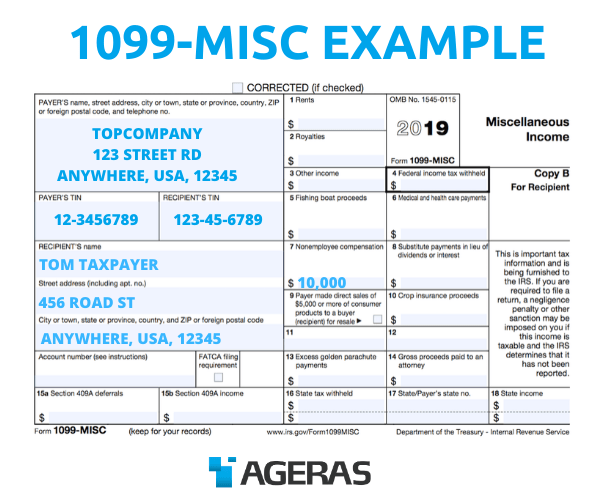

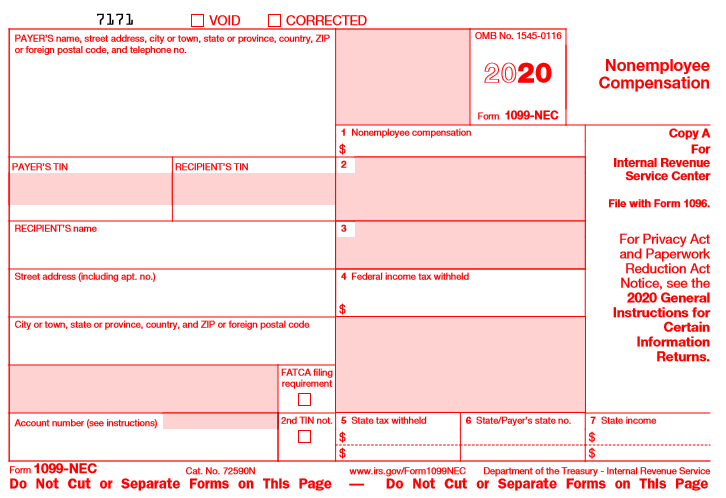

With these changes 2020 onwards the Form 1099-MISC box information has been changed as listed below. With the introduction of Form 1099-NEC there have been some changes to Form 1099-MISC and now the non-employees compensations are not reported on Form 1099-MISC.

Sample 1099 Misc Forms Printed Ezw2 Software

The IRS issued Form 1099-NEC for use beginning with tax year 2020 instead of Form 1099-MISC.

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

1099 form list. 8889 - Health Savings Accounts complete form using 1099-SA info. There are a variety of incomes reported on a 1099 form including independent contractor income but also for payments like gambling winnings rent or royalties gains and losses in brokerage accounts dividend and interest income and more. Certain Government Payments Info Copy Only 2021 12162021 Inst 1099-G.

Ad Find Edit Sign Save or Send via E-mail any Form. At least 600 in. 1099-SSA - Social Security.

Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each. A 1099 form is a record that an entity or person other than your employer gave or paid you money. Financial institutions issue this form to report dividends and other distributions they made to taxpayers.

Payer made direct sales of 5000 or more checkbox in box 7. Instructions for Form 1099-G Certain Government Payments 0122 12162021 Inst 1099-g PDF Instructions for Form 1099-G Certain. Form 1099 is a collection of forms used to report payments that typically isnt from an employer.

4852 - Substitute for Form W-21099-R. The 1099-Q form reports money that you your child or your childs school received from a qualified tuition plan like 529 plan or Coverdell ESA. 1099-CAP Changes in Corporate Control and Capital Structure.

1099-B Proceeds From Broker and Barter Exchange Transactions. Maintaining updated information helps with stress free form preparation in January. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

Review and Update the 1099 Vendor List. This form is used to denote income received through dividends and other stock distributions of 10 or more. Medical and health care payments.

1099-A Acquisition or Abandonment of Secured Property. You do not have any Favorites Lists to add this item to. This can be accomplished in the Vendor Center in QuickBooks.

PATR - Form 1099 Patronage. If youre member of a co-op who received at least 10 in patronage dividends expect a 1099-PATR. Please create a list below.

Form 1099-B has two main uses. The first and most common use is to report capital gains or losses from the sale of stocks bonds securities and property handled by a broker. 1099-RRB - Railroad Retirement Benefits.

Year-end is nearing now is a perfect time to review your vendor information for 1099 preparation. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. So be sure to fill all the required forms the ones that apply to your business specifically and start filling them out.

Form 1099-NEC is used by payers to report 600 or more paid in nonemployee compensation for business services. 22 rows Form 1099 is one of several IRS tax forms used in the United States to prepare and. TOPS IRS Approved 1099 Tax Form 5 12 x 8 Five-Part Carbonless 24 Forms.

Most information returns fall within the 1099 series of forms. Your Year-end Checklist for IRS Form 1099 Filing Compliance Share Learn up-to-the-minute information about changes in IRS Form 1099 filing for 2021 plus the best practices and compliance action calendar for dramatically reduced exposure to errors and penalty assessments against your organization. File Form 1099-MISC for each person to whom you have paid during the year.

This document will detail any income you earned from the sale of securities like stocks bonds exchange-traded funds ETFs and mutual funds. 1099-R - Pensions and Retirement Plan Withdrawals. Form 1099-SB is used when someone sells their life insurance policy but its primarily a form that a life insurance company would send to the IRS.

Small businesses and individuals can still barter for goods and services. The second use is to report barter exchange transactions. 26 rows Form 1099-G.

Payers fill out the form send it to independent contractors excluding attorneys paid at least 600 in a calendar year and file a copy with the IRS. The payer fills out the 1099 form and sends copies to you and the IRS. 1099-DIV Dividends and Distributions.

This form allows the IRS to determine the value of a life insurance policy and how much the person selling the policy has invested in it. 1099 2-Up Blank Perforated This form can be used as a 1099-MISC 1099-INT 1099-R 1099-DIV and 1099-B 2-Up Blank form with 1 vertical perforation and 1 center-cross perforation Printed with heat-resistant ink for use with most inkjet and laser printers Pack size of 100 forms Compatible envelopes are L0153 and L0156. Apart from 1099-NEC businesses also use Form 1099-MISC 1099-DIV and other 1099 forms to report various incomes and payments.

Form 1099-SB Sellers Investment in Life Insurance Contract. Anytime you make withdrawals to pay for school youll likely get one of these. Enter the information from your paper form in the corresponding spaces on the 1099 form screen.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. 1099-C Cancellation of Debt.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Irs Tax Form 1099 How It Works And Who Gets One Ageras

1099 Nec 2020 Public Documents 1099 Pro Wiki

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Form 1099 Nec For Nonemployee Compensation H R Block

Breaking Down Form 1099 Div Novel Investor

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Rules For Business Owners In 2021 Mark J Kohler

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

No comments:

Post a Comment