Divisions and spinoffs Broadridge Financial Solutions. The calculator will provide users the information to put on a new Form W-4.

Adp Employee Information Form 2020 Fill And Sign Printable Template Online Us Legal Forms

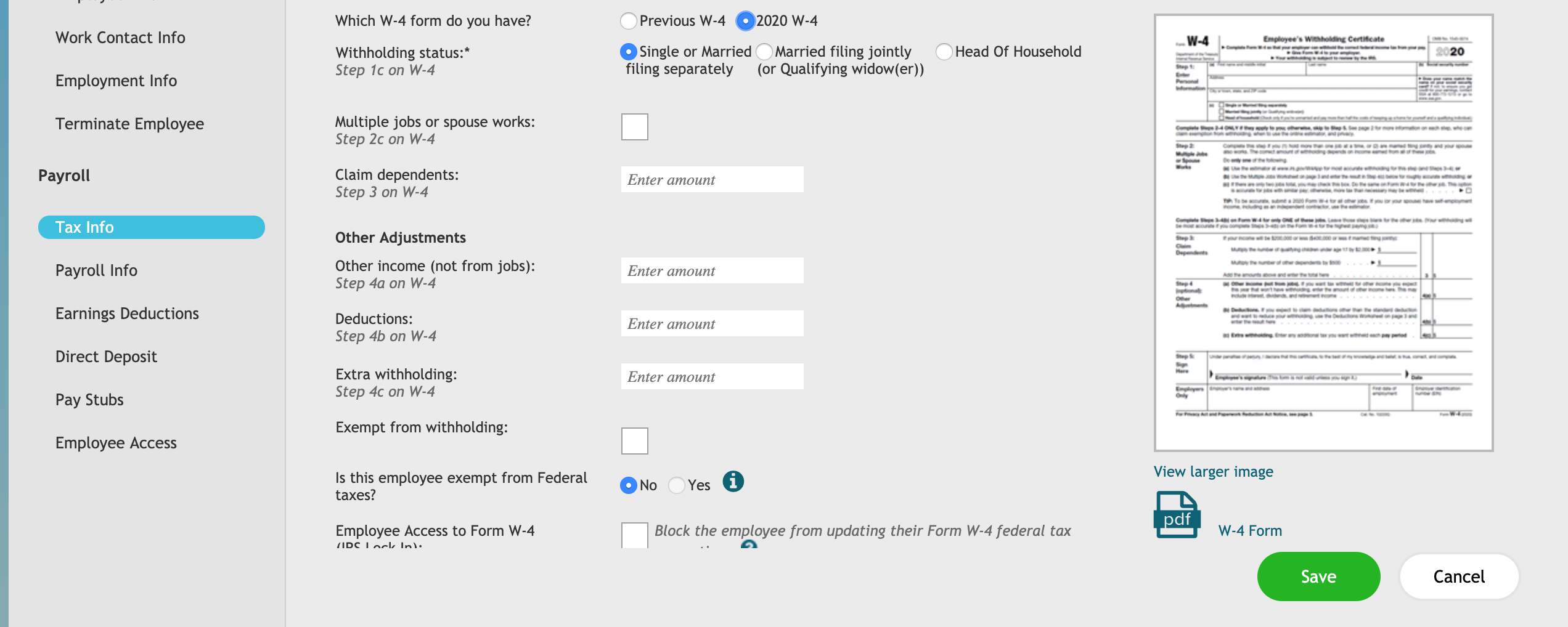

Employers use electronic Form W-4 systems for this.

W4 form adp. Employees will submit the completed Form W-4 to their employers. Printing and scanning is no longer the best way to manage documents. The 2020 IRS Form W-4 Employees Withholding Certificate includes fundamental changes to income tax withholding that will significantly affect both employers and employees.

View and Update Your Federal Tax Withholding Form W-4 in Employee Access Keywords. ADP currently has about 58000 employees worldwide and its fiscal year 2019 revenues were 142 billion. In 2007 the ADP Brokerage Service Group was spun off to form Broadridge Financial Solutions Inc.

On December 5 2019 the Internal Revenue Service IRS released the final 2020 Form W-4 Employees Withholding Certificate. The form includes major revisions including. Ensuring that you have the most up-to-date state or federal forms can be a challengeoften requiring a significant investment of time and effort.

