Schedule A Form 1040 or 1040-SR is an IRS form for US. Schedule C is applicable to those who file the basic Form 1040 as well as seniors age 65 and older who file Form 1040-SR instead of the basic 1040.

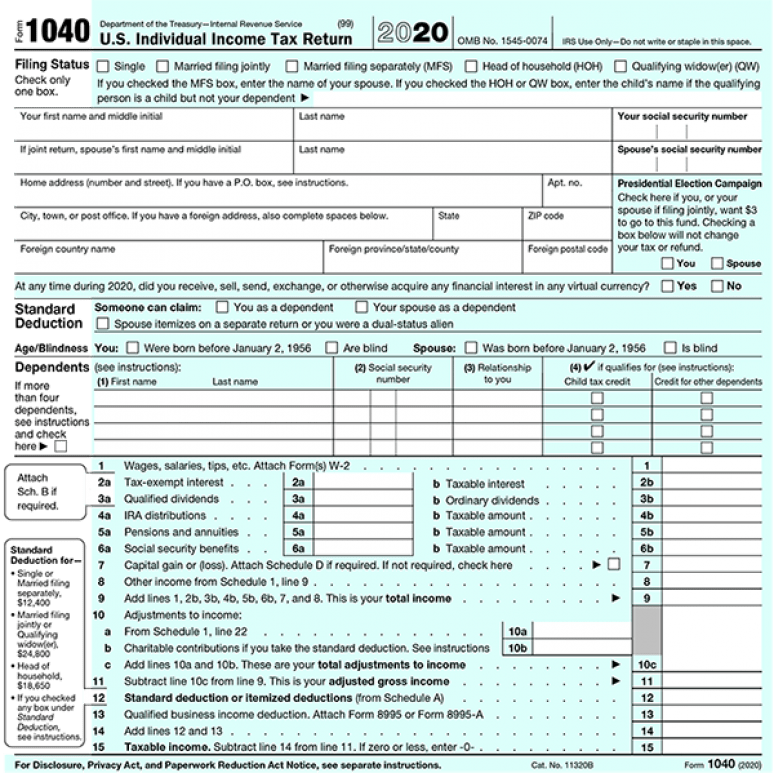

2020 Tax Form 1040 U S Government Bookstore

Then on line 20 the taxpayer is asked to add the amount from Schedule 2 line 10 Other Taxes.

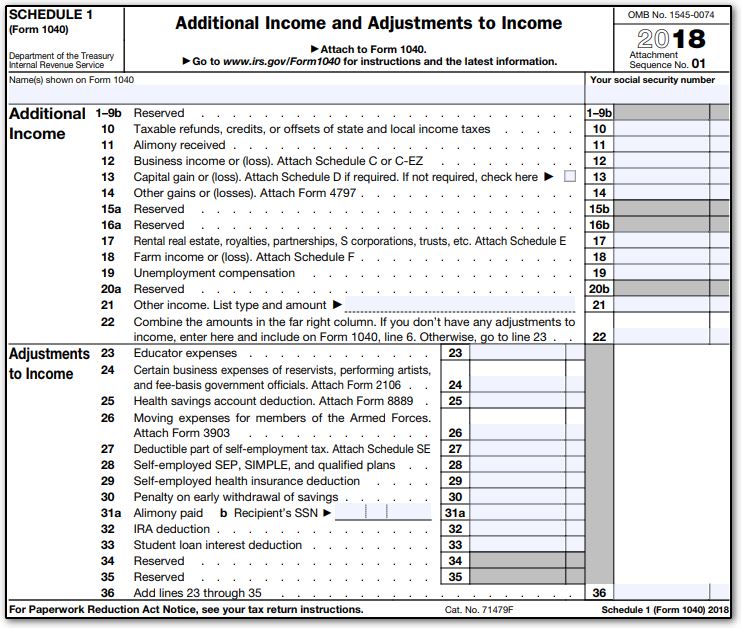

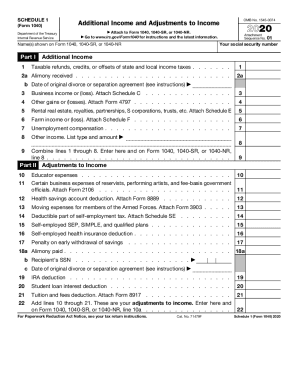

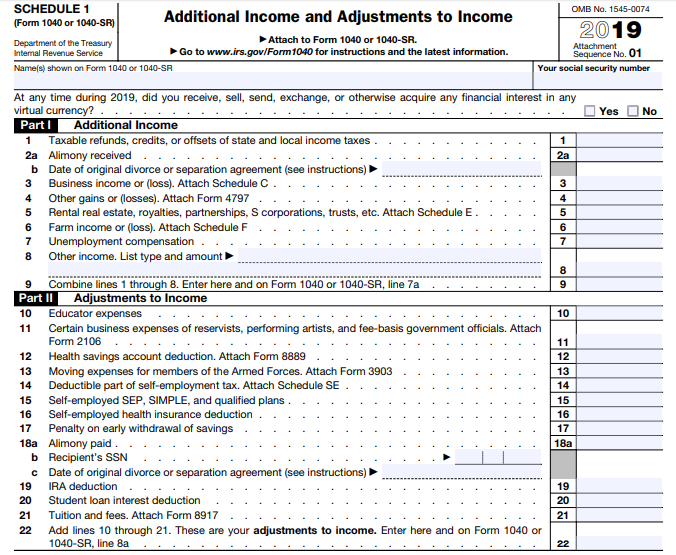

Schedule o form 1040. Additional Income and Adjustments to Income. Schedule EIC Form 1040 or 1040-SR is used by filers who claim the earned income credit to give the IRS information about the qualifying child. At a minimum the schedule must be used to answer Form 990 Part VI lines 11b and 19.

