A 2015 law made it a permanent requirement that employers file copies of their Form W-2 Wage and Tax Statements and Form W-3 Transmittal of Wage and Tax Statements with the Social Security. To Whom you are filing for.

How To Efile W2 W3 Forms To Ssa Youtube

The good news is that when you fill the online form you can do it fast easy and secure.

E file w2 forms social security. Enter your business name or select it from the menu. Social Security Business Services Online W2. You may file Forms W-2 and W-3 electronically on the SSAs Employer W-2 Filing Instructions and Information web page which is also accessible at.

The Form W2 extension for filing with the SSA is no longer automatic as of 2016. You may file Forms W-2 and W-3 electronically on the SSAs Employer W-2 Filing Instructions and Information web page which is also accessible at. Box 3333 Wilkes-Barre PA 18767-3333 Private Delivery Service FedEx UPS etc and Certified Social Security Administration Direct Operations Center Attn.

Answer the questions asked on the page. Apply for this extension by paper filing Form 8809 Application for Extension of. Forms W-2 are sent to Social Security along with a Form W-3 Transmittal of Income and Tax Statements.

The only extension possible is for 30 days and it is granted under special circumstances. Heres how to e-file Form W-2 using 123PayStubs. From W2-1099s W-2 E-File export save your W2s as W2 E-File.

You can file the return either electronically or by paper filing. Export to SSA E-File format. You must register to use Business Services Online Social Securitys suite of services that allows you to file W-2W-2Cs online and verify your employees names and Social Security numbers against our records.

To fill the online application you need to go to their official website SocialSecurityGov. Postal Service Social Security Administration Direct Operations Center PO. It is free and secure and its the method preferred by the SSA over.

9 hours ago You can e-file W-2 forms online at the SSAs Business Services Online website. E-File Direct also creates the required W-2 and 1099 files to send to the IRS and SSA. For starters filing W-2s electronically is free fast and secure.

You can e-file Form W2 with the SSA by following a few simple steps. You can create fill-in versions of Forms W-2 and W-3 for filing with SSA. Heres some information youll want to get you started with filing your W-2s electronically with Social Security.

Enter the EIN or it should appear. Transmit Form W-2 to SSA. The software creates state W-2 files for states that require individuals to file electronic forms.

Later you can just file your W2-s electronically in secure way. The filing deadline of Form W-2 for the 2021 tax year is January 31 2022. Please note that a copy of Form W-2 must also be sent to employees before January 31.

This service offers fast free and secure online W-2 filing options to CPAs accountants enrolled agents and individuals who process W. However the SSA recommends that you e-file Form W-2 for an error-free filing and quick processing. Click on Report Wages to Social Security.

Click on CreateResume Forms W2W2 online. Order a quantity equal to the number of employees you file W2 forms for. Employers are required to file a Form W-2 for wages paid to each employee from whom.

Read it and click accept Electronic Wages Reporting EWR. Check to box for the type of tax you would pay related to the W2 like Form 944 or 941. Moreover the latest social security which you can apply online is social security w2.

Click on Report Wages to Social Security. You can create fill-in versions of Forms W-2 and W-3 for filing with SSA. QuickBooks W2 Tax Form Copy A Specs.

Ii Click on the 2. You dont have to calculate and submit a W-3 transmittal form because the Social Security Administration will generate a W-3 automatically when you submit your W-2s. Mail in a batch to the Social Security Administration with a W3 Summary Transmittal Form.

January 31st is the filing deadline for BOTH electronic and paper forms W-2. E-File Direct might be more beneficial if you are filing many Forms W-2. An e-file dialog-box will popup that The file has been saved to your hard drive.

In addition a Form W-2 must be given to each employee. The Benefits of E-Filing W-2 Forms E-filing saves time and effort and helps ensure accuracy. Mountain Drive Wilkes-Barre PA 18702-7997 PAPER W-2c Correction Forms US.

E-File Options Both use March 31 e-file deadline Two Ways to e-file Upload EFW-2 for large or small filers 2 for large or small filers requires W-2 software Fill-in up to 20 W-2 Online screen no W- - 2 software required Note. Red scannable per IRS requirements. Income Social Security or Medicare taxes were withheld or.

