Tax Return for Seniors or Form 1040-NR US. Where to Report the 1099-S on Form 1040.

1099 S Form 4 Part Carbonless Discount Tax Forms

Since the IRS considers any 1099 payment as taxable income you are required to report your 1099 payment on your tax return.

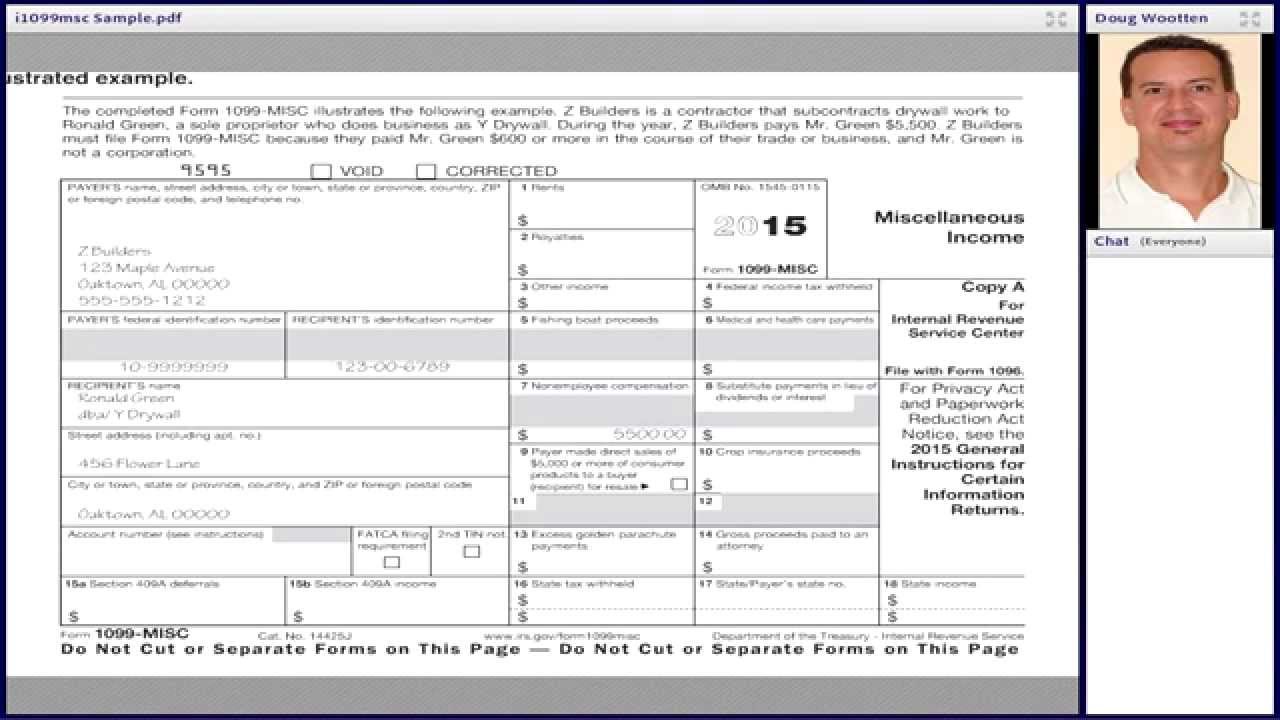

Where do i report 1099-s on 1040. Form 1099-S reports the sale portion of the transaction. If youre not an employee of the payer and youre not in a self-employed trade or business you should report the income on line 8i of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF and any allowable expenses on Schedule A Form. Like-Kind Exchanges Form 8824 Like-Kind Exchanges with cash or boot received.

The correct amount of real estate taxes to deduct on Schedule A Itemized Deductions should not include any real estate taxes reported in Box 5. You will need to complete IRS Schedule D and Form 8949 which will then. Nonresident Alien Income Tax Return.

Business or Rental Property Schedule D and Form 4797. Here are some ways that a 1099 form and a 1040 form can differ. How to report sale of lumber using Capital Gains- Schedule D.

Primary Residence Schedule D and Form 8949. Thats the amount that was paid down or paid off plus any other consideration you received in the transaction. The individual taxpayer can generally report the sales transactions on Form 8949 and.

