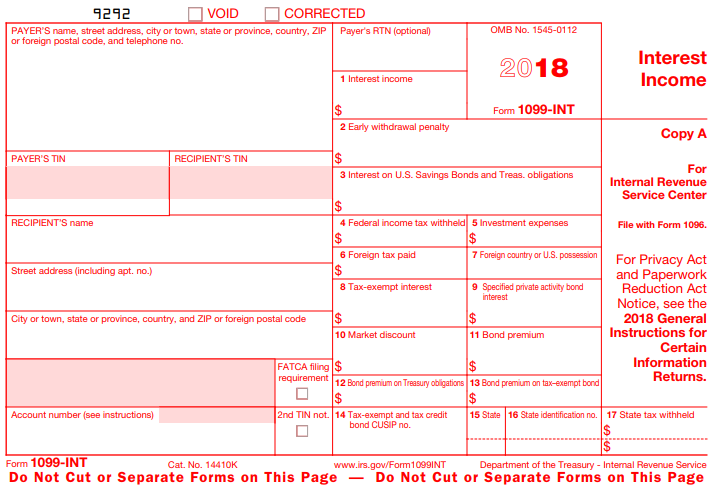

Specific Instructions for Form 1099-INT File Form 1099-INT Interest Income for each person. Each person for whom you withheld or paid any foreign tax on interest must be filed separately.

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

For more details about specific entries select the box numbers below.

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Box 3 form 1099-int. Enter the amount in Original issue discount OID code 11 as a negative number. Interest Income later 2. Furnish Copy B to each owner.

Not everyone should do that. Federal income tax withheld. From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment.

Bond premium on tax-exempt bond. Accumulated dividends paid by life insurance companies should be included. If box 3 of your 1099-INT includes interest from US.

Form 1099- INT filing instructions. Enter the Name of Payer. If you reported a net amount of interest in box.

Enter the Early Withdrawal Penalty. Savings Bonds and Treas. Enter 1 or 2 for taxpayer or.

Log into your account click orange Take me to my return button. Market discount on a tax-exempt security is categorized as interest income so entry as a negative amount will increase the total interest income on Schedule B and. File a form for each person you paid amounts reportable in Box 1 for interest income Box 3 for interest on US.

Savings Bonds and Treas. Saving Bonds interest report on Box 3 Form 1099 INT. File Copy A of the form with the IRS.

The amount you enter in Box 3 will be added to the total interest income on the federal return and will be included on New Jersey Form NJ-1040 Line 16a or Form NJ-1040NR. Department of the Treasury - Internal Revenue Service. It includes tax-exempt interest income like youd get from a municipal bond.

For Privacy Act and Paperwork Reduction Act Notice see the. Savings bonds that were issued after 1989 you may be eligible to exclude those amounts from tax if you use the proceeds to pay qualified higher education expenses. Even though its exempt from federal income tax the interest still needs to be reported to the IRS.

Incentive Payments in Box 3 Other Income from Box 3 of the 1099-MISC form includes what the Internal Revenue Service IRS calls incentive payments Theyre most commonly found in the auto industry as bonuses paid to salespersons when they sell a certain vehicle and they can really add up over the course of the year. However if you have checked the box hereupon or own several accounts for the payee you must not leave this field blank. Enter any qualified stated interest paid or credited on this obligation during the year.

This amount is usually taxable from a federal perspective and exempt for state or local tax purposes. Report interests on US savings bonds and treasury obligations in this box. The amount in Box 3 should not be in the Box 1 amount as well.

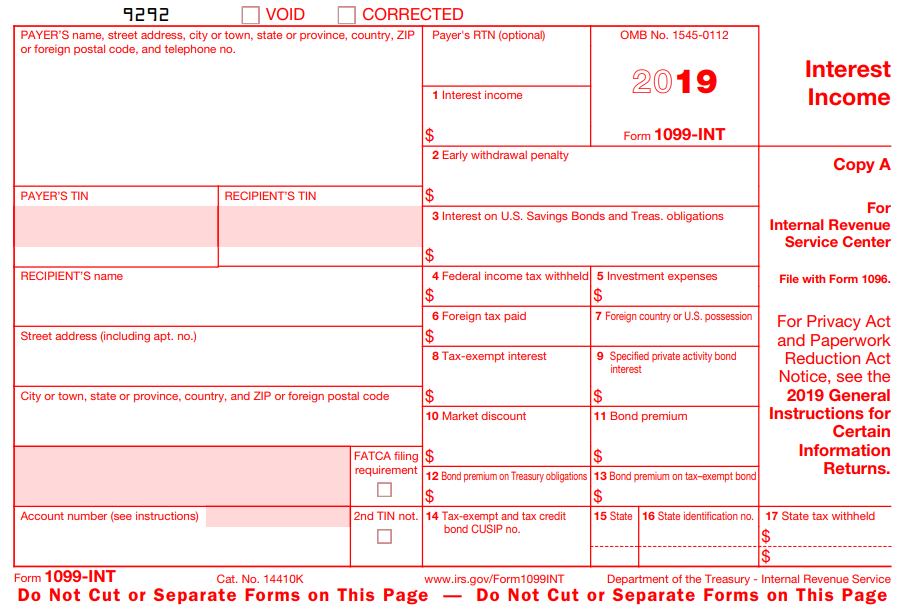

1099-INT 2021 Form IRS 1099-INT Instructions. Scroll down to Adjustments to Federal Taxable Interest. 2021 General Instructions for Certain Information Returns.

