If youre using the separate lot method to determine your basis youll need to take a few more steps. A nondividend distribution reduces the basis of your stock.

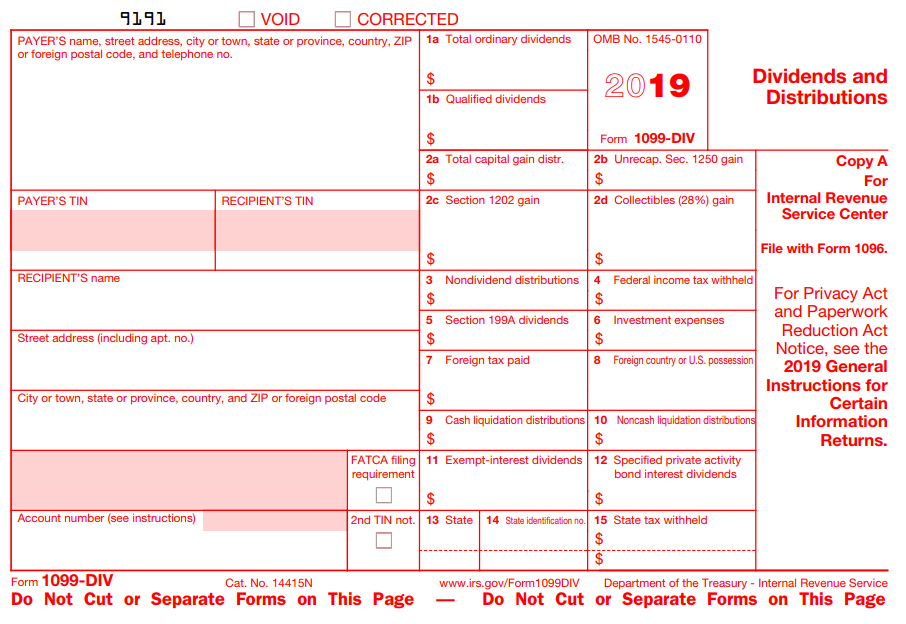

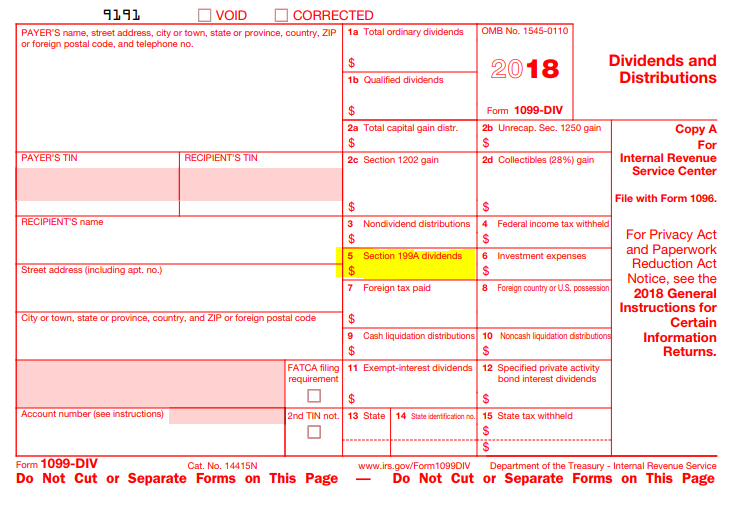

1099 Div 2019 Public Documents 1099 Pro Wiki

On Form 1099-DIV a nondividend distribution will be shown in box 3.

Form 1099-div box 3 nondividend distributions. After you get back all of your cost. Also what are non dividend distributions. Report nondividend distributions box 3 of Form 1099-DIV only after your basis in.

There is of course a box number 3 on Form 1099-DIV for you to input the nondividend amount in TurboTax just as there is in all comparable tax software programs -- but the input field is simply there as a matter of completeness so the software screen matches the 1099-DIV document you receive from your financial institution. When you receive a Form 1099-DIV that has an amount for Box 3 Nondividend Distributions you may be wondering where to report it. A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation.

However the basis of your stock will be reduced by these distributions. Account for the purposes of chapter 4 of the Internal Revenue Code as described in Regulations section 11471-4d2iiiA. On Form 1099-DIV a nondividend distribution will be shown in box 3.

This nontaxable portion is also called a. Im stuck on a notification when filing online saying Box 3 on Form 1099-DIV is a nontaxable return of cost. On Form 1099-DIV a nondividend distribution will be shown in box 3.

Box 3 - Nondividend distributions. You should get a Form 1099-DIV or other statement indicating the non-dividend distributions. Please reduce your cost or other basis by this amount.

It is only for your own information. It is a return of capital. In other words you have been given back part of your original investment and you reduce your cost basis by the box 3 amount.

