If the J-1 alien is a US. Citizens Green Card holders and permanent residents for tax purposes.

W 4 Tax Withholding Form Winona State University

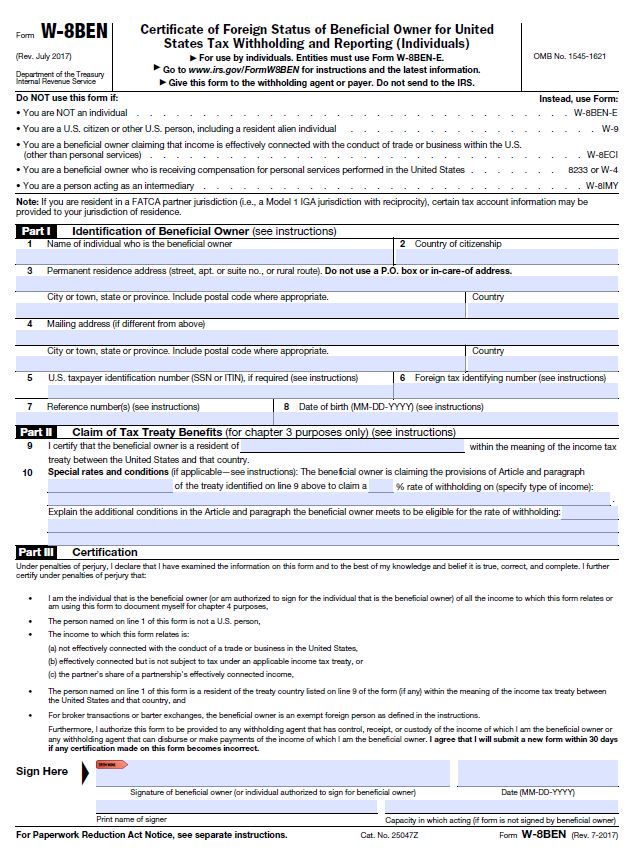

Access codes will be available beginning February 12 2021 If you were present in F-1 F-2 J-1 or J-2 status in the United States during any portion of the calendar year 2020 you are required to file tax Form 8843 with the IRS.