Select jump to 1099-INT and it will take you right to section to enter this. Select Yes on page where it asks Did you receive any interest income. For Internal Revenue Service Center.

These interests are exempt from local and state income taxes. Type 1099-INT in the Search box in top right. File with Form 1096.

Reports interest income obtained from mutual bonds corporate bonds DD and CD accounts. For a tax-exempt covered security acquired at a premium enter the amount of bond premium amortization allocable to the interest paid during the tax year. The interests included in Box.

For whom you withheld and paid any foreign tax on interest. See below for where to enter this Box 3 Interest in the TurboTax software. A 1099-INT tax form is a record that a person or entity paid you interest during the tax year.

Enter taxable interest of 10 or more that is paid to a persons account for savings accounts or for loans or for mutual fund investments. Go to the Input Return tab Income and select Interest Income 1099-INT 1099-OID. All related treasury bills treasury notes and treasury bonds and US.

Any interest earned from Treasury Bills Treasury Bonds Treasury Notes Treasury Bills and United States Savings Bonds is in the Box 3 amount. For interest related to securities transactions the information provided may be different for covered or non-covered transactions. 1099 INT Fillable Form Box 3.

About Form 1099-INT Interest Income. May also show the total instrument during the year while held by you unless it was reported on Form amount of the credits from clean renewable energy bonds new clean renewable energy 1099-OID. This does not include interest shown in box 3.

File Form 1099-INT for each person. Foreign Country or US. Interest on bank deposits should be included.

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. Sometime in February you might receive a. Hereunder you must Indicate the sum that you did not include in box 3 at least 10.

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 or at least 600 of interest paid in the course of your trade or business described in the instructions for Box 1. Form 1099-INT - Interest Income Form 1099-INT is used to report interest paid in the course of a trade or business. Form 1099-INT is issued by banks brokerages and government agencies when you earn at least 10 in interest income.

Savings Bonds and Treasury Obligations and Box 8 for tax-exempt interest. Complete a Form 1099-INT for each of the other owners showing the income allocable to each. Savings Bonds and Treasury Obligations.

However you may report any qualified stated interest on Treasury Inflation Protected Securities in box 3 of Form 1099-INT rather than in box 2 of Form 1099-OID. List yourself as the payer and the other owners as the recipient File Forms 1099-INT with Form 1096 with the Internal Revenue Service Center for your area. ProConnect supports most data entry from Form 1099-INT on the Interest income 1099-INT screen under income.

Refers to early withdrawal penalties from CDs and other securities paid during the year. Specify the Interest Income Amount. When you come to the screen titled Interest Income - 1099-INT Income enter the amount of your New Jersey state exempt interest in Box 3 Interest on US.

Interest reported here must not be reported on Form 1099-INT. The box-by-box split-up of Form 1099- INT is as follows. Federal income tax withheld.

No additional description is required here. For a taxable or tax-exempt covered security acquired on or after. From the left Sections choose Form 1099-INT.

When Do You Need to File 1099-INT. If you are required to report bond premium amortization and you reported a net amount of interest in box 3 leave this box blank.

1099 Int 2018 Public Documents 1099 Pro Wiki

Form 1099 Nec And Form 1099 Misc Instructions Nec Form Instruction

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Student Information

1099 Int Your Guide To A Common Tax Form The Motley Fool

Irs Approved 1099 Int Tax Forms File Form 1099 Int Interest Income For Each Person To Whom You Paid Amounts Reportable In Boxes 1 1099 Tax Form Tax Forms Irs

1099 Int 2019 Public Documents 1099 Pro Wiki

W4 Form Application Simple Guidance For You In W4 Form Application This Or That Questions Tax Forms Power Of Attorney Form

1099 Int A Quick Guide To This Key Tax Form The Motley Fool

Super Forms 1099 Misc Forms Preprinted Set 4 Part Miscs405 Irs Tax Forms Tax Forms Irs Taxes

Interest Income Form 1099 Int What Is It Do You Need It

Irs Form 1099 Int Fill Out Printable Pdf Forms Online

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms Payroll Checks The Secret Book

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

No comments:

Post a Comment