You may need to have additional tax withheld if you have two or more jobs. Quick steps to complete and eSign Iowa w4 form online.

Understanding Your W 4 Mission Money

For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4 and your spouse should enter zero -0- on lines 5 and 6 of his or her Form W-4.

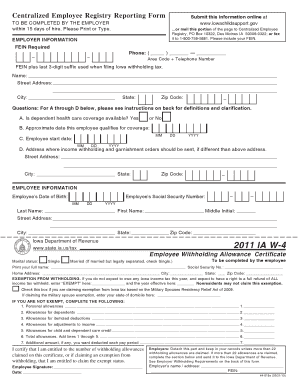

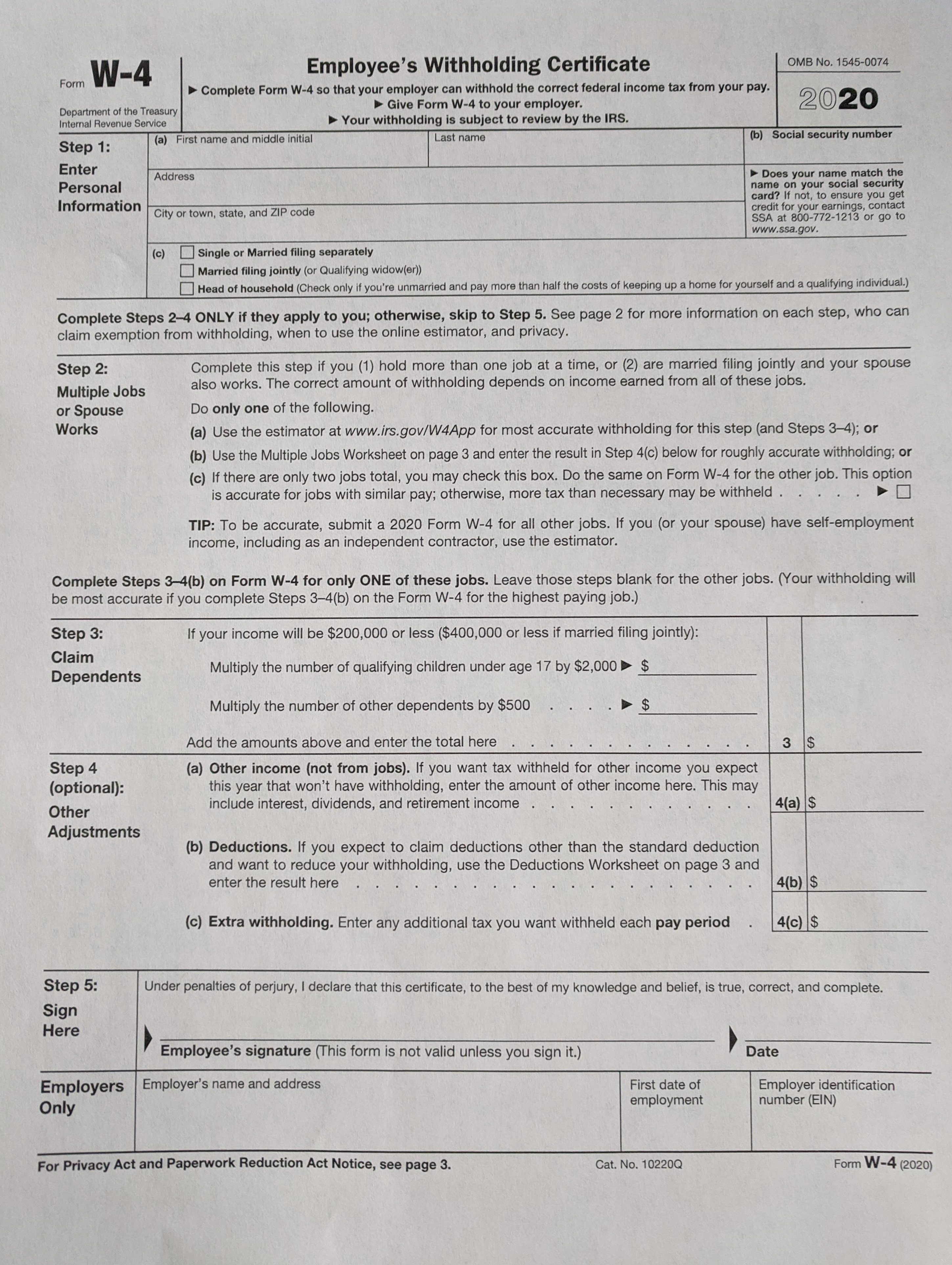

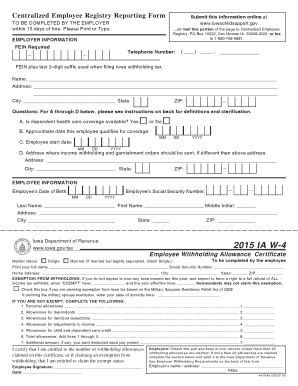

W4 form iowa. Use Get Form or simply click on the template preview to open it in the editor. Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Employers must request the federal tax form W4 from their employees every year or at the time of hiring a new employee.

If you are a resident of Iowa Kentucky Missouri or Wisconsin or a military. Adopted and Filed Rules. Enter Personal Information a.