Personal Use Reporting. How to Report 1099-MISC Box 3 Income Incentive payments and other types of income that appear in box 3 are reported on line 8 of Schedule 1 with the 2019 Form 1040. If no gross proceeds are allocated to a transferor because no allocation or an incomplete allocation is received you must report the total unallocated gross proceeds on the Form 1099-S made for that transferor.

How do 1099s work. As a property seller you will use the information from the form 1099-S along with the settlement statement from the sale of your real estate to report a capital gain or loss. You may receive income by cutting timber and opting to treat that cutting as a sale or by disposing of standing timber which is.

You would then enter the total amount of other income as calculated on. If you get a 1099-C for a personal debt you must enter the total on Line 21 of Form 1040 personal income tax. The IRS does not know that the sales transactions are personal in nature and not business-related nor does the IRS know what your cost basis was in the property sold to the buyer.

If youre reporting Form 1099 - S because you sold a timeshare or vacation home then youll also report the sale on Form 8949 and Schedule D. If youre reporting Form 1099-S because you sold your primary residence then youll report the sale of the home on Form 8949 and Schedule D. Form 5498 includes info on your IRA contributions rollovers Roth IRA conversions and required minimum distributions RMD for the tax year.

On the Form 1040 boxes 5a and 5b are where 1099-R information goes. How you report 1099-MISC income on your income tax return depends on the type of business you own. Form 1099-S data entry for sale of any other property that was not the taxpayers principal residence.

The Buyers part of real estate tax codeamount field is used to report the amount of real estate reported on Form 1099-S box 5. How do I use Form 5498. Heres how to enter the form.

Youll usually report this income on Form 1040 Line 21 as Other incomeThis is taxable income not subject to self-employment tax. Include as income any interest you would have been eligible to deduct. Report the sale of your rental property on Form 4797.

Individual Income Tax Return Form 1040-SR US. If the 1099-S was for the sale of your main home its reported under Less Common Income in the Wages Income section. Enter the ordinary dividends from box 1a on Form 1099-DIV Dividends and Distributions on line 3b of Form 1040 US.

If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From Business. One of the clearest differences between a 1040 form and a 1099 form is the number of types each form has. Yes you must report your 1099-S.

Refer to Form 1040-ES Estimated Tax for Individuals for more details on who must pay estimated tax. Profits of up to 250000 500000 on a joint return on the sale of your home may not be taxable if it was your primary residence for two of the last five years. Reporting Gain or Loss on Your Home Sale.

Investment Use Property Schedule D. A 1099 is a tax form generated for anyone who has earned money as a contract worker. The sales price is the gross proceeds you received in giving up the property.

Reporting 1099-C Income. How do I report 1099-div on my tax return. Why is there no cost basis on my 1099-B.

Lets break down the purposes of Forms 1099-R 1099-SA 5498 and 5498-SA how to use them and whether you need them when filing your tax return. The box numbers 1 and 2a correspond with 1040 boxes 5a and 5b. If you do not receive any allocation or you receive conflicting allocations report on each transferors Form 1099-S the total unallocated gross proceeds.

If youre reporting Form 1099-S because you sold your primary residence then youll report the sale of the home on Form 8949 and Schedule D. If its a business or farm debt use a Schedule C or Schedule F profit and loss from business or farming. When you complete Schedule C you report all business income and expenses.

If youre reporting Form 1099 - S because you sold a timeshare or vacation home then. For personal use reporting the IRS will receive a copy of Form 1099-K. Possible reporting options include but may not be limited to.

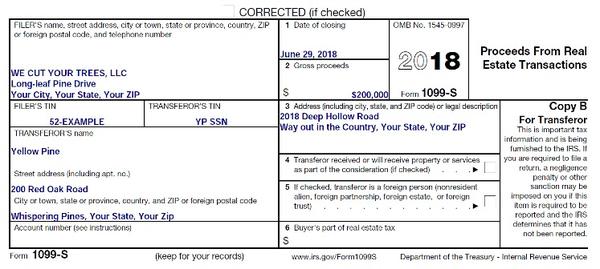

Form 1099-S reports the amount of real estate taxes paid by or charged to the buyer at the time of the real estate transaction in Box 5. So where do I report 1099-R on the 1040. Code the screen unit to T or S to indicate if the Transferor is the Taxpayer or the Spouse.

