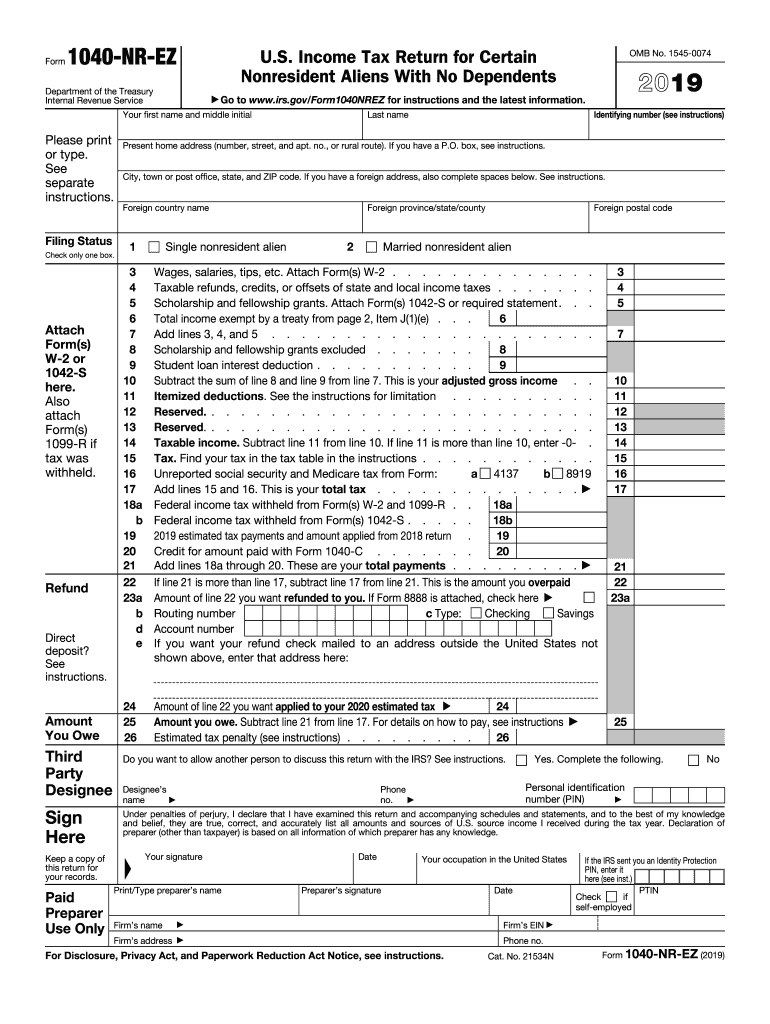

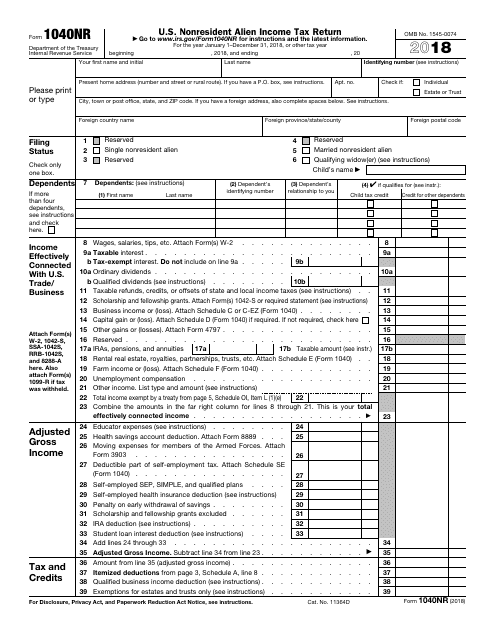

