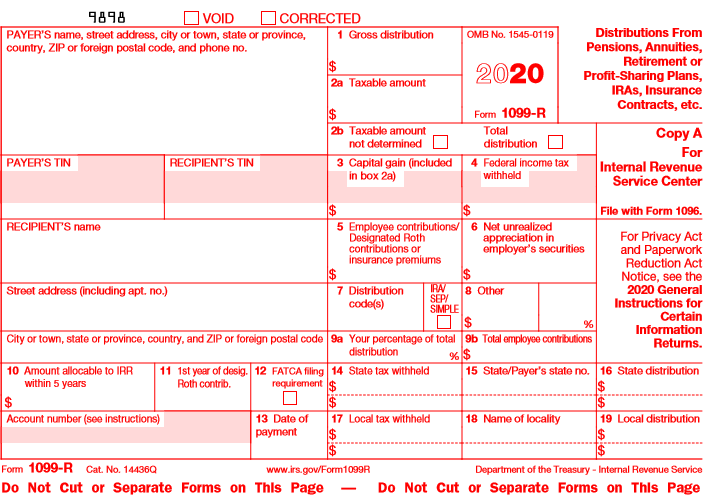

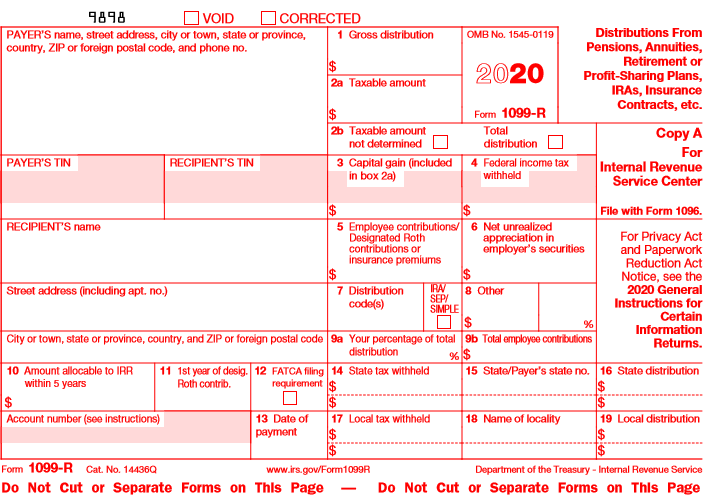

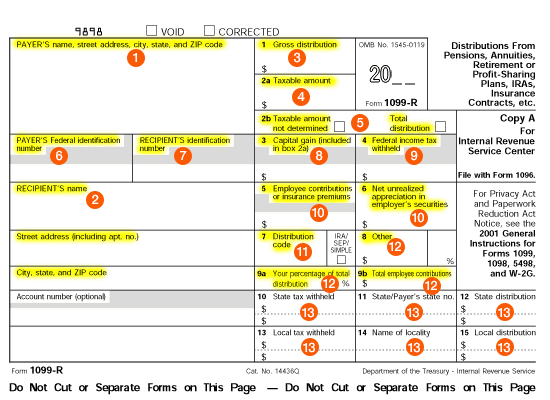

Names as shown on return Box A Payers name and. If the form shows federal income tax withheld in Box 4 attach a copy Copy Bto your tax return.

Blue Summit Supplies Tax Forms 1099 Nec Self Seal 4 Part Tax Form Bundle 2020 25 Pack In 2021 Business Accounting Software Small Business Accounting Software Tax Forms

Basis in a retirement plan is also called cost or contribution.

Form 1099 r 9b. Local tax withheld 18. Local distribution Form. Box 9b is the amount contributed into CSRS and FERS and is on each years 1099R.

Form 1099-R in particular is used to report distributions or withdrawals. In addition to completing your standard IRS Form 1040 youre required to complete form 1099-R if youve received any distributions from profit-sharing or retirement plans IRAs annuities pensions and more. Amount allocable to IRR within 5 years 11.

Total employee contributions 10. Retirement plans including section 457 state and local government. Some of the items included on the form are the gross.

Federal Form 1099-MISC 1099-NEC 1099-R or W-2 as appropriate is required instead of Wisconsin Form 9b if you are required to file the federal Form with the Internal Revenue. As the payments are made to you each payment will consist of two parts. File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts.

Generally distributions from pensions annuities profit-sharing and. Basis in a retirement plan is also called cost or contribution. Summary of Federal Form 1099-R Statements New York State New York City Yonkers Do not detach or separate the 1099-R Records below.

Instructions for 2020 Form 9b Item to Note. Box 9b on the 1099-R shows the amount of the employee contribution to the retirement plan. Box 9b Total employee contributions is for a life annuity from a qualified plan or from a section 403b plan with after-tax contributions an amount may be shown for the employees total investment in the contract.

