Louisiana Directory of New Hires. 6 1986 to work in the United States.

45 Printable State Tax Withholding Forms Templates Fillable Samples In Pdf Word To Download Pdffiller

The major difference between the W2 W4 and W4 2019 is that W4 is an input document whereas W2 is an output document.

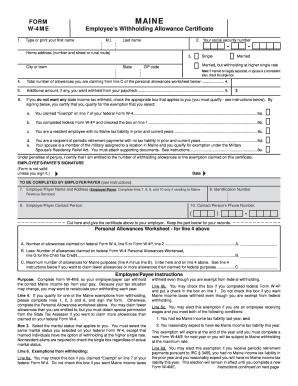

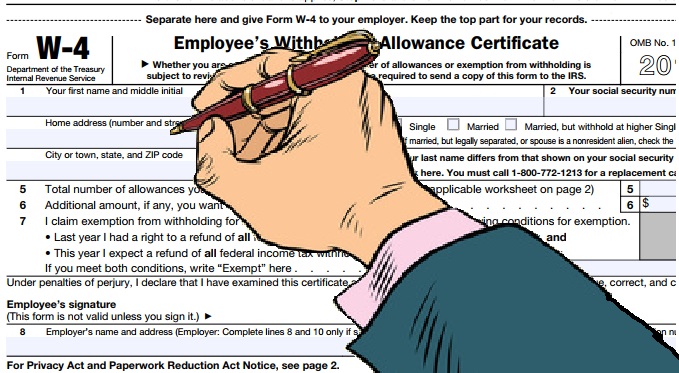

W4 form louisiana. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Louisiana new hire online reporting.

Your withholding usually will be most accurate when all allowances are claimed on the Form W-4. Line 1-3 Enter the correct amount of Louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month. Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

If the form you are looking for is not listed here you will be able to find it on the Louisiana s tax forms page see the citations at the bottom of this page. An employee uses a W4 to inform the. Employers must ensure that their newly hired employees properly complete and sign.

