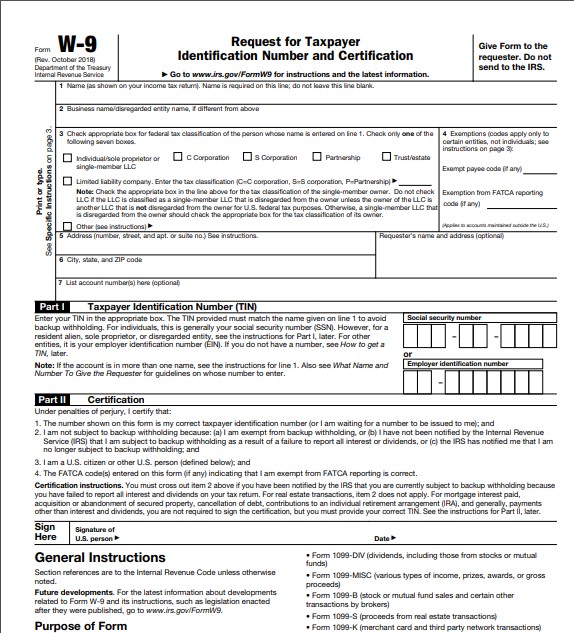

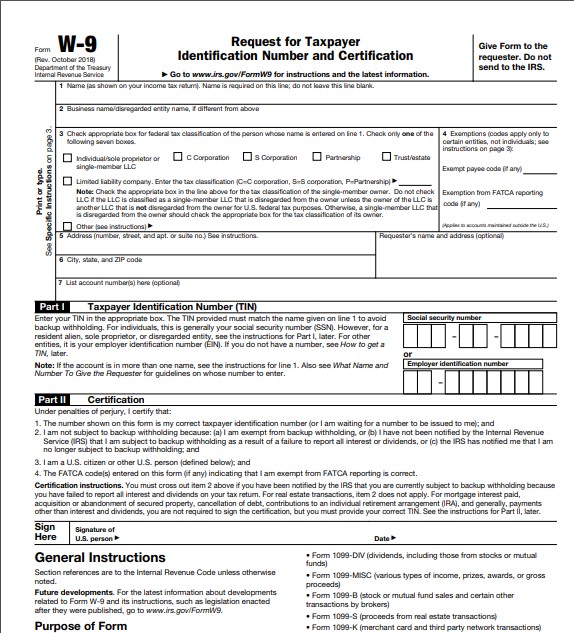

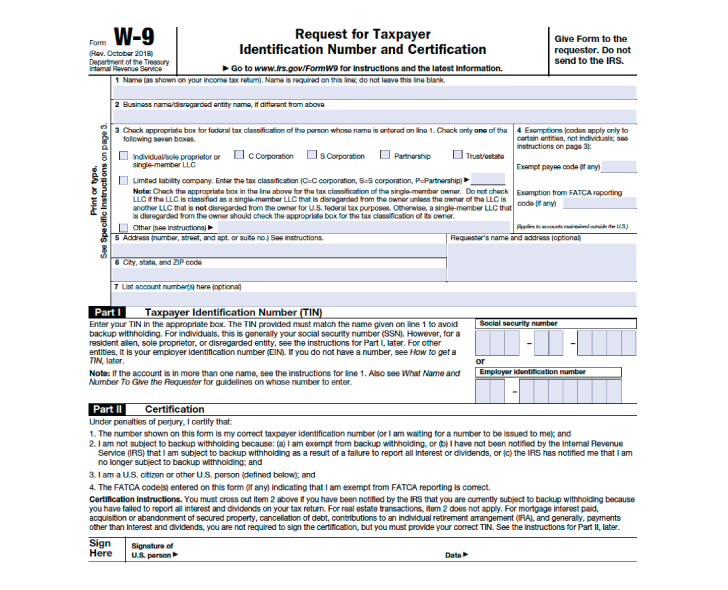

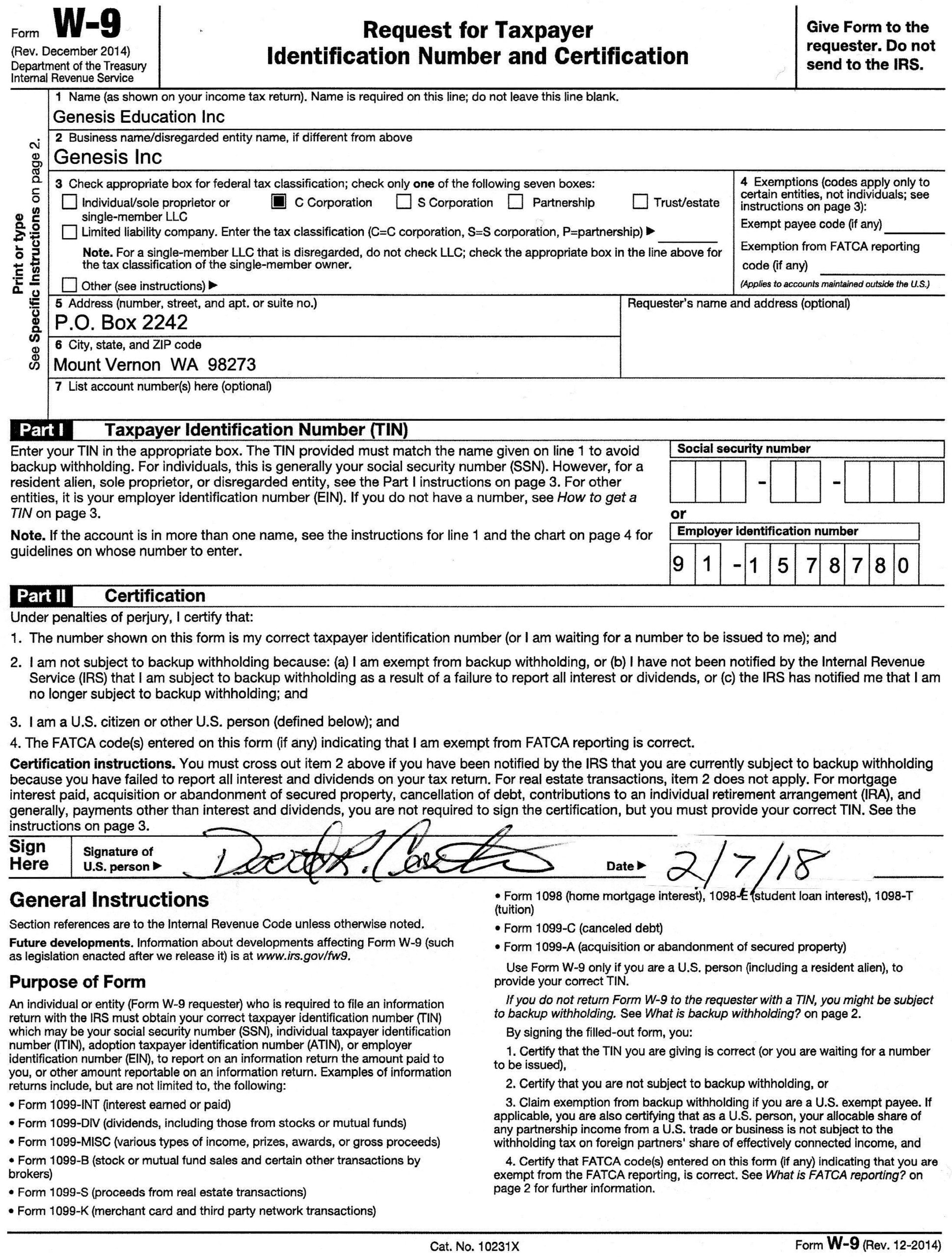

You may enter your business trade or. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS.

Irs W9 Form 2021 Printable W9 Form 2021 Printable

Ask Your Own Tax Question.

W-9 form under $600. Businesses in the United States are instructed by the IRS to request the W-9 be completed by any service provider theyre paying US 600 or more to during the tax year. The form simply reports the amount of income you earned. You need to use it if you have earned over 600 in that year without being hired as an employee.

For example if you are hire a contractor to work on a project for you with a 500 budget you technically do not need a W-9 for that contractor because they are being paid less than 600. Those who should fill out a W 9 are those who are working as independent contractors or freelancers because the W-9 is the form used by the IRS to help gather information about such workers. Companies later fill out IRS information returns Form 1099-MISC and 1099-NEC with amounts of 600 or more that they pay certain types of suppliers during a calendar year a FATCA reporting checkbox and any backup withholding amounts.

I will have received about 350 of income on this W-9 so no - Answered by a verified Tax Professional. Sole proprietor or single-member LLC. Who Has to Fill It Out.

Form W-9 and TINs. If your employer sends you a W-9 instead of a W-4 the company has likely classified you as an independent contractor. The IRS requires companies to file a Form 1099 to report payments to certain vendors in excess of 600.

Winner W-9s and 1099swhat sponsors need to know about tax liability for prizes valued at 600 and over and for prizes under 600. We never send any of your winnings to the IRS. What is required on the form.

Subcontractor anything under 600 you do not need them to fill out the Form W-9. The W-9 form is an informational reporting tax form meaning that it provides information to the IRS about taxable entities. I will have received about 350 of income on this W-9 so no 1099 will be reported since it is under 600.

The W-9 form is an Internal Revenue Service tax form that is used by independent contractors and other self-employed workers that signals the taxpayer is not subject to backup withholding and is responsible for paying his or her own. Form W-9 ensures that the company will have enough information to make a Form 1099 filing if necessary. If the employer doesnt have a taxpayer ID or if the taxpayer ID is incorrect the independent contractor must have federal income taxes withheld known as backup withholding 3.

W-9 forms are for self-employed workers like freelancers independent contractors and consultants. The IRS requires us to submit a Form 1099 to the IRS whenever your winnings exceed 600 or more in a calendar year. The 600 rule applies to labor and services.

