December 2020 Department of the Treasury Internal Revenue Service. Reset Form MI W-4P Michigan Department of Treasury 4924 Rev.

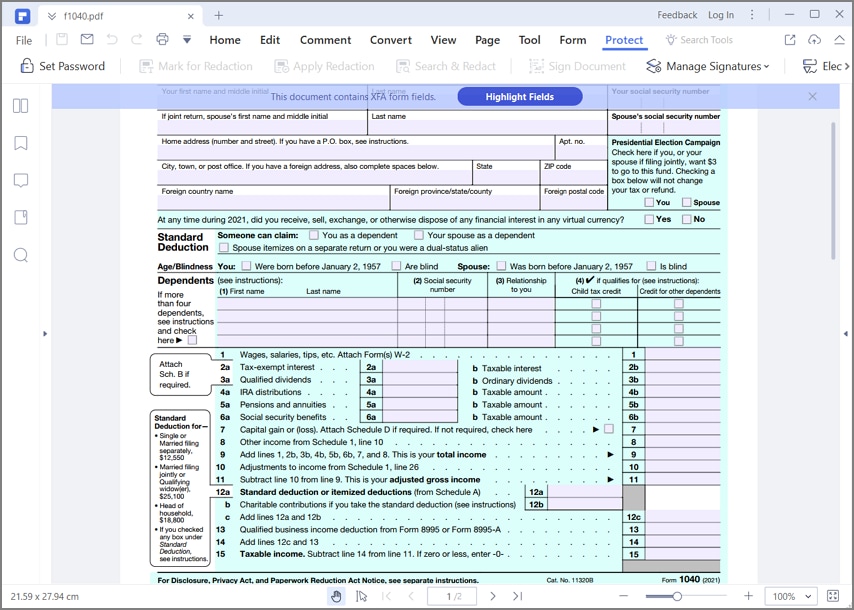

Irs Form W 4p Fill It Out In An Efficient Way

Do not claim more than your allowable personal exemptions on all MI W-4s wages or MI W-4P forms combined.

W4-p form. We recommend using the latest version. To view and download PDF documents you need the free Acrobat Reader. You may also use this form to choose not to have any Michigan income tax withheld from your.

Form W4P is for US. You may designate additional withholding if you expect to owe more than the amount withheld. Form W4P is for US.

