Decide on what kind of eSignature to create. Open W2 List and Fill out W2 Forms.

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Choose your preferred theme and preview your pay stub.

W2 form step 3. Click Yes to save the updated form information. Step 3 More Information. STEP 3 STEP 4.

Click Save under W2. In Box E provide the employees name and address. You can access this screen by clicking the top menu Current Company-Company.

Optional fields are clearly marked down below all required fields. There are three variants. You can also import Employee and W2 Form information quickly by using W2 import form.

On the print option screen select Data Only on preprinted red-ink Laser Form option. Select the document you want to sign and click Upload. - You can print SSA copy A on white paper.

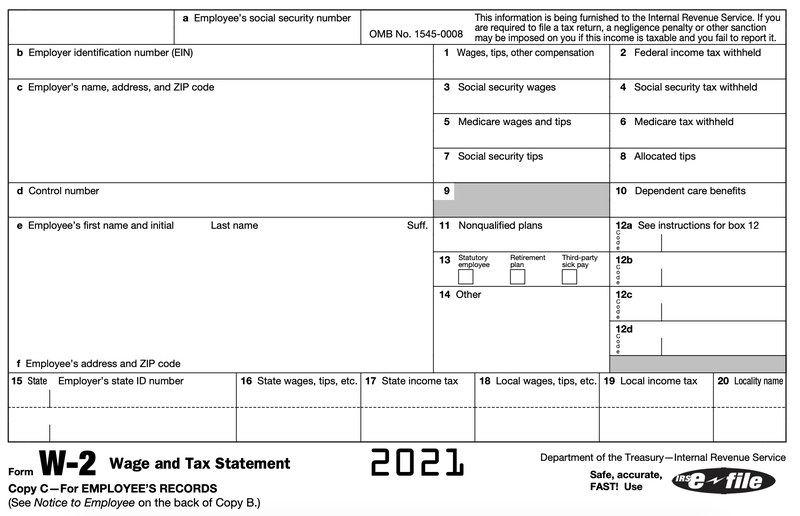

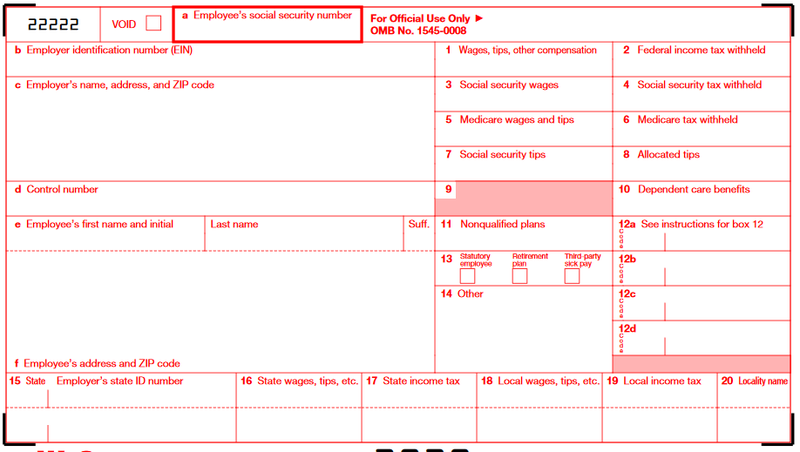

Enter the client-employers EIN in box h of Form W-3 if the Forms W-2 relate to only one employer other than the agent. Lets break this down even further. Copy A goes to the Social Security Administration SSA along with a W-3 form that includes a summary of all of the W-2s for every worker on payroll.

Through this process we compare information provided on the FAFSA and CSS Profile forms to that which students and in the case of dependent students parent sstepparent have reported. Step 1 Company Information. Copy 1 of the W-2 form goes to the appropriate state city or local tax department.

Then click the Print W2 button to open W-2 Print Option screen. A typed drawn or uploaded signature. Click the Pay menu option on the left side menu.

How to setup Affordable Care Act ACA in Sage 100. Click Select under Employee. The SSA only accepts e-filed forms not photocopies.

Employers must fill out Form W2 which indicates how much the employee earned and how much the company withheld in taxes. Villanovas Office of Financial Assistance reviews all prospective undergraduate applicants for financial assistance. The IRS will require Form W2 at the end of the year to help them determine the taxes that an employer withheld.

