The date to submit the 1099-R to Arizona changes every year. Identify the amounts that need to be cha.

1099 Misc Form Copy B Recipient Discount Tax Forms

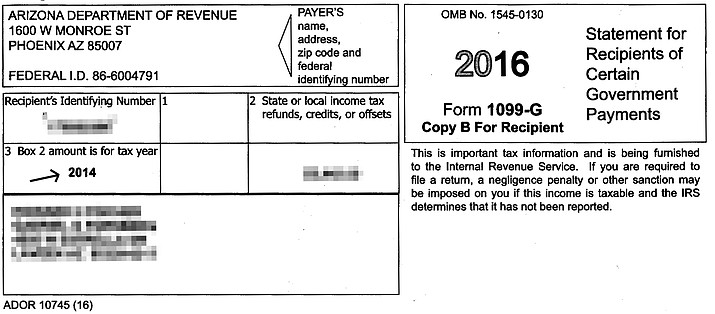

Welcome to Arizona Department of Revenue 1099-G lookup service.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

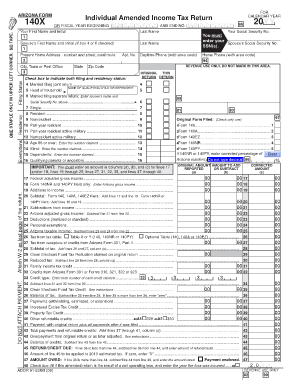

1099 form az. The web address for electronic filing is. EFile Arizona 1099-NEC and W2 directly to the Arizona State agency with Tax1099. Arizona only requires that one type of 1099 form is submitted to its taxing authority the 1099-R.

Department of the Treasury Internal Revenue Service Center Austin TX 73302. To be eligible for a Form 1099-G a taxpayer must have itemized on their federal return and received an Arizona income tax refund. That we paid to you in a tax year if you itemized your federal deductions.

Yes Arizona requires additional forms depending on your 1099 filing method. For calendar year 2021 the following federal Forms 1099 are accepted electronically. 1099-DIV 1099-MISC and 1099-R.

You should receive your 1099-G for the previous year by the last day of February. The Internal Revenue Service form must be filed by Monday February 12021. If you utilize CFSF when filing your 1099s the IRS will forward the information to the Arizona Department of Revenue and you will not have to do so yourself.

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. Once you make over 600 in a year from a client that client is required to send you a 1099 form. Electronically Arizona Form A1-R or Arizona Form A1-APR by the IRS or by the department may submit federal Forms W-2 W-2c W-2G and 1099 by paper or by optical media.

Complete Edit or Print Your Forms Instantly. Download or Email Fillable Forms Try for Free Now. On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020.

The landing page states that AZ Web File AZFSET is. A 1099 could be issued for cash dividends received to purchase stock or for interest income from the bank account. 1099 Tax Form Arizona.

Form 1099-G Tax Information Now Available Online The Arizona Department of Revenue has taken another step to deliver faster and more cost-effective tax service for Arizonans. If you file your 1099s electronically you are only required to submit the Form A1-R Arizona Withholding. Arizona Form A1-R or Arizona Form A1-APR.

Form 1099-G reports the amount of income tax refunds including credits or offsets. Link is external clicking on the View My 1099-G link and providing the necessary information. It is used to track non-employment earnings.

Arizona currently only accepts the following Form 1099 types electronically. Those exempted employers choosing to submit federal Forms by paper attach the federal forms to your paper return Arizona Form A1-R or Arizona Form A1-APR. The due date for these submissions is January 31 2022.

Arizona 1099 filers must send the 2020 1099 state copy to the AZ department of revenue by February 12021. Yes Arizona does participate in Combined FederalState Filing. Filers can download and print their Form 1099-G online by going to wwwAZTaxesgov.

NOTE ON SPECIAL USE BY A REGISTERED USER. If you file 250 or more 1099 forms with Arizona you must file electronically. Complete Edit or Print Your Forms Instantly.

When filing federal copies of forms 1099 with the IRS from the state of Arizona the mailing address is. If you received unemployment payments from Arizona last year you should receive a copy of the information return sent to the IRS called form 1099-G. How to File Form 1099-S to Arizona The Arizona Department of Revenue ADOR maintains a website that permits a user to file Form 1099-S electronically.

Taxpayers receiving Form 1099-G which serves as a confirmation of the previous years state tax refund can now go online to access and print the form. Ad Access Any Form You Need. Payments are coded as 1099-MISC reportable based upon the Comptroller Objects used and should produce a 1099-MISC for the employee.

1099 Tax Form Arizona do i have to report my 1099 g The 1099 forms record certain kinds of earnings that a tax payer earns during the calendar year. Learn how to generate and file Form 1099-NEC with Wave here. Does Arizona require any additional forms to be submitted when filing 1099 forms.

Let us manage your state filing process. Validate the amounts from each report to determine whether payments were missed or incorrectly reported. Arizona Department of Revenue 1600 W.

The department is now providing Form 1099-G online instead of mailing them. The State of Arizona requires Form 1099-NEC to be filed only if there is state withholding. If you didnt get one call the Department of Economic Security.

