Enter your social security number SSN. If you chose to pay via check and are e-filing well prepare your 1040.

Fillable Form 1040 V 2015 In 2021 Tax Payment Irs Forms Form

W-2 1099 Specialists.

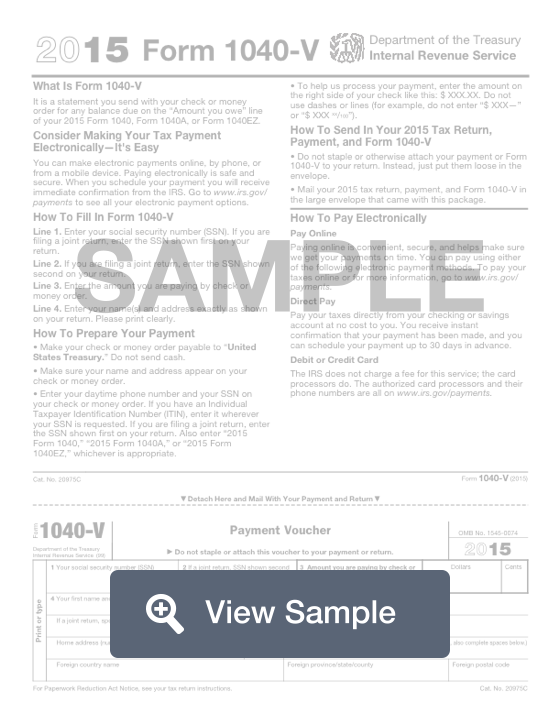

1040 v 1099 form. 40 Years of Experience. The 1040-V officially the Payment Voucher for Form 1040 is used as an optional payment voucher to be sent in along with a payment for any balance due on the Amount you owe line of the 1040. Payments sent in with a 1040-V voucher facilitate payment processing.

Form 1040-V is a payment voucher that is commonly used with Forms 1040 1040A and 1040EZ. Paper E-File Options. These two forms 1040 and 1099 are very different from each other.

The difference between these two forms is in their usage. Are filing a joint return enter the SSN shown first on your return. Department of the Treasury Internal Revenue Service 99 Payment Voucher.

VOH210 - 1040-V Envelope - Cincinnati OH. Enter the amount you are paying by check or money. A Form 1040-V contains sections for you to provide.

The envelope stays on hold until the IRSState confirms the address. Another key difference between the 1099 and 1040 forms is the type of user who usually needs to fill out each form. The form 1040 is used for submitting details of income from which a person is earning on a yearly basis while the form 1099 is the one which has to be presented to the individual who is.

1040-V 2016 Detach Here and Mail With Your Payment and Return Form. Will the IRS catch a missing 1099-B. What is the difference between 1040 and 1099 forms.

