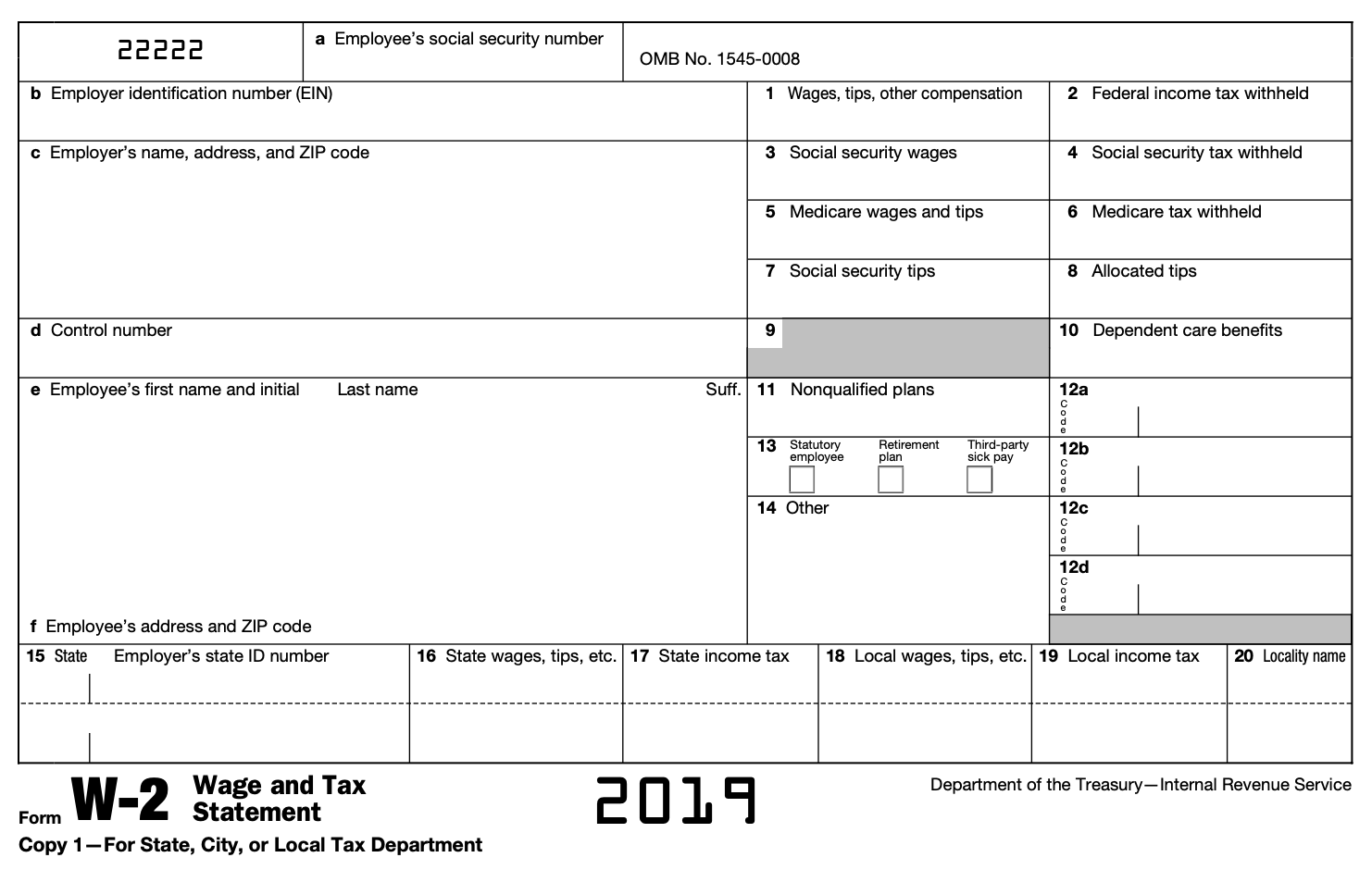

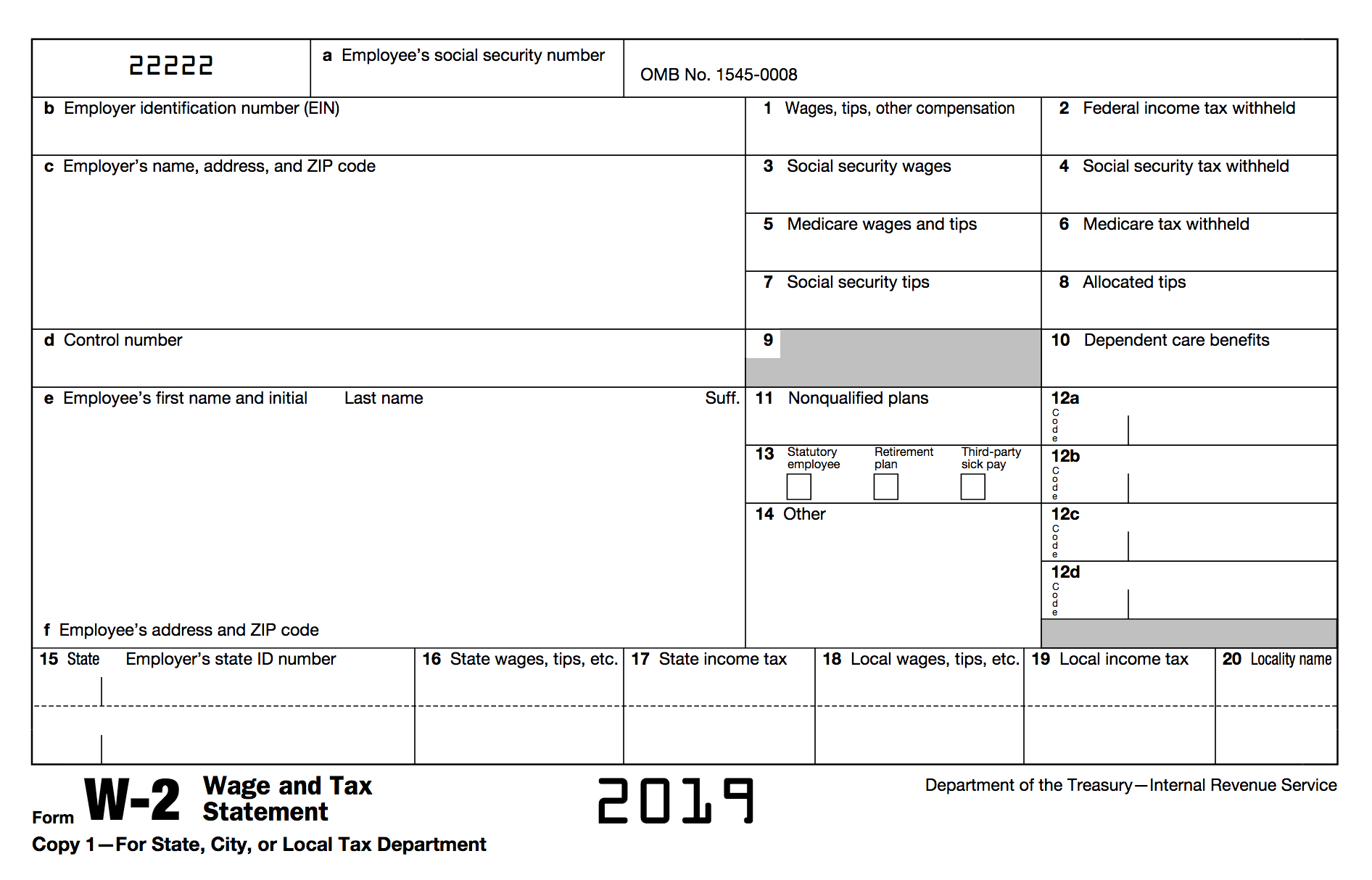

Enter it exactly as it was sent to you to ensure you get credit for the taxes withheld. El formulario 499R-2 W-2PR es una declaración de impuestos anual que los empleadores deben presentar a la SSA.