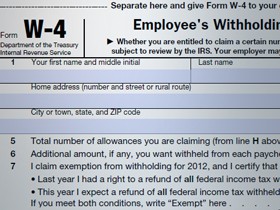

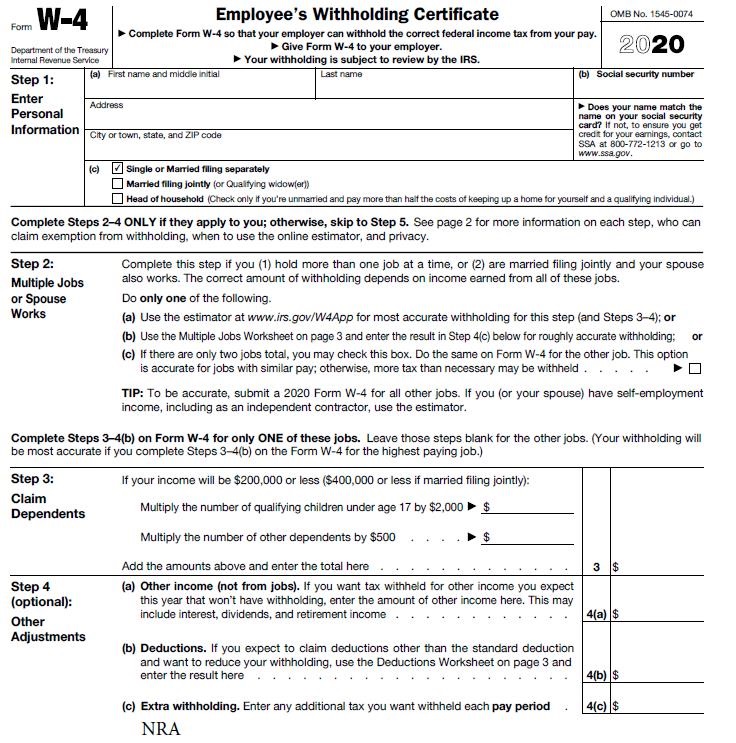

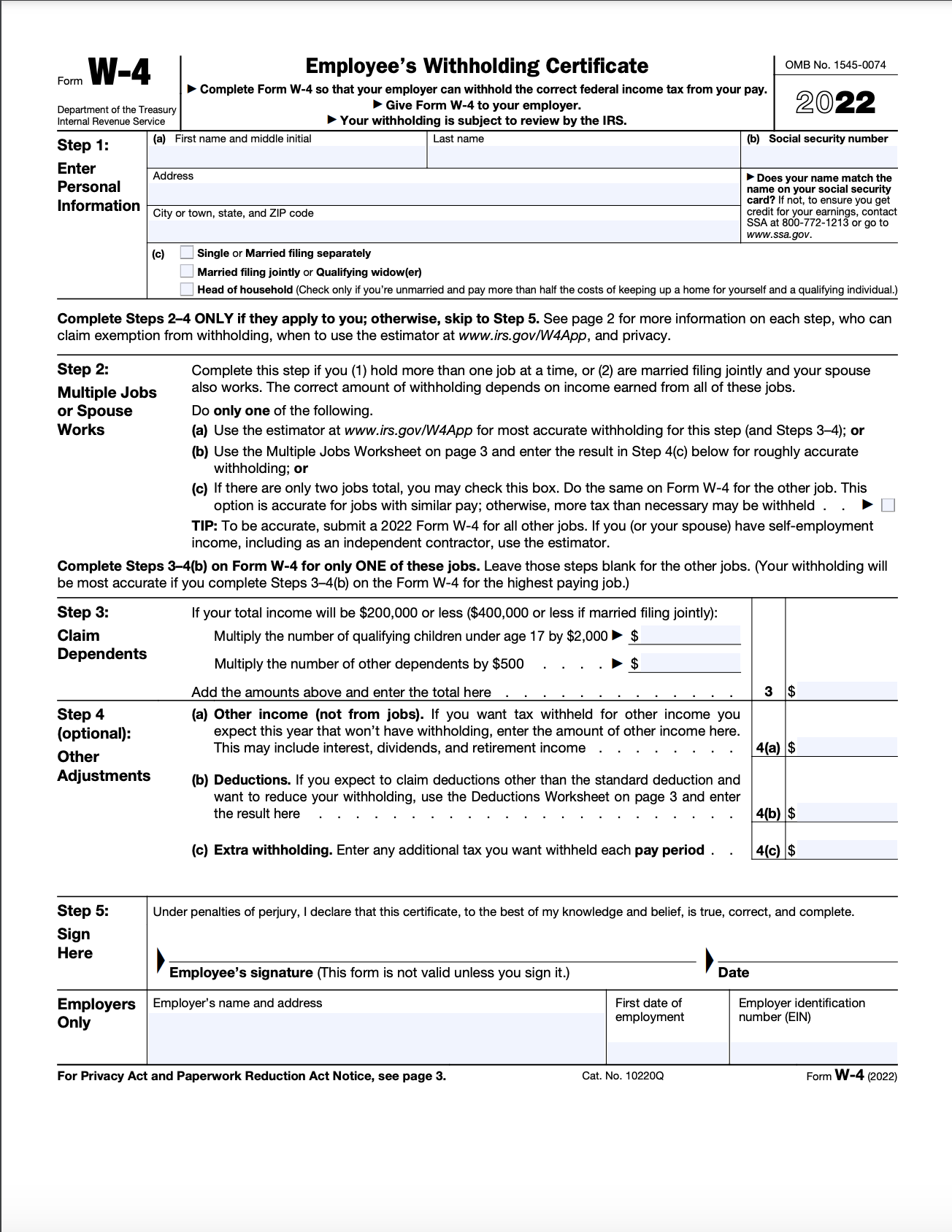

W 4 form j1 visa. With the assistance of the institution all nonresident alien student employees must fill out two W-4 forms at the time of hire one for Federal withholding and one for State withholding. Employer COVID 19 Survey. Completing the W-4 Form.

Your withholding is subject to review by the IRS. How to complete the W-4 Form J-1 Participants only When you start working your new employer will ask you to complete a W-4 Form. Fill out a W-4 Form.

International tax withholding policy determines how these forms are to be completed. The information supplied here will assist you in the process. When filling out the current W-4 form it is recommended that InterExchange Work Travel USA participants follow Supplemental Form W-4 Instructions for Nonresident Aliens as provided by the IRS.

The information on the Form W-4 is used to calculate and withhold the proper amount of tax from your wages scholarship assistantship or grant. Citizen in the same situation ie with the same marital status. The Student and Exchange Visitor Information System SEVIS is a computer system that monitors all aliens on the USA territory including J1 Visa holders.

International students who have been in the US. Starting in 2020 Form W-4 no longer calculated allowances so the title has been shortened to Employees Withholding Certificate 2. If the nonresident alien is eligible for treaty benefits the W-4s will become effective at the time the treaty limits are reached.

SWT Employment Agreement Form. The J-1 Visa offers cultural and educational exchange opportunities in the United States through a variety of programs overseen by the US. Because it is geared towards American workers the instructions do not fully apply to you so we have included a abbreviated.

