You might get a portion or all of what you have already paid back as a. The way you fill out Form W-2c depends on what error you need to correct on Form W-2.

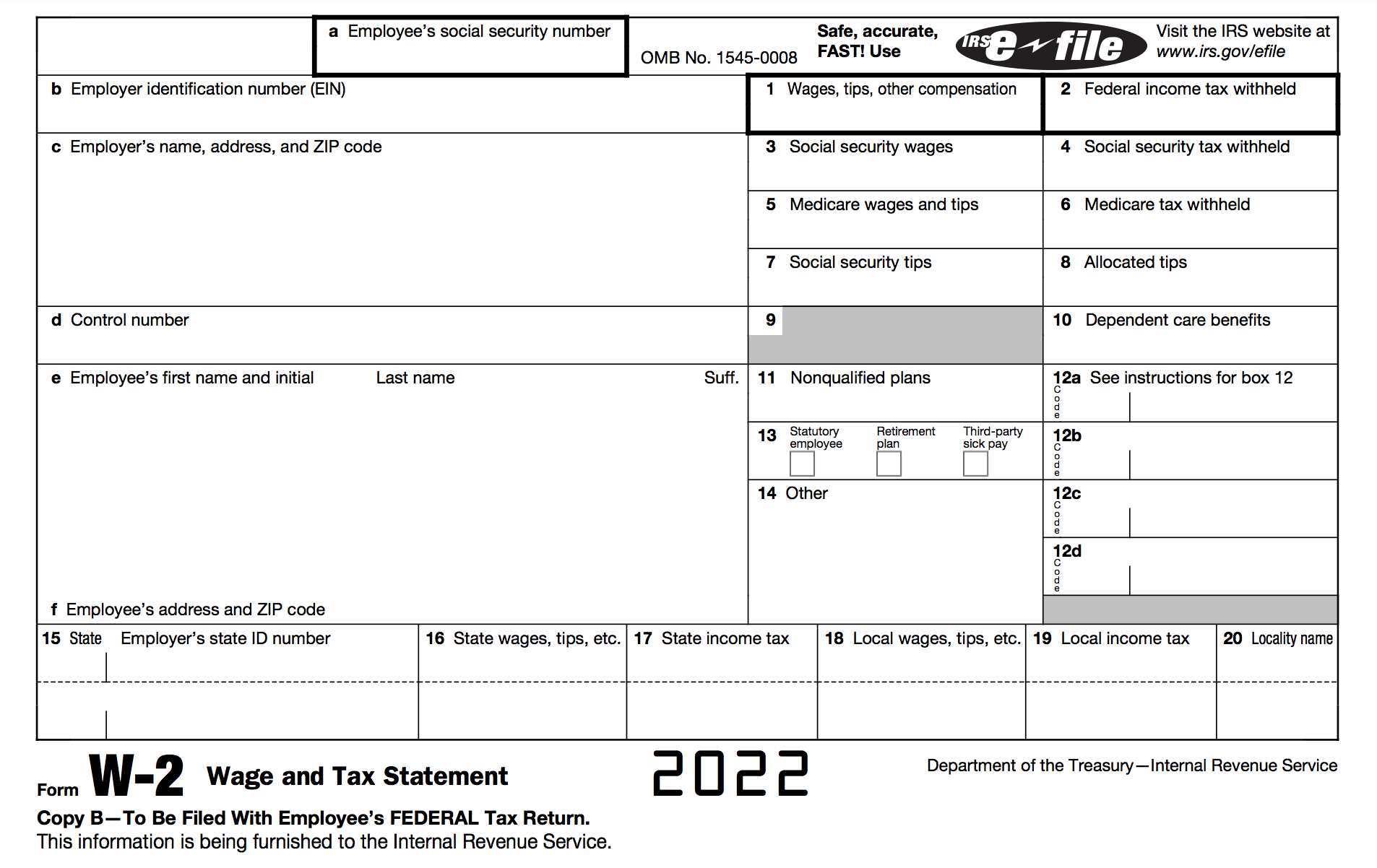

Your W-2 also details how much you contributed to your retirement plan during the year how much your employer paid for your health insurance or even what you received in dependent care benefits.