An employee uses a W4 to inform the. Irs Form W4. This IRS 2020 Form W-4 Employer Guide is intended to help you and your clients.

Final IRS 2020 Form W 4 Released. State and Local Forms. BR removing about 2 billion USD from ADPs total yearly revenue.

Employee Information Form Direct Deposit Information The ADP logo and ADP are registered trademarks and ADP A more human resource is a service mark of ADP LLC. For New Hires And Every Time Your Tax Situation Changes Return must be filed January 5 February 28 2018 at participating offices to qualify. Give Form W-4 to your employer.

The IRS defines a dependent as. Comparison Between W2 W4 and W9 Form. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Adp Employee Information Form online e-sign them and quickly share them. 2020 IRS Publication 15-T Federal Income Tax Withholding Methods Publication 15-T now contains all the instructions and tax tables for employers to calculate withholding after 2019 for employees that provide a 2020 Form W-4 and those who have a 2019 or prior Form W-4 on file. In 2020 the IRS released a new W-4 form that eliminated withholding allowances.

The form has been revised to comply with the federal tax law changes that took place in 2018. Handy tips for filling out Adp Employee Information Form online. Forbes published a great W-2 overview a few years ago on this important earnings summary form you see once a year.

Give Form W-4 to your employer. The major difference between the W2 W4 and W4 2019 is that W4 is an input document whereas W2 is an output document. The form includes MAJOR revisions including new input elements for federal income tax withholding calculations which may require significant reprogramming of payroll systems and ongoing employer support of two distinct.

The Withholding Calculator will help determine if they should complete a new Form W-4. Those claiming exempt that wish to make updates must check the box next to I am claiming exempt then click the W4 form link to download. ADP withholds based off your W4 and a tax withholding table as published by the IRS and state httpswwwirsgovpubirs-pdfn1036pdf Any.

View and Update Your Federal Tax Withholding Form W-4 in Employee Access Author. Claiming dependents on w-4 is a way to get more money from your employer. These changes are largely in response to the 2017 Tax Cuts and Jobs Act.

Find copies of current unemployment withholding IRS ADP and other forms using this extensive repository of tax and compliance-related forms and materials. Your withholding is subject to review by the IRS. On May 31 2019 the IRS released an early draft of the 2020 Form W-4 Employees Withholding Allowance Certificate.

The IRS had released an early draft in May and a second near-final draft in August to enable employers to make software and other changes. W9 is different from a W4 because a W4 is telling the employer how many exemptions one may have and a W9 to find their taxpayer identification number. Answer 1 of 5.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Enter Personal Information a. Your withholding is subject to review by the IRS.

However many states still use withholding allowances for their state income tax structure. Generally the new Form W-4 is an improvement for employees said Pete Isberg vice president of government relations at payroll and HR services firm ADP. If you click on the name of the report but nothing happens check to make sure your pop-up blocker is disabled.

Select the quick link Federal Tax Withholding 3. Is a service mark and ADPCheck is a trademark of ADP LLC. A qualifying child or qualifying relative.

December 2020 Department of the Treasury Internal Revenue Service. Each person you claim as a dependent will reduce the amount of tax taken out of your paycheck each month and will increase the size of the tax refund at the end of the year. Because of this change some states that previously used the federal form for state income tax withholding have created their own version of Form W-4 eg Idaho.

Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Type of federal return filed is based on your personal tax situation and IRS rules. From there it will take you through a wizard where you will be asked all the questions that are on the paper version of the form.

Here are a few things for taxpayers to remember about updating Form W-4. Once you complete your federal withholdings it will prompt you to complete your state withholdings as well. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

The form name in the Instructions column. Tax Reports ADP the ADP Logo and RUN Powered by ADP are registered trademarks ADP A more human resource.

Employee Self Service Adp Portal Is An Employee Self Service Pay Statements Direct Deposit Maintenance Tax

Adp Deciphers Changes To Form W 4 And Its Impact On The Workforce Diversityinc

Adp Deciphers Changes To Form W 4 And Its Impact On The Workforce New Jersey Business Magazine

Changing Your W 4 Form Youtube

Adp Pay Stub Template Pdf Income Tax In The United States Federal Insurance Contributions Act Tax

2020 W 4 Form Overview And Resources Employers Should Be Aware Of

Employers Take Note Irs 2019 Form W 4 Requires A Payroll Systems Overhaul

No comments:

Post a Comment