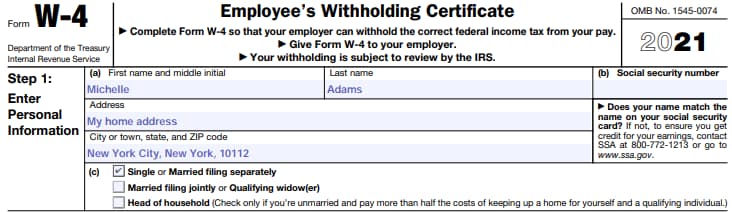

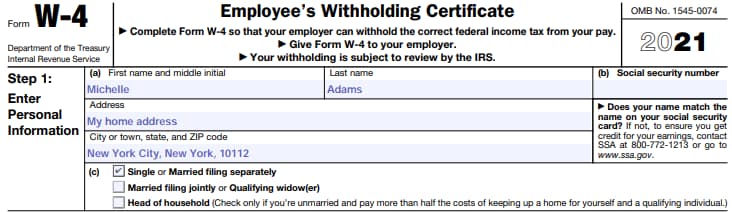

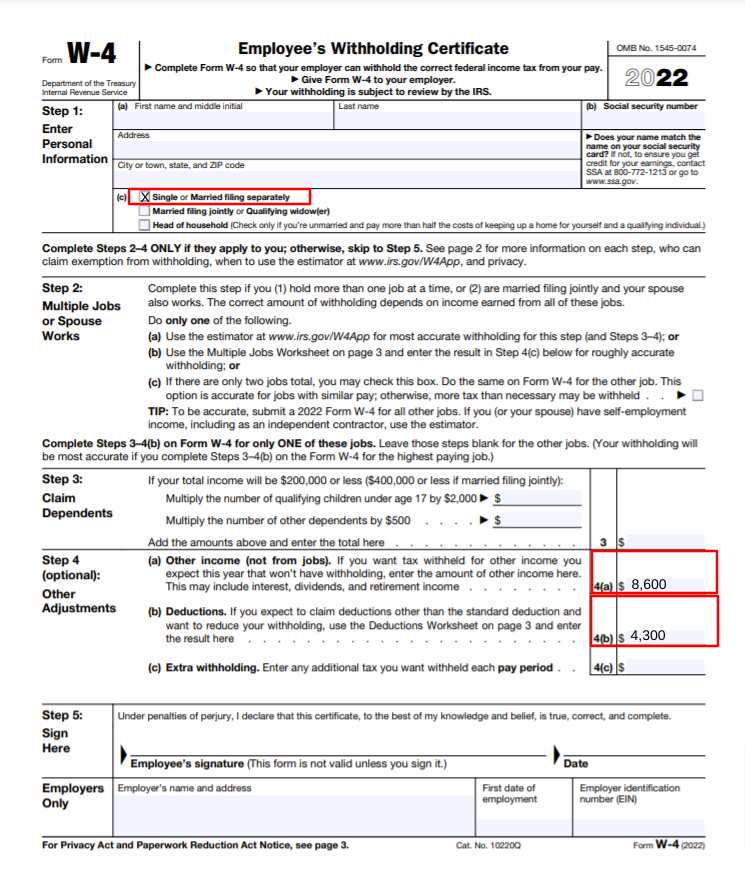

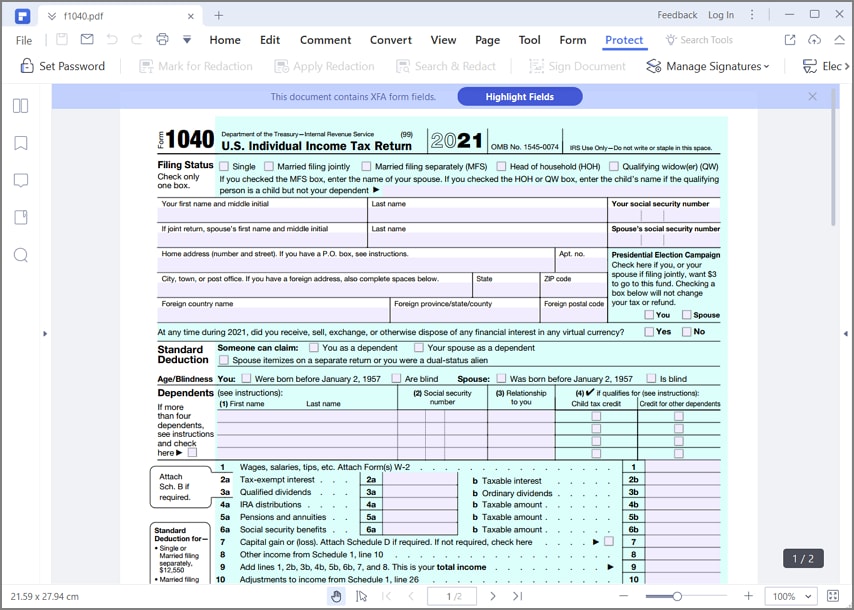

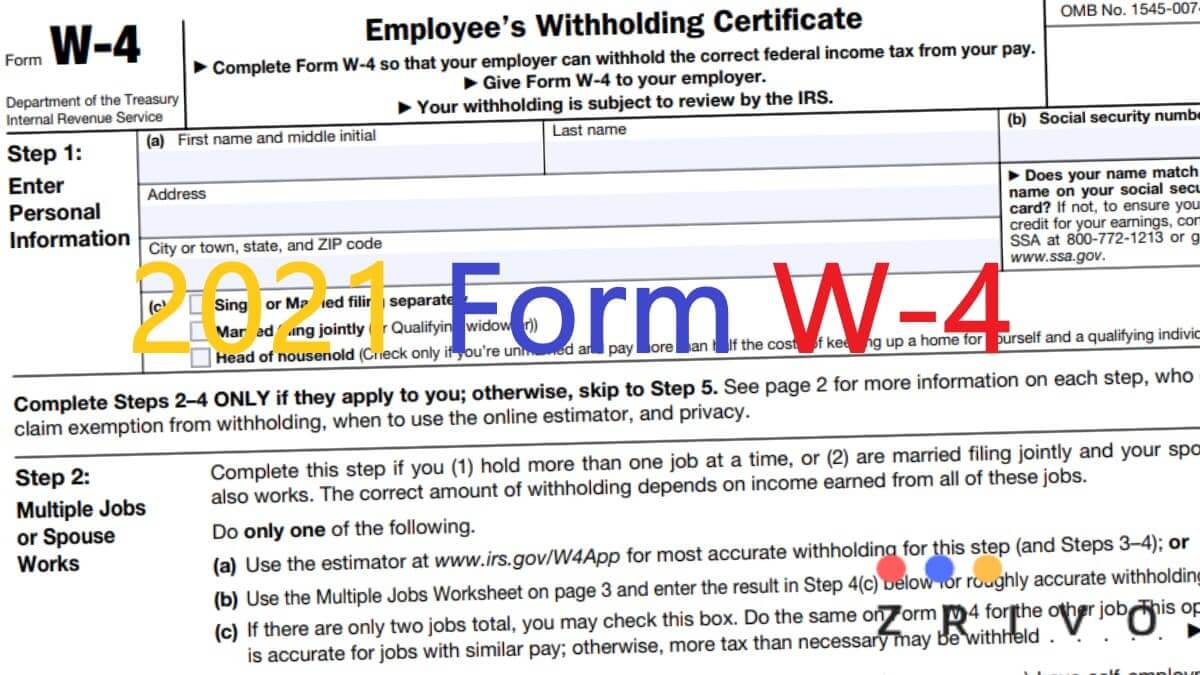

Use Form W4P to tell payers the correct amount of federal income tax to withhold from your payments. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Citizens delivered outside the United States or its possessions or b to have an additional amount of tax withheld.

