If you have lost your Form 1099 dont worryit can be replaced. How to obtain a duplicate 1099-G IRS Tax Form Duplicate 1099-G for the most recent tax year.

1096 Form Printable Template Tax Forms 1099 Tax Form Irs Forms

If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am.

I lost my 1099 form. Please note the following. The deadline for most forms 1099 is January 31st so if you havent received them by that date you may need to wait a couple more days. You can also go to your 1099 E-File Service account to print a copy of the 1099 form.

Contact your client and request a copy of the lost 1099 form. Select Sign In. Youll want to ask for a copy of the one they already sent you.

I am missing my 1099 G tax form from when I was unemployed in CO. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. If you have not already created a.

Here is what they said. Dont worrythere are easy ways you can retrieve the forms you need to file. File an extension form 4868 and you will have up to October 15th to file your return any tax due however will still be due July 15th 2.

Youll be able to access your form and save a printable copy. Arent available to you by January 31 2022 or if your information is incorrect on these forms contact your employerpayerIf you still havent received the missing or corrected form by the end of. I am missing the 1099 forms because of Fidelity.

Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31. You can request a duplicate copy of your 1099 by visiting the following site. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office.

You do not usually have to send the form with your tax return but you should keep it for your personal records. Head to the the 1099 E-File Service sign-in page at this link. Fidelity is taking this action to reduce the number of corrected tax statements you could receive.

A Wage and Income Transcript from the IRS will have the information from all 1099-INT forms that were issued to you but in a different format. Sign in to your account and click the link for Replacement Documents. To do this file a Form 1040X.

If you worked as an independent contractor or received any other payment that needs to be reported on a 1099 then you should reach out to the person or business that paid you. If You Forget to Include a W-2 or 1099. This also applies for those who received an incorrect W-2 or Form 1099.

It should show all Forms 1099 issued under your Social Security number. If you lose your 1099 form the best thing for you would be filing for an extension to avoid penalties for late 1099s. If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account.

Alternatively you could call 1-800-772-1213 or visit your local office. You can retrieve missing forms 1099-INT Interest Income and 1099-DIV Dividends and Distributions by requesting them from the bank or financial institution that issued them. Calling your client is usually the easiest way to get a copy of a lost Form 1099.

Establish change or stop an allotment to an organization. I was unaware that I needed to file a form from my unemployment and therefor did not get it on the website. Missing information or an incomplete tax return may also incur penalties.

Input your Intuit login credentials. How can I a get a lost 1099int. Change your mailing address.

Your original 1099-G form is mailed directly to your address of record. Taxpayers who havent received a W-2 or Form 1099 should contact the employer payer or issuing agency and request the missing documents. Change your Personal Identification Number PIN for accessing our automated systems.

Payers the client in this case are required to keep copies of the 1099 forms they filed with the IRS. In this way how do I get a copy of my 1099 form. Request a duplicate tax-filing statement 1099R.

Contact the payer and ask the individual or company to send you a new copy if you have lost your Form 1099 by accident. Your customer or the issuer is required to keep copies of the 1099s it gives out to non-employees. If you can lose a W-2 you can also forget to include one on your return.

This form is usually mailed before the end of January and is used during your income tax preparation. If they cant get. Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31.

Otherwise you have several choices. Use Services Online Retirement Services to. Start change or stop Federal and State income tax withholdings.

What if I Lost my 1099. This can be done in a lot of ways such as calling them or sending them a formal letter. See if you can guilt your former employer into getting you a copy of the 1099.

The payer should send you a copy of your 1099 by January 31st. If your Form W-2 Wage and Tax Statement andor Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. This is the IRS form for an amended return.

How to get a replacement 1099. Httpssecuressagovapps6zi1099mainhtml Megan C. Secondly what do I do if I lost my 1099.

Contact the IRS at 800-829-1040 for assistance if you have not received the form by February 15. I have changed my address. Click View past forms page.

We are writing to inform you that Fidelity will mail your 2009 Forms 1099 Tax Reporting Statement no later than February 28. So chances are they have a copy of the lost 1099 form. You may obtain a duplicate 1099-G form by accessing your Claimant Self-Service account.

To replace a lost Form 1099-INT ask the bank or other financial institution that issued it to send you another copy. For example sending in a form without your Social. If that happens or if you realize you included incorrect information on your return you can file an amended return as soon as you receive or locate the missing form.

What If I Didn T Receive A 1099 The Motley Fool

How To Refile Taxes For Previous Years Tax Deductions Tax Write Offs Income Tax Return

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

Oh No I Lost My 1099 Here S What You Need To Do

Missing An Irs Form 1099 Don T Ask For It

How To Get A Copy Of A Lost W 2 Or 1099

Haven T Got Your Tax Documents Yet Here S What To Do Abc News

F709 Generic3 Worksheet Template Printable Worksheets Family Tree Worksheet

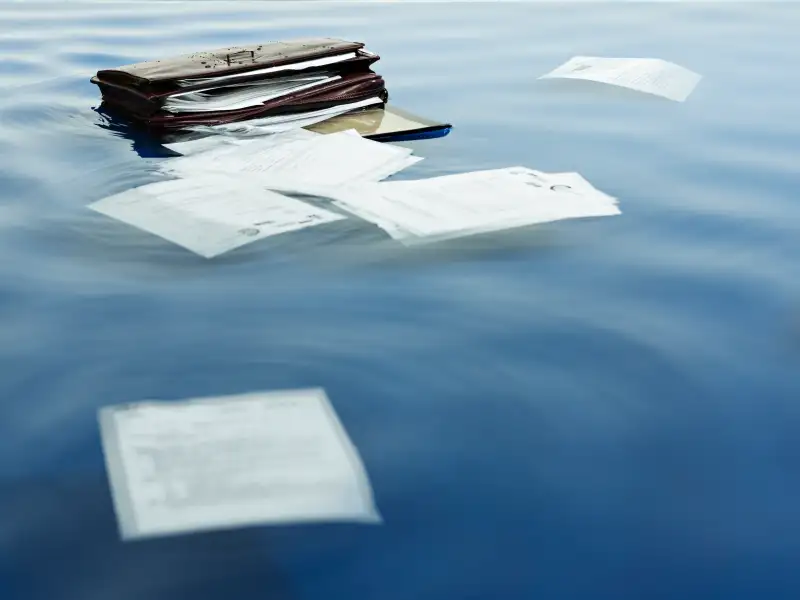

Lost Tax Forms 1099 W 2 Receipts For Donations Money

Oh No I Lost My 1099 Here S What You Need To Do

No comments:

Post a Comment