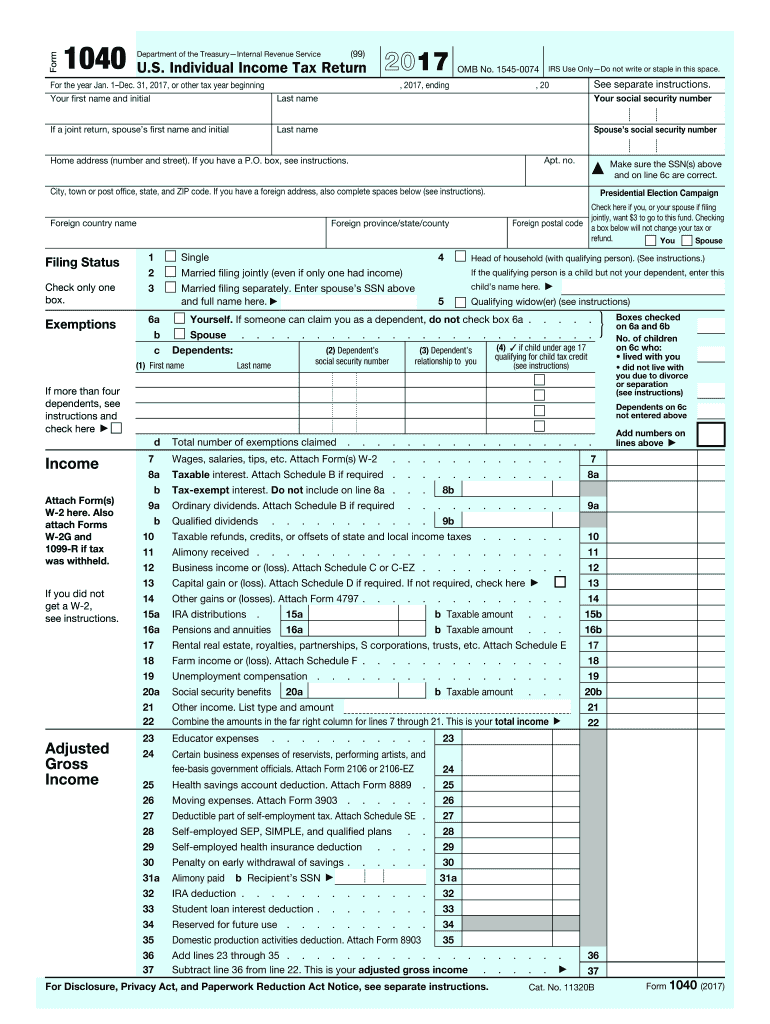

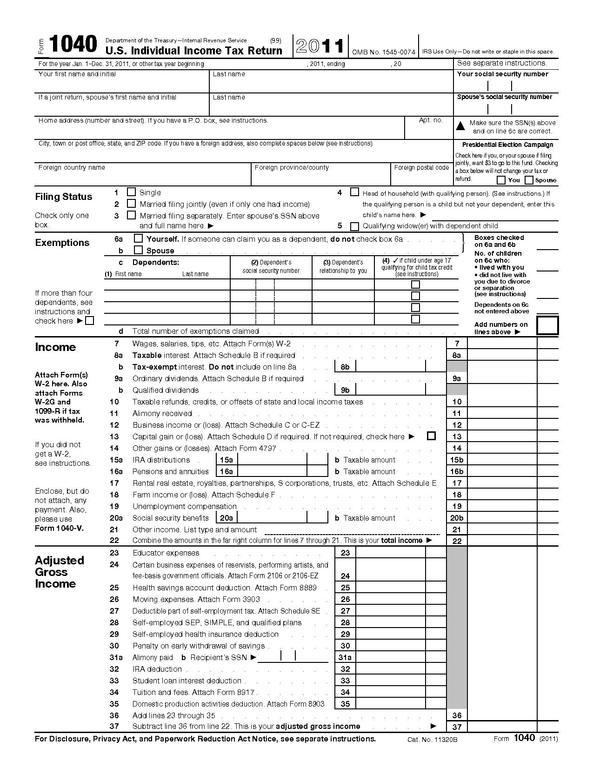

Do I need a 1040 if I have a w2. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund.