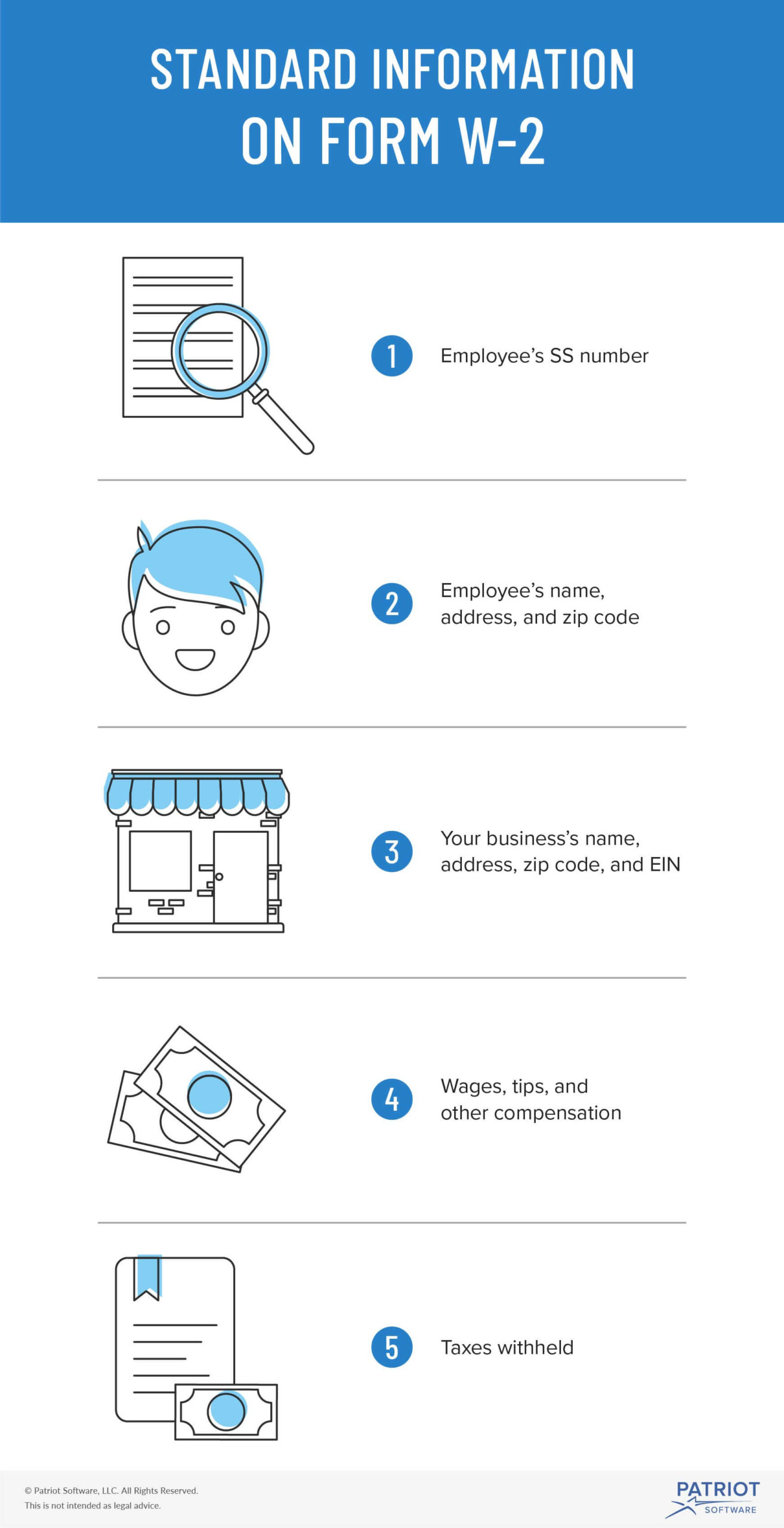

A w 2 form tells you. A W-2 is a document that tells you what income you have earned at your job. A W-2 form totals all of the withdrawings from your gross pay. In order to to file your tax return correctly its ideal to use a W-2 document.

A W-2 reports employees annual wages and the amount of taxes withheld from their paychecks. Form W-2 is sent by employers that pay an individual at least 600 in non-cash income if income taxes and FICA taxes Social. 31 of the following year which contains all the relevant information about your income that youll need for.

Form W-2 shows more than just what you were paid. The W-2 form is a form that is filed by your employer that shows how much you made and how much was deducted and pre-paid to federal and state taxes. In addition it explains what was withheld from your pay such as social security and medicare.

