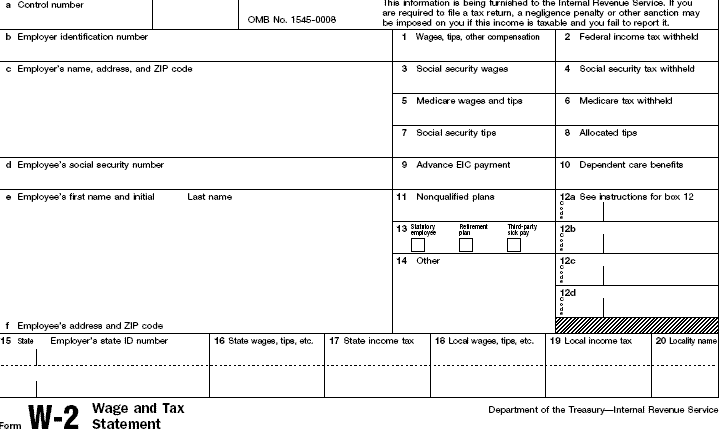

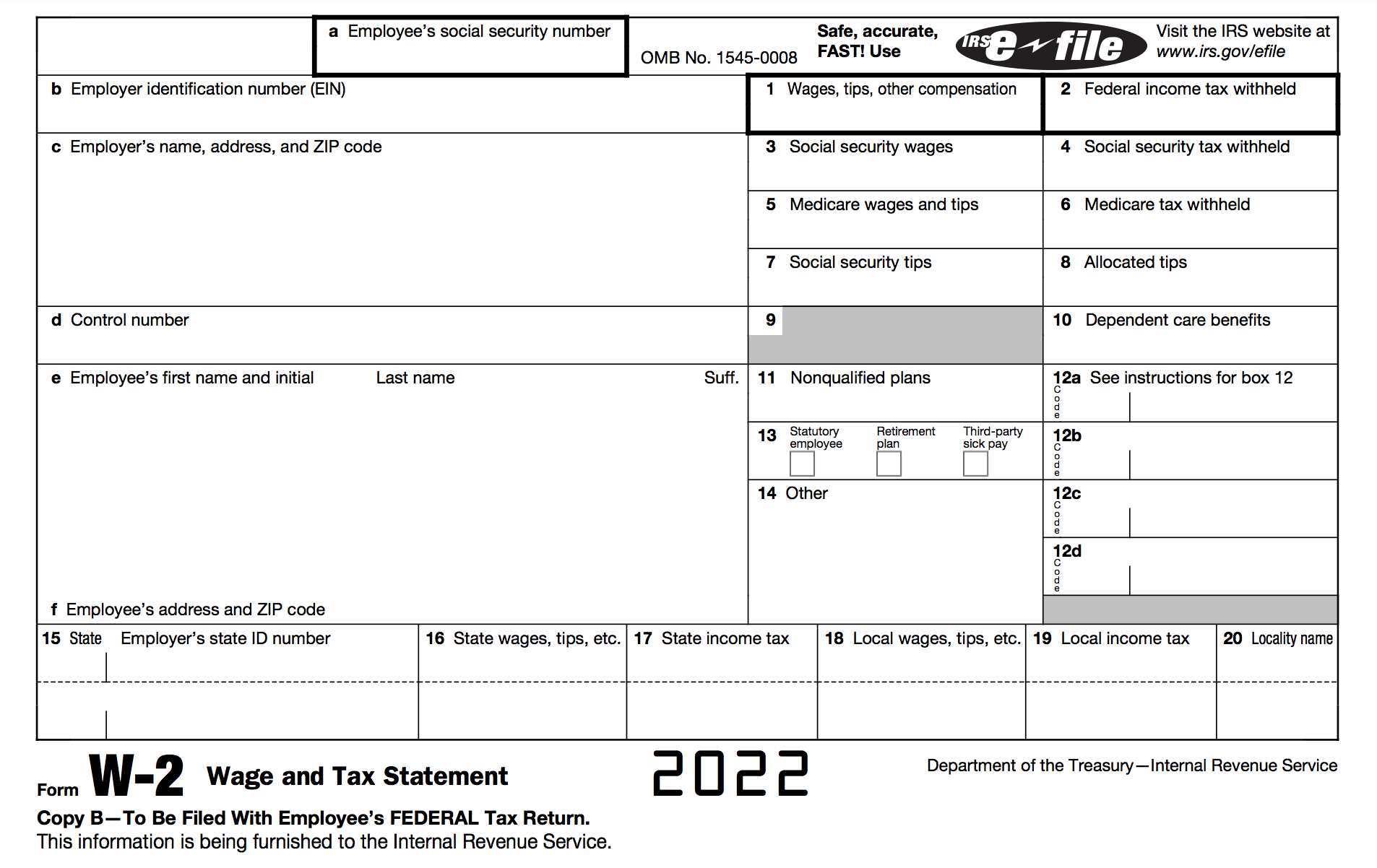

QuickBooks checks and invoices require a specific custom 8 envelope size thats slightly wider than a. - Enter the employee information.

