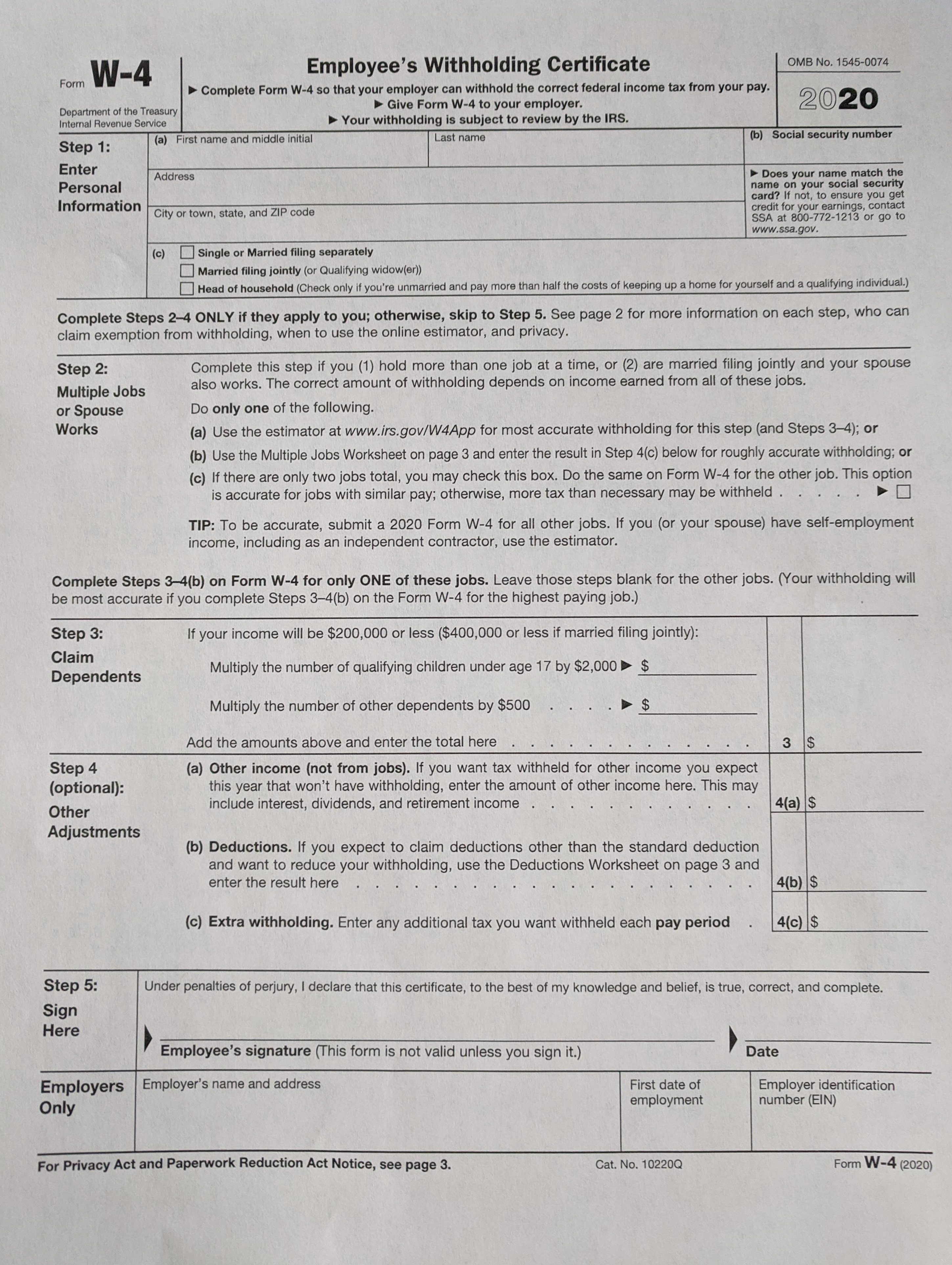

Give Form W-4 to your employer. Every so often the IRS changes the documents to make them more accessible for people to understand and to correspond with changes in tax rules and exemption guidelines.

