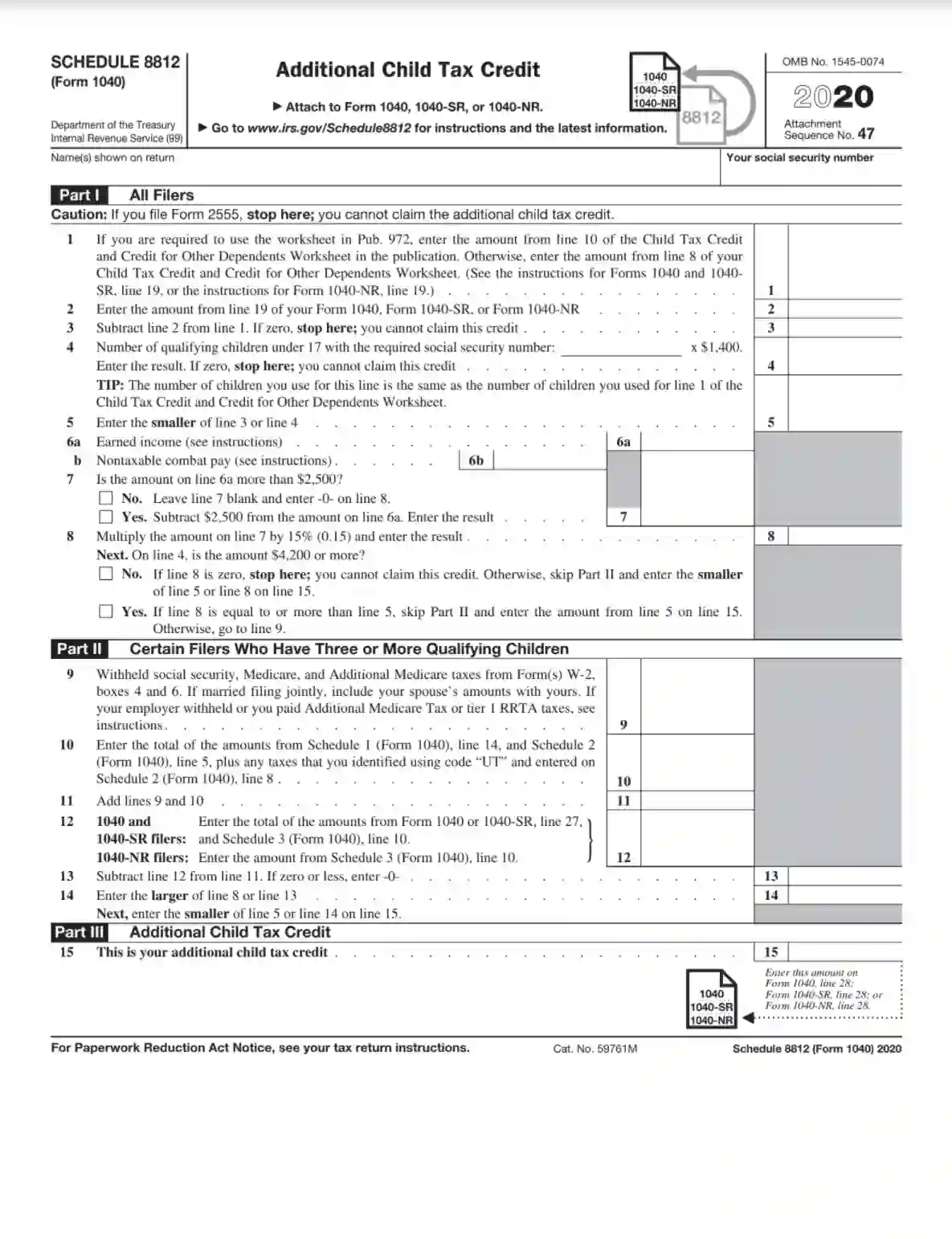

Inst 1040 Schedule A Instructions for Schedule A Form 1040 or Form 1040-SR Itemized Deductions. SCHEDULE 8812 Form 1040 2020 Additional Child Tax Credit Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040-SR or 1040-NR.

Form 8812 Additional Child Tax Credit

As a result Pub.

1040 form 8812. The in-structions now include all applicable worksheets for figuring these credits. For example if the amount you owe in taxes is either zero or less than the credit you cannot claim. IRS Schedule 8812 is the section on Form 1040 that needs to be filled out to claim the federal additional child tax creditThe additional child tax credit is considered a refundable credit which means that it entitles qualifying taxpayers to claim a refunded amount of the child tax credit if it exceeds their tax liability after factoring in the child tax credit.

Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. These are the schedules that allowed for the conversion of. Check only one box.

972 will not be revised. Enter this amount on Form 1040 line 17b or Form 1040NR line 64. Schedule 8812 Form 1040.

The more significant changes to the 2021 Form 1040 are to Schedules 1 2 and 3. As a result Pub. How to create an eSignature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit in Chrome irs child tax credit 2019ue to its number of useful features extensions and integrations.

