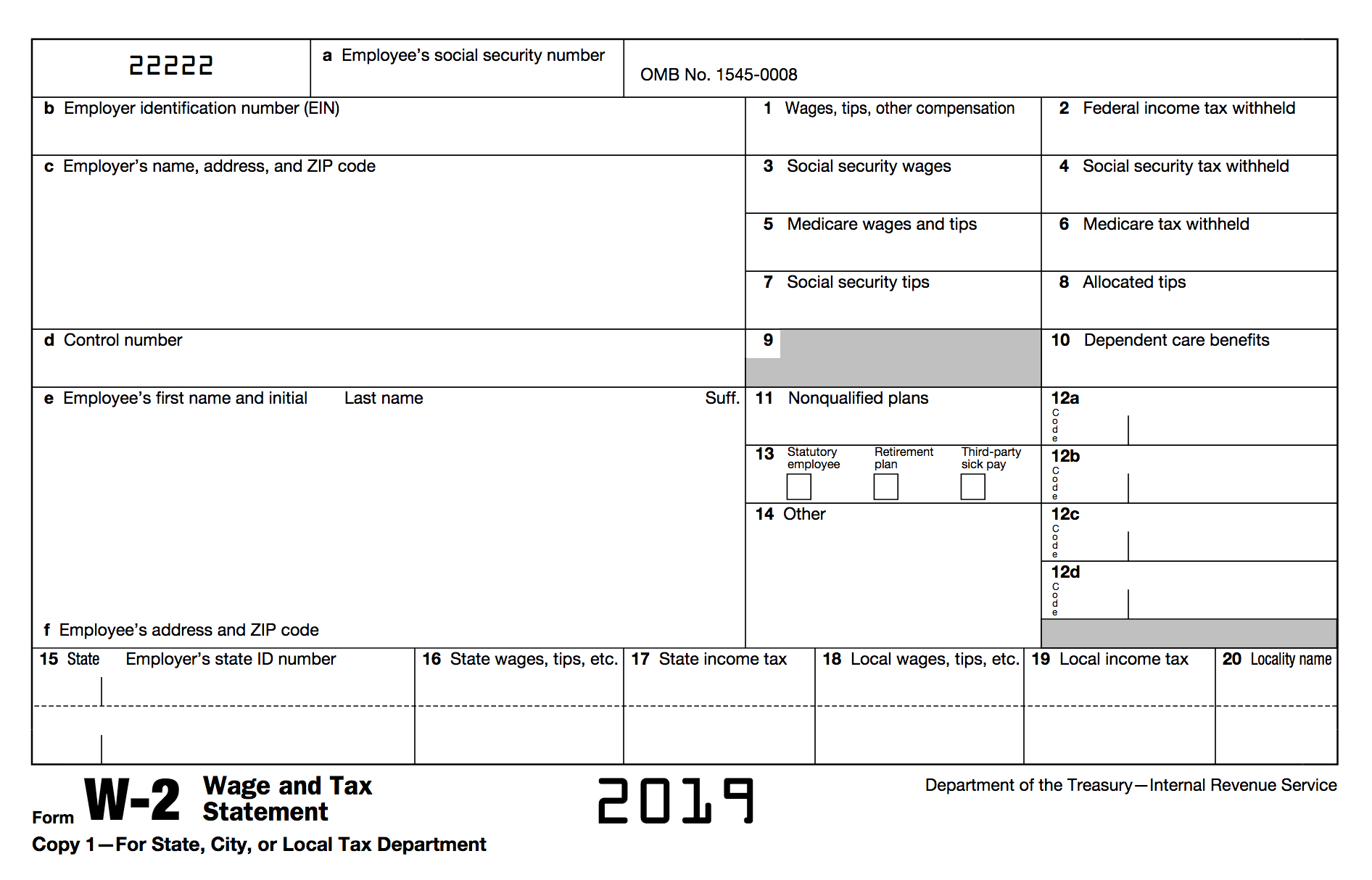

The IRS will require Form W2 at the end of the year to help them determine the taxes that an employer withheld. Claim one allowance at each job or two allowances at one job and zero at the other. The W2 form helps the IRS track the tax payments of individuals.

