If playback doesnt begin shortly try restarting your device. Your withholding is subject to review by the IRS.

However if your form asks for a 1 or 0 take a look at the date on the top of the W.

:max_bytes(150000):strip_icc()/w-4formmarriedfilingjointly-b61794485b5e44beab0ee2cfc3c9ae6e.png)

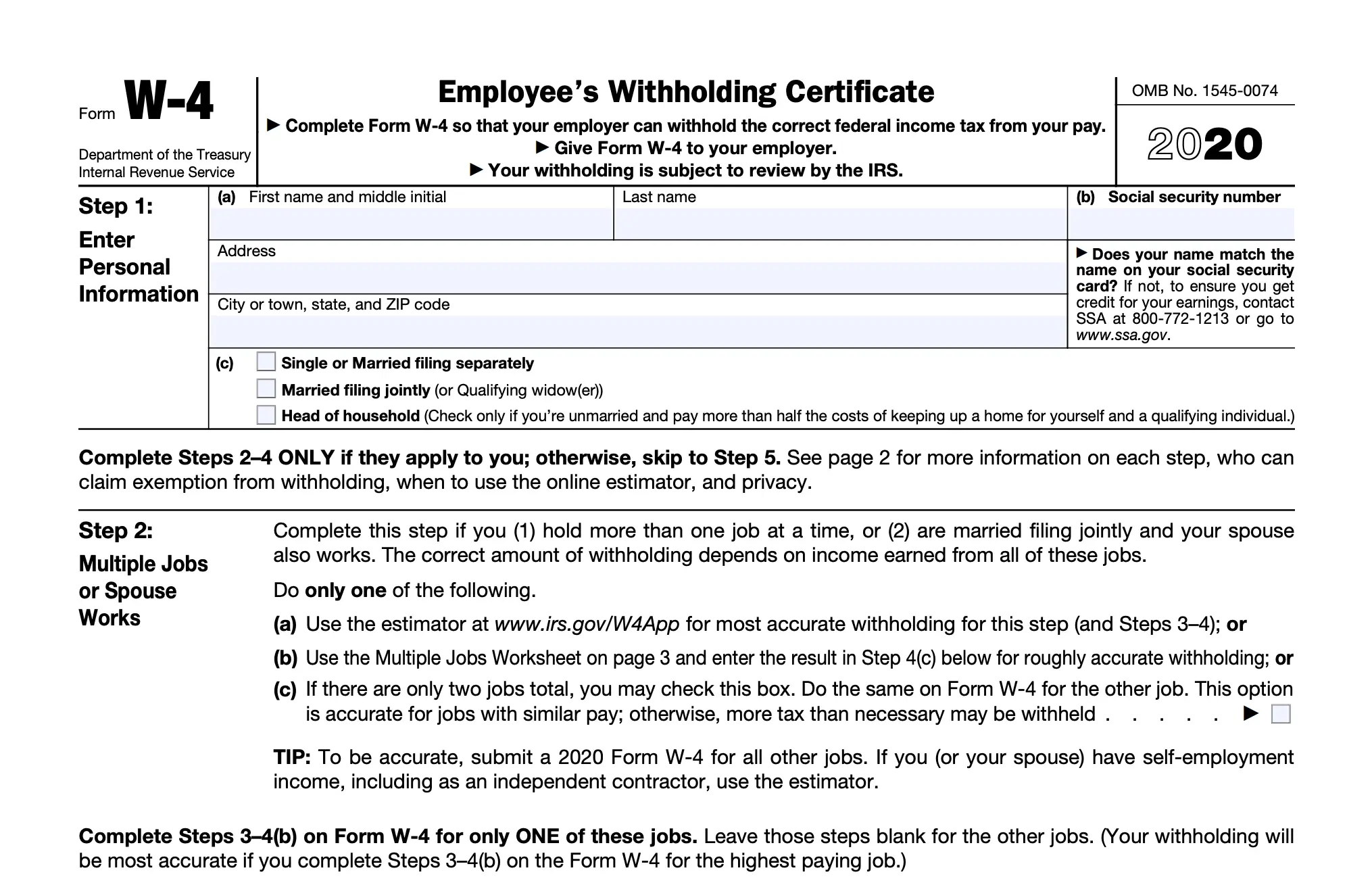

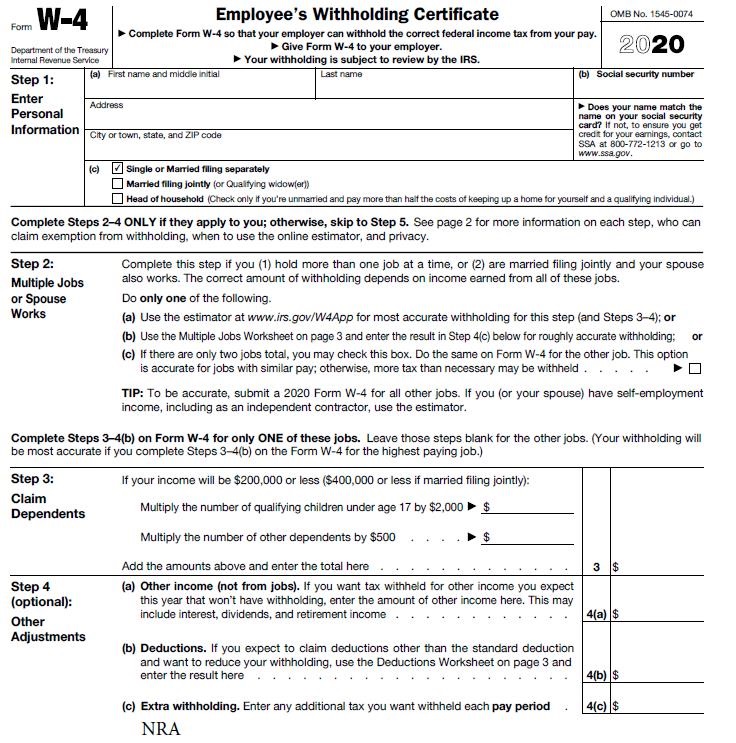

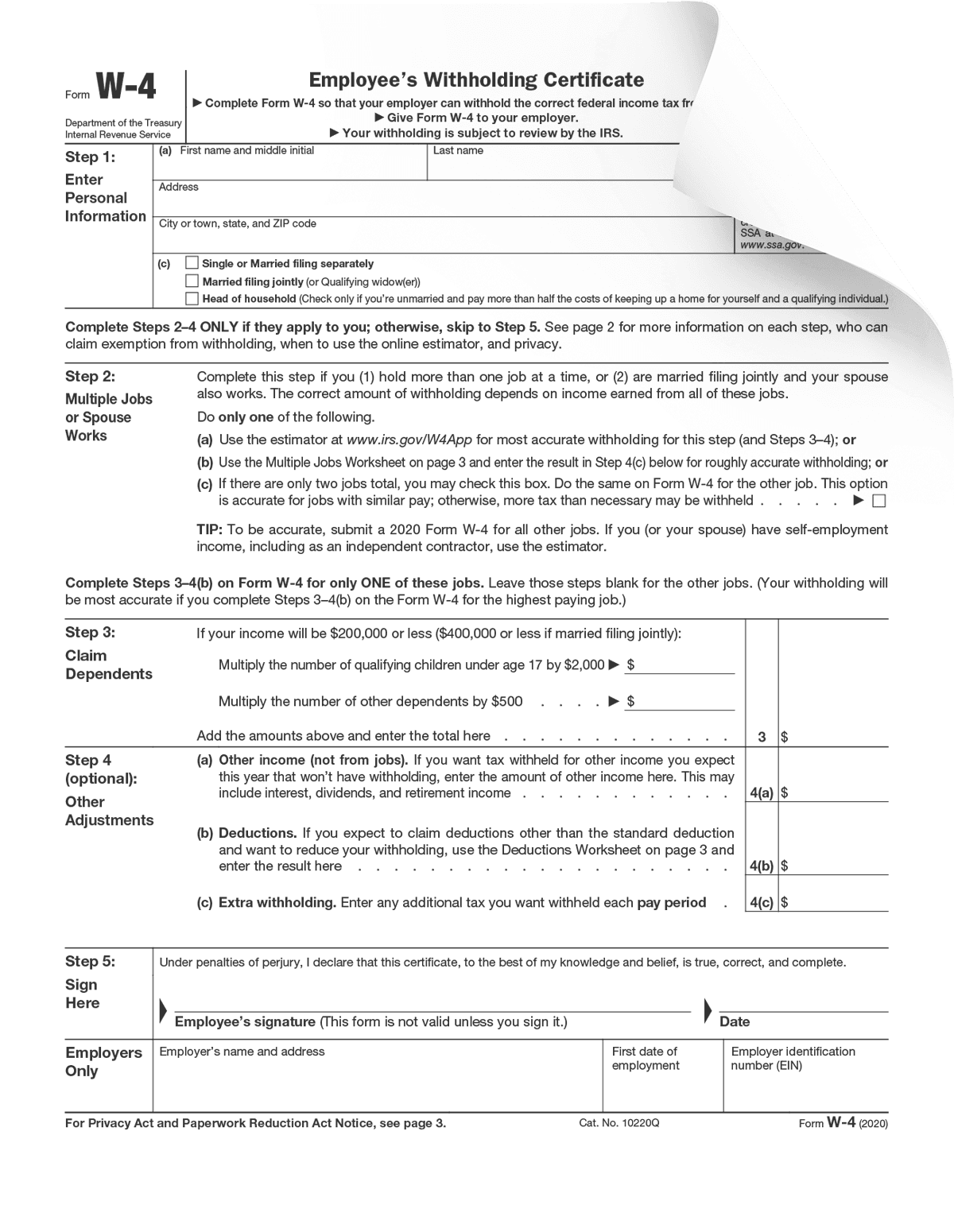

W4 form single zero. The 2021 W4 Form needs to be filled out by all new employees and existing employees who want to update their withholding. Give Form W-4 to your employer. 1 possibly 2 in some situations.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. Im single with no kids. The W4 W-4 form also called the Employees Withholding Allowance Certificate is a form that your employer uses to make sure that they are withholding the correct amount of taxes from your paycheck.

Who Can Claim 0 Allowances. This is a question about the 0 or 1 on your W4 for 2021. When you start a new job you must fill out a W-4 form telling your employer how much tax to withhold from your paychecks.

Make an additional or estimated tax payment to the IRS before the end of the year. Claiming zero allowances or taking certain steps on the 2020 Form W-4 will decrease your take-home pay regardless of whether you file as married or single. IF you use 0s instead you will pay MORE tax throughout the year --.

Can you on your w4 claim 0. Or maybe you recently got married or had a baby. Can I Make Changes to the W-4.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent. More of what you earn will be sent to the IRS. How to Complete a Form W-4 If Single No Dependents.

If youre married with no kids. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. Advertisement If youre unsure as to how many allowances you are eligible to claim or what the tax implications are of claiming zero visit the IRS website for publications interactive tax.

The number of exemptions you claim affects the withholding amount but. Nonmarried single individuals most often will choose single or zero for the withholding allowance question on the W-4. Although I am married with 3 kids and still am at a 1 You can replace the 1s with 0s if you would like a larger refund when you file your taxes.