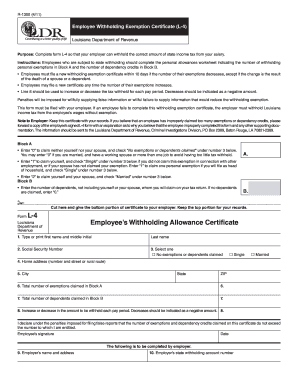

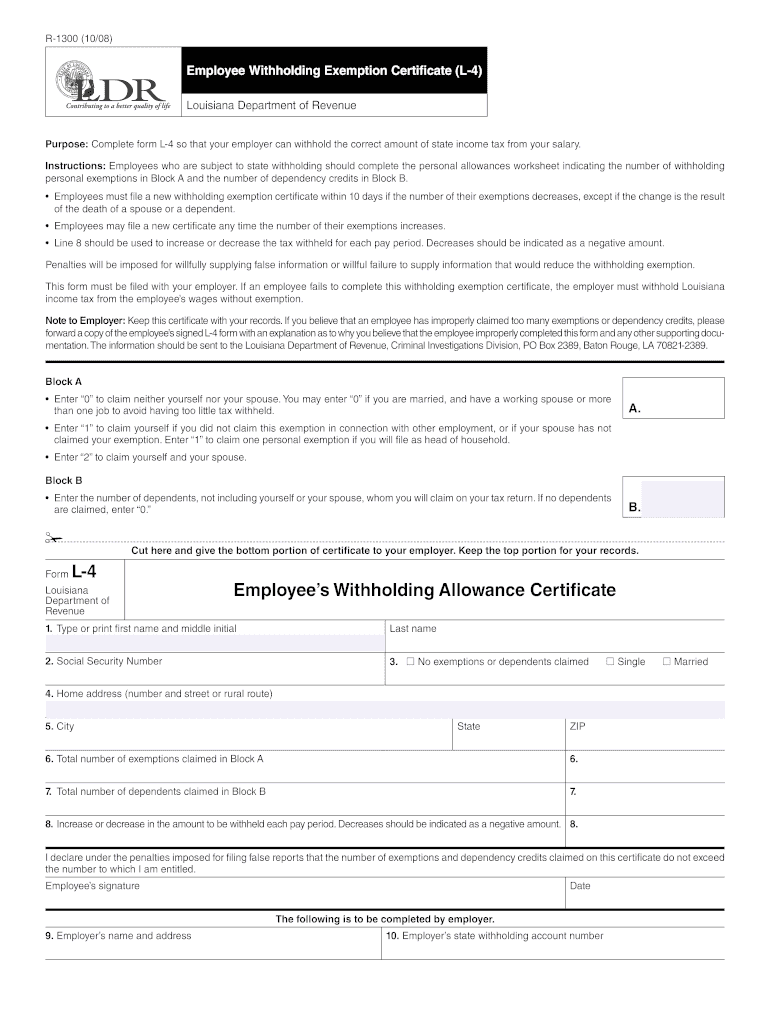

Employee Withholding Exemption Certicate L-4 Louisiana Department of Revenue Purpose. Your withholding is subject to review by the IRS. Form W-4 otherwise known as the Employees Withholding Allowance Certificate is an Internal Revenue Service IRS tax form completed by an employee in the United States to indicate his or her tax situation exemptions status etc to the employerThe W-4 form tells the employer the correct amount of federal tax to withhold from an employees paycheck.

L-3 This form is the Employers Annual Reconcilation of Louisiana Income Tax Withheld used to reconcile the. This is the total amount of taxes withheld for the quarter. Your withholding is subject to review by the IRS.

We last updated Louisiana R-1300 in February 2021 from the Louisiana Department of Revenue. The Louisiana Form L-4 Employee Withholding Exemption Certificate must be completed so that you know how much state income tax to withhold from your new employees wagesThe importance of having each employee file a state withholding certificate as well as a federal Form W-4 cannot be overstated so make its completion a priority. As required by section 274A of the Immigration and Nationality Act employers must complete Form I-9 to document verification of the identity and employment authorization of each new employee hired after Nov.

If you e-file Form W-2 you need to submit Form L-3 Transmittal of Withholding Tax Statements on or before January 31 2022. Keep in mind that some states will not update their tax forms for 2021 until January 2022. Give Form W-4 to your employer.

Form W-4 tells your employer how much tax to withhold from your paycheck. On page 1 enter the number of Forms W-2 W-2G 1099 and the total of. Line 4 Add Lines 1 2 and 3.

City State ZIP 6. W-2 This is a federal form used to indicate the amount of Louisiana wages earned and state income taxes withheld from employees wages during the year. Due to the recent release of the 2020 federal W-4 form some states are still determining whether they will accept the federal W-4 form or will require an additional form unique to their state.

Enter Personal Information a. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as. The following list of states with an income tax and the form they require is accurate as of 05182020.

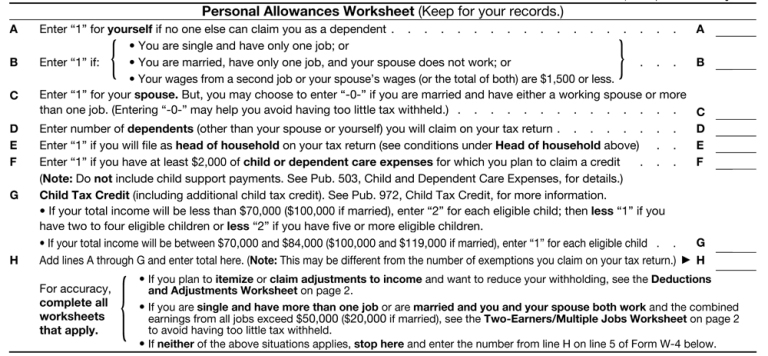

December 2020 Department of the Treasury Internal Revenue Service. Below are the instructions to file an amended Form L-1 Lines 1 - 5. If you have a working spouse or more than one job figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4.

