Dividends distributed from an ESOP under section 404k. Form 1099-R will have either a code 1 or code 7.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

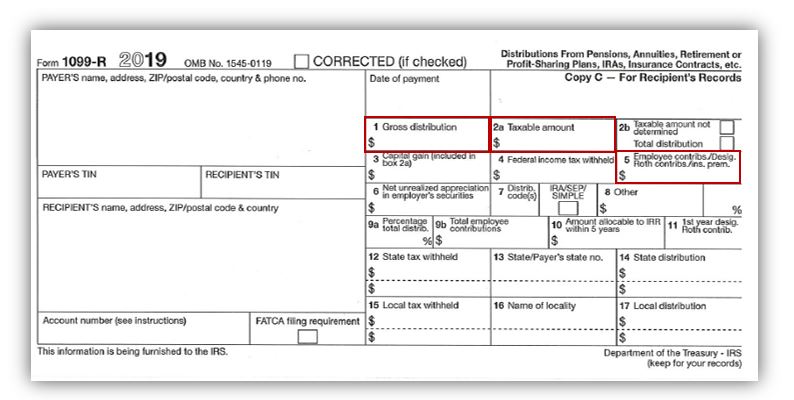

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

A 1099-R form uses a variety of numbered and lettered codes to indicate the type of distribution.

Code 1 form 1099-r. Withdrawals from a IRA because you were affected by COVID-19 are not subject to the 10 early withdrawal penalty. A participant is allowed only one rollover from an IRA to another or the same IRA in. Code L may be used with codes 1 2 4 7 or B.

Add or Edit Form 1099-R. Income Select My Forms IRAPension 1099-R 1099-RRB. They are entered in Box 7 on the form.

See Form 5329 For a rollover to a traditional IRA of the entire taxable part of the distribution do not file Form 5329. What are the 1099-R distribution codes. Use code 1 Early distribution no known exception.

File with Form 1096. The most significant change for our clients is the waiver of the 10 penalty for early withdrawal in certain cases. Use code A if filing Form 4972 - Lump-Sum Distribution.

Additionally the tax on the distribution can be paid over a three year period. Identifying the Distribution Code. What is the Q code in the Roth IRA 1099.

Reported on Form 1099-R. 1 Early Distribution 2 Early Distributionnot subject to 10 early distribution tax 4 Death B Designated Roth Code U. For Privacy Act and Paperwork Reduction Act Notice see the.

Subtract the rollover amount from the gross distribution Box 1 and enter the difference as the taxable amount in Box 2a. The distribution code in box 7 of the Form 1099-R was 1 Early Distribution no known exception. If Form 1099-R has distribution code D along with another code enter the other.

This code indicates the monies are taxable in a prior tax year as opposed to Code 8 with the distribution taxable the year of the 1099-R form. That this was a coronavirus-related distribution is indicated by how you report it. Code K may be used with codes 1 2 4 7 8 or G.

Check the box under Rollover or Disability on Form 1099-R and enter the amount rolled over. Below are the instructions for the 1099-R Box 7 data entry and what each code means. 1099-R Coronavirus Code 1.

See the instructions for Form 1040. Copy A For Internal Revenue Service Center. Form 1099-R Early Distribution Box 7 Code 1 The CARES Act made several changes to retirement plans.

Does he have to contact the payer and have them issue a corrected Form 1099-R showing a code 2 in box 7 since the original Form 1099-R showed a code 1 in box 7. If Form 1099-R Box 7 has a 1 in it we should ask the taxpayer some follow-up questions. Codes Explanations 1 Early distribution no known exception If this amount was rolled over within 60 days of the withdrawal andif the distribution was from an IRA--no prior rollover was made in the same 12-month period.

30 rows For more information about the 1099-R distribution codes please refer. 2020 1099-R Box 7 Distribution Codes. Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

Do not use code L Loans treated as deemed distributions under section 72p to report a plan loan offset. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution amount. Box 7 of Form 1099-R shows the distribution code for the transaction.

Reportable disability payments made from a retirement plan must be reported on Form 1099-R. In box 7 enter L1 or LB whichever is applicable to your situation. Yes you can consider your distribution COVID related.

Department of the Treasury - Internal Revenue Service OMB No. This is an identifier the IRS uses to help determine if the transaction is taxable. Code G is used for rollovers from one institution to another that are tax-free.

Generally do not report payments subject to withholding of social security and Medicare taxes on this form. See Loans Treated as Distributions in the 2020 Instructions for Forms 1099-R and 5498. There is no special reporting for qualified charitable.

He qualifies for exception 9 distribution made for the purchase of a new home. Per IRS instructions distributions with code 8 that are not from an IRA SEP or SIMPLE are reported on Form 1040 line 1 Wages and Salaries. 1099-R Code 1 CARES ACT withdrawal Code 1 is the correct code for the payer to have used.

Report such payments on Form W-2 Wage and Tax Statement. Within the program if your loan is treated as a deemed distribution please enter in box 7 Code L plus Code 1 or Code B whichever is applicable. 1 Early distribution no known exception in most cases under age 59-12.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Form 1099 R Instructions Information Community Tax

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

How To Calculate Taxable Amount On A 1099 R For Life Insurance

American Equity S Tax Form 1099 R For Annuity Distribution

How To Calculate Taxable Amount On A 1099 R For Life Insurance

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Tax Form Focus Irs Form 1099 R Strata Trust Company

Understanding Your 1099 R Form Kcpsrs

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

No comments:

Post a Comment