In a word it is the amount of after-tax dollars that the taxpayer contributed to the retirement plan over the years while heshe was employed. Form 1099-R Department of the Treasury Internal Revenue Service 12 15 State distribution Local distribution Form 1099-R 9b Total employee contributions Account number see instructions 08 keep for your records FIDELITY INVESTMENTS LIFE INSURANCE CO. Posted February 10 2019.

Box 7 Distribution Code The IRS code used to determine what type of benefit you received. 1st year of desig. Form 1099-R is filed for each person who has received a distribution of 10 or more from any of the above.

Total employee contributions 12. Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plan any individual retirement arrangement IRA annuity pension insurance contract survivor income benefit plan. State distribution 15.

In the United States Form 1099-R is a variant of Form 1099 used for reporting on distributions from pensions annuities retirement or profit sharing plans IRAs charitable gift annuities and Insurance Contracts. See instructions on the back. This amount is then used in conjunction with the estimated number of distributions youll receive in your lifetime -- a figure the IRS provides on the worksheet based on your age -- to determine the amount of each distribution you receive tax-free.

This helps to prevent them from underreporting their taxable income. If youre one of over 44 million retired Americans theres a good chance youve come across tax form 1099-R. Do Not Cut or Separate Forms on This Page Do Not Cut or Separate Forms on This Page.

For the beneficiary of an employee who died see Publication 575 Pensions and Annuities. What info does Form 1099-R include. Form 9b Form 9b Form 9b.

ANNUITY SERVICE CENTER PO. The 1099-R tax form is issued by the custodian and is due to the taxpayer by January 31 st. Box 9b on the 1099-R shows the amount of the employee contribution to the retirement plan.

State distribution 17. Shown in Box 9b of 1099-R. State tax withheld 15.

For a joint or survivor annuity add the ages of both spouses on the start date. What is IRS Form 1099-R. These totals only reflect what was withheld from your MPERS benefit if.

Local distribution Form. OPM uses that to compute the taxable amount of the annuity as shown in Box 2a. Understanding Box 9B on Form 1099-R.

File Form IT-1099-R as an entire page. The simplified method cannot be used for code D or other non-qualified plan distributions. To determine the amount of tax-free distributions apply the amount in your Form 1099-R line 9b to line 2 of the Simplified Method Worksheet.

Boxes 8 and 9a These boxes are blank. Form 1099-R continued Box 7 is a required entry Enter exactly as shown on document. Form 1099-R is one of twenty information returns the Internal Revenue Service IRS uses to report different kinds of non-employment income that taxpayers might receive outside of their salary.

Box 9b Total Employee Contributions If this is your first year of retirement Box 9b will show the total employee contributions paid to the system prior to your retirement. When a taxpayer retires they will start to receive money from their retirement plan eg. BOX 770001 CINCINNATI OH 45277 800-634-9361 JOHN Q.

Its sent to you no later than January 31 after the calendar year of the retirement account distribution. See Distribution Codes Chart in this tab. In a word it is the amount of after-tax dollars that the taxpayer contributed to the retirement plan over the years while heshe was employed.

See instructions 133336 CORRECTED if checked PAYERS name street address city state and ZIP code The following 2016 premium information is provided for your convenience. Box 5 is the amount paid for FEHB premiums for the year. Plans IRAs insurance contracts etc are reported to recipients on.

Enter the age of the taxpayer on the date the pension started this may be different than the taxpayers age at the end of that year. Date of payment. If IRASEP Simple is marked check to enter exactly as on document.

Local tax withheld 16. One portion will be the amount if any that you contributed to the plan and the second portion will. Box 9b Employee contributions00 Box 10 Amount allocable to IRR within 5 years00.

FORM 1099-R FOR INFORMATIONAL PURPOSES ONLY Account no. The 1099-R form is an informational return which means youll use it to report income on your federal tax return. State tax withheld 13.

Box 9b shows the total employee contributions and.

Tax Form Focus Irs Form 1099 R Strata Trust Company

1099 R 2020 Public Documents 1099 Pro Wiki

Generate Tax Form Free Tax Extension In 2021 Irs Extension Tax Extension Tax Forms

Blue Summit Supplies Tax Forms W2 6 Part Tax Forms Bundle With Software And Self Seal Envelopes 50 Count In 2021 Tax Forms Small Business Accounting Software Business Accounting Software

Irs Form 1099 R Fill Out Printable Pdf Forms Online

Synthesis And Biological Activities Of Azalamellarins Boonya Udtayan 2010 Chemistry 8211 An Asian Journal Wiley Online Library

Form 1099 R Instructions Information Community Tax

Efile Irs Form 2290 With 4 Simple Steps Form2290filing In 2021 Irs Forms Irs Tax Forms Irs

Form 1099 R Instructions 401k Fedforms

No comments:

Post a Comment