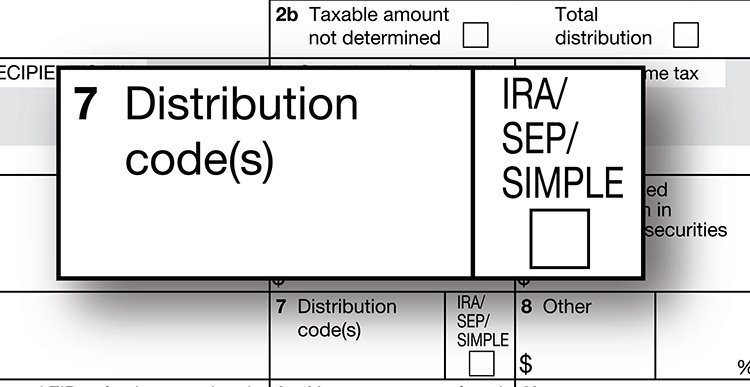

Tax or other deductions were withheld. 1 Early Distribution 2 Early Distributionnot subject to 10 early distribution tax 4 Death B Designated Roth Code U.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

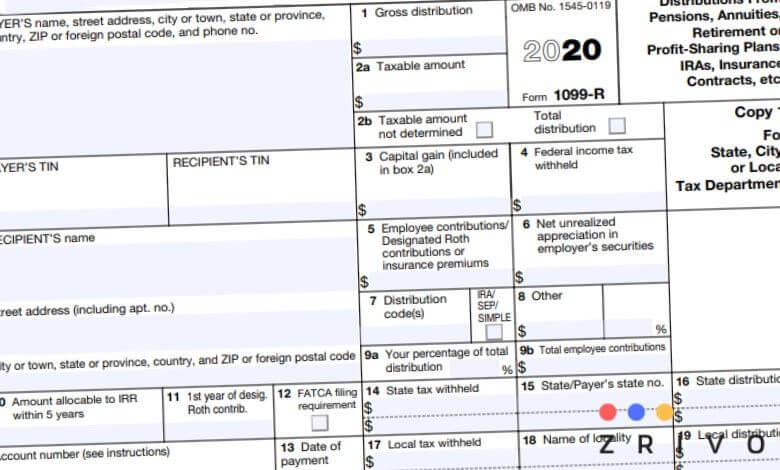

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099-R - Early Withdrawal - Coronavirus.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

1099 form 401k withdrawal. I just got a 1099-R form which seems like a form for me withdrawing money. Anytime you move money out of your Solo 401k plan you are required to file IRS form 1099-R. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from.

None of the money was taxed and in column 7 Distribution codes it says G theres an unchecked box right next to it IRASEPSIMPLE. 401k distribution tax form. Lets cover best practices for completing IRS form 1099-R for a number of different scenarios.

Profit-sharing or retirement plans. From within your TaxAct. Taking a distribution from your 401k plan before 59 12 usually results in an extra 10 percent penalty.

Enter the distribution amount from your Form 1099-R on your Form 1040. The CARES Act 401k Withdrawal allows those with a 401k plan to withdraw their funds for financial hardship reasons relative to the COVID-19 pandemic without being penalized. The correct Box 1 amount includes the tax that was withheld.

Showing the total amount of your pension. Given the relatively small amount it will NOT be too much of a financial hardship for you but you DO need to properly report it on your federal and state income tax returns. Form 1099-R - 401 k Distributions.

To report the 401 k distribution in your TaxAct return. Hi I have closed a 401k in 2018 and moved the money into an IRA. When it is you can finish your distribution information.

File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts. In January or 2008 I changed jobs. A copy of that form is also sent to the IRS.

When you take a distribution from your 401k your retirement plan will send you a Form 1099-R. Taxpayers will receive a Form 1099-R from the payer of the 401k distribution. IRS Form 1099-R is used to document a distribution from your retirement plan.

If you are under age 595 you will also incur a 10 early withdrawal penalty. 401k withdrawal under cares act. To enter a 401k distribution in your TaxAct return.

What form - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Annuities pensions insurance contracts survivor income benefit plans. Form 1099-R Box 1 Gross Distribution - 401K withdrawal The 1099-R you received is correct.

Dividends distributed from an ESOP under section 404k. Rollovers to another retirement plan are generally not taxable but you must still file form 1099-R to document the funds leaving the Solo 401k plan. My 1099 says code 1 but I believe I qualify for a covid related withdrawal.

This amount should be shown in. Enter the distribution amount from your Form 1099-R on your Form 1040. I was unable to do my taxes because I did not receive a 1099R form.

Youll receive a Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. When do I get my 1099-R. If the entire amount is taxable which is typically the case enter the total amount on line 16b too.

You will receive a Form 1099-R for the 600 withdrawal on which you will pay normal state and federal income tax plus a 10 Early Withdrawal Penalty. The only way to avoid the early withdrawal penalty on a 401k distribution is if you qualify for an exception specified in the tax code. A copy of that form is also sent to the IRS.

This tax form for 401k distribution is sent when youve made a distribution of 10 or more. Form 8915 -E is not yet finalized by the IRS. From the payer of your 401 k distribution.

And annuity payments before income. All I received was the check and stub stating the amount before federal taxes the amount of federal taxes withheld and the actual amount checked. Withdrawals from a 401k go on line 16a.

The act provides access to retirement funds from 401k plans. The work hours were reduced and were told by their employer that they did not have to pay federal state or 10 penalty since the withdrawal was related to Coronavirus. From within your TaxAct return Online or Desktop click Federal.

I attempted to do my taxes tonight on turbo tax. You should receive a Form 1099-R. In February or march I decided to withdraw my 401k.

This code indicates the monies are taxable in a prior tax year as opposed to Code 8 with the distribution taxable the year of the 1099-R form. Avoiding a 1099-R Penalty for a 401k. From 401k 403b and governmental 457b plans.

Those who qualify as individuals directly impacted by the pandemic will be able to withdraw up to 100k from their retirement accounts without facing the 10 early withdrawal penalty. When you receive your 1099-R documenting your early distribution it will usually have a code 1 in box 7 representing a non-qualified distribution. On smaller devices click in the upper left-hand corner then select Federal.

Any individual retirement arrangements IRAs. As your own Solo 401k plan administrator you may use form 1099-R for a few reasons. Box 1 of Form 1099-R.

The bill was signed into law on March 27 2020 by President Donald Trump. Avoiding a 1099-R Penalty for a 401k. I have a 53-year old client who withdrew 100K from his 401K and his 58-year old wife withdrew 50K from her 401K.

This tax form shows how much you withdrew overall and the 20 in federal taxes withheld from the distribution. Withdrawals from a 401k go on line 16a. If the entire amount is taxable which is typically the case enter the total amount on line 16b too.

Contrary to common assumptions the 20 is a withholding tax just like on a W-2 or a 1099-R for pensions.

Form 1099 R Retirement Income Retirement Zrivo

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Do I Get A Tax Statement For 401k Tax Walls

Opers Tax Guide For Benefit Recipients

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

2020 Form 1099 R Solo 401k Ira Distribution Sheet My Solo 401k Financial

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Form 1099 R Instructions Information Community Tax

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k Solo 401k

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

No comments:

Post a Comment