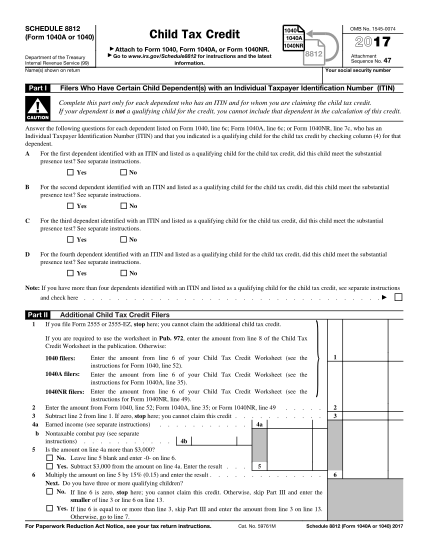

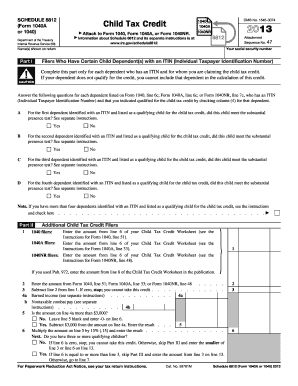

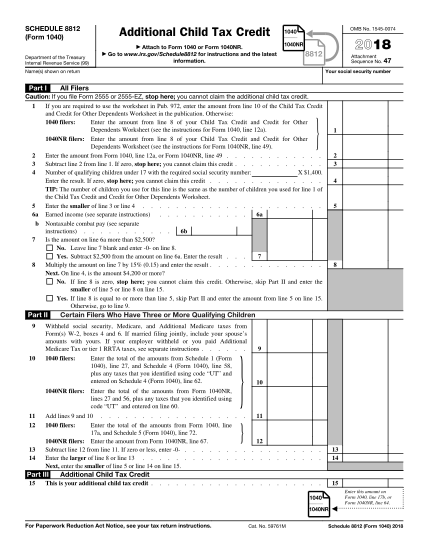

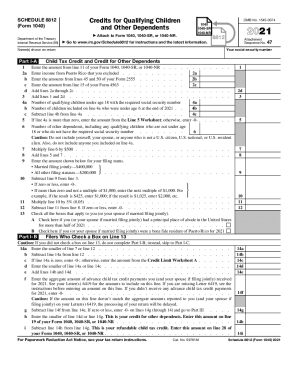

Printable and fillable Form 1040 Schedule 8812. Schedule 8812 Form 1040 2018. SCHEDULE 8812 Form 1040 2021 Credits for Qualifying Children and Other Dependents Department of the Treasury Internal Revenue Service 99.

The Schedule 8812 Form 1040 and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents. Married filing separately MFS Head of household HOH Qualifying widower QW. 26 rows Inst 1040 Schedule 8812 sp Instructions for Form 1040 Schedule 8812 Credits for.

972 will not be revised. Instructions for Form 1040 Schedule 8812 Additional Tax Credit Spanish Version 2020. On page two of the IRS Form 1040 line 19 and line 28 the taxpayer is asked to add the amounts from Schedule 8812.

Form 1040 officially the US. Instructions for Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents Spanish Version 2021 01132022 Form 1040 Schedule A Itemized Deductions 2021 12202021 Inst 1040 Schedule A Instructions for Schedule A Form 1040 or Form 1040-SR Itemized Deductions. - A Schedule 8812 is form for Child Tax Credit.

For Paperwork Reduction Act Notice see your tax return instructions. For prior year ver-. Get a 1040 Schedule 8812 2020 here.

Form 1040 Schedule 8812 sp Credits for Qualifying Children and Other Dependents Spanish Version 2021 12172021 Inst 1040 Schedule 8812 sp Instructions for Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents Spanish Version 2021 01132022. Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents. Inst 1040 Schedule B Instructions for Schedule B Form 1040 or Form 1040-SR Interest and Ordinary Dividends.

Single Married filing jointly. Get a 1040 Schedule 8812 2018 here. Instructions for Schedule 8812 Form 1040A or 1040 Child Tax Credit 2017 Form 1040 Schedule 8812 Child Tax Credit 2016 Inst 1040 Schedule 8812 Instructions for Schedule 8812 Form 1040A or 1040 Child Tax Credit 2016 Form 1040 Schedule 8812 Child Tax Credit 2015.

The instructions now include all applicable worksheets for figuring these credits. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents can be used with the redesigned Form 1040.

- Schedule 8812 Form 1040 is use to figure the additional child tax credit. Form 1040 Schedule 8812 sp Credits for Qualifying Children and Other Dependents Spanish Version 2021 12172021 Form 1040 Schedule A Itemized Deductions 2021 12202021 Form 1040 Schedule B Interest and Ordinary Dividends 2021 11032021 Form 1040 Schedule C Profit or Loss from Business Sole Proprietorship. You can also file IRS Schedule 8812 with the older 1040 series forms such as Form 1040A and Form 1040EZ.

Income tax returns for individual calendar year taxpayers are due by Tax Day which is usually. It was attached to the form 1040A r 1040. The Schedule 8812 Form 1040 and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents.

For instance browser extensions make it possible to. The Schedule 8812 Form is found on Form 1040 and its used to calculate an alternative refundable credit known as the additional child tax credit. IRS Use OnlyDo not write or staple in this space.

The additional child tax credit may qualify a refund even to those who do not owe any tax. The remaining changes to the 2021 Form 1040 are primarily updates to the year or a line reference.

Irs Schedule 8812 Form 1040 Fill Out Printable Pdf Forms Online

4 1040 Schedule 8812 Free To Edit Download Print Cocodoc

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

Irs Form 1040 Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2020 Templateroller

8812104 Form 1040 Schedule 8812 Additional Child Tax Credit Page 1 2 Nelcosolutions Com

Form 8812 Additional Child Tax Credit

5 Printable 1040 Schedule 8812 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Did You Pay A Penalty For Under Withholding 2018 Taxes When You Filed Your Tax Return This Year If You Filed Your 2018 Tax Return And Tax Refund Tax Tax Return

4 1040 Schedule 8812 Free To Edit Download Print Cocodoc

8812104 Form 1040 Schedule 8812 Additional Child Tax Credit Greatland Com

Irs Form 1040 Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2020 Templateroller

No comments:

Post a Comment