Work and Travel program participants are obliged to register in SEVIS during 10-20 days since their program start date depends on Sponsor requirements. Firstly your employer must submit a Labor Condition Application form ETA-9035 to. Resident alien the employer must withhold US.

Your employer can confirm these. 3- Check Single regardless of your marital status. 5- Put 1 regardless of the number of dependents you have.

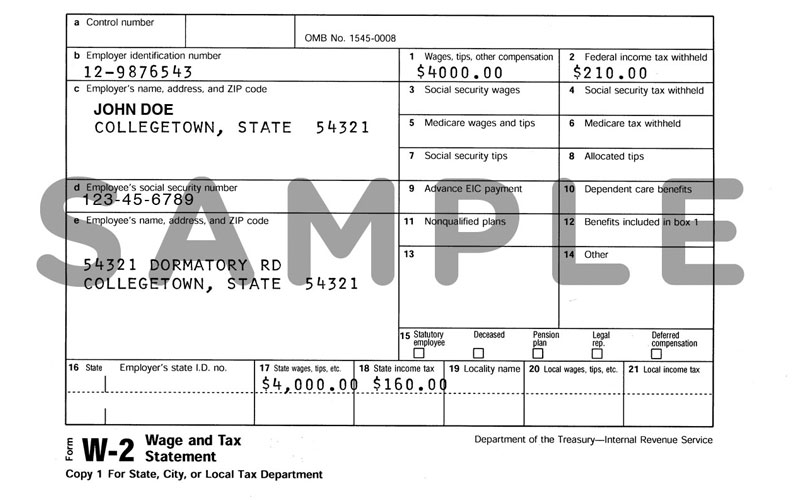

To claim your J-1 tax refund youll need your W2 Form or final cumulative payslip and social security numberITIN number. Please check with the US. 4- Dont check this box.

The participant will complete Section 1 and you will complete Section 2. J-1 Exchange Visitor programs include au pairs summer work travel interns high school and university student exchanges physician exchanges and more. For the only job you entered which has a projected salary of 18000.

Check the Single box on your Form W-4 Assuming this recommendation is in effect for the rest. Once you have completed the DS-160 Form you will need to print out the confirmation page with the barcode visible and bring it to your visa interview. 7- Dont write anything.

Buh-Bye Personal Allowances Worksheet. This form is given to you by each employer for whom you work. Give Form W-4 to your employer.

For less than 5 years with an F1 or J1 Visa must complete two W-4 forms. Fill out a W-4 form once you get a job. 2- Social Security Number.

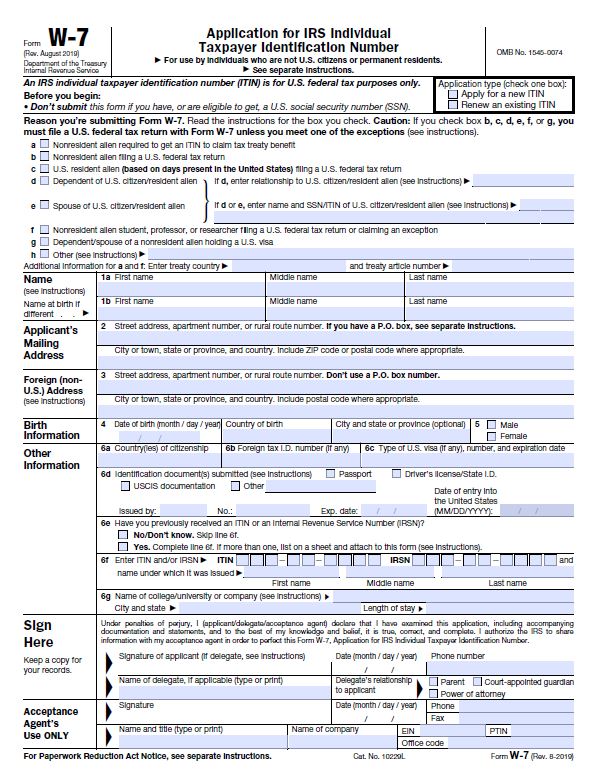

W4 Instructions for J1 Participants. The purpose of this form is to determine how much tax should be withheld from an individuals wages scholarship or grant. The Form W-4 is available on the IRS website.

Recommendations From the IRS. Thats right the Personal Allowance Worksheet from page three of the old Form W-4 disappeared in 2020and it remains gone. 6- Write NRA nonresident alien on line 6.

You must obtain a job offer from a US employer before you can apply. The J-1 visa holder should file a Form W-4 Employees Withholding Allowance Certificate according to those same rules. Once you have received your forms DS2019 indicating you have been approved for J1 sponsorship you will need to take the next step in applying for your visa at the US embassy nearest you.

