Also even if you qualify for an exemption your employer will still withhold for Social Security and Medicare taxes. A W-4 form formally titled Employees Withholding Certificate is an IRS form employees use to tell employers how much tax to withhold from each paycheck.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

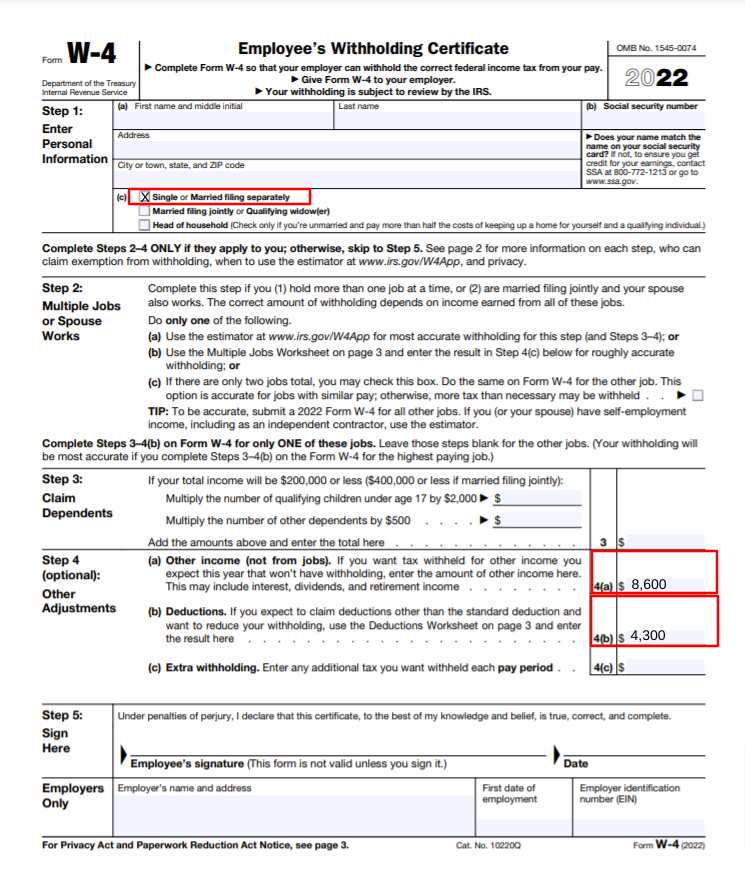

W 4 Form How To Fill It Out In 2022

Is Filing as Exempt Illegal.

W4 form tax exempt. Employers use the W-4 to calculate. 2022 Withholding Tax Forms. When can you claim exempt on W4.

Instead use Form OR-W-4 to help you calculate. EmployersPayers must complete lines 7 through 10 only if required to submit a copy of Form W-4ME to Maine Revenue Services. Line 7 Enter employerpayer name and business address.

Additional information about eligibility to claim exempt appears on. Withholding and when you must furnish a new Form W-4 see Pub. However due to federal tax law and form changes the federal form no longer calculates Oregon withholding correctly.

Date of Birth 4 3. Claiming exempt status on Form W4 basically tells your employer to not withhold federal income tax from your income. Employees Signature Date Employers Name and Address Employer Identification Number Y O U R W A G E S 1.

Fillable Forms Disclaimer Many tax forms can now be completed on-line for printing and mailing. Give Form W-4 to your employer. Confused on W4 form and the IT2104 form.

One may claim exempt from 2020 federal tax withholding if they BOTH. This could affect your tax return filed at the end of the year. Unemployment compensation taxable social security benefits pensions annuities cancellation of debt and distributions of unearned income from a trust.