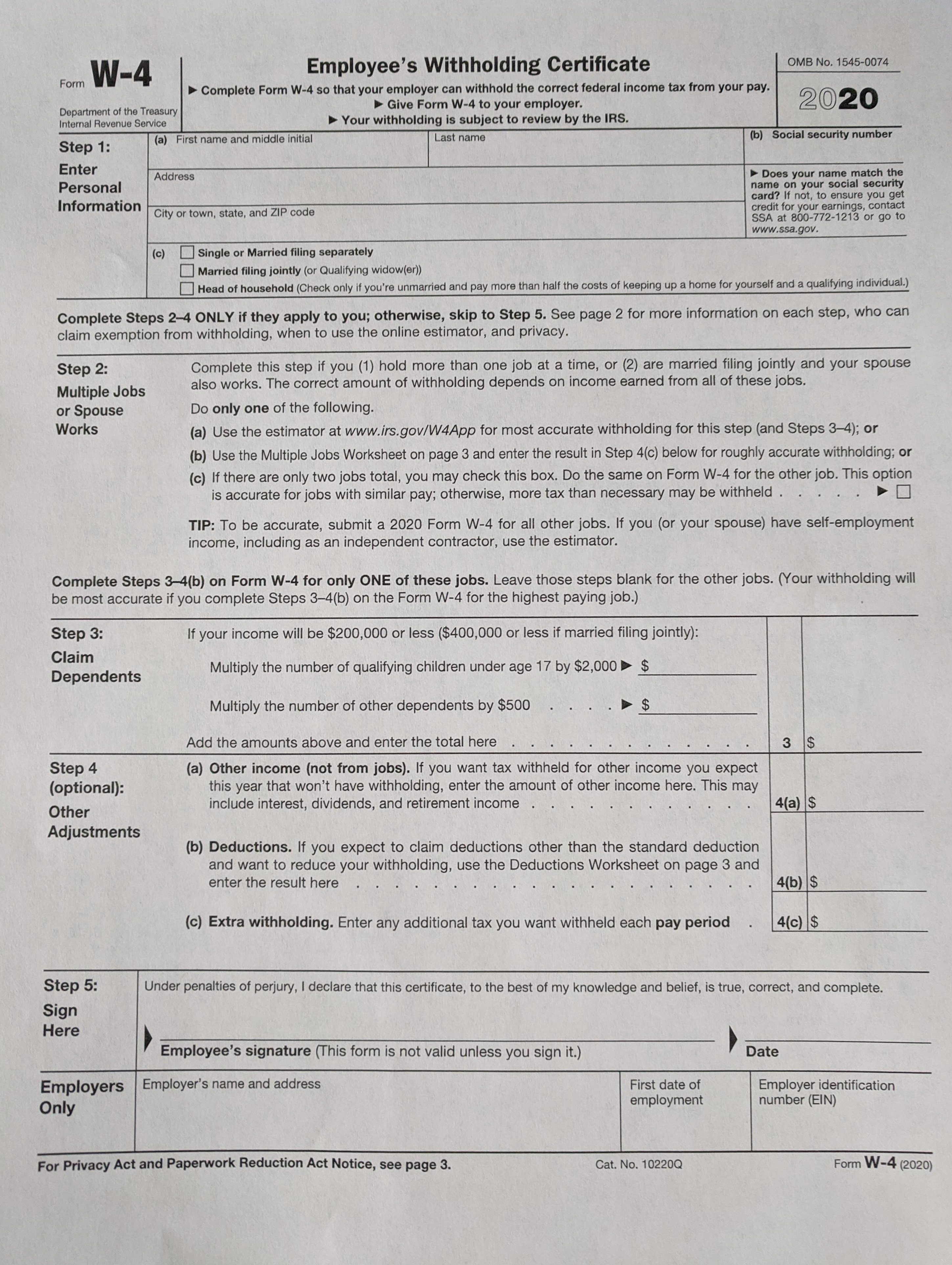

Form W-4P and indicate your marital status by checking the appropriate box. This estimator could be used by almost all taxpayers. This estimator can be utilized by virtually all taxpayers.

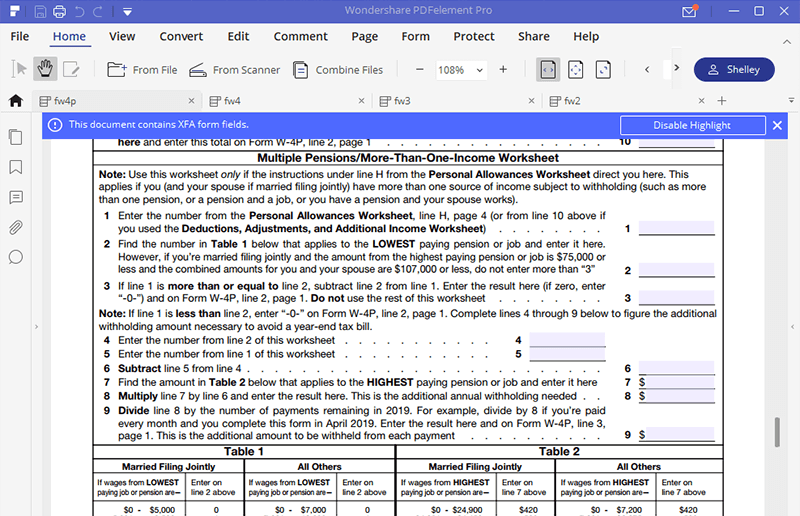

To complete the form electronically be sure to first download the form complete using. Form W-4P Department of the Treasury Internal Revenue Service Withholding Certificate for Pension or Annuity Payments. The revised Form W-4P is to be used only to withhold federal income tax from periodic retirement plan and IRA payments.