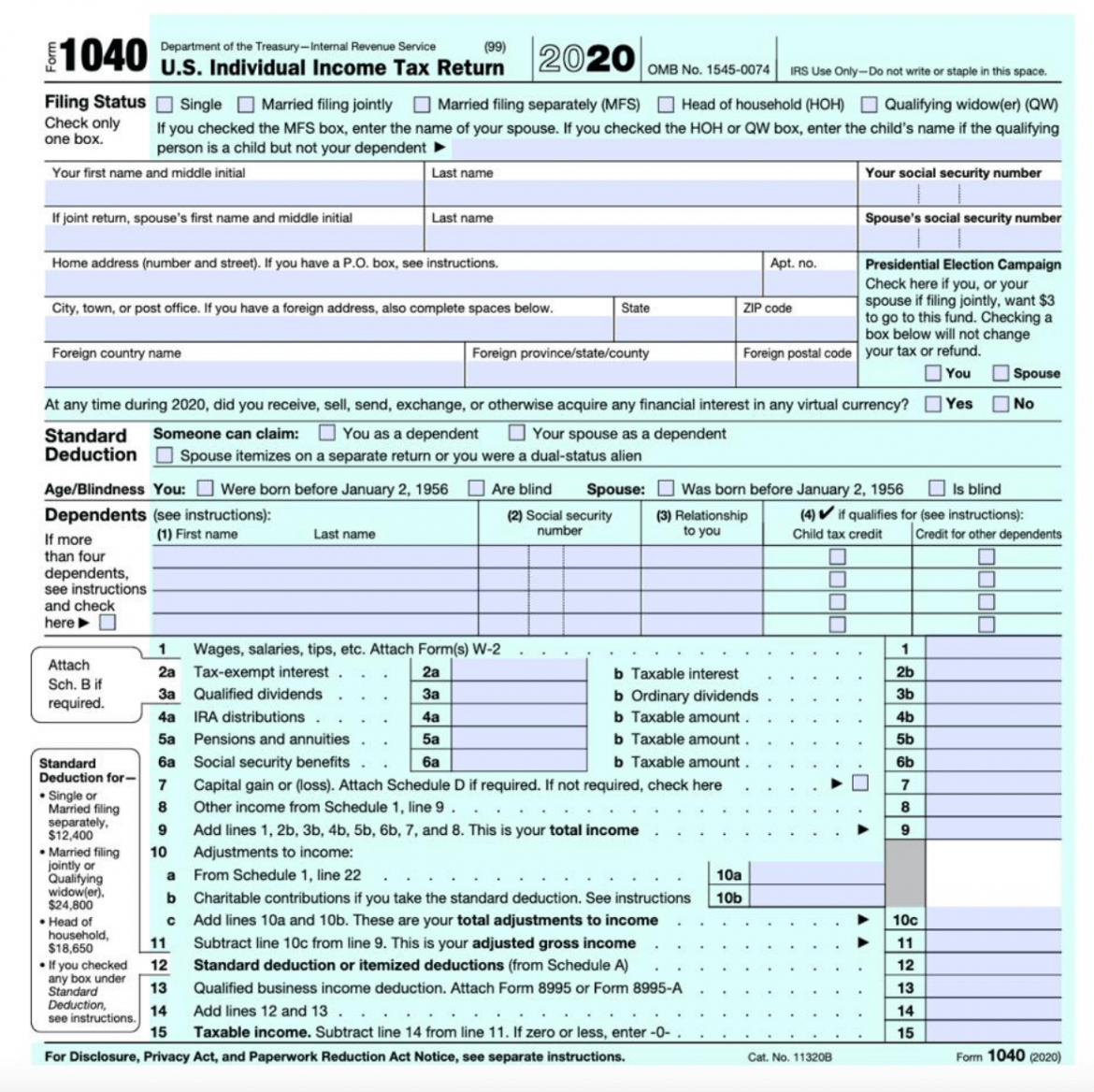

The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Form 1040-V includes enough instructions on the form to complete the. Do not staple or attach this voucher to your payment or return.

Form 1040-V is the payment voucher you detach and mail with your annual Form 1040EZ Form 1040A Form 1040-SR or Form 1040 income tax return. Form 1040-V is a statement you send with your check or money order for any balance due on the Amount you owe line of your Form 1040 or 1040-NR. 2019 Form 1040-V Department of the Treasury Internal Revenue Service What Is Form 1040-V Itsa statement you send with.

This envelope is put on hold April 16 each year. If youre paper-filing and are paying via check well include the 1040-V with your tax return printout along with mailing instructions. Amount you are paying.

This form is a payment voucher you send along with your check or money order when you have a balance due to the IRS on any of the following forms. The key difference between these forms is that Form 1040 is typically used by taxpayers to file their income tax returns for the year while 1099 is for anyone who earns income other than salary. Only people who have earned income other than a salary or wages will receive a Form 1099.

Do not staple or attach this voucher to your payment or return. Payment Voucher is a payment voucher that taxpayers send to the Internal Revenue Service IRS along with their tax return if they choose to make a payment with a check or money order. Form 1040-V Payment Voucher is an optional form that you can include with your check payment if you owe the IRS at the time of filing.