When filing state copies of forms 1099 with Arizona department of revenue the agency contact information is. Download or Email Fillable Forms Try for Free Now. If you are a freelance writer self-employed teacher or tutor web designer entrepreneur or in any other self-employed position you will need to file a 1099.

Business owners in Arizona can file Form 1099-NEC with the IRS with Wave Payroll. 1099-DIV 1099-MISC and 1099-R. Arkansas only requires you to file Form 1099-NEC with the Arkansas Department of Finance and Administration if payments amount to 2500 or more or if state withholding is reported.

Quick Reference Guide -Internal Use Only ADOA - Review GAO 9012019 and Update Form 1099 4 If your department sent 1099 External data view FIN-AZ-AP-N176e 1099 External Report. W-2 and 1099 Information. Our state filing team stays up-to-date with changing requirements.

We file to all states that require a state filing. Federal Forms W-2 W-2c W-2G and supported federal Forms 1099. This even applies to you if you are an independent contractor.

When reimbursing an employee for travel however it is important that the proper non-1099-MISC reportable Comptroller Objects be used on the claim otherwise a 1099-MISC could be issued to the traveler. This information return reports Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts and more. Ad Access Any Form You Need.

IRS approved Tax1099 allows you to eFile Arizona forms online with an easy and secure filing process.

Az 1099 Form Printable Fill Online Printable Fillable Blank Pdffiller

Dept Of Revenue To Mail New 1099 G Forms By Mon

Arizona Department Of Revenue Makes Form 1099 G Available Online Kingman Daily Miner Kingman Az

1099 Nec Form Copy A Federal Discount Tax Forms

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The Verde Independent Cottonwood Az

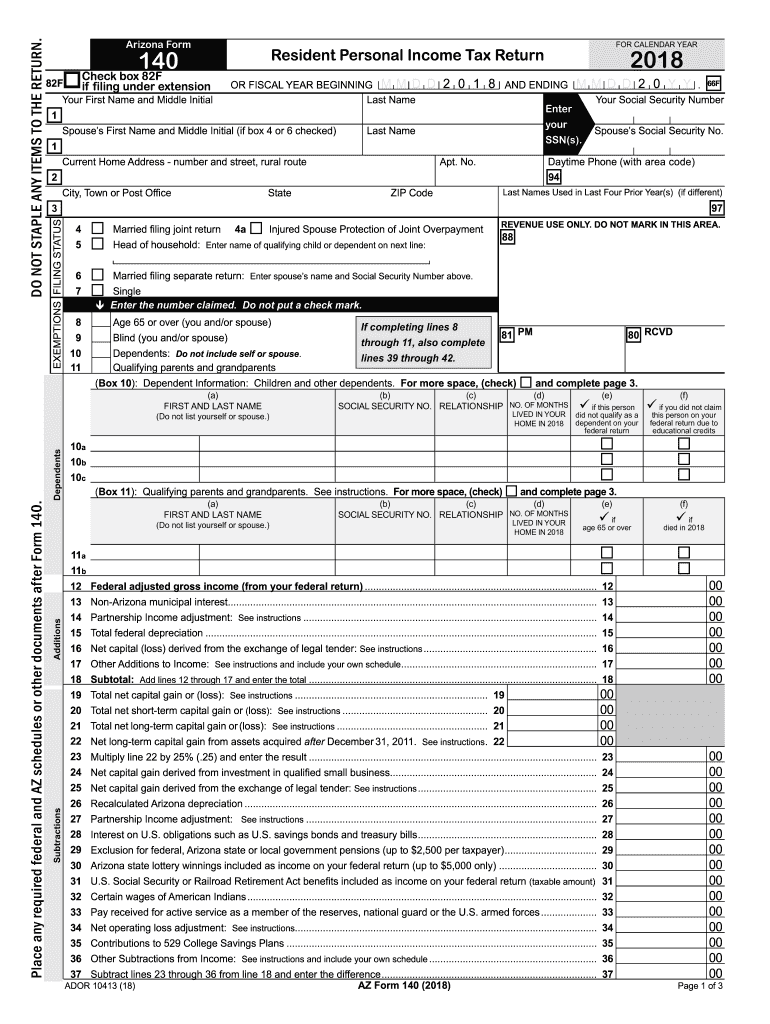

Az Form 140 2018 Fill Out Tax Template Online Us Legal Forms

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 Misc Form 3 Part Carbonless Discount Tax Forms

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 G Tax Information Is Available Online San Tan Valley News Info Santanvalley Com

1099 Misc Form Copy A Federal Discount Tax Forms

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

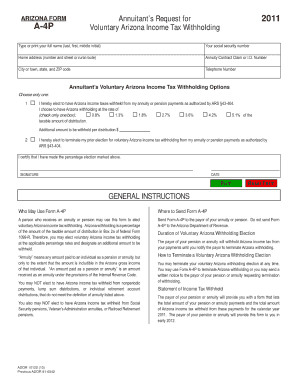

Arizona Withholding Tax Fill Online Printable Fillable Blank Pdffiller

No comments:

Post a Comment