When the income reported on Form 1099-MISC Box 3 is from your trade or business report it with your business income. There are two ways to report the income received from a timber sale depending on how the income is derived. These are components on the form that go toward determining what your taxable income is.

Because a 1040 form can show the information from all other tax forms a taxpayer might need to fill out theres only one type of 1040 form. How do I report Form 1099-S Sale of Timber.

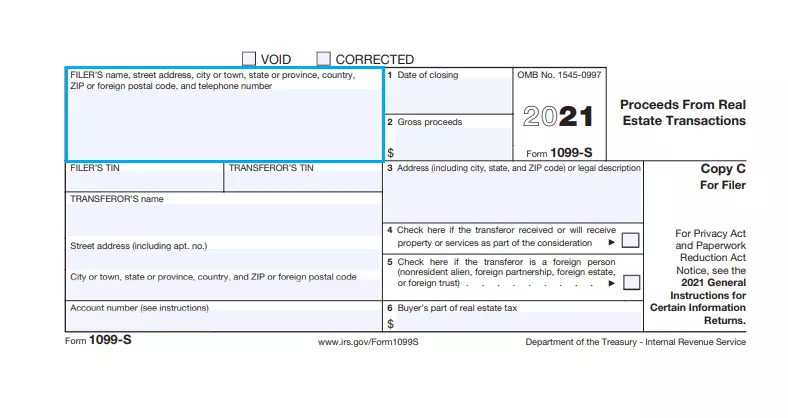

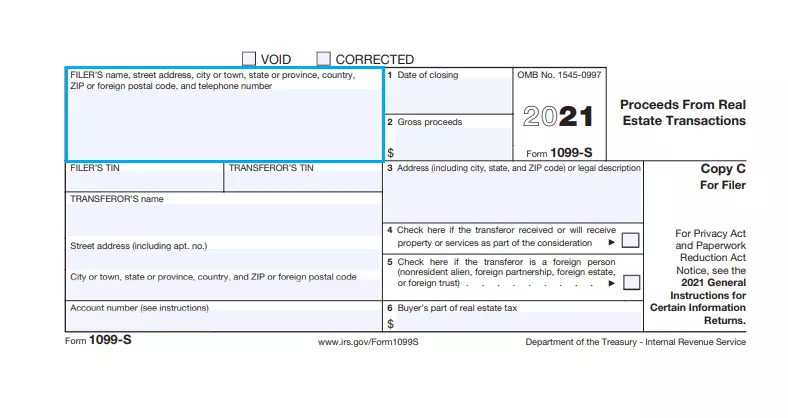

What Is Form 1099 S 1099 S Instructions

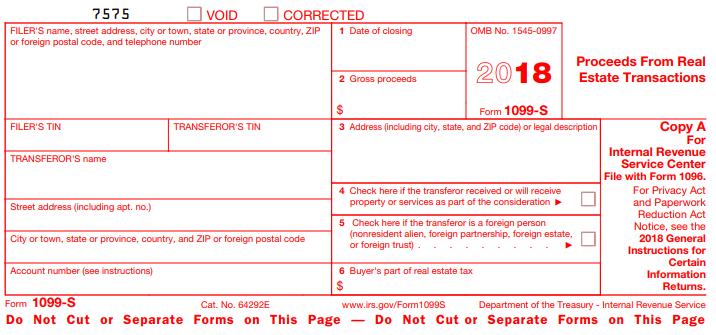

1099 S 2018 Public Documents 1099 Pro Wiki

