Add the excess deferral amount to your wages on your 2020 tax re-turn. 1 Early Distribution 2 Early Distributionnot subject to 10 early distribution tax 4 Death B Designated Roth Code U.

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Instructions for Form 1099-CAP 0919 10212019 Inst 1099-CAP.

Form 1099 code 8. Refer to Corrective distributions on page 6 and IRA Revocation or Account Closure on page 3 for more information. Codes 81 82 or 84 or 18 28or 48. Code 8 indicates a distribution of an excess contribution from an employer plan.

Code 8 indicates a distribution of an excess contribution from an employer plan. This distribution is not eligible for rollover and the amount shown in box 2a is the amount that is taxable on your tax return. Also use this code for corrective distributions of excess deferrals excess contributions and excess aggregate contributions unless Code P applies.

Line 7 of the 1040 to be included in wages. A participant is allowed only one rollover from an IRA to another or the same IRA in. According to the 2020 Instructions for Forms 1099-R and 5498 Code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020 signifies that excess contributions were deposited and returned in the same year regardless of the year for which the excess was attributed.

Which distribution codes should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution. This code indicates the monies are taxable in a prior tax year as opposed to Code 8 with the distribution taxable the year of the 1099-R form. Only three numeric combinations are permitted on one Form 1099-R.

Use Code 8 for an IRA distribution under section 408d4 unless Code P applies. Section 404k dividends paid directly from the corporation to participants or their beneficiaries are reported on Form 1099-DIV. Including a tax credit ESOP are reported on Form 1099-R.

This distribution is not eligible for rollover and the amount shown in box 2a is the amount that is taxable on your tax return. But this taxpayer is receiving a corrective distribution from an employer plan the IRA box will not be checked and no penalty would apply. You can then ignore the Form 1099-R with the Code P when you receive it a year later.

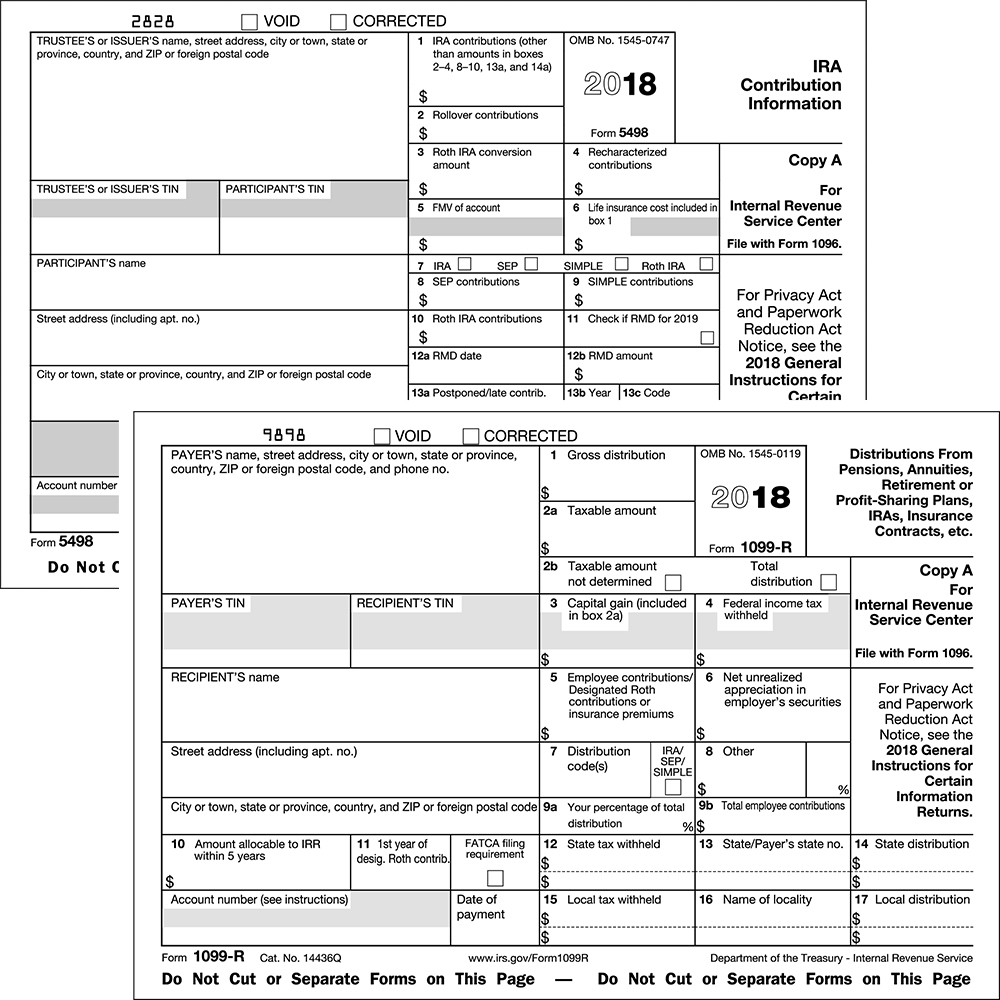

If two or more distribution codes are not valid combinations then the IRA custodian must file more than one Form 1099-R. In 2018 realized my wife had more then 6500 combined traditional Ira and Roth ira. That is a separate Form 1099-R must be filed for each distinct distribution code.

