Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. Its on the left hand corner of forms for the return.

Covid 19 Tax Relief What Is Irs Form 7202 And How It Could Help If You Had Virus Wsb Tv Channel 2 Atlanta

Inst 7202 SP Instructions for Form 7202 Credits for Sick Leave and Family Leave for Certain SE Individuals Spanish Version 2020 02102021 Inst 7202.

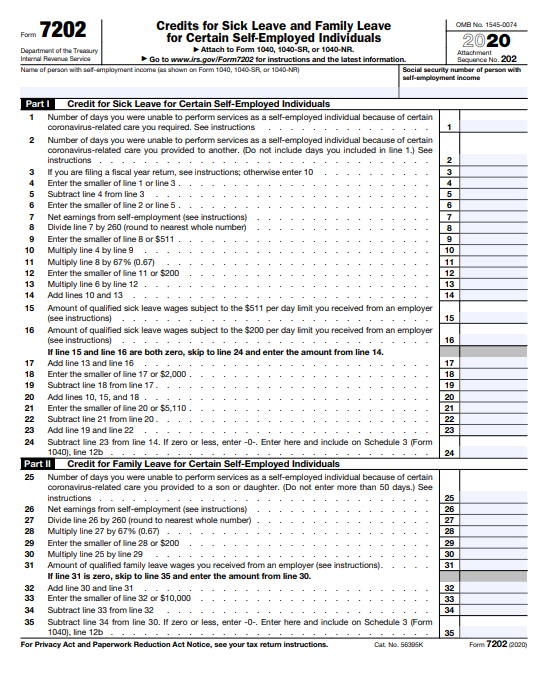

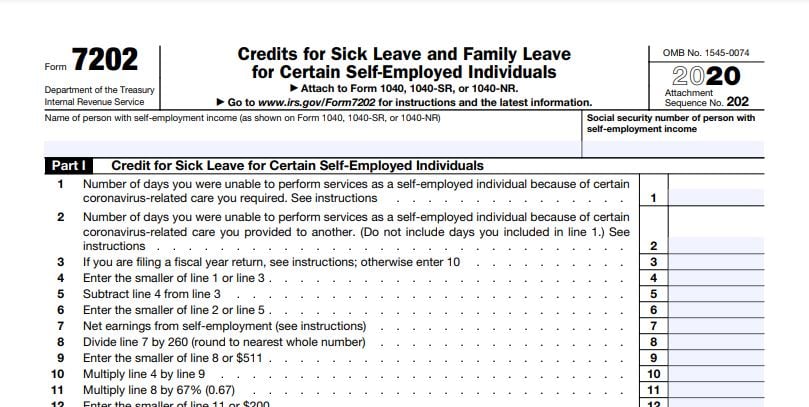

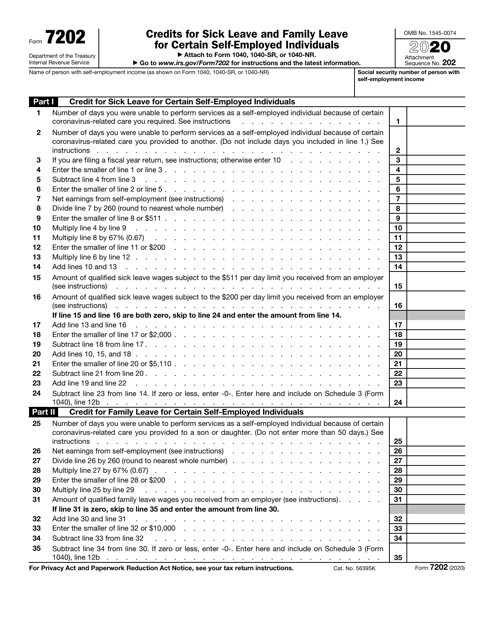

1040 form 7202. The Instructions for Form 7202 were also released and provide additional information. Part I of Form 7202 gives the sick leave credit and Part II figures the family leave credit and the sum of the sick leave credit and if any family leave credit will be included on line 12b of the Schedule 3 that is filed with the Form 1040. Wait until the original return is processed more than just accepted fully processed generally takes 21-28 business days after acceptance and then file Form 1040X to amend the original return.

About Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. Form 7202 and instructions released. See the 2020 Instructions for Form 7202 for eligibility information.

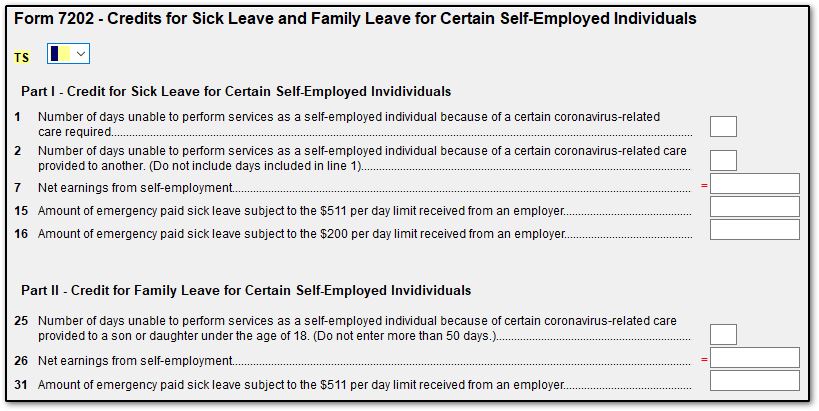

Questions and Answers on the IRS website also. An entry for line 7 or 26 overrides the programs calculation. What am I doing wrong here.