You can adjust the federal and state withholding taxes by contacting the human resources department in the business and publishing a Form W4. Whether youre married or single. Generally the housing allowance is reported in box 14 of the W-2 and is not included in boxes 1 3 or 5.

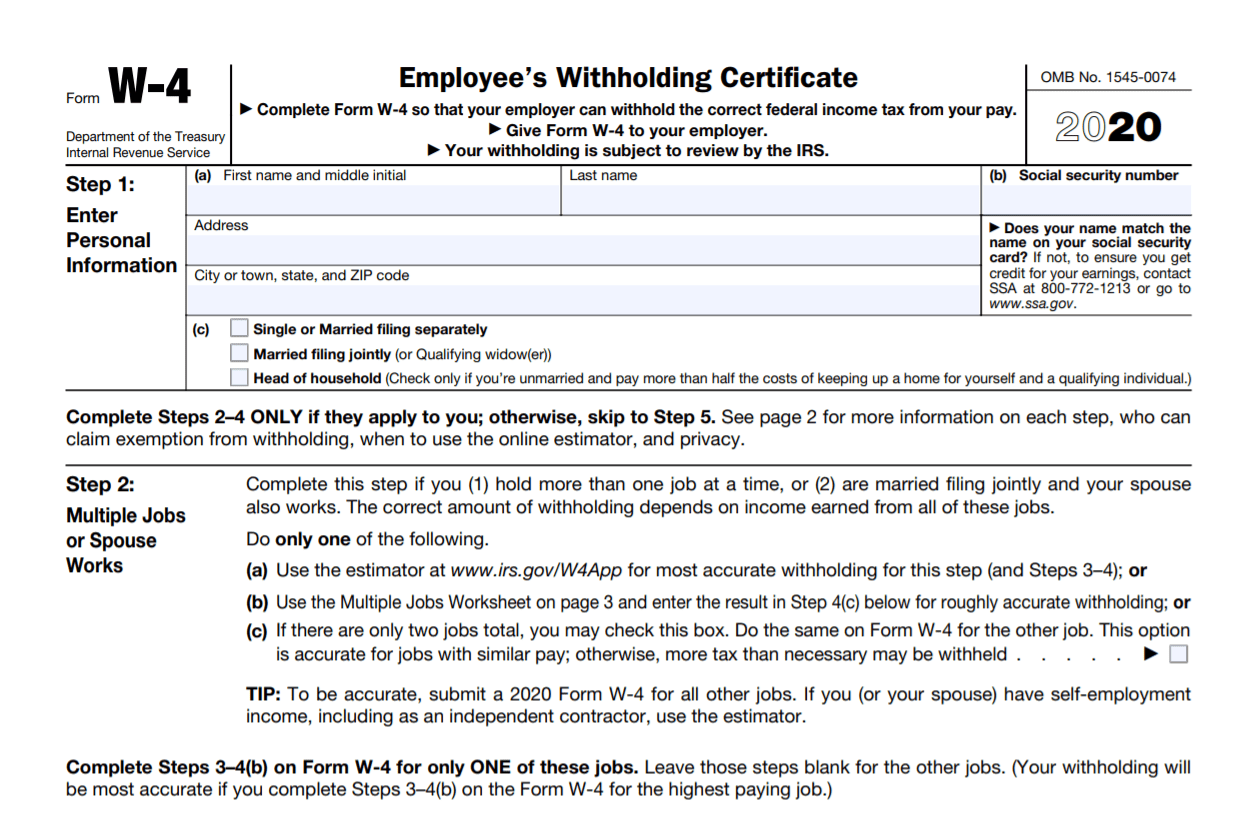

Youre single and work more than one job. Additional worksheets are on page 2 so you can adjust your withholding allowances based on itemized deductions adjustments to income or two-earnertwo-job situations. The W2 Form Wage and Tax Assertion will mirror the amount of wages paid and the tax withheld.