What is Form 1040-V. E-file or Paper Options. Current Revision Form 1040-V PDF About Form 1040-V Payment Voucher Internal Revenue Service.

If a joint return SSN shown second on your return. The amount shown in Box 11 on Form 1099-DIV should be reported on your Federal income tax return on IRS Form 1040 or Form 1040A. 1040 forms vs 1099 forms.

Fast Easy ordering. Your social security number SSN if a joint return SSN shown first on your return 2. Department of the Treasury Internal Revenue Service 99 Payment Voucher.

1040-v Irs Template qoj1m7zde4o9. Form 1040 vs. If you are filing a joint return enter the SSN shown second on your return.

This is a statement accompanying a taxpayers payment for any balance on the Amount you owe line of the 1040 or 1040-NR. 1040-V 2009 Detach Here and Mail With Your Payment and Return Form. If you need the envelope to ship prior to October please contact customer service.

Confirmation from the IRSState generally occurs in the Fall. A 1099 form is sent to people by a company to show a miscellaneous income that they earned from the company for services rendered or work done. Components of a Form 1040 V.

To make a cash payment you must first be. The form is entirely optional. However you should not be filing an amended 1040X if you just forgot to attach any of the forms such as 1099-B.

The envelope stays on hold until the IRSState confirms the address. Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents. Use IRS Form 1040-V when you are paying by check or money order and make your check or money order payable to United States Treasury.

Browse W-2 1099 1095 forms or compare our all inclusive e-file options. The IRS will accept payment without the 1040V form. How to complete a Form 1040 V Step by Step.

Your social security number SSN if a joint return SSN shown first on your return 2. Your social security number SSN 2. How To Fill in Form 1040-V.

1040-V 2018 Detach Here and Mail With Your Payment and Return Form. Youll know you have a balance due by looking at the Amount you owe section of the 1040 form you completed. The key difference between these forms is simply that most people who file a tax return whether on paper or electronically will use Form 1040 some seniors may file a 1040-SR.

While the information in a 1099 form does appear on a 1040 form a 1099 form only contains information about the source of income it focuses on such as freelance work capital gains or royalties. Department of the Treasury Internal Revenue Service 99 Payment Voucher Do not staple or attach this voucher to your payment or return. Confirmation from the IRSState generally occurs in the Fall.

This envelope is put on hold April 16 each year. VOH210 - 1040-V Envelope - Cincinnati OH. Form 1040-V.

If you need the envelope to ship prior to October please contact customer service. The Big Difference.

1040 Forms Versions And Schedules Pdffiller

What Is An Irs Schedule C Form

Fillable Form 1040 Individual Income Tax Return Income Tax Income Tax Return Tax Return

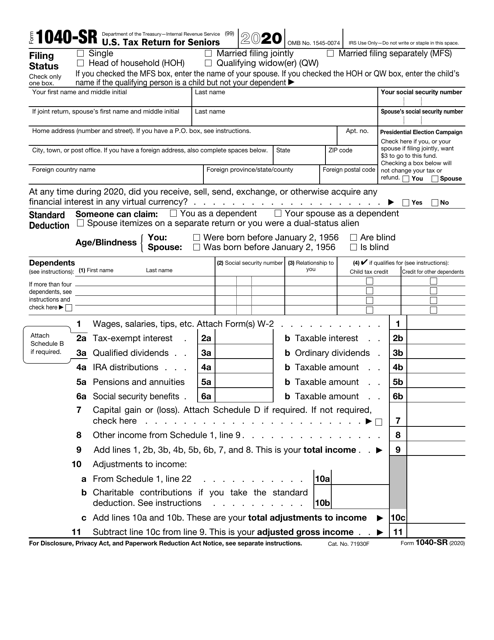

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Form 1040 V Payment Voucher Definition

Form 1040 V What Is A 1040 V Fill Out Online Pdf Formswift

What Is The 1040 And What S The Difference Between The 1040 1040a And 1040ez

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

No comments:

Post a Comment