To be safe some businesses will send out Form W-9 to every single one of their contractors to fill out ahead of time even if they dont expect them to perform 600 of work for them. The Form W-9 you send us simply provides the tax-payer information we will need from you such as social security number to. According to the instructions for line 1 which is where the name should be entered it appears a company name is acceptable.

It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. Form W-9 is a tax document that must be signed by independent contractors to provide a taxpayer ID number Social Security Number or Employer ID. Some accountants will even suggest collecting a W-9 before issuing any payments at all to encourage people to file up-front.

Income under 600 must still be included only on an individuals annual tax forms. What Is a W-9 Form Used For. IRS Form W-9 is typically used by a business to request a payees name address and taxpayer identification number TIN so the business can issue a 1099 to the payee and to the IRS.

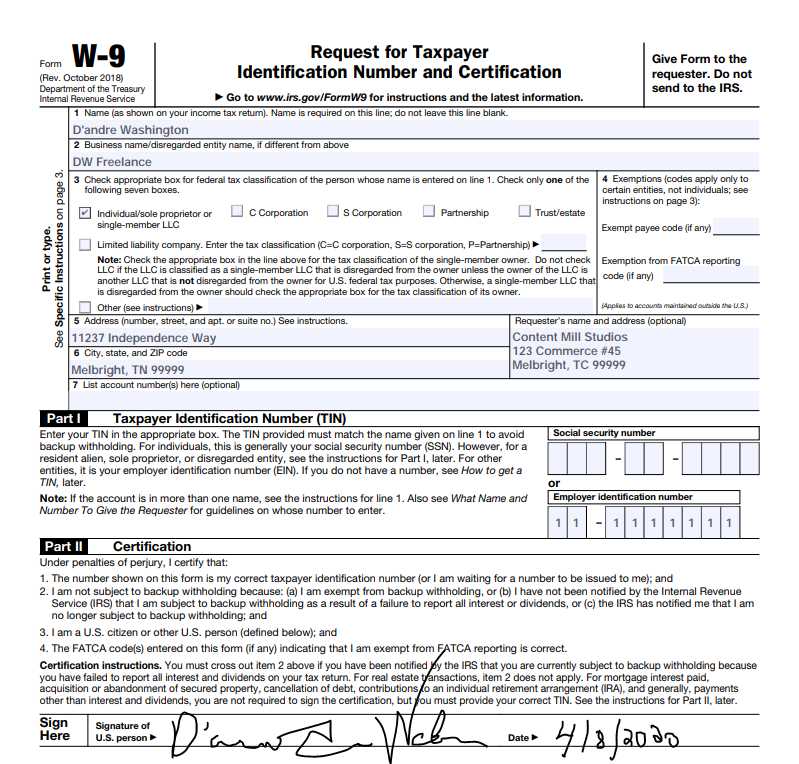

Filling out a W-9 form isnt very difficult as it really only requires a few pieces of basic information. If youre an independent contractor consultant or another type of self-employed worker the company youre providing a service for will ask you to complete Internal Revenue Service IRS Form W-9 if your total compensation for the year will exceed 600The company will use that form to complete its Form 1099-NEC which reports to the IRS the amount of income it. If I signed a W-9 form.

If you are a US citizen and you win 600 or more in a calendar year on PlayEdge Games and we do not already have your IRS Form W-9 on file then you must fill out IRS Form W-9 and send it to us before we can deliver your redemptionWhen your prize winnings trigger this requirement we will hold the rewards for you in a pending state until we receive your Form W-9. For direct sales a W-9 is required for total purchases over 5000. United States provide Form W-9 to the partnership to establish your US.

The IRS recommends that you request all vendors submit a W-9 when you plan to make payments to them of 600 or more if they are individuals or independent contractors an estate or part of a domestic trust partnership companies corporations a limited liability company associations or organizations created in or under the laws of the US. However if you pay someone 600 or more you will need to report that the following year. Answer 1 of 7.

Status and avoid section 1446 withholding on your share of partnership income. Thanks for your answer. Form W9 is an Internal Revenue Service form for vendors to fill out and provide to the trades or businesses that pay them.

Enter your individual name as shown on your 10401040A1040EZ on line 1. In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. This form is pretty simple.

W 9 Form What Is It And How Do You Fill It Out Smartasset

W 9 Form 2021 Pdf Free W9 Tax Form 2022

Pin By Tanya Fife On My Life Tax Forms Irs Forms Calendar Template

What Is A W9 Form How To Fill It Out

Blank W 9 Form Pdf Blank W9 Form 2022

W9 2021 Form Printable W9 Tax Form 2022

W 9 Request For Taxpayer Identification Number And Certification Pdf Tax Forms Irs Forms Calendar Template

W 9 Form 2022 Fillable Printable

What Is A W9 Form How To Fill It Out

W 9 Tax Form 2018 2021 Fill Out Online Download Free Pdf

W9 Tax Form Sample W9 Tax Form 2022

What Is Irs Form W 9 Turbotax Tax Tips Videos

No comments:

Post a Comment