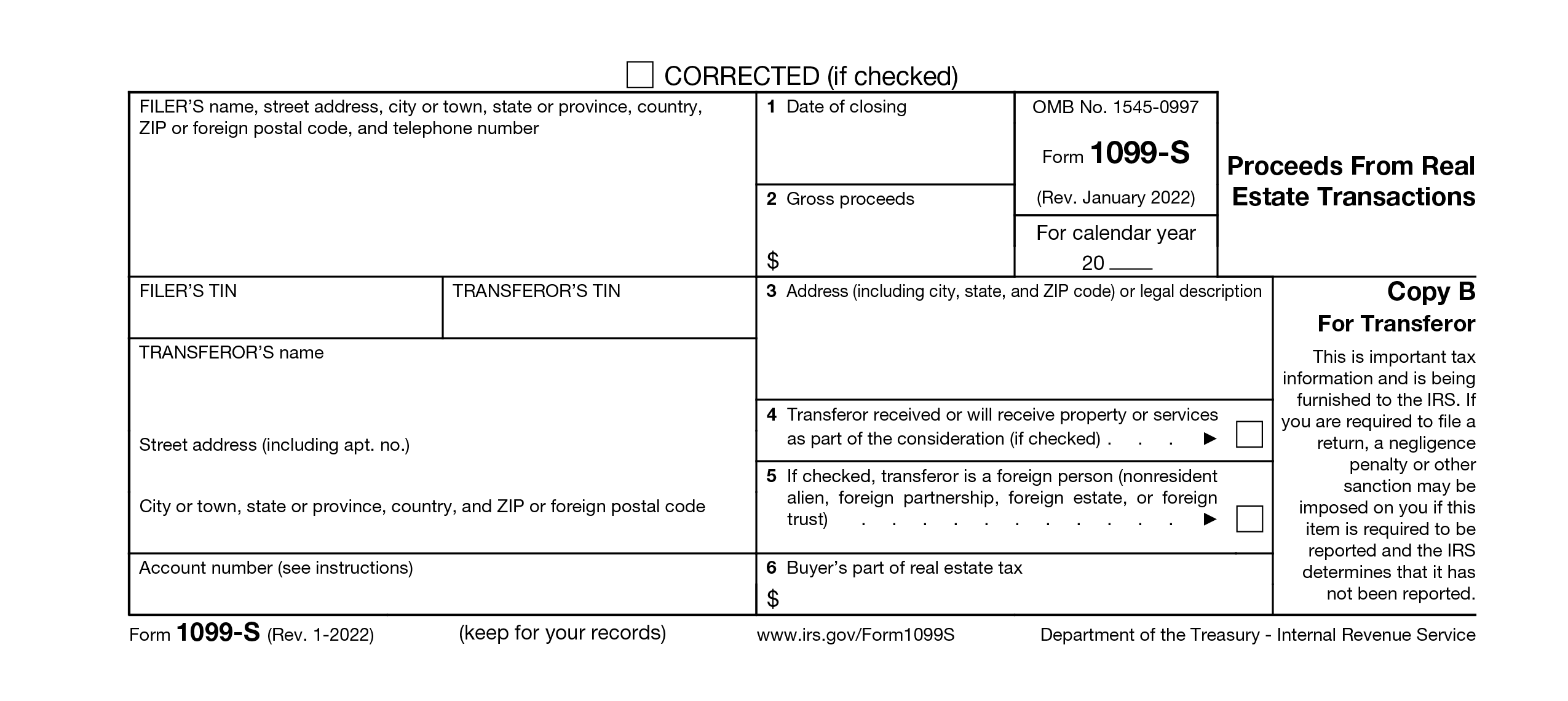

1099 S Form Copy B Transferor Discount Tax Forms

1099 S 2020 Public Documents 1099 Pro Wiki

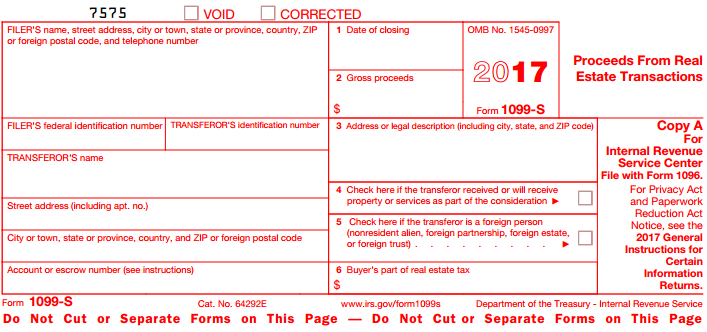

1099 S 2017 Public Documents 1099 Pro Wiki

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

New Reporting Rules For Lump Sum Timber Sales Nc State Extension Publications

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Irs Form 1099 S Fill Out Printable Pdf Forms Online

Irs Form 1099 S Fill Out Printable Pdf Forms Online

1099 S Form Copy C Filer State Discount Tax Forms

Capital Gains Losses Including Sale Of Home Pub

Which 1099 Forms Should You Complete

No comments:

Post a Comment