You must reduce your cost or other basis by these distributions. Nondividend distributions Form 1099-DIV box 3 Generally not reported Table 11. A non dividend distribution is a return of capital.

Box 3 is for your information. Once you recover your full basis report distributions as capital gains. A non dividend distribution will be shown in Box 3 on this form.

You can find your nontaxable distributions on Form 1099-DIV Box 3. That is you are getting some of your original investment back. Any nondividend distribution you receive is not taxable to you until you recover the basis of your stock.

Reduce your basis in your investment by the amount of your nontaxable distribution. On the Form 1099-DIV a nondividend distribution will be shown in Box 3 and generally is not taxable. Record of nondividend and liquidating distributions statement dialog Nondividend distribution.

Box 5 - Section 199A dividends. As a reduction in basis it is not taxed until your basis or investment in the stock is fully recovered. If you do not receive such a statement you report the distribution as an ordinary dividend.

There are occasions where corporations make distributions to shareholders during a time where the corporation does not have retained earnings ie it either has not made net income or it has previously distributed out is net income. Box 6 - Investment expenses. How to Calculate Nondividend Distributions.

How do I enter a nondividend distribution reported on Form 1099-DIV box 3. Non-dividend distributions Box 3 of Form 1099-DIV is for your information. As such you reduce your cost basis by the box 3 amount in your own records for when this investment typically stock or mutual fund is sold.

If your basis is zero this should be treated as capital gains The IRS 2019 Publication 550 says. You will make note of this in your own records for when the investment is sold in the future. It is worth noting that Box 3 does not actually count as part of your tax return.

Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed. On the Form 1099-DIV a nondividend distribution will be shown in Box 3 and generally is not taxable. Dividend Income statement dialog.

1099-DIV worksheet Box 3 Nondividend Distributions. Box 3 Nondividend Distributions. A nondividend distribution reduces the basis of your stock.

Box 4 - Federal income tax withheld. In most circumstances the dividend is not taxable. On the Form 1099-DIV a nondividend distribution will be shown in Box 3 and generally is not taxable.

That is you have been given back part of your original investment. A Form 1099-DIV or other statement showing the nondividend distribution should be issued to the taxpayer. A nondividend distribution reduces the basis of your stock.

Divide that figure by the number of shares to which it applies. Box 3 on Form 1099-DIV indicates a payout that was not made as a dividend. Box 3 is a return of capital.

Find the amount in box 3 of Form 1099-DIV and subtract that amount from the total basis of your shares. You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. Such distributions are not taxable as dividends.

Check the box if you are a US. On the Form 1099-DIV a nondividend distribution will be shown in Box 3 and generally is not taxable. Dividend Income statement dialog.

Nondividend Distributions A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. Based on Federal instructions box 3 Nondividend Distributions are generally considered return of your cost or other basis. Non dividend distributions do not go anywhere on your actual tax return.

Start with the amount in box 3 of Form 1099-DIV. Similarly where do nondividend distributions go on a tax return. If you do not receive such a statement you report the distribution as an ordinary dividend.

As a reduction in basis it is not taxed until your basis or investment in the stock is fully recovered. Form 1099-DIV Box 3. They will not be taxed until you recover your cost or other basis.

Payer that is reporting on Forms 1099 including reporting distributions in boxes 1 through 3 and 9 10 12 and 13 on this Form 1099-DIV as part of satisfying your requirement to report with respect to a US. The distribution is reported as an ordinary dividend if no such statement is provided.