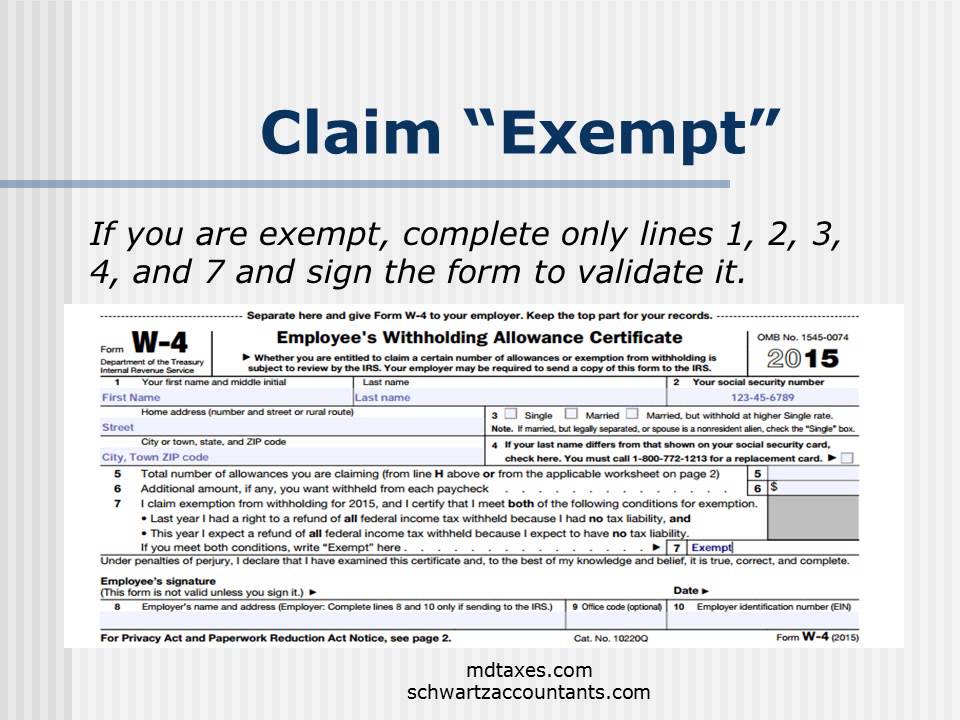

12-20 EMPLOYEES MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE STATE OF MICHIGAN - DEPARTMENT OF TREASURY This certificate is for Michigan income tax withholding purposes only. You may claim exemption from withholding for 2022 if you meet both of the following conditions. This may be the case if you were entitled to a full refund of all the federal taxes you paid last year and thus expect a full refund of all the federal taxes that would be withheld from your paychecks this year.

I got married in late 2020. Read instructions on page 2 before completing this form. If you claim exempt no federal income tax is withheld from your paycheck.

This comes in handy if youre a student working part-time and you wont owe any taxes. I recently got a new job position and I am currently in the process of filling out my W4 form. You may owe taxes and penalties when you file your 2020 tax return.

If you claim exempt no federal income tax is withheld from your paycheck. SS Name Address City State Zip State of New Jersey - Division of Taxation Employees Withholding Allowance Certificate Form NJ-W4 1-10 R-13 2. Your withholding is subject to review by the IRS.

No filing as exempt is not illegal however you must meet a series of criteria in order to file exempt status on your Form W-4. If you claim exemption you will have no Federal income tax withheld from your paycheck. As mentioned CPB will not withhold state taxes for Virginia residents and you are responsible.