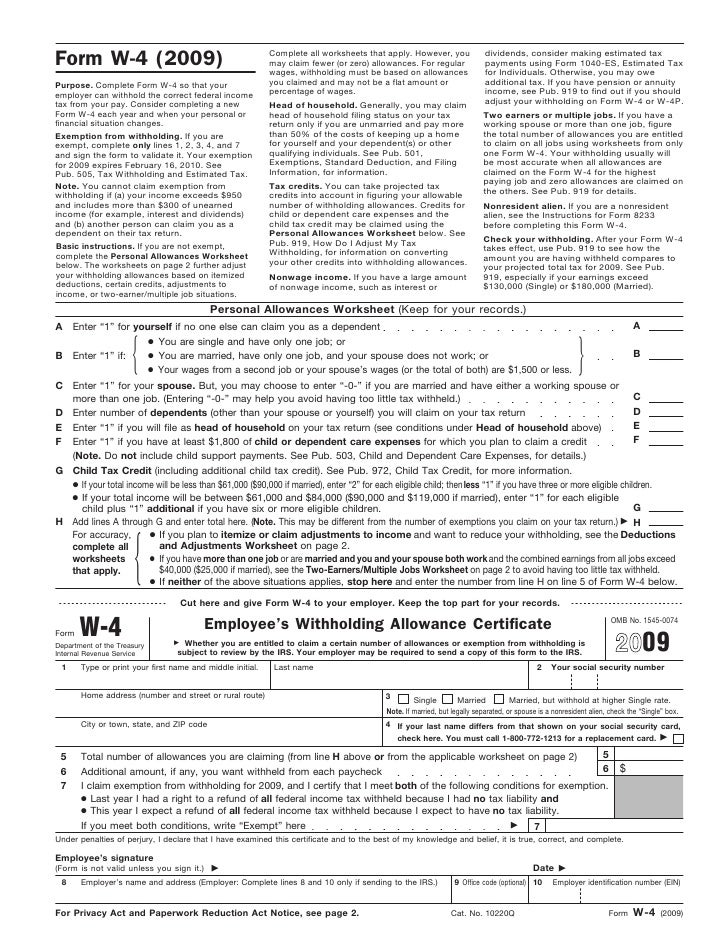

RRB-W4P 04-14pdf 73863 KB Form Type. The employer will take care of the estimated tax payment of the employee by withholding money from the employees paycheck based on their W-4If you are a receiver of pensions annuities and other deferred compensation you are expected to use the IRS Form W-4P to tell the payers the correct amount to be withheld from your federal income tax. If you want with three allowances write Revoked next to the checkbox on line 1 of the form.

This tax calculator aids you determine how much withholding allowance or additional withholding must be noted in your W4 Form. If you want tax withheld at a different rate write Revoked next to the checkbox on line. Get and Sign Form W 4P Department Of Retirement Systems 2021-2022.

Get And Sign W 4p Form 2016-2021. Give Form W-4 to your employer. Based on the tax information submitted on the W-4 your employer withholds income.

W-4P Withholding Certificate for Railroad Retirement Payments. Here are some helpful hints for completing form W4-P for a few different withholding scenarios. If you dont want any federal income tax withheld from your periodic payments check the box on line 1 of Form W-4P and.

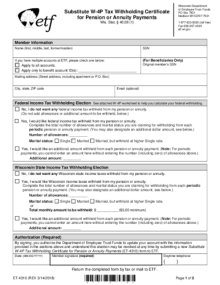

Visit our online Income Tax Withholding Calculator a free tool to help calculate the impact of your income tax withholding on the annuity payments you receive. For the latest information about any future developments related to Form W4P such as legislation. If you want to change federal or state income tax withholding you must submit this form to ETF.

