It is in PDF form and then open it in the PDFelement program. 12-20 EMPLOYEES MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE STATE OF MICHIGAN - DEPARTMENT OF TREASURY This certificate is for Michigan income tax withholding purposes only.

Pin By Bianca Kim On W 4 Form Form Fillable Forms W4 Tax Form

To sign a nj w4 form right from your iPhone or iPad just follow these brief guidelines.

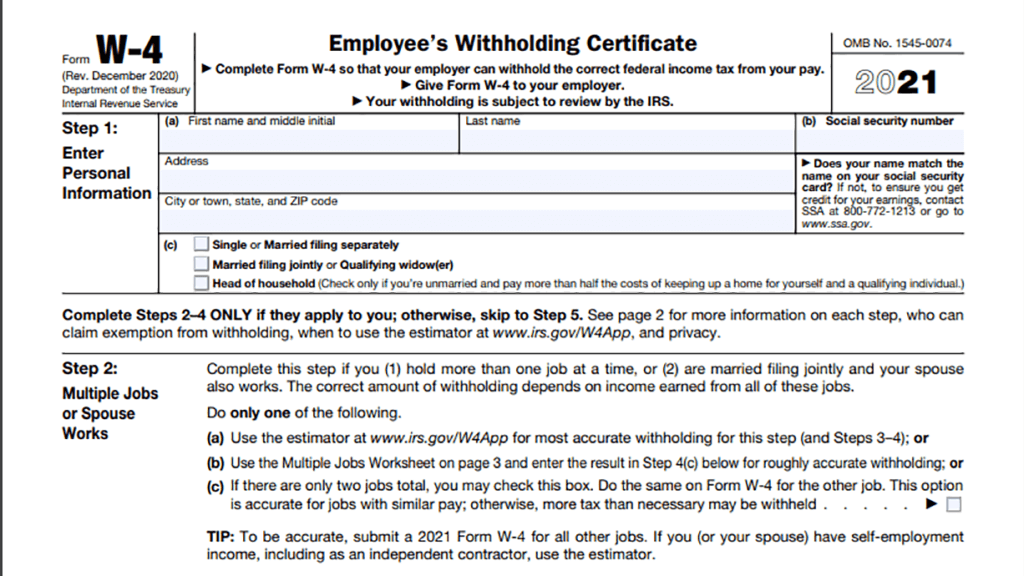

W4 form 2021 pdf. Complete Steps 34b on Form W-4 for only ONE of these jobs. I claim exemption from withholding for 2021. To be accurate submit a 2021 Form W-4 for all other jobs.

Leave those steps blank for the other jobs. Get and Sign W 4 Form Ri State 2021-2022. Read instructions on page 2 before completing this form.

Once you have completed Form RI W-4 for your employer Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. MarriedCivil Union Partner Separate 4. If any of the circumstances below occur the employer or payer must withhold as if the employee or payee were single and claiming no allowances.

Here you start by downloading the IRS form from the website. Form RI W-4 must be completed each. Date of Birth 4 3.

South Carolina Income Tax withheld because I had. Withholding Certificate for Pension or Annuity Payments. If you are using Form WT 4 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected.

Subtract line 11 from line 10. This is your total tax liability. Choosing not to have income tax withheld.

2021 IA W-4 Employee Withholding Allowance Certificate taxiowagov. 2017 ri formevice like an iPhone or iPad easily create electronic signatures for signing a ri w4 form in PDF format. You may file a new W -4 at any time if the number of your allowances increases.

To find it go to the AppStore and type signNow in the search field. You can change the amount to be withheld by using lines 2 and 3 of Form W-4P. To find it go to the AppStore and type signNow in the search field.

Change the entries on the form. SignNow has paid close attention to iOS users and developed an application just for them. Fill each fillable field.

10 rows Form W-4P. Carol does not have a job but she also receives another pension for 25000 a year which. W-4P 2021 Form W-4P 2021 Page.

Turn on the Wizard mode on the top toolbar to get additional recommendations. How to Fill the New W-4 Form 2022. Tax liability and.

Federal Form W-4 can no longer be used for Rhode Island withholding purposes. On opening the program click on Open File and upload form W4 2022. For more information on withholding and when you must furnish a new Form W-4 see Pub.

Form NJ-W4 State of New Jersey Division of Taxation 1-21 Employees Withholding Allowance Certificate 1. You had no federal income tax liability in 2021 and. Maine income tax must be withheld at this rate until such time that the employee or payee provides a valid Form W4-ME.

Head of Household 5. He will make no entries in Step 4a on this Form W-4P. Form nj w4igning a nj w4 2021 in PDF format.

South Carolina Income Tax withheld because I expect. Check only one box 1. Check the box for the exemption reason and write.

You must complete Form RI W-4 for your employers. Do not claim more allowances than necessary or you will not have enough tax withheld. Qualifying WidowerSurviving Civil Union Partner Name Address City State Zip 3.

Carol a single filer is completing Form W-4P for a pension that pays 50000 a year. If you or your spouse have self-employment income including as an independent contractor use the estimator. Hit the orange Get Form button to start editing and enhancing.

You may claim exemption from withholding for 2022 if you meet both of the following conditions. See FTB Form 540. Form W-4 Step 4a then he will instead enter 26000 in Step 2bi and in Step 2biii.

Income tax liability you may use Form WT4A to minimize the over withholding. For tax year 2020 I had a right to a refund of. Before setting out to fill out the IRS form ensure that you read the instructions carefully.

Missing or invalid Forms W-4 W-4P or W-4ME. Indicate the date to the template using the Date option. 44-019a 07072020 Each employee must file this Iowa W-4 with hisher employer.

Be sure the data you fill in Fillable 2021 W4 is up-to-date and correct. 2 Because your tax situation may change from year to year you may want to refigure your withholding each year. Full Social Security Number 4 2.

SignNow has paid close attention to iOS users and developed an application just for them. MarriedCivil Union Couple Joint 3. How to create an electronic signature for a PDF on iOS devices w4 form 2021 iOS device like an.

505 Tax Withholding and Estimated Tax. Your withholding will be most. Calculate the tax withheld and estimated to be withheld during 2021.

For tax year 2021 I expect a refund of. WT-4 Instructions Provide your information in the employee section. Select the Sign tool and make an electronic.

Contact your employer to request the amount that will be withheld on your wages based on the marital status and number of withholding allowances you will.

2021 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

W4 Form 2021 W 4 Forms Zrivo With W 9 Form 2021 Printable In 2021 Irs Forms Getting Things Done Irs

Downloadable Form W 9 Printable W9 Printable Pages In 2020 Throughout Free W 9 Form Printable In 2021 Fillable Forms Blank Form Irs Forms

What You Should Know About The New Form W 4 Atlantic Payroll Partners

2021 W4 Form How To Fill Out A W4 What You Need To Know Form Need To Know Data Entry Job Description

How To Fill Out 2020 2021 Irs Form W 4 Pdf Expert

Form W 4 2012 Tax Forms Fillable Forms How To Get Money

W4 Form 2021 W 4 Forms Zrivo With W 9 Form 2021 Printable In 2021 Irs Forms Getting Things Done Irs

Cleaning Proposal Form In 2 Sizes A4 Us Letter Etsy In 2021 Proposal Cleaning Lettering

Irs Form W 4 Fill Out Printable Pdf Forms Online

W4 Form 2021 Printable Fillable

No comments:

Post a Comment