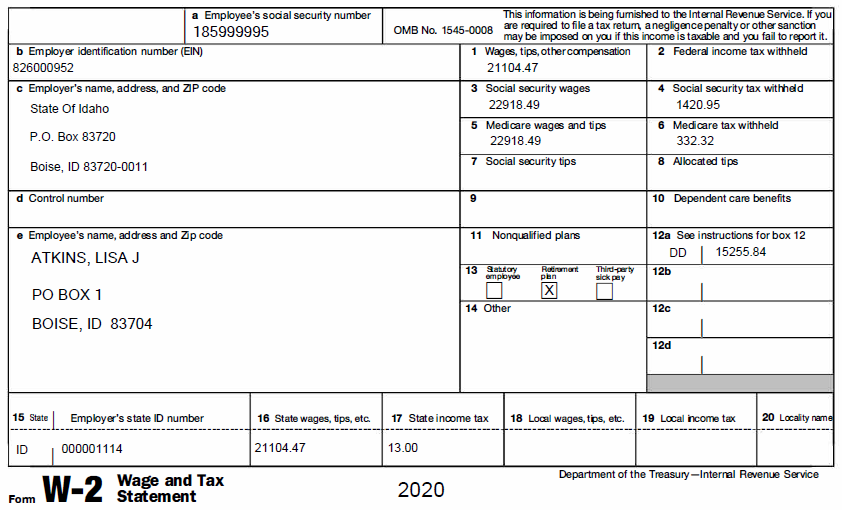

How To Read Your W 2 University Of Colorado

If youre an independent contractor or self-employed your payers dont have to send you Form W-2.

W2 form guidelines. You can click the Add W2 link to add a new form. The employer must send the employee the W-2 form on or before Jan. For other QuickBooks mail you will need different envelopes.

The problem is that there is no Annual Forms link under the Forms section. Register to Use Business Services Online You must register to use Business Services Online Social Securitys suite of services that allows you to file W-2W-2Cs online and verify your employees names and Social Security numbers against our records. Form Requirements for W2 -The Employee copy of the W2 should be printed on the blank 4 part perforated paper.

To fill the form properly you may need federal and state tax paychecks. Ive read the instructions on how to print my w2. The electronic format to Bulk Upload or submit on media if the total number of W2 statements meets or exceeds 25.

Hence there is no minimum amount of income you need to file a W2 form. Create an account using your. If the figures dont match taxpayers Form W-2 correct the data so.

Its used to provide information on just how much income the taxpayer has just how much income she or he has paid out and what deductions and credits have been claimed on a tax return. First of all a W2 Form is really a type of tax return thats submitted by a taxpayer. Page 1 of 35 950 - 23-Nov-2021.

The entries in boxes 3 4 5 6 and 16 will auto-populate based on the Box 1 entry. Per IRS W2 record retention guidelines employers need to retain tax records for at least 4 years after the last filing for a quarter. An employee may still request a physical copy of their W2 so employers need to be able to generate both an electronic and physical version of the form.

It includes a full roadmap filing specifics and other important information regarding wage reporting. 31 each year so that the employee has ample time to file income. -The State copy if any should be printed on the blank 4 part perforated paper.

Stay compliant and find answers fast. 10 Draft Ok to Print. Within the appropriate period of limitations the IRS may.

- Fill in the boxes on the w-2 Form. Form W2 is also known as the Wage and Tax Statement form. To sign a south carolina w2 form right from your iPhone or iPad just follow these brief guidelines.

Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom. There are however several requirements that should be followed when generating these W2 forms. Form W-2 Instructions continued Review Box 2 and box 17 to ensure tax withheld was entered and is correct.

Standard half-sheet W2 form envelopes should work for QuickBooks printed W2 tax forms. In the Forms section select the Annual Forms link. It should be completed by every employer who gets more than six hundred dollars per year.

The W2 form is a template made for the employers report of a salary and insurance details to the Internal Revenue Service. Please review our current guidance for in-person appointments if you require a visit to one of our Field Offices. The form reports several details relevant to an employees employment including.

We encourage all employers regardless of the number of W2s to file electronically. The annual filing deadline of W2 wagetax. It is an IRS tax form that all employers should submit to the IRS by the end of each year.

Identifying info about the employee. - Click the Question icon or the instructions link to get help. To find it go to the AppStore and type signNow in the search field.