Federal income tax withheld from the payment except for eligible rollover distributions or payments to US. Withholding Certificate for Pension or Annuity Payments. This tax calculator aids you establish how much withholding allowance or extra withholding must be noted with your W4 Form.

Use Form MI W-4P to notify pension administrators of the correct amount of Michigan income tax to withhold from your pension or annuity payments. The IRS has issued a fourth draft of the 2022 Form W-4P Withholding Certificate for Periodic Pension or Annuity PaymentsIn it the IRS indicates that while final versions of the redesigned Form W-4P and Form W-4R will be released for 2022 based on comments received on prior drafts from stakeholders the IRS will postpone requirements to begin using the. About Form W-4 P Withholding Certificate for Pension or Annuity Payments.

Also be sure to read the important notices on page 9 of the booklet. Carefully complete item 1 and items 3 through 11 as appropriate. December 2020 Department of the Treasury Internal Revenue Service.

Use Form W4P to tell payers the correct amount of federal income tax to withhold from your payments. Periodic payments are made in installments at regular. Citizens resident aliens or their estates who are recipients of pensions annuities including commercial annuities and certain other deferred compensation.

Beginning January 1 2009. However you can designate an additional amount to be withheld on line 3. 01-21 Withholding Certificate for Michigan Pension or Annuity Payments INSTRUCTIONS.

Use Form MI W-4P to notify pension administrators of the correct amount of Michigan income tax to withhold from your pension or annuity payments. The IRS has released the 2022 Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments and 2022 Form W-4R Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions. Get and Sign Rrb W 4P 2007-2022 Form Tax Withholding and Railroad Retirement Payments which explains information needed to complete the form.

When you work as an employee the W-4 form is what you submit to your employer to set the tax-withholding ball in motion. 01-21 Withholding Certificate for Michigan Pension or Annuity Payments. W-4P is the form you use to tell ACERA how much to withhold from your check.

A comparative way of looking at the W-4P form is that it is the unearned income counterpart of the earned income Form W-4 Employees Withholding Certificate. W 4p Withholding Calculator The tax withholding estimator 2021 permits you to compute the federal income tax withholding. The amount on line 7 must be a percentage.

Citizens resident aliens or their estates who are recipients of pensions annuities including commercial annuities and certain other deferred compensation. Return the completed form to the address shown above and write. Form 4924 Page 3 Line 7.

Form W 4p Allowances Calculator The tax withholding estimator 2021 allows you to definitely calculate the federal income tax withholding. Form WH-4P State Form 37365 R2 8-08 You may select any amount over 1000 to be withheld from your annuity or pension payment. Your withholding is subject to review by the IRS.

Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension annuity including commercial annuities profit-sharing and stock bonus plan or IRA payments. Citizens resident aliens or their estates who are recipients of pensions annuities and certain other deferred compensation use Form w-4P to tell payers the correct amount of federal income tax to withhold from their payment s. Federal income tax withholding applies to the taxable part of these payments.

You also may use Form W4P to choose a not to have any. This withholding will be reported to you on a W-2P at the end of each year as Indiana State and County Tax Withheld. You cant designate a specific dollar amount to be withheld.

Enter personal exemptions you are claiming for withholding.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

Substitute W 4p Tax Withholding Certificate For Pension Or Annuity Payments Etf

2021 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

W4 Form Example For Single 2022 W 4 Forms Zrivo

2022 New W 4 Form No Allowances Plus Computational Bridge

Form W 4 Personal Allowances Worksheet

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Irs Form W 4p Fill It Out In An Efficient Way

W 4 Form Basics Changes How To Fill One Out

Can You Change Social Security Tax Withholding Online Fill Out And Sign Printable Pdf Template Signnow

Irs Form W 4p Fill It Out In An Efficient Way

No comments:

Post a Comment