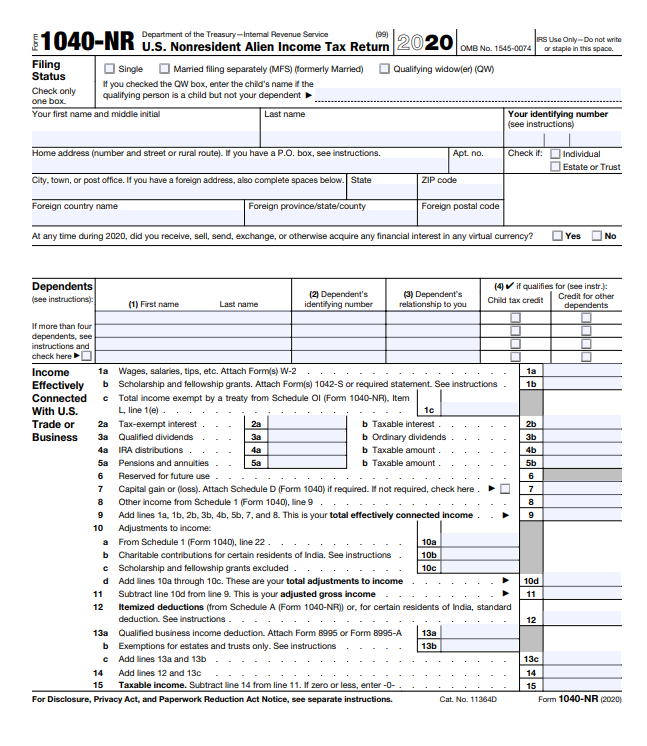

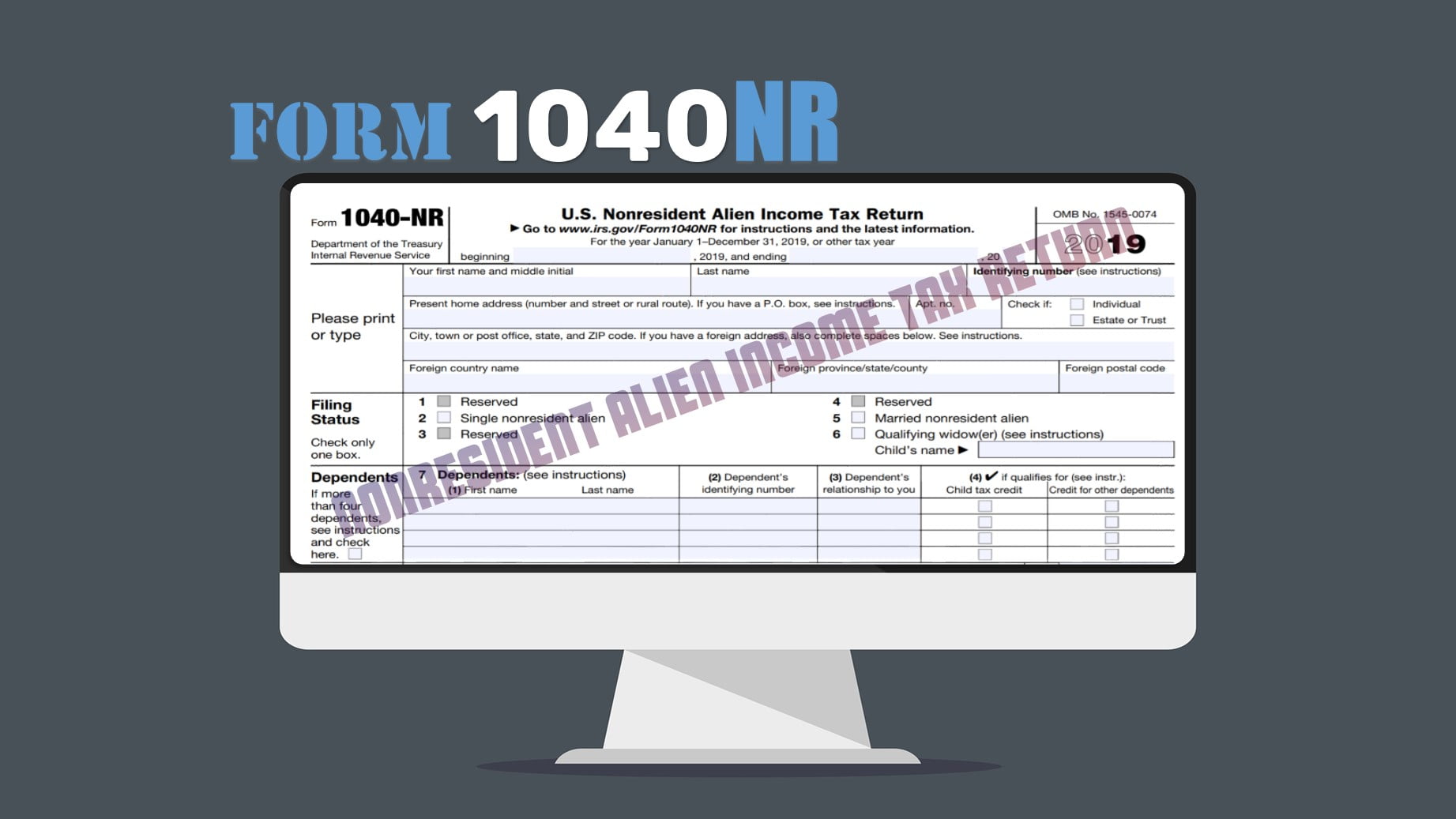