To order official IRS information returns such as Forms W-2 and W-3 which include a scannable Copy A for filing go to IRS Online Ordering for Information Returns and Employer Returns page or visit wwwirsgovorderforms and click on Employer and Information returns. Your Form W-2 tells you how much you earned from your employer in the past year and how much withholding tax youve already paid on those earnings. When you earn wages or a salary from an employer youll receive a W-2 form by Jan.

If you are looking for your W-2 online it probably means your employer has listed the documents online or you have already filed your W-2 with the IRS and need to check it for. Simply put its a report on what you paid the employee over the course of the yearincluding bonuses and tipsand total payroll taxesincome withheld for things like social security pension Medicare taxes or savings. If you still havent received your W-2 use Form C 4267 Employees Substitute Wage and Tax Statement.

Use black ink in 12-point Courier font if possible when filling out Form W-2c. Form W-2c includes the same boxes as Form W-2. The information on your W-2 helps determine your taxable income and shows the amount of tax youve already paid through withholding.

Aatrix Nj Wage And Tax Formats. A W-2 employee is someone whose employer deducts taxes from their paychecks and submits this. A 1099 is all of your income earnings.

If you lose it issuing a new one can take. A W-2 form is a key documents youll need when filing your taxes One document youll need is a W-2 form which is provided by your employer that shows information about taxes and your income. You should receive a copy of FORM W-2 from your employer by __________.

Additionally a year-end summary of all payment activity is mailed to employers by January 15. A W-2 form is a year-end tax document that youll fill out as an employer. A W-2 form is a statement that you must prepare as an employer each year for employees showing the employees total gross earnings Social Security earnings Medicare earnings and federal and state taxes withheld from the employee.

The W-2 also lists how much money has been removed from your checks for taxes. It asks for things like employer name and EIN employee name and SSN and federal state and local tax information. The W-2 form is a report you generate that tells the employee as well as the IRS their gross pay and tax withholding for the year.

Its important to hang onto your W-2 form. Well mail you the scannable forms and any other products you order. List two things that the W 2 form tells you 2 Whats an advantage to always from ECON 101 at Lancaster High School Lancaster.

A W-2 tax form shows important information about the income youve earned from your employer amount of taxes withheld from your paycheck benefits provided and other information for the year. The document also details what you have paid in taxes throughout the year both federal and state. I went in there and selected No to ask for a deferral but it still gave me the W-2c message after the checks.

You use this form to file your federal and state taxes. Your W-2 form shows how much you earned which is known as your compensation including wages and tips for the year. If you received income from an employer then your employer will send you a W-2 tax form when the tax year ends.

It may be due to my small 1099-NEC since the questions ask something about my self-employment tax Turbotax does say that I can go ahead and file and may need to amend if I get a W-2c later which Im pretty sure I wont. You can also use Form 4506-T to request a copy of your previous years 1099-G. IRS Form W-2 is called the Wage and Tax Statement and its one of the most common tax forms.

Youll use the 2019 W-2 to file your tax return in 2020. It is the form you need when you file your taxes. Because a W2 form tells you how much taxes have been taken out of your paycheck it also tells you how much net income youve made throughout the year but waiting around for your W2 isnt your only option especially if you can calculate your W2 wages from any of your paystubs.

W-2 Is a form that shows your wages or salary the amount of tax your employer withheld what you paid in Social Security taxes and other contributions you made.

Rainbow And Stormy My Little Pony Cartoon My Little Pony Comic Mlp My Little Pony

What Is A W 2 Form Definition And Purpose Of Form W 2

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms How To Get Money Fillable Forms

Kaido Hybrid Form Vs Luffy You Will Never Believe These Bizarre Truths Behind Kaido Hybrid F Bizarre Luffy Attack On Titan

What Is A W 2 Form Definition And Purpose Of Form W 2

How To Create A Form In Convertkit A Complete Tutorial Convertkit Tutorial Email Marketing Strategy Online Business Tools

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Pin By Corliss Tang On Voltron Voltron Funny Voltron Memes Voltron Klance

How To Fill Out A W 4 Business Insider Tax Forms How To Get Money Fillable Forms

Will Or Going To Quiz Quiz Short Quiz Education

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

No comments:

Post a Comment