Box 1 contains employees total earnings for the plan year. Step 4 Preview W-2 Form. After that your w2 form 2009 is ready.

Enter the basic details on W2-Form. If any changes are desired you may make them at this step. Click W2 Forms from the Shortcuts menu.

You can access this import form by clicking the top menu Current Company-Import W2. Full W2-form Including all 5 copies 2495. This information will be displayed on both forms W-2 and W-3.

View W-2 Form List You can access W2 form list list by clicking the top menu Current Company-Form W2. This view may be different per program but the option will have the same name. If not leave box h blank.

In Box D fill out the control number a unique number assigned to each employee. The W2 Forms link will take you to an external site at ADP and should look like the example to the right. STEP 1 STEP 2.

3 Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W-4. How to report Employer-Sponsored Health Care coverage on the W2 form. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

Filing tax returns is a cumbersome business at the best of times. Employers also need to file a copy of the form with the Social Security Administration SSA by the end of February. Employees also need a copy of the form to calculate their taxes and determine if they can expect any tax refunds.

Step 3 - Submitting Tax Forms and W-2s. Follow the step-by-step instructions below to eSign your w2 form 2009. You can add or edit or delete the W2 forms here.

Select the Employee from the list. Losing your W2 form or never receiving it in the first place isnt going to make anything any easier for you. Create your W-2 Form Step 1 - Company Information Step 2 - Employee Information Step 3 - More Information Step 4 - Preview Your Stub Step 1 Company Information Step 2 Employee Information Step 3 More Information Step 4 Preview Your Stub.

- You can print employees copies in 4-up format print copy B C 2 on one sheet on white paper. View verify the details in the Preview mode before proceeding to checkout. However if you do find yourself in this situation the steps above should help you to avoid getting into trouble.

W2 is an IRS form employers that are required to complete and distribute to their employees by January 31 of each calendar year. Make sure you have the correct Company open inside W2 Mate. Set up W-3 information Click the Next button and enter the information for W3 form.

Click the Print W2 button to open W-2 Print Option screen Step 4. Generating W-2 Form online is a three-step process only. Step 2 Employee Information.

Staying on Top of Your W2 Form Obligations. Download your W2-Form instantly. Here is what you have to follow.

Paystub Form W-2 Create your pay stub Step 1 - Company Information Step 2 - Employee Information Step 3 - Salary Information Step 4 - Preview Your Stub Step 1 Company Information Step 2 Employee Information Step 3 Salary Information Step 4 Preview Your Stub. You need to enter the W-3 control number W3 Establishment Number Contact Information and others. Optional fields are clearly marked down below all required fields.

Create your eSignature and click Ok. You need to enter the general company information for w2 and 1099 forms such as Company Name Address Tax ID and others. Optional fields are clearly marked down below all required fields.

Download and print your W2-Form copy instantly. - You can select one copy B C D 1 and 2 print them on white paper in one-form-per-sheet format. Edit the form data as needed.

An agent files one Form W-3 for all of the Forms W-2 and enters its own information in boxes e f and g of Form W-3 as it appears on the agents related employment tax returns for example Form 941. Set up W-3 information You can access this screen by clicking the top menu Current Company-W-3 information. W2 Forms option on the menu bar example to the right.

The SSA uses that information to determine future social security disability and Medicare benefits. Make payment for the respective W-2 Form via the preferred payment option. If you have not filled out w2 forms you can click here to check how to add employees and enter W2 form data.

Pin By Bianca Kim On W 2 W2 Forms Irs Tax Forms Tax Forms

W3 Form Dd 3 Ingenious Ways You Can Do With W3 Form Dd Tax Forms Taxact W2 Forms

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Expense Report Sample Template

How To Read And Understand Your Form W 2 At Tax Time W2 Forms Irs Tax Forms Tax Forms

3 Ways To Send Forms W 2 To Your Employees In 2022 The Blueprint

A 2022 Employer S Guide To The W 2 Form The Blueprint

Have Your W 2 Form Here S How To Use It The Motley Fool

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

No comments:

Post a Comment