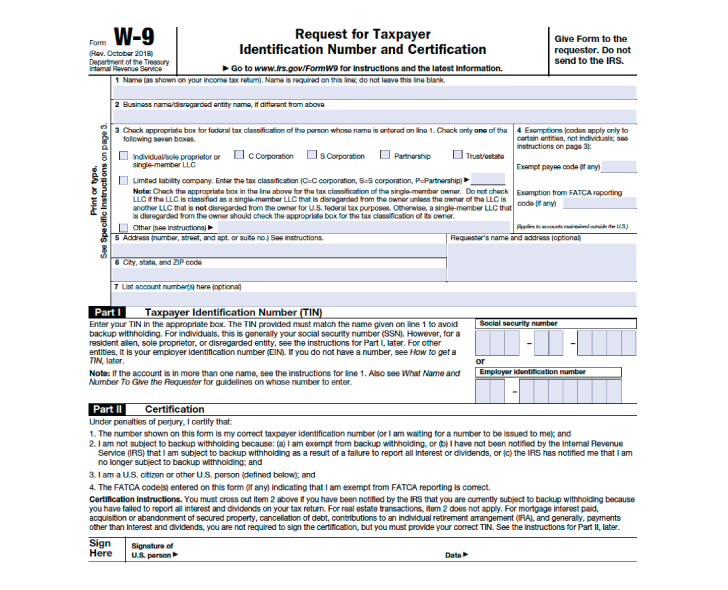

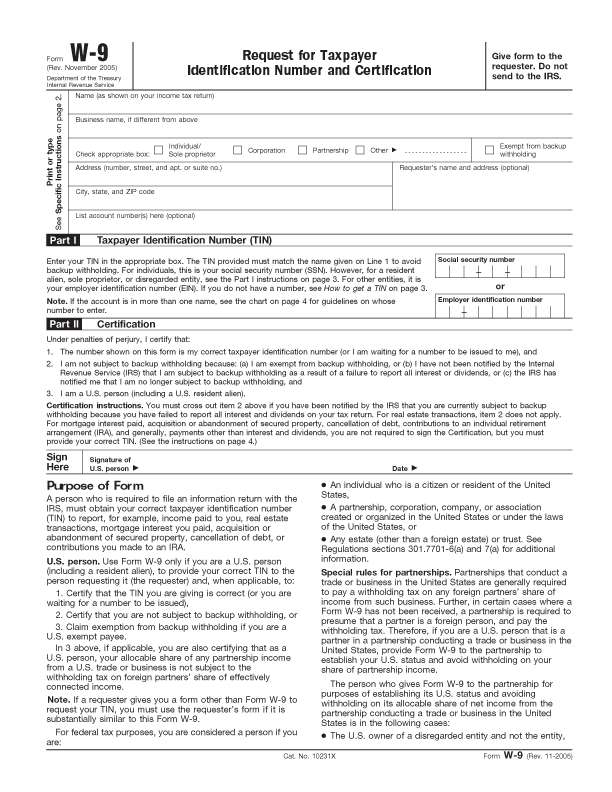

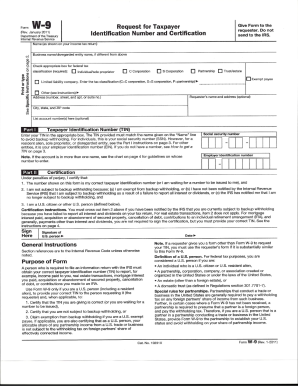

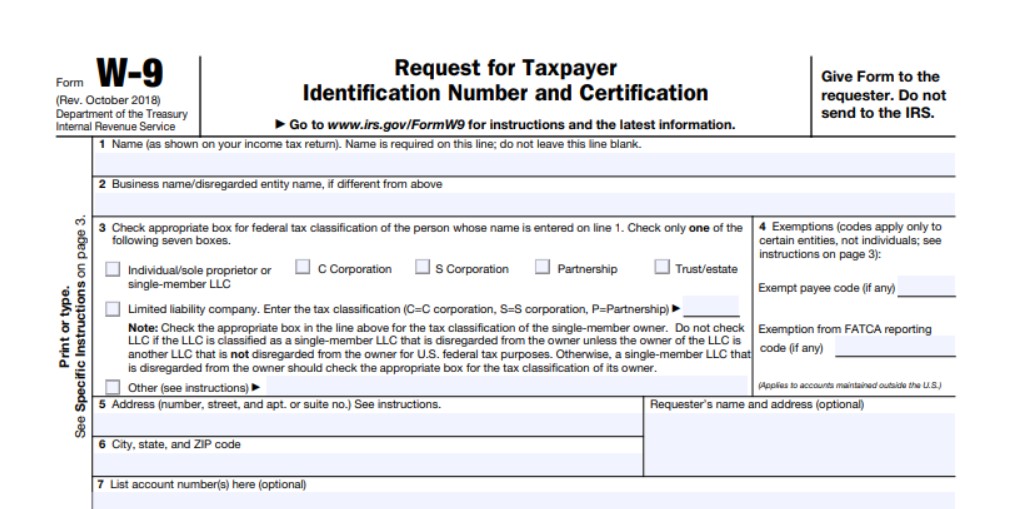

Youll receive a 1099-INT tax form if youre the primary account holder and were paid a combined total of 10 or more in interest for all your deposit accounts including closed accounts during the relevant tax year. IRS Form W-9 Request for Taxpayer Identification Number and Certification is a one-page IRS tax document that individuals and businesses use to send the correct taxpayer identification number to other individuals clients banks and financial institutions.

If the combined total of miscellaneous income across all accounts is 600 or more you will receive a 1099-MISC form for.

W9 form capital one. Please review each field for accuracy. Business OVERVIEW Capital One Financial Corporation which was established in 1995 is a diversified financial services holding company headquartered in McLean Virginia. If you are self-employed you can send the form to a person.

What can I do if I have questions about my form or if I think the form is wrong. How to Get a W9 Form From Companies. Name as shown on your income tax return.

Income paid to you. Luckily the above and this. Taxpayer Identification Number to the person including a financial institution who needs to report certain information about you such as income paid to you contributions to IRAs made by you interest dividends and capital gains earned by you certain real.

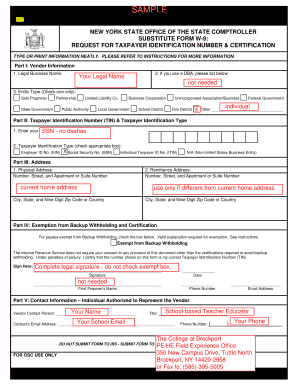

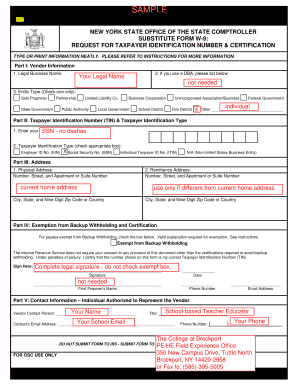

Request for Taxpayer Identification Number and Certification. The taxpayer you the payee isnt subject to backup withholding. 1 PART I Item 1.

By signing it you attest that. Click the W9button to produce a W9 form with prepopulated information from the Escrow Sub Account. Print or type.

Contributions you made to an IRA. The fax cover will include the Escrow Sub Account Numberand Tax IDfields pre-filled. What is a W9 Form.

1 Set up or update your Form W-9 Step-by-Step Instructions 1. When you have the above ready to go either mail the completed and signed W-9 form and a copy of your legal document to Capital One PO. Ive had to repeatedly send the exact same form and it has consistently been lost.