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

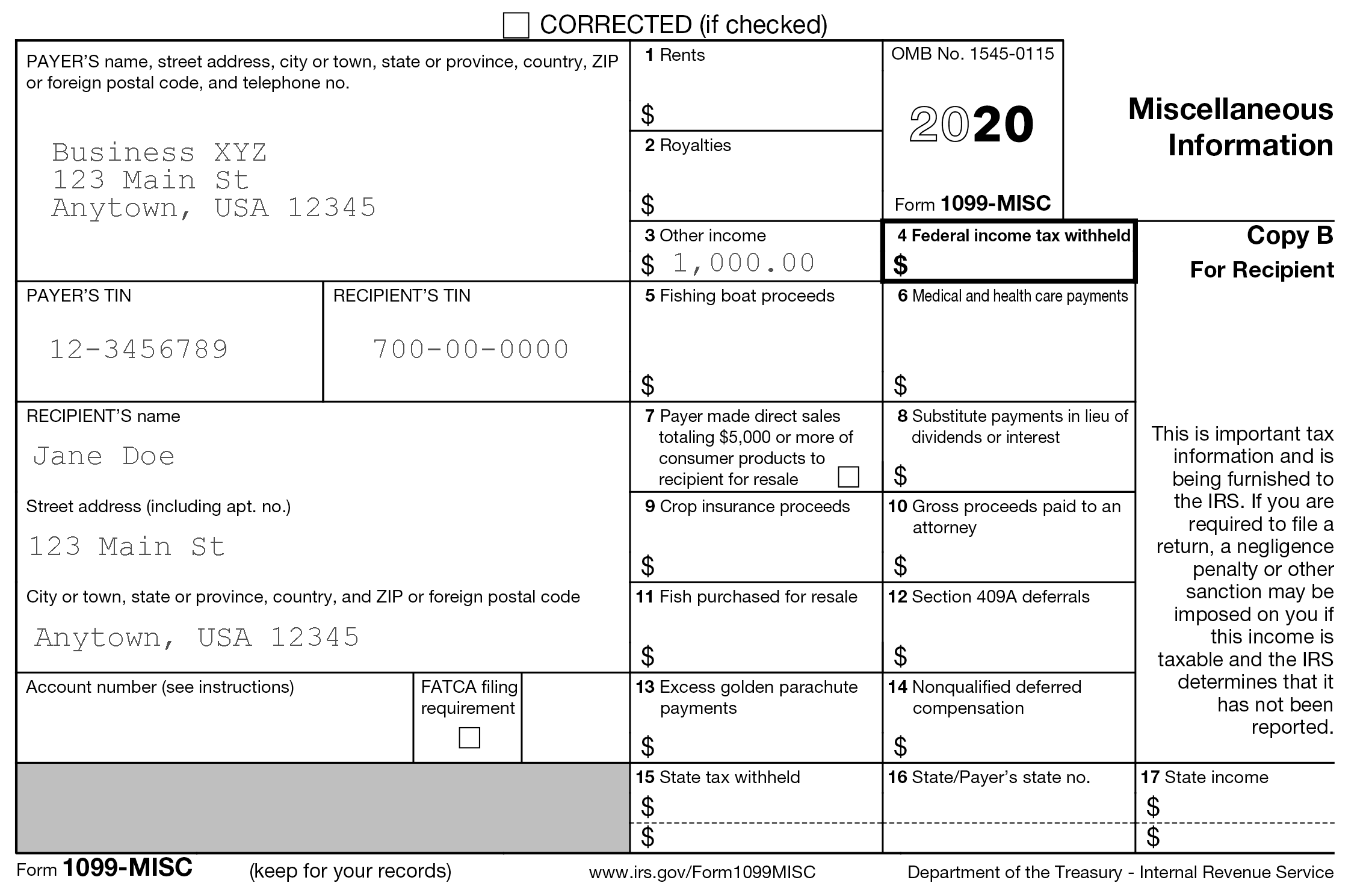

Understanding what is a 1099 misc form is the first step to financial freedom as a freelancer.

Formulario w2 o 1099-misc. Internal Revenue Service Austin Submission Processing Center PO. Banks might send you a 1099 misc if theyve paid interest on your savings. File Specifications for Original Files.

Verifying the information on this form and keeping it up-to-date ensures you collected accurate personal information. This is a series about Income tax. Theyre common among self-employed contractors.

Thats anyone thats not your employer. Employers are only required to supply the independent contractor with a Form-1099 at the beginning of the year for any payments made to them in the previous year. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

You must also submit 1099 forms to the IRS by January 31. Filing your Tax Returns Should i file a Tax Return Whats the difference B. Este formulario informa los salarios pagados y los impuestos federales y estatales retenidos del cheque de pago de los empleados.

1099 Where to fileThe Austin Submission Processing Center address has changed. First enter the W-2 in the Wages and Salaries interview of Federal Taxes Wages and Income or Personal Income. Box 149213 Austin TX 78714.