This form has replaced the previous forms DS-156 157 and 158. These instructions apply only to J-1 visa holders and should be used instead of the instructions printed on the W-4. Form W-4 Every J1 participant must complete this form when they start working.

For a sample of this form and how it should be completed download this form. You should file your summer camp counselor tax return before the deadline to avoid any fines and penalties. The participant should fill out Section 1.

Consulate or Embassy where you will apply for your visa for information about using this form. To transfer your J1 visa to an H1B visa. You should adjust your withholding on a new Form W-4 as follows.

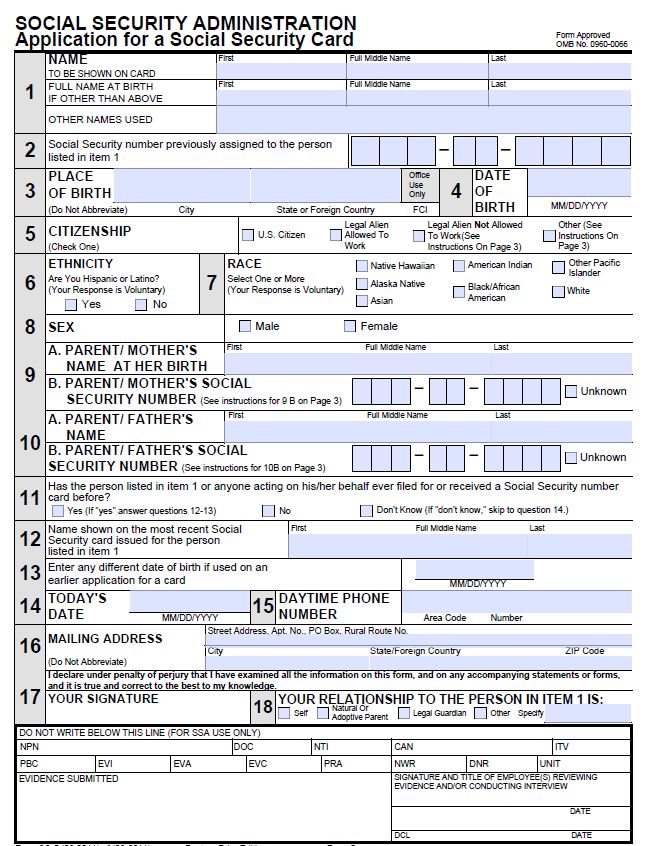

All students must fill out a W-4 employee withholding allowance certificate. 1- Your Name. You must fill out this form so that the exact amount of the taxes to be paid can be determined.

W-4 and Taxes for J-1 Participants. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. You must fill this form out and give it.

You will complete these forms in the. Completing Form W-4 as a Non-Resident Tax Payer Instructions on the Form W-4 are intended only for US. W-4 Form for J-1 Exchange Visitors J-1 Visa Exchanges.

The participant will show you his or her passport I-94 ArrivalDeparture Record J-1 Visa and DS-2019 Form when completing this form. Enter Personal Information a. Based on the information you provide on the W-4 your taxes will be calculated and deducted from your paycheck.

All non-resident aliens must complete a W-4 form when they begin employment. This form determines how much tax will be withheld from your paycheck. You MUST file a US tax return if youre on a J-1 visa.

When you arrive in the US your host employer will give you a W-4 Form. When you start your internship or traineeship you will receive the W-4 Employees Withholding Allowance Certificate form from your host company employer. The W-4 Form Employees Withholding Allowance Certificate is used primarily for US employers to calculate Federal state and local tax responsibilities of their American workers.

F1 and J1 visa holders may request the Glacier Tax Preparation Access Code. Federal income tax on the employees wages in the same manner as one would withhold on wages paid to a US. ALL F-1 students are required to complete Form 8843 even if you.

You must go through the H1B visa application process.

How To File Us Taxes As A J 1 Visa Holder Work Travel Usa Interexchange

5 Us Tax Documents Every International Student Should Know

5 Us Tax Documents Every International Student Should Know

When Do I Need New W 4 Forms For Employees Genesishr Solutions

Money Monday J 1 Exchange Visitors Social Security Withholding The J 1 Visa Explained

How To File Us Taxes As A J 1 Visa Holder Work Travel Usa Interexchange

5 Us Tax Documents Every International Student Should Know

Can I Hire A Nanny With A J 1 Visa Answers For Household Employers

How To Fill Out The New W 4 Form Correctly 2020

Required Checklist J 1 Visa Partners Pips

How To File Us Taxes As A J 1 Visa Holder Work Travel Usa Interexchange

Tax Information Career Training Usa Interexchange

5 Us Tax Documents Every International Student Should Know

No comments:

Post a Comment