Can be found in box 16 of Form W-2 and the Louisiana State Income Tax Withheld can be found in box 17. Form L-4 Louisiana Department of Revenue Employees Withholding Allowance Certificate 1ype T or print first name and middle initial Last name 2. R-1307 110 State of Louisiana Exemption from Withholding Louisiana Income Tax Form L-4E TAX YEAR 20 _____ For use by employees who.

If the employee fails to provide a. Give Form W-4 to your employer. W9 is different from a W4 because a W4 is telling the employer how many exemptions one may have and a W9 to find their taxpayer identification number.

Form W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

Louisiana State Wages or Payments. Enter Personal Information a. Also in the space provided.

If you file W-2 by paper you must attach W-3 and Form L-3 Transmittal of Withholding Tax Statements. Meet the conditions set forth under the Servicemember Civil Relief Act as amended by the Military Spouses Residency Relief Act. Home address number and street or rural route 5.

Your withholding on Form W-4 or W-4P. Yes the State of Louisiana requires additional forms to be submitted based on your method of filing. Copies of W-2s are submitted with the annual reconciliation form L-3.

Social Security Number 3. Check a box below incurred no tax liability in the prior year and anticipate no tax liability for the current year. Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding.

Two earners or multiple jobs. Comparison Between W2 W4 and W9 Form. Microsoft Word - 2020 State Withholding Forms ND 3-3-2020docx Created Date.

Louisiana New Hire Reporting. Give Form W-4 to your employer. Your withholding is subject to review by the IRS.