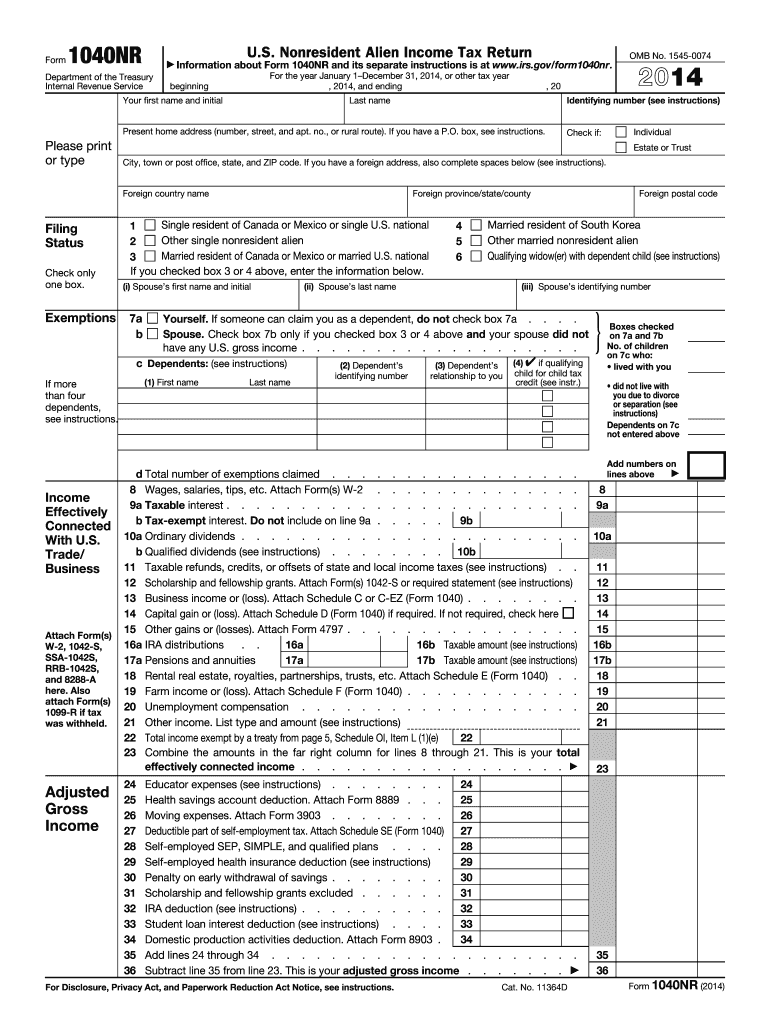

1040-NR for Nonresident Aliens NRA 1040NR. About Form 1040-NR US.