Complete all worksheets that apply to your situation. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. You also need the W4 form when there have been changes in your financial standing within the tax year.

When you withhold less tax you have less to be refunded when you file your return. To figure out how much to withhold -- which is the amount shown on your W-2 that you report to the IRS when you file your return -- you must submit a Form W-4 to your employer. In this regard should housing allowance be reported on w2.

Make sure youre not accidentally committing tax fraud by claiming the wrong number of allowances. No exclusion applies for self-employment tax purposes. If you claim the maximum.

What Were Tax Allowances. It is called a wage and tax statement. Ad Sign documents with PDF signer without having to travel and meet your clients in person.

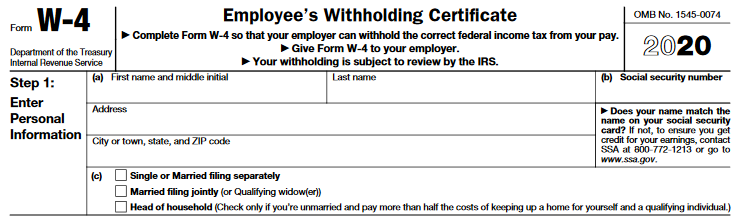

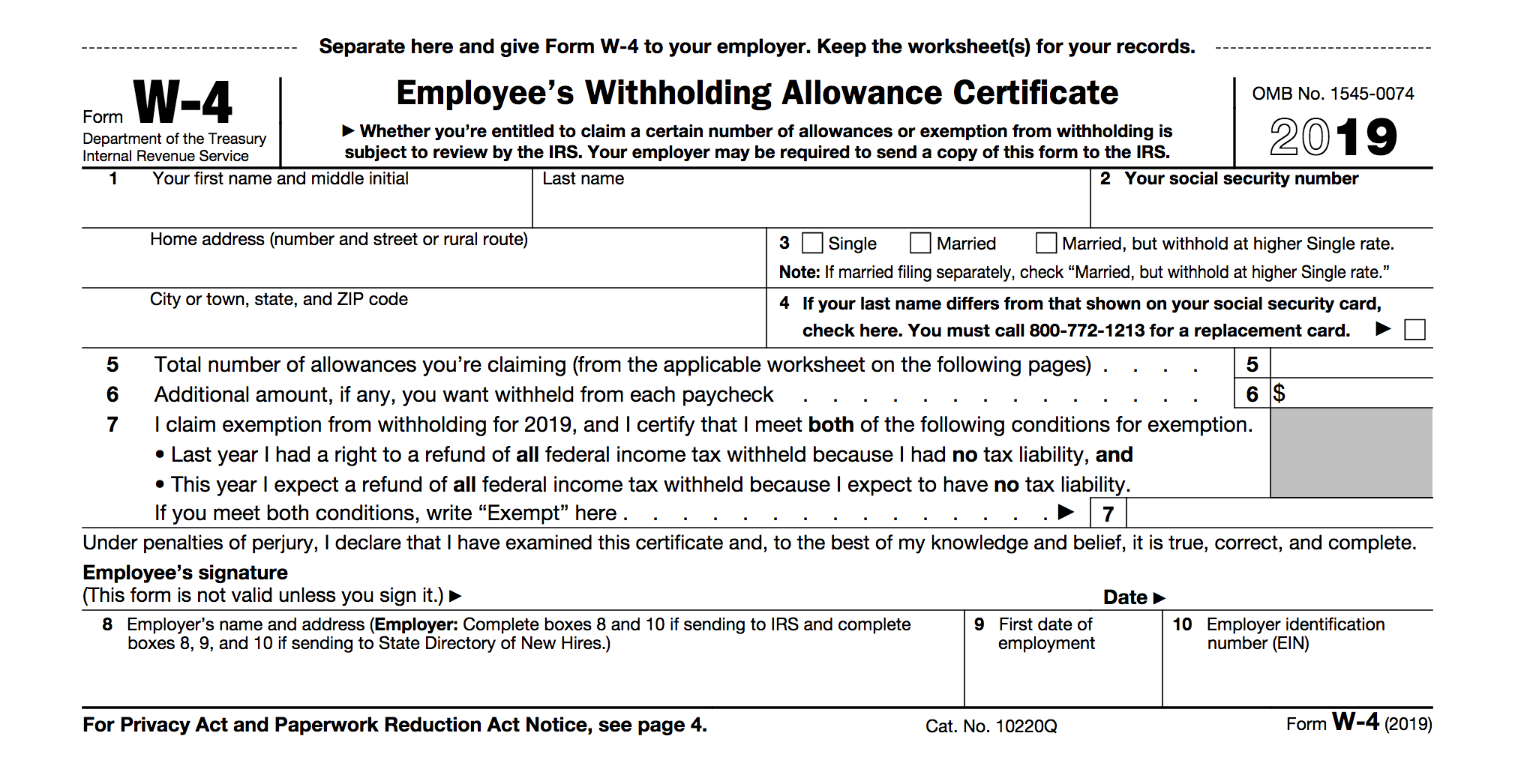

This is the Withholding allowance certificate and you need it before filing the W2 form. Employers must fill out Form W2 which indicates how much the employee earned and how much the company withheld in taxes. Who should complete Form MW-4.

Complete Form MW-4 and provide to your employer if you. If youre married have only one job and your spouse doesnt work. Note that youre not required to fill out a new W-4 in 2020 if you already have a form on file with your current employer as of 2019.

So I claim a number of 2 allowances on W2 and not sure why my refunds are so low. How does the Tax Withholding Estimator function. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.

If your wages from a second job or your spouses wages are 1500 or less. 2021 Forms W-2 Reporting of Qualified Sick Leave Family Leave Wages Paid Under the Families First Coronavirus Response Act as amended by the American Rescue Plan-- 26-NOV-2021. Complete the Personal Allowances Worksheet.

The employer sends the w2 form to the employee and the IRSInternal Revenue Service. But if neither of those applies to you use the Personal Allowances Worksheet. The 2020 W-4 form wont use allowances but you can complete other steps for withholding accuracy.