W-2c Process 1150 E. You may also print out copies for. E-File Services is a great resource if you hire many 1099 workers.

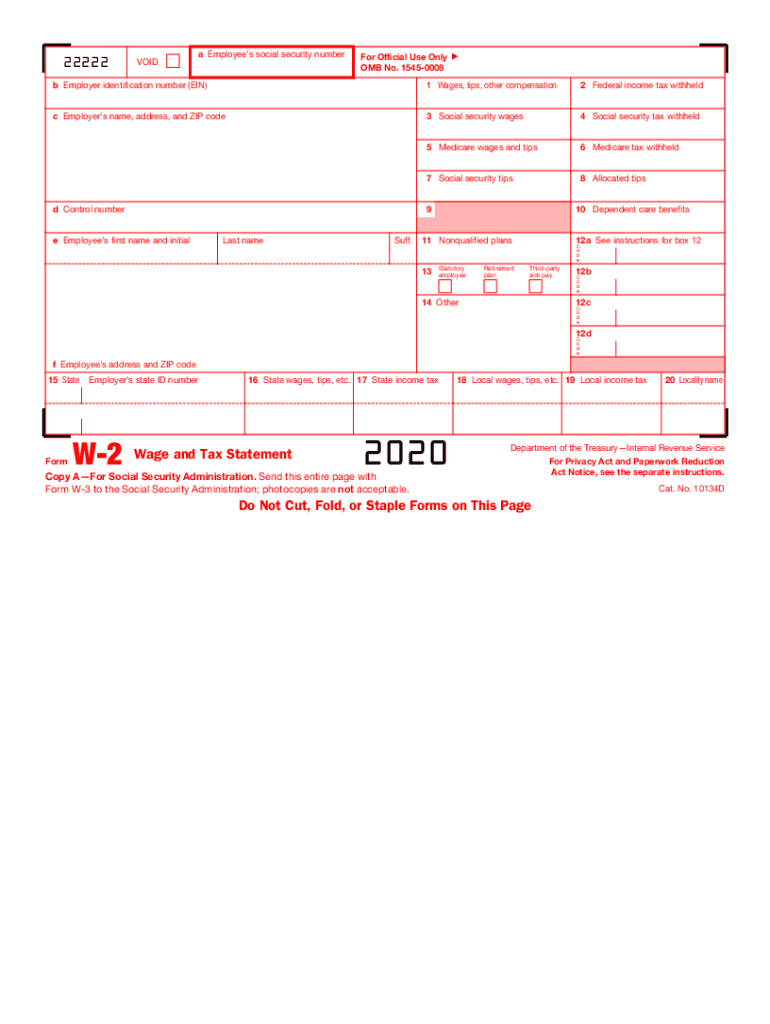

Enter the form information including employee and employer info federal and state wages info and federal and state taxes withheld. Select a filename using the button. Form W-2 is a wage tax form filed by employers to report the wages paid to employees and the taxes social security income and Medicare tax withheld from the employees to the SSA Social Security Administration.

Explain the different ways to file. Enter your business name. Form W-2 must be filed on or before January 31st with the SSA.

Tapes cartridges and diskettes are no longer acceptable. You also receive an acknowledgement receipt. You may also print out copies for.

If this date falls on a Saturday Sunday or. Under Form W2W3 online click on Create Resume Forms W2-W3 online Forms W2-W3 Online Page.

How Do I Create An Electronic W 2 File

File W 2 Online W 2 W 2c E File Form W2 For 2021

W 2 Electronic Filing Software 289 W 2 Software

Quickbooks W2 Tax Form Copy A Ssa Federal Discounttaxforms Com

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

E File Form W 2 For 2021 Tax Year File Form W 2 Online

2020 Form Irs W 2 Fill Online Printable Fillable Blank Pdffiller

W2 1099 Nec Printing And E Filing Software Free Trial

W 2 Form Fillable Printable Download Free 2021 Instructions Formswift

W 2 Software W 2 Software To Create Print E File Irs Form W 2

No comments:

Post a Comment