Form 1040 U S Individual Tax Return Definition

Furthermore what is the difference between a w2 and w4 tax form.

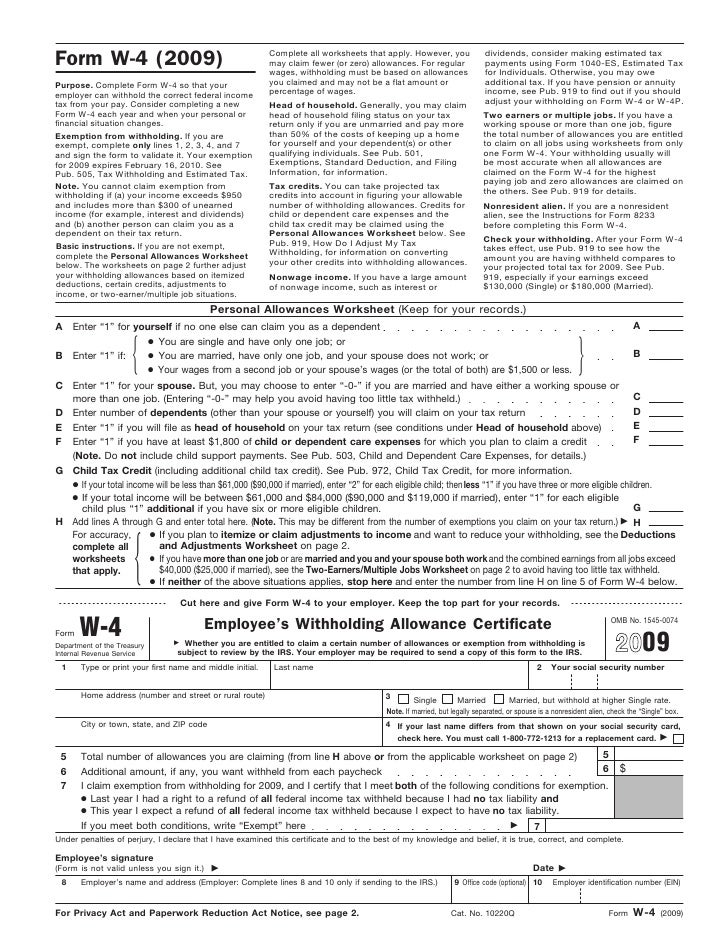

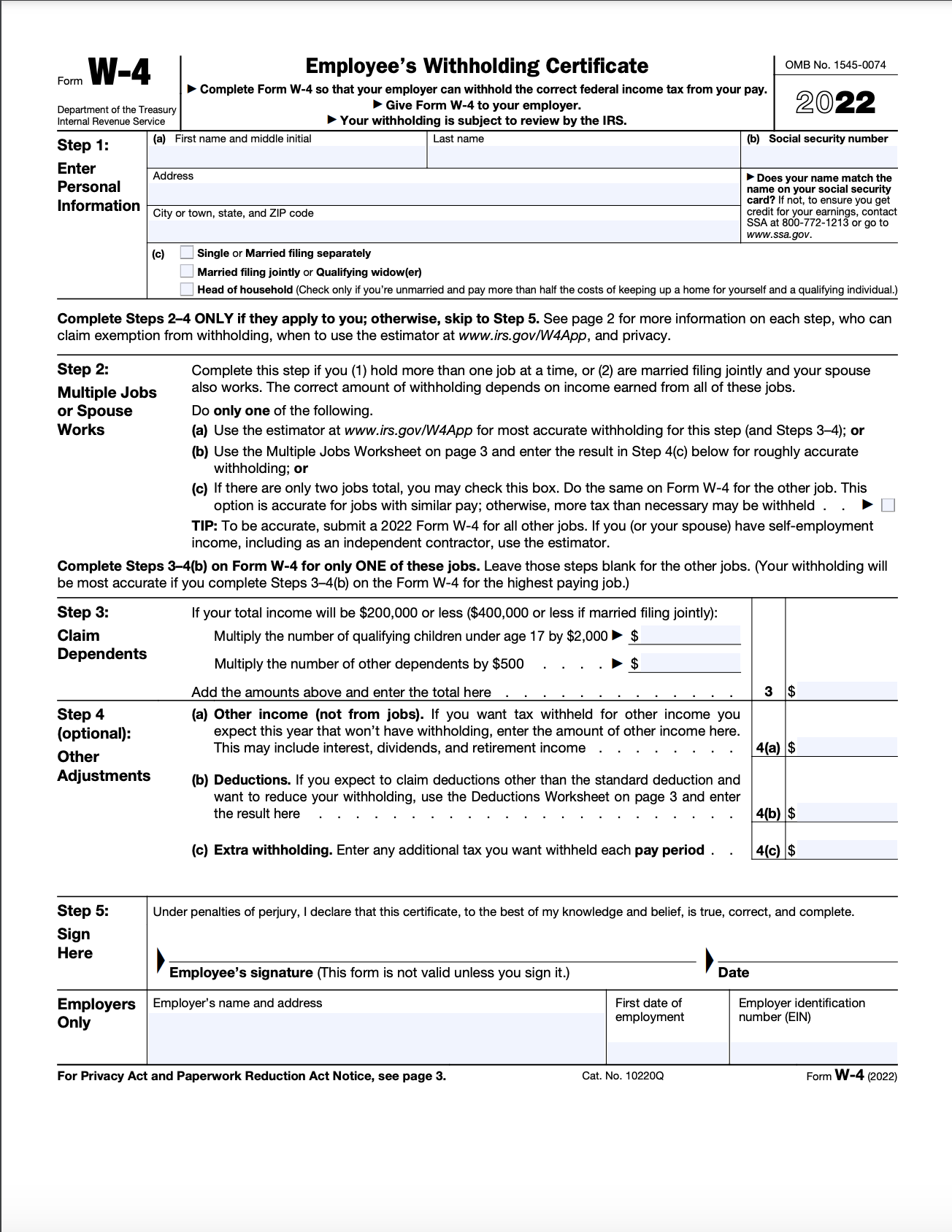

W4 form 1040. Complete a new Form W-4. Give Form W-4 to your employer. If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty.

Your personal tax return is IRS Form 1040. Purpose of Form Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. After the end of the year youll receive a Form W-2 Wage and Tax Statement reporting the taxable.

Enter Personal Information a. 2021 Estimated Individual Income Tax Voucher. When you do your tax return you are actually preparing one of those forms.

Form W-4 also known as the Employees Withholding Certificate is a document you must fill out for your employer when undertaking part-time and full-time employment not contract work that receives income on Form 1099The W-4 reveals how much federal income tax your employer must withhold from your paycheck meaning filling out it correctly is critical to. That form does not go to the IRS. Complete a new Form W-4 when.

On your W-4 Form you claim allowances which your employer uses to calculate the tax withheld from your paycheck. If you look at the worksheet on page 3 assuming youre using the current W-4 form youll see that you eventually subtract the standard deduction from this total amount so you could just put 0 and youll get to the same result as if you use the standard deduction. Take note that youll need to fill out a new Form W4.

It calculates the amount of tax you owe or the refund you receive. Tax payments using Form 1040-ES Estimated Tax for Individuals. Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Form 1040 is the standard Internal Revenue Service IRS form that individual taxpayers use to file their annual income tax returns. It is based on allowances the more allowances one has the less money the employer will withhold for federal and state taxes. You may need to fill out the extra 1040-ES Form only if you receive multiple dividends or you have interests.

