If the preparer is the third party. Schedule SE Form 1040 or 1040-SR 2019 Attachment Sequence No.

Fillable Form 1099 A 2019 In 2021 Fillable Forms Form Financial Information

Starting in tax year 2019 Schedule 6 is obsolete.

Schedule 6 1040 form 2019. Foreign Address and Third Party Designee. You may be able to enter information on forms before saving or printing. 2019 IT-40 Income Tax Form.

Forms and Publications PDF Instructions. Information about Schedule 6 Form 8849 Other Claims including recent updates related forms and instructions on how to file. When filing you must include Schedules 3 7 and CT-40 along with Form IT-40.

Page one of the latest Schedule 6 form alongside the first page of the latest Schedule 6 instructions. Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses. The foreign address will be included on page 1 of the 1040 or 1040-SR Form after the United States address.

Forms and Publications PDF Enter a term in the Find Box. Information about Schedule EIC Form 1040 or 1040-SR Earned Income Credit including recent updates related forms and instructions on how to file. Foreign Address and Third Party Designee Keywords.

Part 1 and Part 2 of the Additional Credits and Payments schedule combines the less frequently used tax payments. Form 1040 PR Schedule H Household Employment Tax Puerto Rico Version 2021. Schedule SE Form 1040 or 1040-SR 2019.

Schedule 1 Additional Income and Adjustments to Income. 2021 Schedule 6 Form and Instructions. Form 1040 Schedule D Capital Gains and Losses.

Schedule C-EZ Form 2555-EZ and Form 8965 also obsolete for the 2020 tax season. Federal Self-Employment Contribution Statement for Residents of Puerto Rico. Click on the product number in each row to viewdownload.

2018 Schedule 6 Form 1040 Author. On page two of IRS Form 1040 line 20 the taxpayer is asked to add the amount from Schedule 3 line 8 Nonrefundable CreditsThen on line 31 the taxpayer is asked to add the amount from Schedule 3 line 15 Other Payments and Refundable Credits. January 2020 Itemized Deductions.

Click on column heading to sort the list. Beginning in tax year 2019 Schedule 6 will be combinedincluded on the Form 1040 or the Form 1040-SR whichever form you qualify to use. Schedule EIC Form 1040 or 1040-SR is used by filers who claim the earned income credit to give the IRS information about the qualifying child.

Click on column heading to sort the list. Name of person with self-employment income as shown on Form 1040 1040-SR or 1040-NR Social security number of person with self-employment income. The new schedules contain mostly information that previously was on Form 1040 plus a few new items.

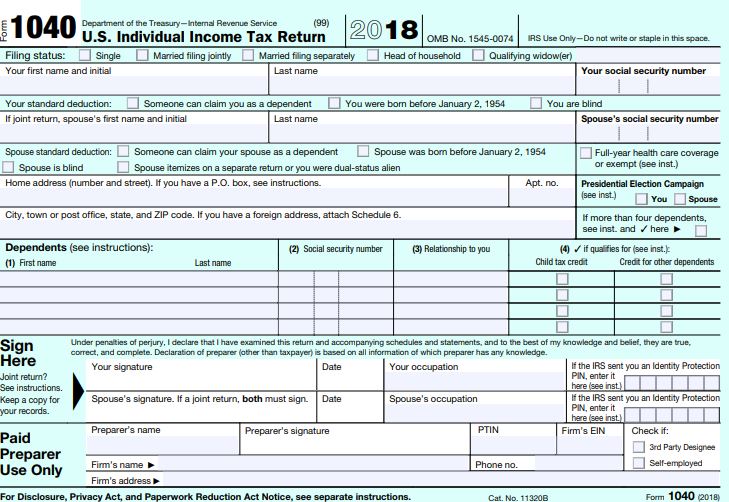

The IRS Form 1040 is a basic document for all employees and other persons who receive any type of income during the financial year. Form 1040 Schedule 1 Additional Income and Adjustments to Income. This schedule reports income from state tax refunds businesses rentals partnerships unemployment compensation and more.

Use this schedule for claims not reportable on Schedules 1 2 3 5 and 8 including refunds of excise taxes. Schedule 4 5 and 6 have been merged into lower numbered schedules 2 and 3 or the main Form 1040. These schedules generally contain the following.

List of obsolete IRS forms tax year 2019. The information entered previously on Schedule 6 has been added to Form 1040. Department of the Treasury Internal Revenue Service 99.

The Third-Party Designee will be on page 2 following line 38 on the 1040 Form or the 1040-SR Form. Instructions for Schedule E Form 1040 or Form 1040-SR Supplemental Income and Loss 2019 Form 1040 Schedule E Supplemental Income and Loss 2019 Inst 1040 Schedule E Instructions for Schedule E Form 1040 Supplemental. Foreign address and third party designee info is back on Form 1040 or 1040-SR.

You may be able to enter. Select a category column heading in the drop down. Select a category column heading in the drop down.

SCHEDULE A Form 1040 or 1040-SR 2019 Rev. Name of person with self-employment income as shown on Form 1040 1040-SR or 1040-NR. Section BLong Schedule SE Part I Self-Employment Tax.

Form 1040 Schedule D Capital Gains and Losses. Schedule 6 was used to report a taxpayers foreign address and if someone other than the preparer was the third party designee their information would appear on this schedule. About Schedule E Form 1040 Internal Revenue Service Mar 6 2019 - Use this Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and.

Schedule 6 has been discontinued by the IRS beginning with the 2019 income tax year. Click on the product number in each row to viewdownload. You must include Schedules 1 add-backs 2 deductions 5 credits such as Indiana withholding 6 offset credits and IN-DEP dependent information if you have entries on those schedules.

Enter a term in the Find Box.

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Tax Questions Irs

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

1040 Simplified Drake18 K1 Schedule1 Schedule2 Schedule3 Schedule4 Schedule5 Schedule6 Schedulea Schedulec Schedulee

The New 2018 Form 1040 Tax Forms Form Example Income Tax

2017 Irs Tax Forms 1040 Schedule C Profit Or Loss From Business Tax Forms Irs Forms Irs Tax Forms

Fillable Form 2438 Tax Forms Fillable Forms Form

Irs Gov Tax Questions Tax Preparation Tax Forms

What Is Irs Form 1040 In 2021 Income Tax Return Tax Return Filing Taxes

1040 Schedule 6 Drake18 Schedule6

1040 Schedule 6 Drake18 Schedule6

No comments:

Post a Comment