/1040x-3fa72efbba54446580f8dcbf8ec947e6.jpg)

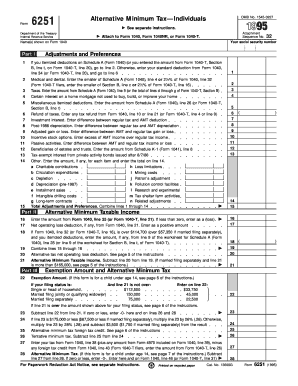

Form 1040 X Amended U S Individual Income Tax Return Definition

Go to Screen 581 Nonresident Alien 1040NR.

E-file form 1040-nr. To determine if you need to file Form 1040NR please follow the steps below. Instead it is a statement you file for the US Government if you are a certain type of nonresident alien for tax purposes. Taxpayers can e-file Form 1040-X or send it to the IRS by mail but the electronic tax filers will get a faster response if they are expecting a check.

Represented an estate or trust that had to file Form 1040-NR. Represented a deceased person who would have had to file Form 1040-NR. Per the IRS Instructions for Form 1040NR US.

File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. Form 8843 is not an income tax return. The IRS today released an advance version of Notice 2020-70 that generally removes Form 1040-NR from the list of returns that are exempt from the electronic filing e-file requirement imposed on specified tax return preparersie tax return preparers who prepare more than a relatively de minimis amount of tax returns.

Complete all other applicable sections for this form. 1040-NR is that a US person such as a US citizen Lawful Permanent Resident or Foreign National subject to. Under Federal Products check the Form 1040 NR box.

I need advice and feedback if someone had experience with e-filing of 1040 NR from Canada. Schedule NEC - Tax on Income Not Effectively Connected with a US Trade or. And the premium tax credit for dependents are only available in full to residents of Canada and Mexico and to a limited extent to residents of.

Use the Page Down function to access additional data entry screens. Who Must File Form 1040NR You must file Form 1040NR if any of the following conditions apply to you. Form 1040-X 1040X Tax Amendment.

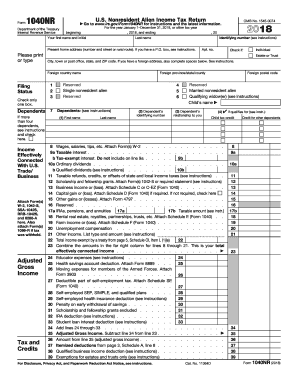

May help in e-filing. Nonresident Alien Income Tax Return. Certain tax benefits such as the child tax credit the credit for other dependents and the additional child tax credit.

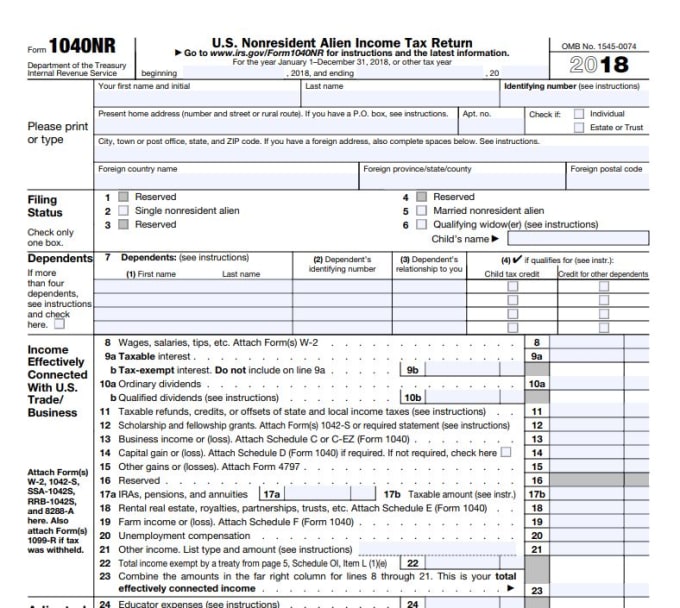

The AZ individual return cannot be e-filed when the federal return is Form 1040NR US. Tax return preparers must generally e-file Forms 1040-NR for taxable returns filed for tax years ending on or after December 31 2020 unless filing for a dual. Where To Find Your Lines on Redesigned 2020 Form 1040-NR later showing where the former Form 1040-NR lines are in the redesigned Form 1040-NR follows this section.