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

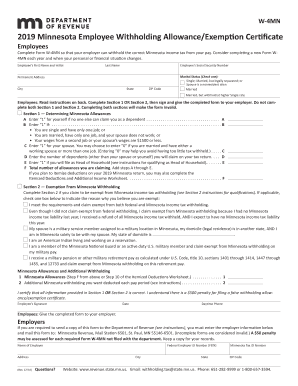

Form W-4MNP Minnesota Withholding Certificate for Pension or Annuity Payments The new Form W4-MNP is used so the financial institution making distributions can withhold the correct Minnesota income tax from income.

W4 form mn. You will need to fill out both the Federal and State Minnesota W4 forms in order for your employer to withhold the correct amount from each paycheck. Create this form in 5 minutes. Form W-4MN instructions for 2020.

Get access to thousands of forms. Form W-4MN Minnesota Employee Withholding AllowanceExemption Certificate is the Minnesota equivalent of federal Form W-4. The employee must sign and date the form.

Use our W-4 calculator see how to fill out a 2022 Form W-4 to change withholdings. Minnesota form m1pr instructions 2020. Do the job from any device and share docs by email or fax.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. For each withholding allowance you claim you reduce the amount of income tax withheld from your wages. If one is not provided IRS requires taxes to be withheld at the rate of.

Minnesota tax forms 2021. Employers See the employer instructions to determine if you must send a copy of this form to the Minnesota Department of Revenue. Minnesota tax forms 2020.

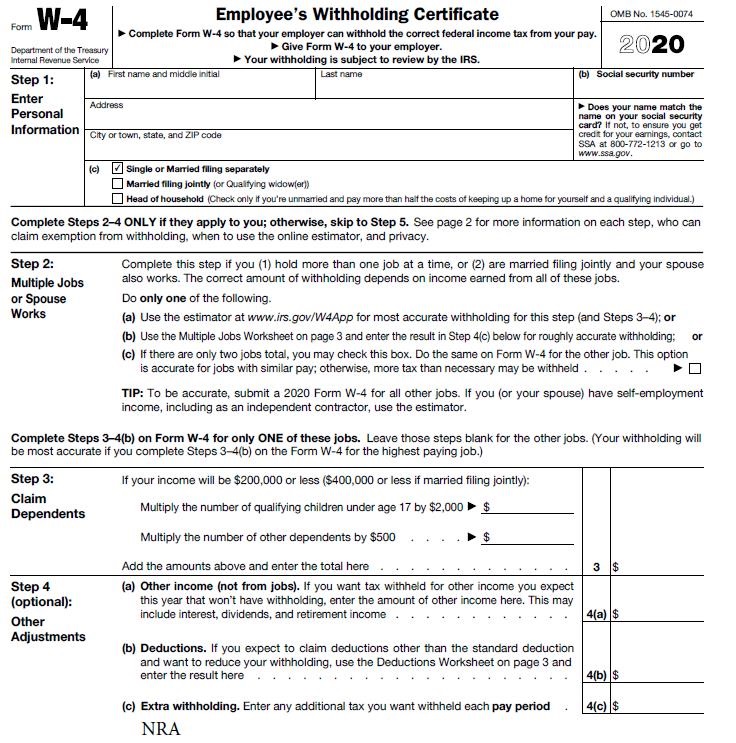

Employees who complete IRS 2020 Form W-4 must complete Minnesota Form W-4MN NRAs may claim more than 0 allowancesThe W-4MN 2020 instructions indicate that nonresident employees can claim 1 withholding allowance in Section 1A for themselves and if from Canada Mexico South Korea or India additional withholding allowances for dependents. The Minnesota Department of Revenue released the 2020 state income tax withholding guide that contains the 2020 wage-bracket tables and computer formula. Employers use our payroll tax software to do payroll in Minnesota.