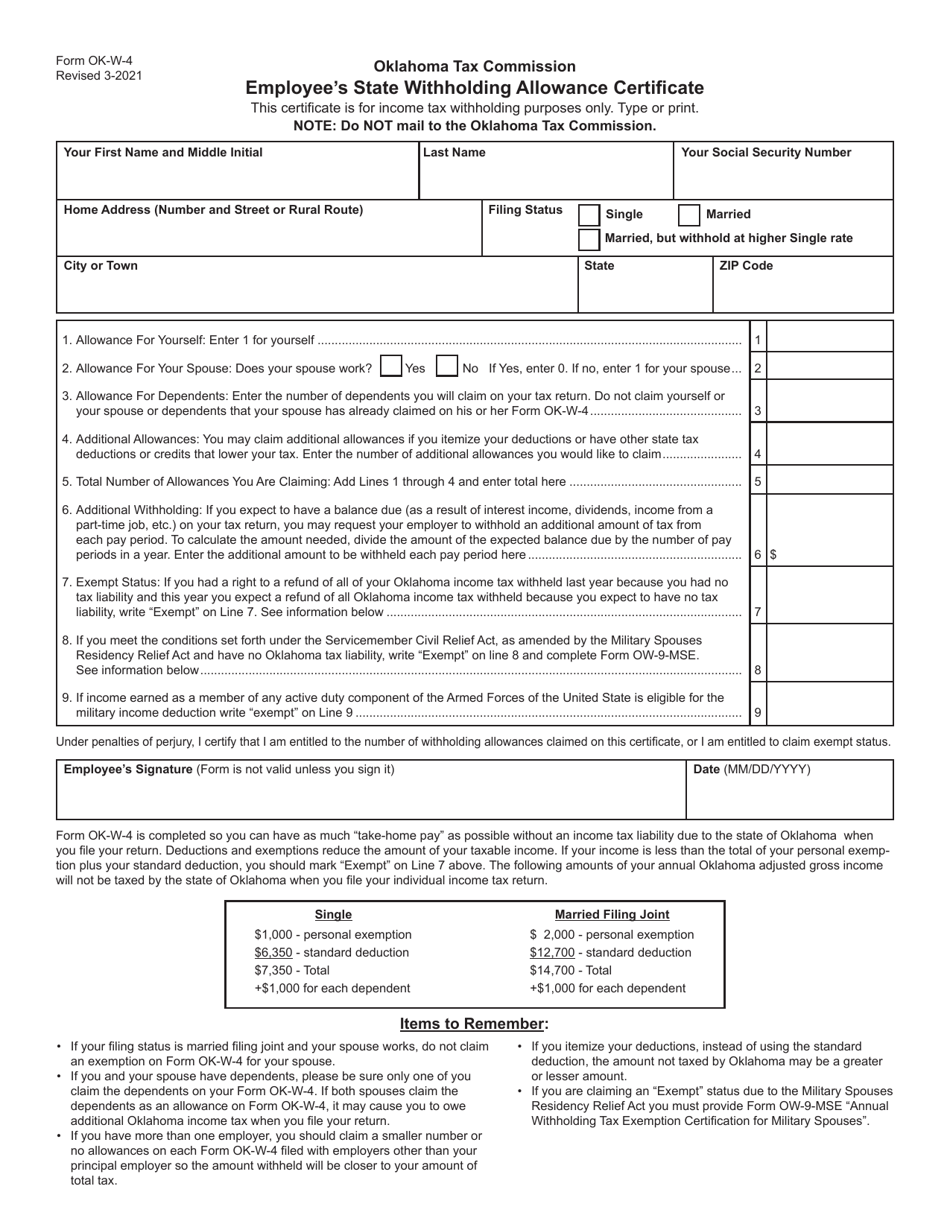

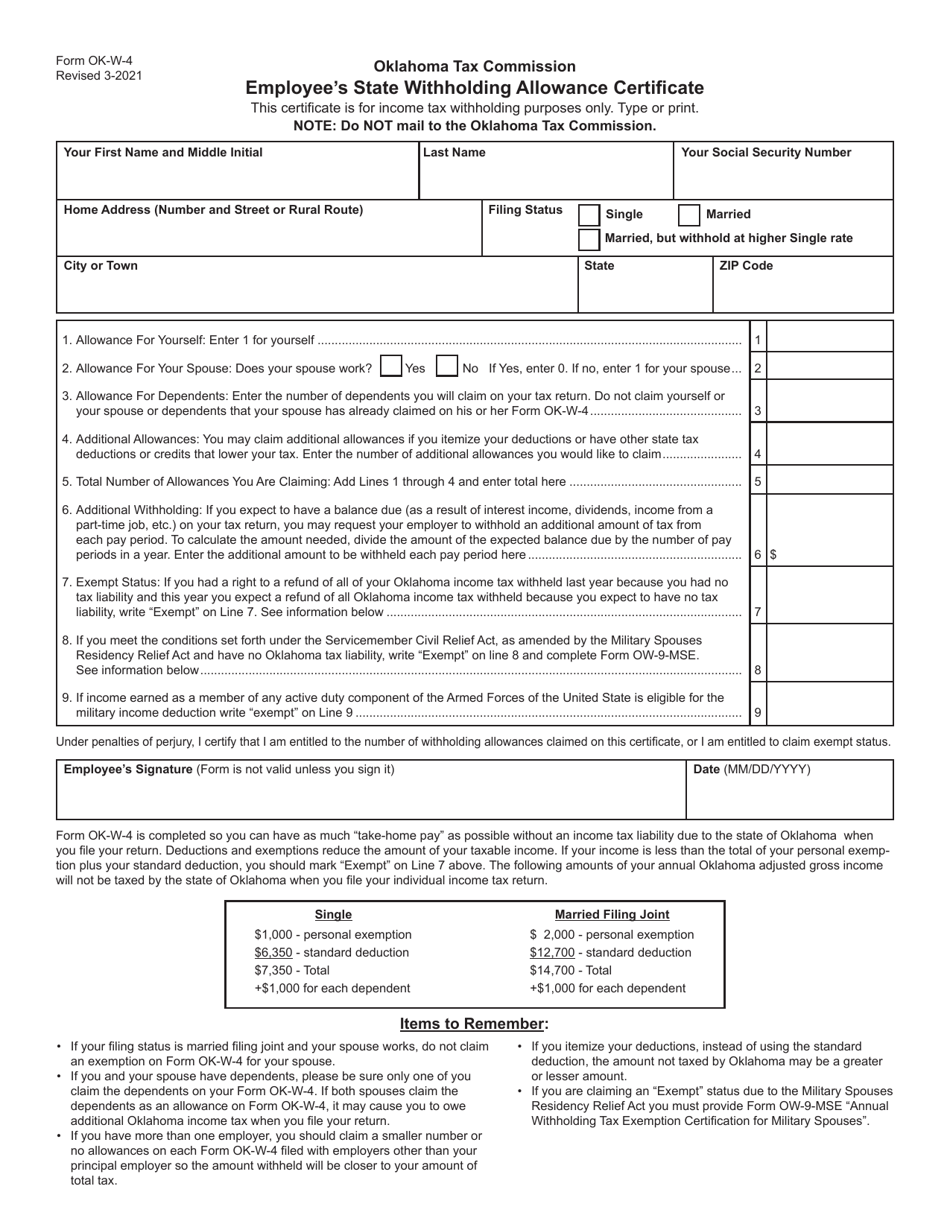

The amount of Louisiana income tax to be withheld is based on the income tax withholding tables or formulas prescribed by Louisiana Administrative Code 61I1501 and the withholding exemptions and dependent credits provided by the employee in the Employees Withholding Exemption Certificate Form R-1300 L-4. Select one No exemptions or dependents claimed Single Married 4. Use our W-4 calculator see how to fill out a 2022 Form W-4 to change withholdings.

Louisiana Form Exemption Fill Out And Sign Printable Pdf Template Signnow

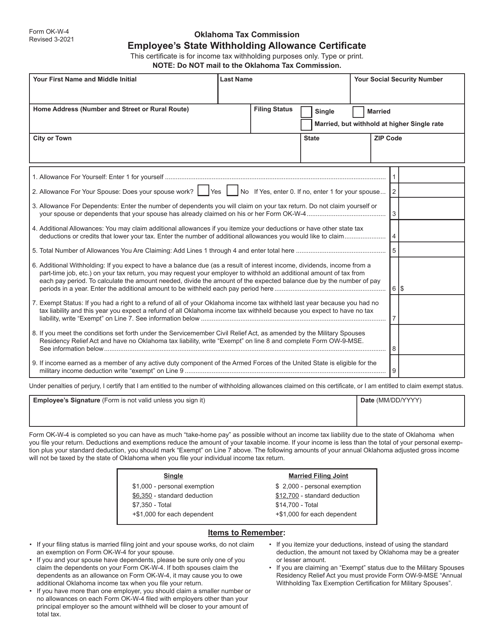