If too much is withheld you will generally be due a refund. Instructions included on form. Your withholding is subject to review by the IRS.

If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty. Many people simply count their family members and put that number down as the number of allowances on W-4 Form. Your withholding is subject to review by the IRS.

By the way you can download W-4 form and print it directly from our site. Your W-4 is the form you give your employer to tell the employer how much tax to withhold from your paycheck. Purpose of Form Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

This form can handle multiple sources of income and more. Thereof what is the difference between a w2 and w4 tax form. December 2020 Department of the Treasury Internal Revenue Service.

Its used to report your gross incomethe money you made over the past yearand how much of that income is taxable after tax credits and deductions. If too much is withheld you will generally be due a refund. It is not intended to provide withholding for other income or wages.

MI-1040H Unitary Apportionment Worksheet Example. Fill out a new W4 form to adjust your Taxes. No interest is paid on over-withholding but penalties might be imposed for under-withholding.

Your personal tax return is IRS. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Otherwise it will be difficult to estimate your tax.

The 1040 is the tax return form that goes to the IRS. A W4 shows how much you should be taxed by noting your income level marital status and the number of financial dependents you have. Tax returns are filed on either a 1040EZ 1040A or 1040.

The number of dependents you have factors into your overall W-4 allowances. When filling out a Form W-4 an employee calculates the number of Form W-4 allowances to claim based on their expected tax filing situation for the year. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

The W-4 form accompanies an allowances worksheet that will enable you to make sense of what number to guaranteeThe more allowances you guarantee the less tax will be withheld from your paycheckWhats the best way to fill out Form W-4Heres the general strategyIf you got a huge tax bill in April and dont want another you can use Form W-4 to increase your withholding. Alternatively or in addition the employee can send quarterly estimated tax payments directly to the IRS Form 1040-ES. The amount entered on the W4 is withheld in extra every pay period.

For line 4 those schedules are filed in addition to the 1040. A W2 reports the wages earned taxes and deductions that were withheld in a. This Wage Chart applies to taxpayers who are marriedcivil union couple filing jointly heads of households or qualifying widowersurviving civil union partner.

Instructions included on form. In most cases the fillable form W4 doesnt require you to attach other forms. Employee Tax Forms that all employees need to complete.

Form 1040 is how individuals file a federal income tax return with the IRS. Additional instructions and worksheet. It helps employees from overpaying on taxes.

Give Form W-4 to your employer. Employees Withholding Certificate is filled out by an employee to instruct the employer how much to withhold from your paycheck. A W4 shows how much you should be taxed by noting your income level marital status and the number of financial dependents you have.

Valid unless you sign it. Whether youre paid weekly bi-weekly or monthly the additional withholding amount will be withheld from your income. On the Form W4 for the 2021 tax season you can enter an additional withholding amount on Step 4 c.

The W4 is a form to let the employer know how much money to withhold from the employees paycheck for federal taxes. Do I need a 1040 if I have a w2. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

You may estimate your federal income tax liability by using the worksheet above. Besides you can get. Statement of income tax withheld.

If you need additional withholdings for other income or wages use Line 5 on the NJ-W4. A W2 reports the wages earned taxes and deductions that were withheld in a. If you didnt file those then put 0 meaning you.

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Form 1040 V Payment Voucher Definition

Many Different Usa Tax Form W4 W9 And 1040 Form For Fill In April Tax Time Stock Photo Download Image Now Istock

:max_bytes(150000):strip_icc()/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Form W 4 Personal Allowances Worksheet

Irs Form 1040 Fill Out Printable Pdf Forms Online

2021 Form Irs 1040 Fill Online Printable Fillable Blank Pdffiller

Tax Information Career Training Usa Interexchange

No comments:

Post a Comment