Leave those steps blank on the W-4s for the other jobs. Tax Credits. Your withholding is subject to review by the IRS.

Claim exemption from withholding if you are an Iowa resident and both of the following situations apply. Get and Sign Iowa W 4 Printable Form. Give Form W-4 to your employer.

W-2s and 1099s must be filed using GovConnectIowa. Report Fraud Identity Theft. 1 for 2020 you had a right to a refund of all Iowa income tax withheld because you had no tax liability and 2 for 2021 you expect.

Give Form W-4 to your employer. Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. You can also submit a new W-4 to your HR or payroll department when you have a life event that affects your taxes eg getting married or divorced or having a baby or if you paid too little or too much in taxes.

Start completing the fillable fields and carefully type in required information. Spouse see Form W-5-NR Employees Statement of Nonresidence in Illinois to determine if you are exempt. Iowa net income between 0 - 19999 enter an 5 allowances.

For instance if an employee has a child during the current. Iowa net income between 20000 - 34999 enter an 4 allowances. Stay informed subscribe to receive updates.

Forms W-4 filed for all other jobs. December 2020 Department of the Treasury Internal Revenue Service. Are you exempt from Iowa withholding.

Iowa withholding tax W4 W-4. For the highest paying jobs W-4 fill out steps 2 to 4 b of the W-4. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

IA W-4 Instructions Employee Withholding Allowance Certificate. Additional Amount of Withholding Deducted. 1545 0074 1a first name and middle initial last name address city or town state and zip code 1b.

Your withholding is subject to review by the IRS. W4 Form 2022 Printable Pdf W4 Form 2022 Printable. The IA 1040ES voucher and instructions are available on our website at httpstaxiowagov.

Iowa net income between 35000 - 44999 enter an 3 allowances. You should claim exemption from withholding if you are a resident of Iowa and do not expect to owe any Iowa income tax or expect to have a right to a refund of all income tax withheld. IA W-4 Employees Withholding Certificate and Centralized Employee Registry 44-019.

Employees have to fill the form out by themselves each year and let the employer know when the financial situation changes and a new W 4 blank form has to be filled. IRS Form W-4 tells your employer how much federal income tax to withhold from your paycheck. Law.

Give Form W-4 to your employer. The filing deadline for W-2s and 1099s is February 15 2022. Your withholding is subject to review by the IRS.

If you do not file a completed Form. Businesses that issued W-2s or 1099s that contain Iowa withholding must electronically file those documents with the Iowa Department of Revenue using GovConnectIowaThis data is an essential tool the Department uses to increase the accuracy. Enter Personal Information a.

Youll be asked to fill one out when you start a new job. Form w 4r 2022 withholding certificate for nonperiodic payments and eligible rollover distributions department of the treasury internal revenue service give form w 4r to the payer of your retirement payments. You should claim exemption from withholding if you are an Iowa resident and both of the following situations apply.

In 2020 the W 4 form changed to help individuals withhold federal income tax more accurately from their paychecks. Exemption from withholding. Exemption from Withholding.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. BOTTOM PORTION OF FORM IA W-4 INSTRUCTIONS EMPLOYEE WITHHOLDING ALLOWANCE CERTIFICATE. Receipt of this form and payment the Department will issue a release letter to the payers of the Iowa nonwage income.

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. If youre married and. Compliance Services Iowa Department of Revenue PO Box 10456.

Check the exempt status box on Form IL-W-4 and sign and date the certificate. BOTTOM PORTION OF FORM IA W-4 INSTRUCTIONS January 1 2011 EMPLOYEE WITHHOLDING ALLOWANCE CERTIFICATE Exemption from Withholding. Mail this form the IA 1040ES voucher and payment to.

Use the Cross or Check marks in the top toolbar to select your answers in. Persons below the annual income levels shown below are eligible to claim exemption from Iowa withholding. A married couple or a head of household with a total income of 13500 or less.

Form W-4 otherwise known as the Employees Withholding Allowance Certificate is an Internal Revenue Service IRS tax form completed by an employee in the United States to indicate his or her tax situation exemptions status etc to the employerThe W-4 form tells the employer the correct amount of federal tax to withhold from an employees paycheck. Do not complete Lines 1 through 3. 1 for 2018 you had a right to a refund of all.

Iowa Centennial Half Dollar Commemorative Iowa Centennial Half Dollar Commemorative Half Dollar Bullion Coins Silver Eagles

State W 4 Form Detailed Withholding Forms By State Chart

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

2019 Ia W 4 Fill Online Printable Fillable Blank Pdffiller

Form W 4v 2021 In 2021 Tax Forms Irs Forms Income Tax

Various 2020 Us Irs Tax Forms On A Desktop Stock Photo Download Image Now Istock

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

Ia Dor W 4 2019 Fill Out Tax Template Online Us Legal Forms

Form Ia W 4 Employee S Withholding Certificate And Centralized Employee Registry

Bill Of Sale Form Iowa W 4 State Of Iowa Templates Fillable Printable Samples For Pdf Word Pdffiller

Where To Order A Fake Id Idinstate Product List Best Fake Ids Buy Fake Id Fake Id Card Drivers License Driving License Passport Online

Withholding Forms Solution I 9 Form Form Jobs For Freshers

No comments:

Post a Comment