This form cannot be used as an initial application for a new account or to add or update owners on an already existing account. W-9 Form Defined. For instructions and the latest information.

Ad Find Edit Sign Save or Send via E-mail any Form. The purpose of form W9 is to provide your US tax ID aka TIN. This can be a Social Security number or the employer identification number EIN for a business.

This permits you to submit information such as income earned IRA contributions and your capital gains earnings and capital gains earnings to IRS. Ad Find Edit Sign Save or Send via E-mail any Form. The form also provides other personally identifying information like your name and address.

They will then be able. Most often when youre a self-employed contractor you send it to someone so. October 2018 Department of the Treasury Internal Revenue Service.

All of which have been lost by capital one. W9 Lookup And Verification Form IRS Form W-9 Request For Taxpayer Identification Number And Certification is a one-page IRS tax file that individuals or businesses use to deliver the right taxpayer ID number to consumers individuals banks or financial institutions. What is form W-9.

When you hire another company or an independent contractor you must obtain a W-9 form from the company or the contractor. Instructions continue on the next page. Request for Taxpayer Identification Number and Certification.

Do not send to the IRS. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. If the combined total of interest across all accounts is 10 or more you will receive a 1099-INT form for the interest paid in your Capital One 360 accounts and a separate form for the interest paid in your non-360 accounts.

Money Market Account Acceptance Form Provides Capital One the authority to maintain an account certifies that the taxpayer identification number is correct and acts as the signature card for the account. If you have misplaced or need an additional copy of your form for the current or prior tax year you may request a copy via mail by contacting us at the address listed below. The online version of W9 Form 2021 can be used by those who are going to submit one electronically.