At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. Nonresident Alien Income Tax Return. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

While filing this amendment form the taxpayer is also required to file the entire 1040 or 1040-SR along with other attached schedules and forms even if they were not amended. Nonresident Alien Income Tax Return is now available in the TaxAct program. A 1040-NR is not eligible for e-fling and generates EF.

Form 1040-NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from. Federal Form 1040NR US. Arkansas only allows 1040 1040A and 1040-EZ to be attached for efiling.

You were a nonresident alien engaged in a trade or business in the United States during. Limitations for Form 1040NR. Were a nonresident alien engaged in a trade or business in the United States.

Starting in Drake18 Arizona NR returns can be filed with the 1040NR. Nonresident Alien Income Tax Return click the link and view the entire publication for additional details regarding the items below page 6. Most of the forms and schedules that are required with Form 1040NR can be e-filed with the return.

October 1 2020. You may need to file Form 1040-NR if you. IncomeCredits Taxes and Adjustments.

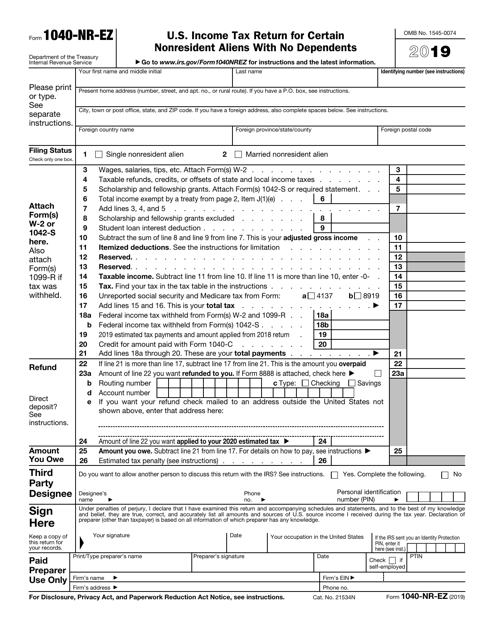

File with Jackson Hewitt Tax Pro For Our Biggest Refund Guarantee. In the Client Information section select the Filing Status CtrlT MANDATORY. For example Form 1040NR-ez and dual-status returns are still not available.

Most US persons who file a US tax return each year will file an IRS Form 1040Alternatively the Form 1040-NR is filed by nonresident aliens to report US-sourced income FDAP and ECIThe distinction between the 1040 vs. Drake does not produce Form 1040NR-EZ. Had any one tried it before to e-file 1040 NR.

From within your TaxAct return Online or Desktop click on the Basic Info tabOn smaller devices click the menu icon in the upper left-hand corner then select Basic Info. Select Next to begin downloading and installing the 1040NR. To create the 1040-NR you will use the NR screen on the Taxes tab.

This will generate the 1040NR in forms view. However since 2017 was the first filing season for Form 1040NR in the e-file system there are still a few limitations and restrictions. A nonresident alien filing Form 1040-NR cannot have a Married filing jointly or a Head of household filing status.

In prior years AZ EF Message 0106. Generating state returns in the 1040NR. Once the 1040NR module has been downloaded and installed into your ProSeries product you can now access Form 1040NR returns from the HomeBase View dropdown menu.

However if you earned income in the US you must file a tax return either Form 1040NRForm 1040 NR-EZ only for years prior to 2020 as well as Form 8843.

Instructions For Form 1040 Nr 2020 Internal Revenue Service

Forms 1040 And 1040nr Ez Which Form To File 2022

Irs Form 1040nr Download Fillable Pdf Or Fill Online U S Nonresident Alien Income Tax Return 2018 Templateroller

Instructions For Form 1040 Nr 2020 Internal Revenue Service

Form 1040nr Fill Out And Sign Printable Pdf Template Signnow

2021 1040 Nr Form And Instructions 1040nr

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Forms 1040 And 1040nr Ez Which Form To File 2022

Everything You Need To Know About Form 1040nr Sdg Accountant

No comments:

Post a Comment