Mn withholding form 2021. Claiming W-4 Allowances The W-4 allowances you claim determine the federal and state taxes that are withheld from your gross pay each pay period. Minnesota Revenue Mail Station 6501 St.

Enter Personal Information a. Give Form W-4 to your employer. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Minnesota form W-4MN should be completed in addition to federal form W-4 in some situations. Your withholding is subject to review by the IRS. Link to Minnesota Revenues web page on W-4MN.

The W-4 form has been changed for 2021 and looks different than the W-4 forms from previous years. A separate IRS form W-4 will be required for state withholding. Your employees must complete Form W-4MN to determine their Minnesota tax withheld.

Give the completed form to your employer. If recipients do not want income tax withheld from their distributions they can elect to not have tax withheld by completing. Employers are required to keep copies of completed federal Forms W-4 or state Form W-4MN for their employees in their files.

Your withholding is subject to review by the IRS. Incomplete forms are considered invalid A 50. Transform them into templates for numerous use add fillable fields to gather recipients.

Minnesota requires nonresident aliens to claim Single with no withholding allowances. Your withholding is subject to review by the IRS. The payroll solution is very affordable and a free demo can be downloaded from the Minnesota payroll software page.

Minnesota Revenue Mail Station 6501 St. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Select each form under COURSE CONTENT to access and fill out your federal and state withholding information.

A 50 penalty may be assessed for each required Form W-4MN not filed with the department. I understand there is a 500 penalty for filing a false Form W-4MN. Employers If you are required to send a copy of this form to the Department of Revenue see instructions you must enter the employer information below and mail this form to.

Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 tells your employer how much tax to withhold from your paycheck. All new employees are required to complete a form W-4.

Get and Sign Minnesota Form 2021-2022. December 2020 Department of the Treasury Internal Revenue Service. Consider completing a new Form.

You also may need to submit Forms W-4MN to the Minnesota Department of Revenue. 2020 W-4MN Minnesota Employee Withholding AllowanceExemption Certificate Employees. Give the completed form to your employer.

Mark the W-4 For State Use Only and enter Marital Status as Single and Number of Allowances as 0. Information put and request legally-binding electronic signatures. The tables and formula must be used with wages paid on and after January 1 2020.

Section 2 is correct. Complete Form W-4MN so that your employer can withhold the correct Minnesota income tax from your pay. Benefit from a digital solution to generate edit and sign documents in PDF or Word format on the web.

Enter Personal Information a. 2021 W-4MN Minnesota Employee Withholding AllowanceExemption Certificate. Give Form W-4 to your employer.

W-4 form 2021 pdf. Use professional pre-built templates to fill in and sign documents online faster. The forms serve as verification that federal and state income taxes are being withheld according to the employees.

You will need to fill out both the Federal and State Minnesota W4 forms in order for your employer to withhold the correct amount from each paycheck. Select each form under COURSE CONTENT to access and fill out your withholding information. The Minnesota Department of Revenue released a new Form W-4MN Minnesota Employee Withholding AllowanceExemption Certificate which employees may be required to complete.

On the 2021 W-4 form you can still claim an exemption from withholding. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If required enter your information below and mail this form to the address in the.

Form W 4mn Fillable Minnesota Employee Withholding Allowance Exemption Certificate Revised 1 12

W2 Form 2019 W2 Forms Form Generator Business Template

Minnesota State Form W 4 Download

W4 Form Mn 2021 Fill Online Printable Fillable Blank Pdffiller

Printable Chalander With Space To Right For 2020 In 2021 Calendar Template Calendar Printables Monthly Calendar Template

W 9 Form 2020 Printable Pdf Irs Example Calendar Printable Pertaining To Irs W9 Form 2021 D Fillable Forms Blank Form Irs Forms

2019 Form Mn W 4mn Fill Online Printable Fillable Blank Pdffiller

Guidance On 2020 Form W 4 Conway Deuth Schmiesing Pllp

How To Fill Out The New W 4 Form Correctly 2020

No comments:

Post a Comment