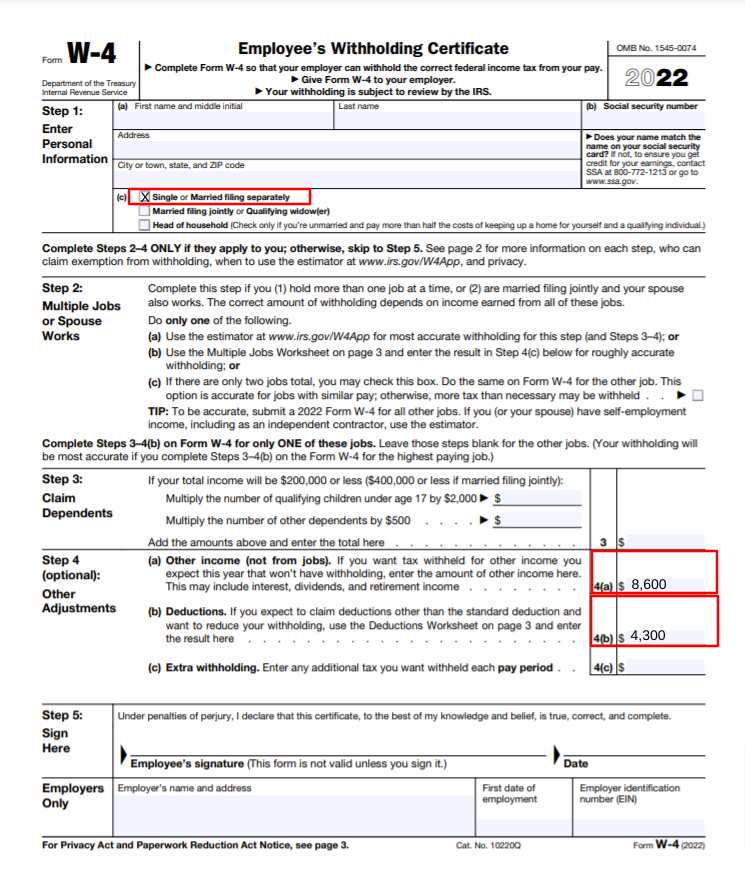

The form makes sure your employer can withhold the correct amount of federal income tax from your pay. If employees have children under the age of 17 they should multiply the number of children by 2000 and enter it into the first box on the worksheet. Because the lower wage job will automatically be withheld at a lower rate and when it is added to the other income it will be under withheld.

The IRS requires that certain stipulations be met before someone can claim themselves as head of household. Anyone can claim 0 allowances. One for you and one for your spouse.

December 2020 Department of the Treasury Internal Revenue Service. If you are happy with your withholding and you already submitted a W4 to your employer during a previous year you do. Employers use the W-4 to calculate.

A W-4 form formally titled Employees Withholding Certificate is an IRS form employees use to tell employers how much tax to withhold from each paycheck. In order to know whether you should claim 0 or 1 there are a few things that need to be evaluated. If you file jointly you can claim two allowances.

If you want to have zero allowances on Form W-4 simply put 0 on lines A to G as well as on line H then follow the instructions on the worksheet to complete the form. Ive filed 0 on both W4s but someone told me file 1 for the second job. How to fill out W4 Form 2020.

If youre filling out a Form W-4 you probably just started a new job. You can not make changes to a previously filed W-4. I work two jobs part time.

Can I file 1 without owing for taxes. If you have a second job and your filing status is single youll end up filling out a W-4 for each job. IRS Form W4 2021 Single One Job No Dependents.

It wont create problems with the IRS it will just determine how much youll get back on your tax return next year. Single withholding identifies the individual as the head of household. The answer is YES.

However you can file a new W4. If you are not expecting income from this job then you should claim the 0 on the w4 but if you are expecting income from this job then you should claim the 1 on the w4. You can claim either 0 or 1 on your W-4.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Just keep in mind that by choosing 0 allowances more money will be withheld from your paycheck. You can achieve the same effect in other ways however.

Perfect if you are a teenager or single with no children. 0 possibly 1 in some situations Single one job no dependents. Complete a new Form W-4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer.

The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck. Due to changes in the 2021 guidelines the number 0 or 1 you write down on your W-4 form will no longer significantly impact your paycheck during the year. You can claim either one.

Single is a video on how to complete the IRS Form W4 for tax withholding for employmentHow to fill out the W4 is a video speci. Any employee filing single with an income of 200000 or lessor an employee thats married filing jointly with a combined income of 400000 or lesscan claim dependents on Form W-4. You can claim 1 allowance on each form W-4 OR you can claim 2 allowances on one W-4 and 0 on the other.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer.

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

How To Complete The W 4 Tax Form The Georgia Way

2022 New W 4 Form No Allowances Plus Computational Bridge

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Fill Out The New W 4 Form Correctly 2020

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

:max_bytes(150000):strip_icc()/w-4formmarriedfilingjointly-b61794485b5e44beab0ee2cfc3c9ae6e.png)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Understanding Your W 4 Mission Money

W 4 Form Basics Changes How To Fill One Out

2021 W4 Form How To Fill Out A W4 What You Need To Know

How To Fill Out A W 4 Complete Form W 4 Instructions For 2021

No comments:

Post a Comment