If you paid household employment taxes enter the refundable portion of the credit for qualified sick and family leave wages you are eligible for due to reasons related to the coronavirus from your Schedule H Form 1040 Household Employment Taxes. Nonresident Alien Income Tax Return is being restructured to look like the redesigned Form 1040. New line 13h added to report qualified sick and family leave credits from Forms 7202 for leave taken after March 31 2021.

Business Rules and Schemas Form 1040-ES and Form 7202. If you didnt file a 2020 Form 7202 enter -0-. Qualified sick and family leave credits from Schedules H and Forms 7202.

This form shall allow the qualified self-employed taxpayers to file claims for tax credits on their federal tax form 1040 for the financial years 2020 and 2021. Form 1040-NR US. The program calculates net self-employment earnings for the taxpayer or spouse.

Each eligible self-employed individual must file a separate Form 7202. 25c d Enter the smaller of line 25a or line 25c. Since the form wont be supported in e-file youll need to print both Form 7202 and your entire 1040-series return and mail them to the IRS.

Also just noticed that when the return is printed form 7202 is not printing. Form 7202 - Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals As provided under the Families First Coronavirus Response Act FFCRA enacted on March 18 2020 the costs of providing leave to workers unable to work or telework due to circumstances related to the coronavirus can be offset with refundable tax credits against employment tax. The sum of the sick leave credit and the family leave credit will be included on Schedule 3 Form 1040 line 12b.

Self-employed individuals use this form to figure the amount to claim for qualified sick and family leave equivalent credits under the Families First Coronavirus Response Act. Form 7202 and its instructions are used by self-employed individuals to calculate their sick and family leave equivalent credits. Form 7202 is a form that the IRS has brought forth to enable adequate calculation of the tax credit on sick and family leaves of eligible self-employed individuals in the US.

New IRS Form 1040. Part One of Form 7202 is used to calculate the credit for sick leave for. Explain in Part III of Form 1040X a brief reason for the change.

The tax credits will be claimed on 2020 Form 1040 for leave taken between April 1 2020 and December 31 2020 and on their 2021 Form 1040 for leave taken between January 1 2021 and March 31 2021. You can elect to use prior-year net earnings from self-employment to. Additionally the name of the taxpayer is not appearing on the program form 7202.

25b c Subtract line 25b from the number 50. This form will be used to calculate the refundable credits for sick and family leaves caused by the COVID-19 outbreak. Purpose of Form 7202 Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self-employed individual due to certain COVID-19 related circumstances between January 1 2021 and September 30 2021.

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self-employed individual due to certain COVID-19 related circumstances between January 1 2021 and September 30 2021. Individual Tax Return and Estimated Tax Payments Reporting Requirements Penalties and Deadlines 90 Minutes 07 December 2021. Schedule EIC Earned Income Credit added a checkbox for taxpayers to self-certify that they qualify for the EIC when married filing separately.

Form 7202 is produced in view mode to calculate the eligible credit on either line 24 or 35 part I or part II to flow to Form 1040 Schedule 3 line 12b. Form 7202 must be attached to your tax return. Form 7202 is then attached to the self-employed taxpayers Form 1040 Form 1040-SR or Form 1040-NR.

Form 7202 had been filed separately by each taxpayer with net self-employment earnings. Form 1040X has three columns. It has the information I have entered but its somehow not connected to the return.

Instructions for Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals 2021 01072022 Inst 720-CS. New Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals has been added to UltraTax1040. Form 1040X can be electronically filed using tax software.

This redesigned form will use Schedules 1. New Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals can be. Screen 7202 was added under the Credits folder.

Solved Form 7202 Intuit Accountants Community

Draft Of Form To Be Used By Self Employed Individuals To Compute Ffcra Leave Credits Released Current Federal Tax Developments

Bloomberg Tax On Twitter The Irs Released A New Form That Allows Self Employed Taxpayers To Claim Tax Credits Available Under A Pandemic Relief Law Taxtwitter Https T Co Fwygqoka3j Https T Co F0rmzz7d9k Twitter

Printable Fileable Irs Form 7202 Self Employed Sick Leave And Family Leave Covid Cpa Practice Advisor

2020 Form Irs 7202 Fill Online Printable Fillable Blank Pdffiller

New Form For Self Employed Covid 19 Leave Credits

Getting Ready For The 2021 Tax Season Basics Beyond

Form 7202 Covid 19 Credit For Sick Leave Or Family Leave Drake20

Irs Form 7202 Download Fillable Pdf Or Fill Online Credits For Sick Leave And Family Leave For Certain Self Employed Individuals 2020 Templateroller

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Desktop Form 7202 Credits For Sick Leave And Family Leave For Certain Self Employed Individuals Support

Draft Of Form To Be Used By Self Employed Individuals To Compute Ffcra Leave Credits Released Current Federal Tax Developments

No comments:

Post a Comment