The Employer W-21099 Menu allows you to. Si eres un trabajador que gana un sueldo o un salario al finalizar el año tu empleador informa tu ingreso anual en el Formulario W-2. W2 Employees on the other hand are paid on an hourly or salaried basis usually on some sort of consistent schedule once per month twice per month weekly.

At the end of the day the W2 and the 1099 are both year-end tax forms that youll receive detailing how much money youve made. Form 1099-MISC Box 11The amounts in box 11 on Forms 1099-MISC must now be included in Box 5 on Form 1096. It is important to note that e-filed Form 1099-NEC will not be forwarded to states.

La persona o entidad que te paga es responsable de completar el formulario de impuestos 1099 correspondiente y enviártelo en o antes del 31 de enero. Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling 5000 or more of consumer products for resale on buy-sell deposit-commission or any other basis. Because recipient forms are required to be mailed in envelopes marked Official Tax Document Enclosed mailed recipient copies raise a huge flag to identity thieves.

The new address is. 1099-NEC forms are due to non-employees by the same date. For State Tax Department.

Ingresos como contratista independiente. Form 1099-MISC must be filed by March 1 2021 if filing on paper or March 31 2021 if filing electronically. What does this mean.

And 1099-MISC1099-NEC income files that were uploaded using the File ReturnPayment link. For further information see the instructions later for box 2 Form 1099-NEC or box 7 Form 1099-MISC. Whats the Difference Between a 1099 and a W2.

A significant portion of these identity crimes are committed by stealing personal mail and using the personal tax ID info contained in 1099-MISC and W-2 recipient forms to impersonate the victim. A full-time employee will receive the W2 and an independent contractor will receive the 1099. File Form 1099-MISC for each person you have given the following types of payments in the course of your business during the tax year.

Form 1099 is used to record many items but form 1099-MISC records an independent contractors earnings. Whether you should switch from being a W2 worker to a 1099 worker is completely dependent on your. Department of the Treasury - Internal Revenue Service.

I didnt pursue it any further with him and needless to say I did not win the prize but it got me. On the following screen choose the source of your royalty income. Enter or edit information that was filed manually or uploaded in e -TIDES.

Get Your 1099 vs W2 Calculator Now. Employers use form 1099-MISC to inform the IRS how much they paid a contractor. The data is used to generate a 1099-MISC.

A 1099 form records money given or paid to you by a company or a person. I asked the dealer if the winner would get a W2 but he said that any win over 600 got a 1099 not a W2. When you enter your 1099-MISC enter the income in Box 2 - Royalties.

Si recibes un formulario 1099-MISC por los servicios que provees a un cliente como contratista independiente y el ingreso neto anual que recibes totaliza US400 o más necesitarás presentar tus impuestos de una forma un poco diferente a como lo haría un contribuyente que recibe un ingreso regular como empleado informado en un formulario W-2. W-2 forms are due to the employees no later than January 31 of the year after the tax year. PAYERS name street address city or town state or province country ZIP or foreign postal code and telephone no.

Some other 1099s include 1099 G which is used to record taxable unemployment compensation and 1099 B which reflects taxable interestdividend income. Investment income from property you own This includes natural resources extracted from your property by a third party who leases your property as well as royalties from intellectual property that you didnt. Then enter the Form 1099-MISC in the Income from 1099-MISC interview in Wages and Income Other Common Income.

Form W-9 should be reviewed and updated yearly. I was at the local poker room last week and they were running a high hand promotion that paid 1300 to the winner. W-2 forms must also be sent to the Social Security Administration by this date.

The W-9 Form is an essential tool for employers to gather information about contractors for income tax purposes.

Que Es El Formulario W 2 Turbotax Tax Tips Videos

W2 Vs W4 What S The Difference Valuepenguin

Tain Company Inc Que Forma Debo Reportar W2 O 1099 Misc

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

Que Sucede Si Recibi Un Formulario 1099 Misc Con Solo La Informacion Del Recuadro 7

Diferencias Entre Formularios W2 Y 1099 Misc Calidad Insurance Auto Home Commercial We Are A Quality Insurance Agency

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is Form 1099 Nec Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

W 2 And W 4 A Simple Breakdown Bench Accounting

Irs 2021 Como Verifico Los Formularios 1099 Y W 2 Antes De Hacer La Presentacion De Impuestos Marca Claro Usa

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Do I Fill Out A W 9 Form For The State I Live In Or Work In Doordash Quora

No comments:

Post a Comment