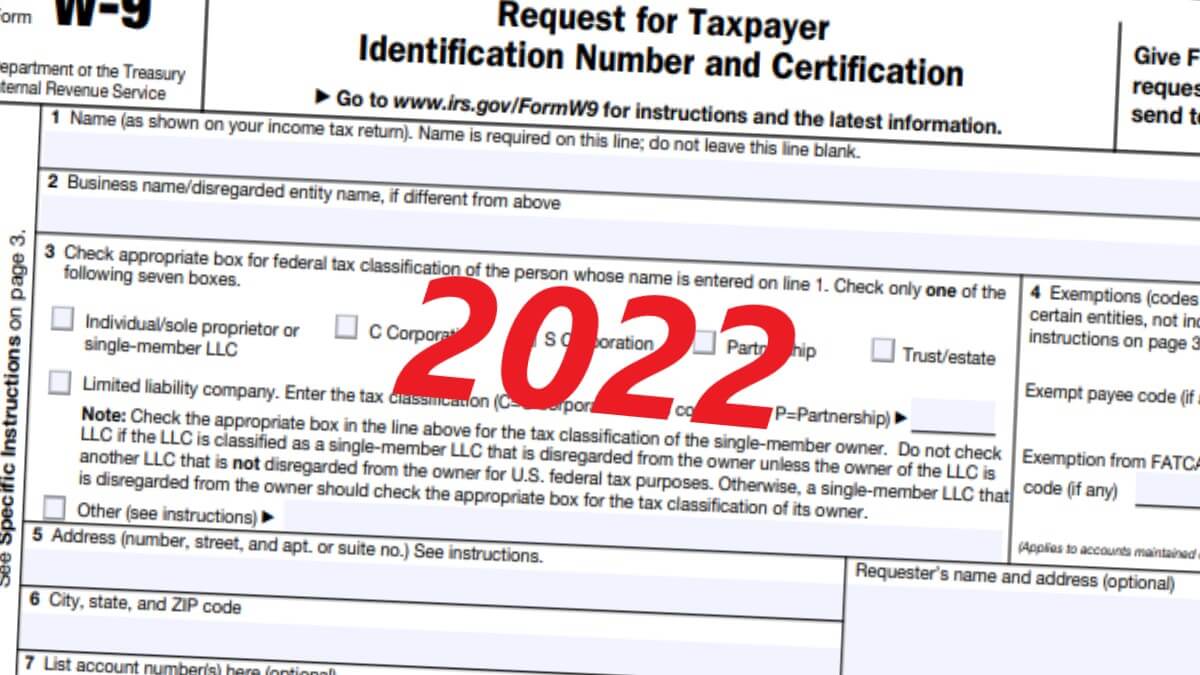

Click the Faxbutton to produce a fax cover form. W9 Form 2021 Online. Give Form to the requester.

Do not leave this line blank. Form W-9 is the federal form that provides you with the companys tax identification number. Give Form to the requester.

What Capital One did. December 2014 Department of the Treasury Internal Revenue Service. So if youre going to mail your W9 to the requester this is the one you need to use.

The TIN you gave is correct. I have submitted a W9 form now three times. The title of Form W-9 is officially Request for Taxpayer Identification Number and Certification.

Employers use this form to get the Taxpayer Identification Number TIN from contractors freelancers and vendors. Cloud MN 56302 or fax to 1-877-464-4963 ATTN. Form W-9 will contain any existing information we have for your company.

Days to verify your Form W-9. Acquisition or abandonment of secured property. Name is required on this line.

Box 30285 Salt Lake City UT 84130-0285. Form W-9 is officially titled Request for Taxpayer Identification Number and Certification. Do not send to the IRS.

Capital One Financial Corporation and its subsidiaries the Company offer a broad array of financial products. W9 Form Kansas A W9 form is a way for you to give an individual or the financial institution you work with with taxpayer Identification Number TIN. Once you have this number you have the information you need to.

Mortgage interest you paid. You will also receive a 1099-INT if your deposit accounts had any backup withholding or if you took an early withdrawal from a CD before the maturity date. Setting or updating your Form W-9 Keep going.

For convenience Capital One Escrow Express can produce a W9 form. In Seller Center click Settings and click Form W-9 2.

W9 Form Example Fill Out And Sign Printable Pdf Template Signnow

W 9 Form What Is It And How Do You Fill It Out Smartasset

The Irs W9 Form It S Important If You Want To Get Paid The Motley Fool

Printable W 9 Federal 2021 In 2021 Tax Forms Irs I 9 Form

Capital One Voided Check Fill Online Printable Fillable Blank Pdffiller

W9 Template Fill Out And Sign Printable Pdf Template Signnow

Learn How To Fill Out A W 9 Form Correctly And Completely

How Do I Fill Out Irs W 9 Form For My Solo 401 K Rocket Dollar

What Is Irs Form W 9 Turbotax Tax Tips Videos

W9 Form 2021 Printable Pdf Irs W9 Form 2021 Printable

W9 Form 2022 Fillable Editable Printable

Irs W9 Form Fill In W9 Form 2022

No comments:

Post a Comment