You if youre an employer should print W2 and give it out to each of your employees who need to file it. No payment threshold is required to file a W2 form. You should download and fill the 1099 Form on our website instead.

Select Taxes then Payroll Tax. 2021 General Instructions for Forms W-2 and W-3. Fill out W-2 information and print Forms.

The latest version of Sage MAS 90 and 200 version 43 supports printing of you W2 to plain paper. Someone who earns 20000 per year will file it the same as someone who earns over 100000. Their annual income from their work with the employer.

Form W2 is used by employers who have paid at least 600 to an employee in a tax year. The IRS has a set of guidelines which specify the layout of your W2 forms that you print to plain paper. Install the signNow application on your iOS device.

The Ultimate Guide to Filing 10999 W2 Forms. A perfect companion for tax pros during the tax season this comprehensive guide features must-have information for 1099NEC W2 and Other 1099 forms. - Click the save button to save the W-2 information.

Unf Controller Mywings W2 Wage And Tax Statement

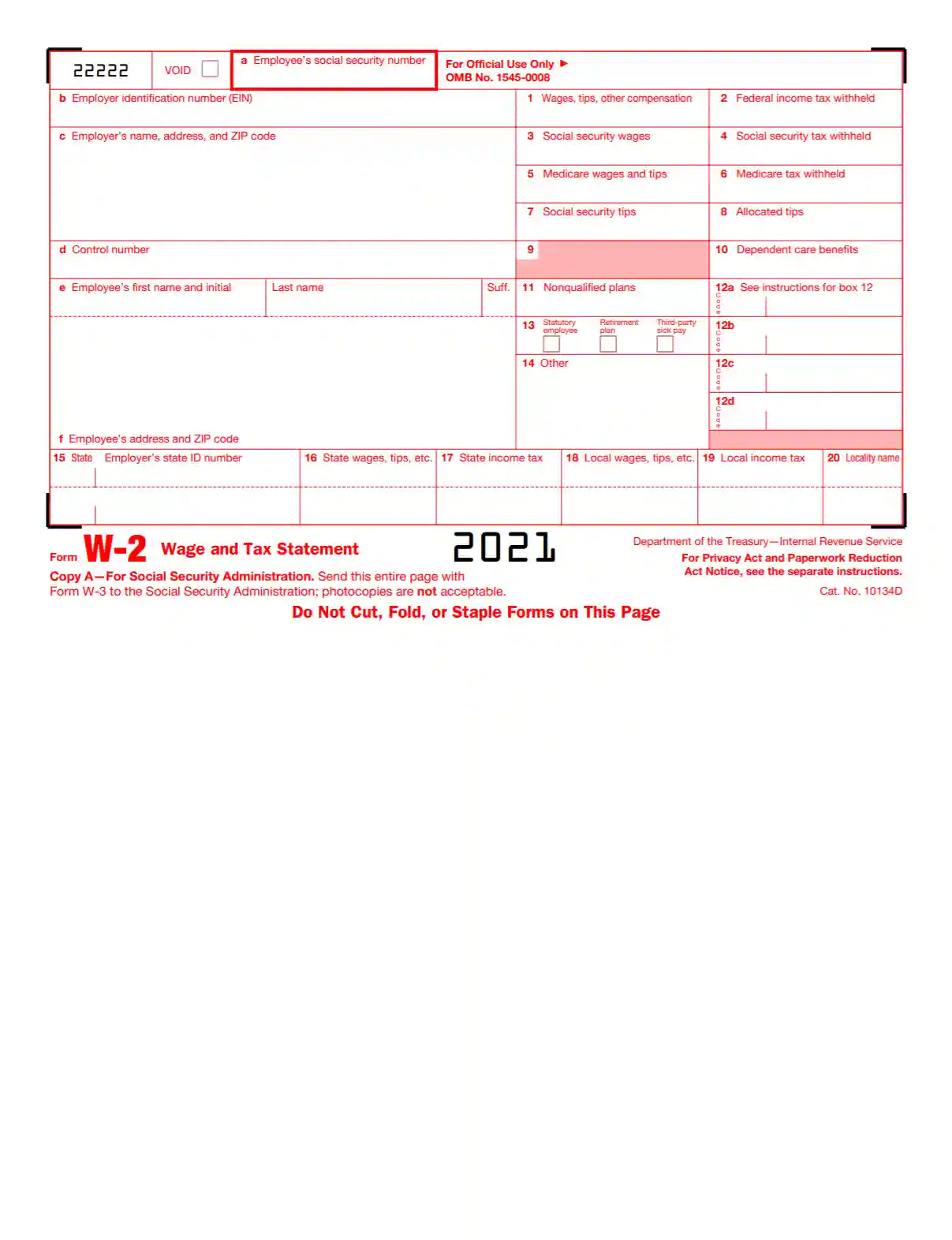

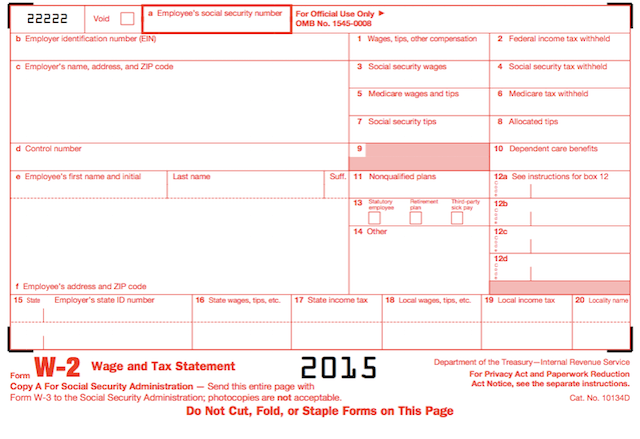

Irs Form W 2 Fill Out Printable Pdf Forms Online

Irs Form W 2 Fill Out Printable Pdf Forms Online

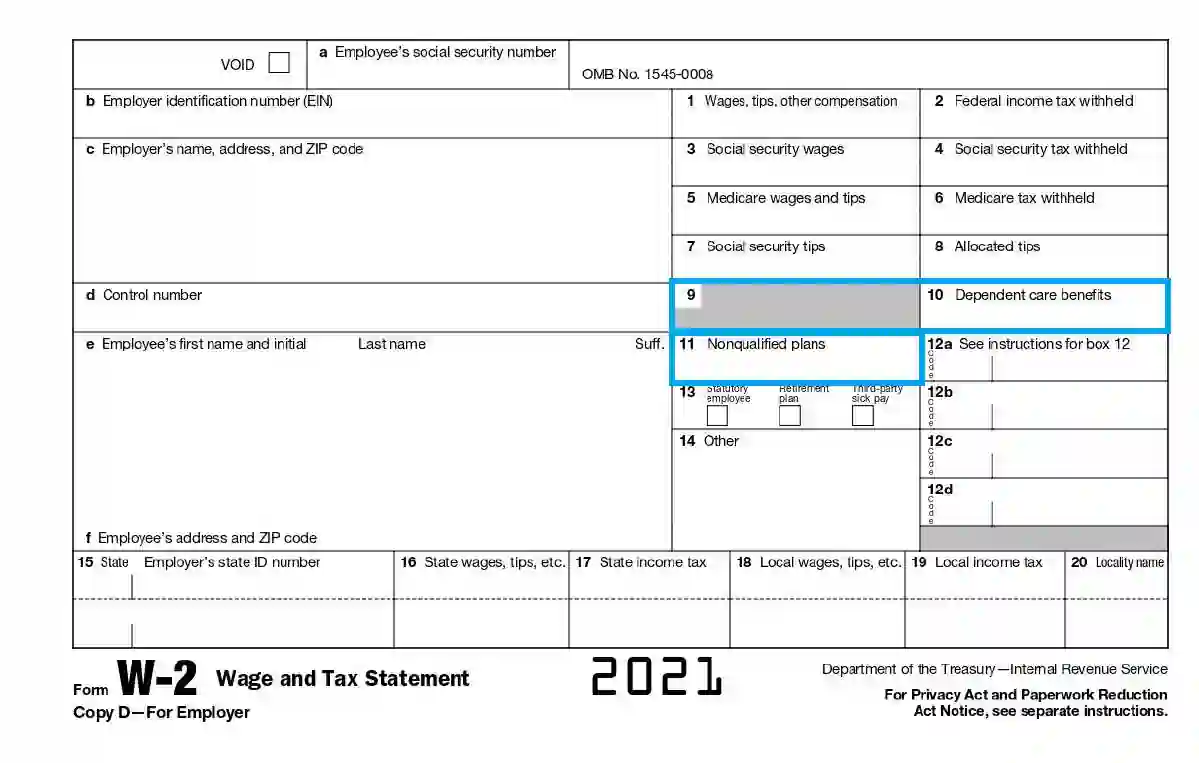

Form W 2 Explained William Mary

Reading Your W 2 Wage And Tax Statement

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

2012 W2 And W3 Instructions And Box 12 Codes

How To Read Your W 2 Form To Correctly File Your Tax Returns

Form W 2 Recipient Filing Requirements

W2 Form Irs Tax Form Filing Instructions Online

Forms W 2 And 1099 Explained For International Students Other Nonresidents

No comments:

Post a Comment