For example if part of a distribution is premature Code 1 and part is not Code 7 file one Form 1099-R for the part to which Code 1 applies and another Form 1099-R for the part to. Code 8 indicates that the amount is taxable in the tax return you are currently working on and Code P indicates the amount is taxable in the prior tax year See IRS Form 1099-R Instructions for Code P for more information. See Announcement 2008-56 2008-26.

On april 13th 2019 we contributed 4700 to the roth ira on april 18 i had them change 2300 to 2019 contributionwe never took the distribution so A do i have to report the 285 as income in line 4b form 1040 or does. May be eligible for 10-year tax option See Form 4972. Use code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2021 and code 1.

Code 8 indicates to the IRS that Mindy is distributing the excess contribution in the same year that it was deposited into her IRA at. Designated Roth account distribution. If code B is in box 7 and an amount is reported in box 10 see the instructions for Form 5329.

30 rows For more information about the 1099-R distribution codes please refer. You can then ignore the Form 1099-R with the Code P when you receive it a year later. Form 1099-R will have either a code 1 or code 7.

Dividends distributed from an ESOP under section 404k. If two or more other numeric codes are applicable you must file more than one Form 1099-R. What does Distribution Code 8 mean on 1099 r.

Changes in Corporate Control and Capital Structure Info Copy Only 2019 09122019 Inst 1099-CAP. Enter the 1099R amounts into your software as reported with the code 8 shown in box 7. Code 8 indicates that the amount is taxable in the tax return you are currently working on and Code P indicates the amount is taxable in the prior tax year.

Instructions for Form 1099-CAP 2019 09132019 Form 1099-DIV. Because this is a return of earnings from an IRA it will flow to line 15a and the taxable portion on line 15b will be -0-. If the IRA box is checked on the 1099R a code 8 produces a 10 penalty on the amount in 2a.

If the distribution was for a 2020 excess deferral your Form 1099-R should have code 8 in box 7. Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020. Use code 8 for an IRA distribution under section 408d4 unless code P applies.

Also mandatory in three numeric code combination situations. Cost of current life insurance protection. Subtract the rollover amount from the gross distribution Box 1 and enter the difference as the taxable amount in Box 2a.

Received a form 1099-r with codes 8and j. In Drake17 and prior if the 1099-R reports a code of 8 in box 7 Distribution Code and is typed in that field on the 1099 screen the amount will flow to. Line 15 of the 1040 to be included in IRA distributions if the.

For example use code 8 to report a contribution deposited in. There would not be a penalty and Form 5329 does not apply. Distributions other than section 404k dividends from the plan must be reported on a separate Form 1099-R.

Codes 8 and 1 8 and 2 or 8 and 4. Also use this code for corrective distributions of excess deferrals excess contributions and excess aggregate contributions unless code P applies. If the distribution was for a 2020 excess deferral to a designated Roth account your Form 1099-R should have codes B and 8 in box 7.

Ira Valuations And The Closely Held Business Interest Ric Omaha

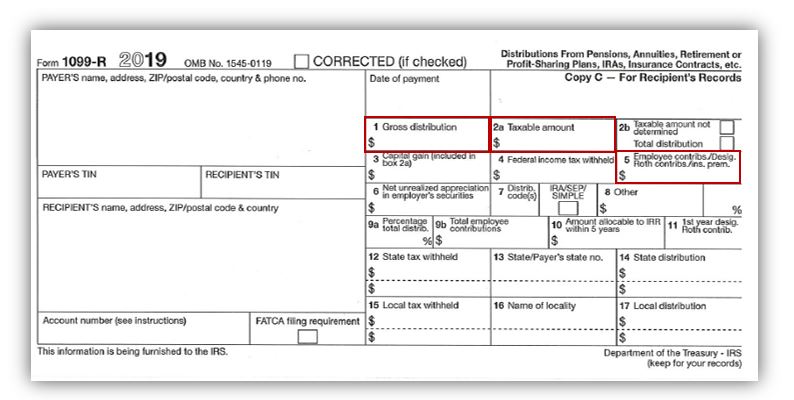

Understanding Your 1099 R Form Kcpsrs

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Form 1099 R Instructions Information Community Tax

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Form Focus Irs Form 1099 R Strata Trust Company

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

File Form 1099 R 2015 Jpg Wikipedia

No comments:

Post a Comment