It might be more convenient than switching between your browsers tabs. Read rest of the answer. IRS Use OnlyDo not write or staple in this space.

IRS Schedule 2 Form 1040 or 1040-SR. Schedule 1 of Form 1040 1040-SR is among these templates too. On page two of IRS Form 1040 line 17 the taxpayer is asked to add the amount from Schedule 2 line 3 Tax.

Of this schedule a copy of Pages 1 and 2 of federal. The additional child tax credit may give you a refund even if you do not owe any tax. SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service 99 Itemized Deductions Go to wwwirsgovScheduleA for instructions and the latest information.

The name you enter must coincide with the one you have written in your initial tax return. Schedule 3 attached to Form 1040 or 1040-SR cannot be utilized to report child tax credits refundable credits and credits for other than children dependents. Use Schedule 2 to identify any additional taxes that must be reported on line 15 of Form 1040-SR and line 15 of the regular Form 1040 such as the alternative minimum tax AMT for the few that still owe it self-employment tax the 09 additional Medicare tax for higher-income folks and the 38 Net Investment.

Taxpayers who choose to itemize their tax-deductible expenses rather than take the. In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Use Schedule A Form 1040 or 1040-SR to figure your itemized deductions.

Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file. Take advantage of Schedule 3 to clarify the following units of Forms 1040 1040-SR. Information about Schedule EIC Form 1040 or 1040-SR Earned Income Credit including recent updates related forms and instructions on how to file.

Taxpayers use to report and pay their individual income tax. On page two of IRS Form 1040 line 20 the taxpayer is asked to add the amount from Schedule 3 line 8 Nonrefundable Credits. Download your fillable IRS Schedule 2 Form 1040 or 1040-SR in PDF.

Attach to Form 1040 or 1040-SR. Schedule C is applicable to those who file the basic Form 1040 as well as seniors age 65 and older who file Form 1040-SR instead of the basic 1040. Part 2 is used to calculate your net long-term capital gain or loss for assets held more than one year.

You must fill out Schedule A if you choose to itemize your deductions instead of taking the standard deduction. Tax purposes included on Line 25 of federal Form 1040 Schedule 1. Organizations that file Form 990-EZ must file Schedule O Form 990 or 990-EZ.

Part 3 on the second page of Schedule D directs you. Then on line 31 the taxpayer is asked to add the amount from Schedule 3 line 15 Other Payments and Refundable Credits. Check only one box.

Form 1040 Schedule 1 Additional Income and Adjustments to Income 2021 12032021 Form 1040 Schedule 1 sp Additional Income and Adjustments to Income Spanish Version 2021 12102021 Form 1040 Schedule 2 Additional Taxes 2021 12032021 Form 1040 Schedule 2 sp. Schedule A asks you to list and tally up all your itemized deductions to figure out your Total. You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ.

Schedule A is an optional schedule of Form 1040 which is the form US. If claiming either of the deductions on Line 5 or Line 6. Part 1 and Part 2 of the Additional Taxes schedule combines the less frequently used income tax types onto one form.

Connect with us as our world-class tax instructors share knowledge in a high energy using real-life experiences which helps you understand complex topics in an easy manner. 1040 Department of the Treasury Internal Revenue Service. Single Married filing jointly.

This online IRS Approved CE CPE webinar covers the following key topics. Schedule a form 1040 January 10 2022 Im Sure Many Of You Have Heard Of Schedule A And Have Questions About How To Use It When Applying For A Federal Job Im Sure Many Of You Have Heard Of Schedule A And Have Questions About How To Use It When Applying For A Federal Job This video will go over the Schedule A Process in greater detail. COLUMNS c AND d.

If the declarant has any taxation withdrawals that they cannot enter directly in Forms 1040 or 1040-RS they should use Additional Taxes Schedule 2 to compute and reflect the required data. If you are claiming a net qualified disaster loss on Form 4684 see the instructions for line 16. Married filing separately MFS Head of household HOH Qualifying widower QW.

Part 1 of form Schedule D is used to calculate your net short-term capital gain or loss for assets held one year or less. If an organization is not required to file Form 990 or 990-EZ but chooses to do so it must file a complete return and provide all of the information requested including the required. Use Schedule 8812 Form 1040 to figure the additional child tax credit.

Export or Print. Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No. Form 1040 along with a copy of Form 1040 Schedule 1 must be included with the PA-40 Personal Income Tax Re - turn.

The form begins with blank fields for your name and social security number or SSN. The focus of this 2 CECPE course is on Schedule C of Form 1040 sole proprietorship tax returns. Write Your Name and SSN.

The calculated amount in Unit 7 of Schedule 3 should be listed on Line 13 b of 1040-related forms.

What Was Your Income Tax For 2019 Federal Student Aid

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Tax Forms Irs Tax Forms Income Tax

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

Free 8 Sample Schedule Forms In Pdf

1040 Schedule 1 Drake18 And Drake19 Schedule1

1040 Schedule 1 Drake18 And Drake19 Schedule1

Irs Form 1040 How To File Instructions Tips Due Date Penalities

2020 Form Irs 1040 Schedule 1 Fill Online Printable Fillable Blank Pdffiller

Solved Demarco And Janine Jackson Have Been Married For 20 Chegg Com

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

No comments:

Post a Comment