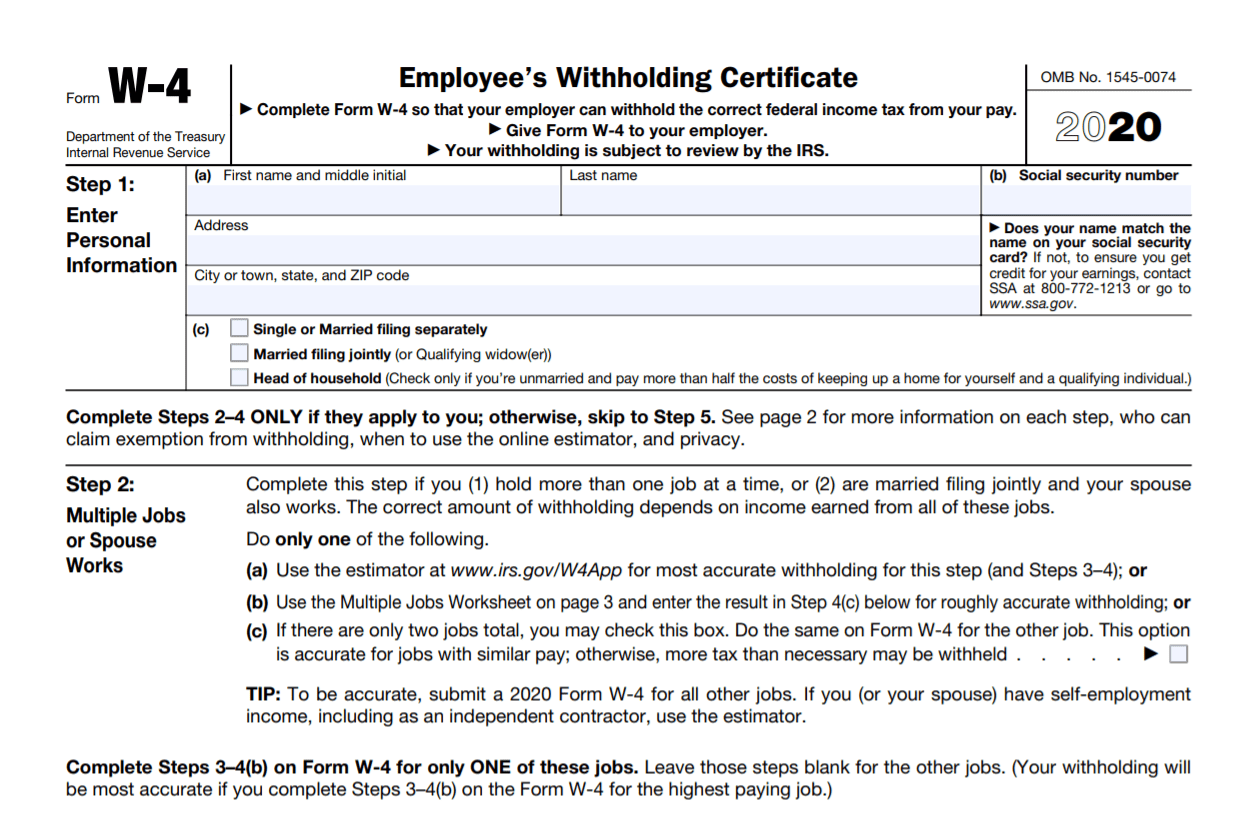

Forms W-4 that are submitted to your employer after January 1 2020 cant be used to calculate Oregon with-holding. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Exempt you will need to check the box for Virginia under line 4 and write the word EXEMPT on the space provided to the right of number 4.

Full Social Security Number 4 2. Eral Form W-4 to determine and claim Oregon withholding. This means you will have a higher take-home pay as you should since youre not going to have tax liability.

December 2020 Department of the Treasury Internal Revenue Service. The fewer allowances claimed the larger withholding amount which may result in a refund. You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022.

Submit copies of Form W-4ME directly to the MRS Withholding Unit separately from any other tax fi ling. One may claim exempt from 2020 federal tax withholding if they BOTH. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for.

Had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. Filing StatusCheck only one box 1. Before I was married Id obviously filed single and Id claimed myself as an allowance.

To claim exemption from withholding certify that you meet both of the conditions above by writing Exempt on the 2021 W-4 form in the space below Step 4c. Claiming you are tax exempt on Form W-4 tells the Internal Revenue Service that you are exempt from federal withholding. Currently there is no computation validation or verification of the.

505 Tax Withholding and Estimated Tax. This tool doesnt cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section 911. My husband 29M and I 26F filed jointmarried for the first time in 2021.

How do I claim exempt on W4 2021. Filing Exempt on Taxes When You Are Not Eligible. Generally the more allowances you claim the less tax will be withheld from each paycheck.

Had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. Is therefore exempt from Maine income tax withholding. You may owe taxes and penalties when you file your 2020 tax.

If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or access the 2021 Sales Use and Withholding Taxes Annual Return fillable form.

Client Question What Should I Do If An Employee Claims A High Number Of Exemptions Shindelrock

Figuring Out Your Form W 4 How Many Allowances Should You Claim

How Do You Input The New W4 For 2020 Information For The Employees

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

2022 New W 4 Form No Allowances Plus Computational Bridge

2018 Exempt Form W 4 News Illinois State

The Difference Between Form W 2 And Form W 4 Techunz

Why Might Someone Want To Claim Exempt On Their W 4 Form Quora

W 4 Form Basics Changes How To Fill One Out

How Many Exemptions Do I Claim On My W 4 Form Tandem Hr

How To Fill Out Irs Form W 4 Exempt Youtube

Help Working Kids And Students Correctly Complete A W 4 Form Youtube

No comments:

Post a Comment