Form Ok W 4 Download Fillable Pdf Or Fill Online Employee S State Withholding Allowance Certificate Oklahoma Templateroller

Understanding Your W 4 Mission Money

2008 Form La R 1300 Fill Online Printable Fillable Blank Pdffiller

New Year New Withholding Forms A Better Way To Blog Paymaster

Withholding Tax Withholding Tax Information Guide

How Many Exemptions Do I Claim On My W 4 Form Tandem Hr

How Many Exemptions Do I Claim On My W 4 Form Tandem Hr

Form Ok W 4 Download Fillable Pdf Or Fill Online Employee S State Withholding Allowance Certificate Oklahoma Templateroller

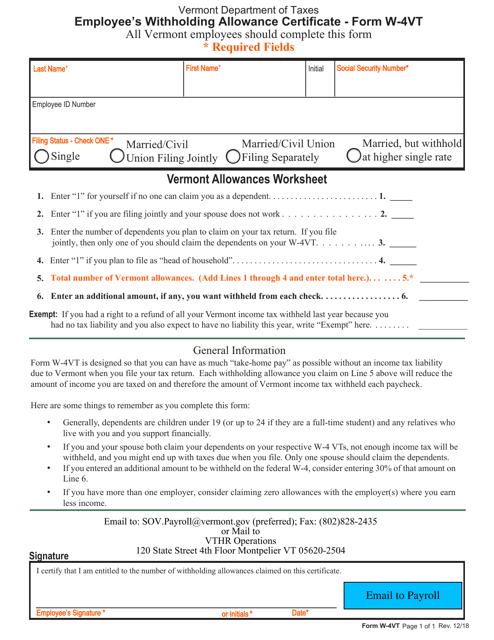

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

No comments:

Post a Comment