If you plan to itemize your deductions or claim substantial adjustments to income use the Deductions Adjustments and Additional Income Worksheet. You fill the W4 and hand it to your employer when youre a new employee. Employees also need a copy of the form to calculate their taxes and determine if they can expect any tax refunds.

So when you claimed an allowance you would essentially be telling your employer and the government that you qualified not to pay a certain amount of tax. Are a newly hired employee or. This statement is sent to workers at the stop from the year.

Claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes. The W2 forms are for an employee to know about the wages and taxes filled by the employers. The amount is based on their wages and the number of allowances the employee is eligible for.

Form IT-2104 Employees Withholding Allowance Certificate and if applicable Form IT-21041 New York State City of New York and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. If youre single and have only one job. Ad Sign documents with PDF signer without having to travel and meet your clients in person.

Withholding allowances vary from person to person based on a number of circumstances including. Employers use Form W4 to calculate how much federal state and local taxes to withhold from an employees paycheck for the IRS. If you happen to have a second job youll need to complete the additional steps.

The Internal Revenue Service requires employers to withhold money from your paychecks during the year to cover your income taxes. Claiming two allowances. The worksheets will help you figure the number of withholding allowances you are.

A withholding allowance was like an exemption from paying a certain amount of income tax. A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. I do work for the state of colorado.

The Difference Between Form W 2 And Form W 4 Techunz

W 2 And W 4 A Simple Breakdown Bench Accounting

How Many Tax Allowances Should I Claim Community Tax

The Difference Between Form W 2 And Form W 4 Techunz

Filling Out Your W 4 Line By Line Peoples Income Tax

W2 Vs W4 What S The Difference Valuepenguin

W 2 And W 4 A Simple Breakdown Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How Many Tax Allowances Should I Claim Community Tax

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

3 Essential Tax Tips You Might Not Be Aware Of Intelesoft Financials

No comments:

Post a Comment