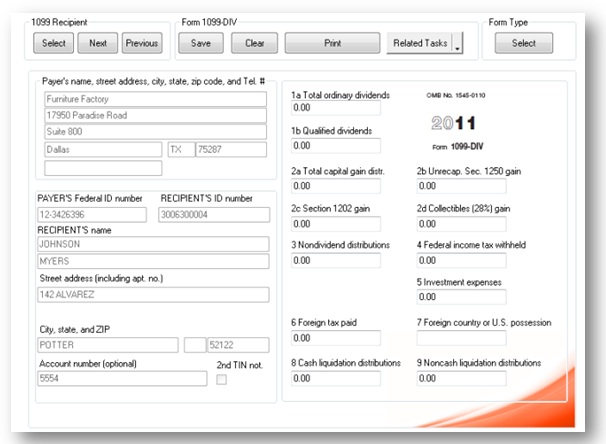

1099 Div Software 2019 Form 1099div Software Filing 1099 Div Electronically And Printing 1099 Div

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

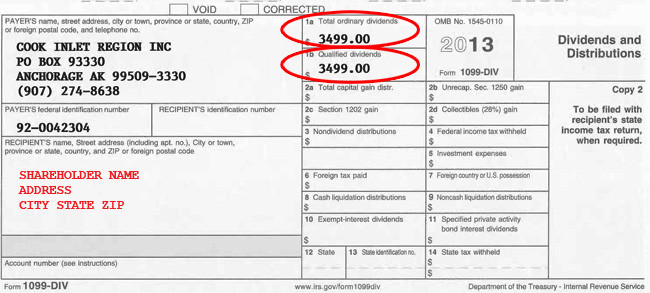

2013 Ciri Shareholder Tax Information Ciri

2015 Ciri Shareholder Tax Information Ciri

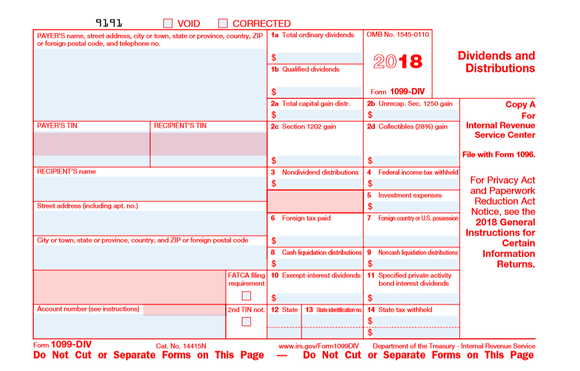

1099 Div 2016 Public Documents 1099 Pro Wiki

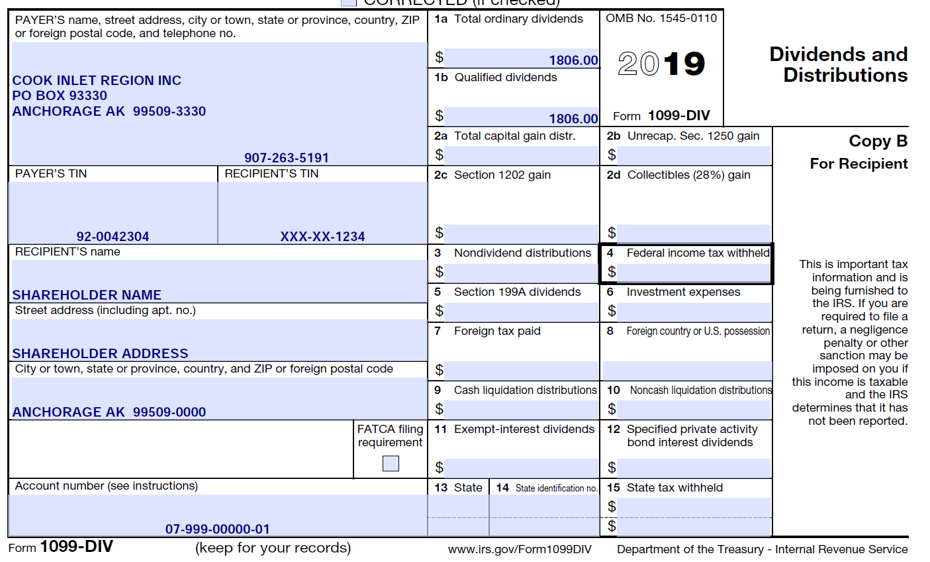

2019 Ciri Shareholder Tax Information Ciri

Breaking Down Form 1099 Div Novel Investor

Nondividend Distributions H R Block

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

1099 Div 2018 Public Documents 1099 Pro Wiki

Relationships Between Aais And Boxes On 1099 Forms

A Quick Guide To Your 1099 Div Tax Form

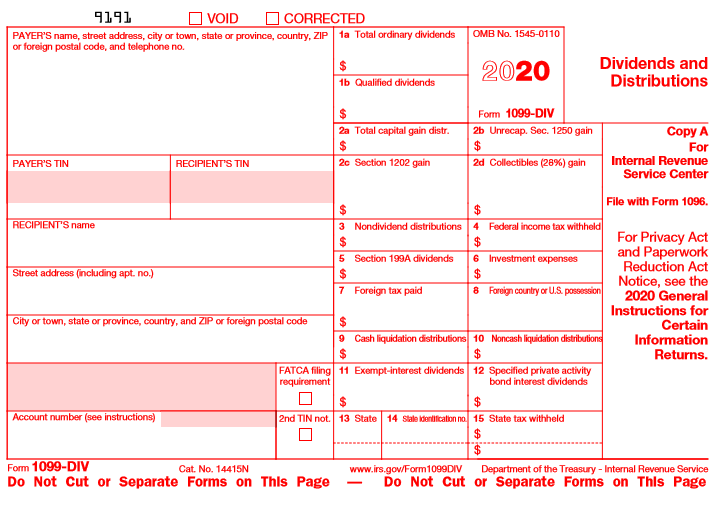

1099 Div 2020 Public Documents 1099 Pro Wiki

No comments:

Post a Comment