For whom they sold stocks commodities regulated futures contracts foreign currency contracts forward contracts debt instruments options securities futures contracts etc for cash Who received cash. On the form all boxes are empty.

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

View Cash-1099pdf from MSC 415 at Southeastern Louisiana University.

1099 b form cash app. Listen to the tax specialist. Was this a Form 1099 for interest dividends or government payments. Do i still have to import my csvs as well.

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. Connect your account by importing your data through the method discussed below. From the 1099B PDF page 1 NOTE.

Say Thanks by clicking the thumb icon in a post. Tax Reporting with Cash For Business. About Form 1099-B Proceeds from Broker and Barter Exchange Transactions.

Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. The fact that JoeBiden is planning on taxing money over 600 that comes into PayPal CashApp Venmo etc. The proceeds box amount on the Form 1099-B shows the net cash proceeds from your Bitcoin sales.

The Composite Form 1099 will list any gains or losses from those shares. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. Will Cash App send me 1099-B form for investing in the mail.

Early on pulled a 25 gain from sellingwithdrawing back to bank account. Cases basis for transactions to you and the IRS on Form 1099-B. Cash App SupportTax Reporting with Cash For Business.

A broker or barter exchange must file this form for each person. Robinhood not an exchange but a crypto broker What do I need to do on my crypto taxes if I get a Form 1099-B. I have imported my 1099-B from cash app for the cryptocurrency that i bought and sold.

It was from cash app I sold bitcoin but heres the thing I sold it but I did not make any profit the 1099-B does not show how much I invested it just shows what I sold so I am confused. Cash App for Business accounts will receive a 1099-K form for those who accept over 20000 and more than 200 payments per calendar year cumulatively with Square. Select the 2021 1099-B Cash App Investing will provide an annual Composite Form 1099 to customers who qualify for one.

Applicable checkbox on Form 8949. Cash App formerly known as Squarecash is a peer-to-peer money transfer service hosted by Square Inc. File Form 1099-B for each customer who received cash stock or other property from a corporation that you know or have reason to know based on readily available information must recognize gain under section 367a from the transfer of property to a foreign corporation in an acquisition of control or substantial change in capital structure.

Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app. Which exchanges send Form 1099-Bs. Cash app payments over 600 will now get a 1099 form according to new law Fortunately the idea that you will have to pay additional taxes is false.

Checked the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year. Is another bs way to tax the poor on money they barely have instead of the rich on money they have in excessive amounts.

Cash App does not report your Bitcoin cost-basis gains or losses to. I sold a few dollars worth of bitcoin purchased through the Square Cash app and so as a result they issued a 1099-B to me. Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app.

You should have an option to select Ill enter additional information on my own and under the next page there is an option to enter corrected cost basis. You can generate your gains losses and income tax reports from your Cash App investing activity by connecting your account with CryptoTraderTax. I have a question regarding my 1099-B.

Individuals andor their crypto tax professionals use Form 1099-B to fill out Form 8949 which is eventually filed on the taxpayers Schedule D. Indicates where to report this transaction on Form 8949 and Schedule D Form 1040 or 1040-SR and which checkbox is applicable. Woman using cash app on phone Photo credit Getty Images.

Idk what to do. You may be required to recognize gain from the receipt of cash stock or other property that. Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app.

Be aware however that because of. Im confused as to how to fill out the Credit Karma 1099B page with the info from the Cash 1099B as it seems like it doesnt have much info. Posting Cashtag Permanent Ban.

Cash App reports the total proceeds from Bitcoin sales made on the platform. The IRS currently requires those apps to send a 1099-K form for user accounts with at least 200 business transactions that total at least 20000 in gross payments in a. How to adjust in Turbo Tax.

Cash App does not provide tax advice. Cash App Tax Reporting. Cash App does not provide tax advice.

You may also have a filing requirement. Help with importing your CSV file has been provided by clicking here. Can someone who has experience with this please help me understand.

Im not a fan atm first go around with BTC on cash app. Cash App exports a complete Transaction History file to all users. Cash App does not report your total Bitcoin cost basis gains losses to the IRS or on this form 1099-B.

Cash App does not provide tax advice. Here is the 1099 with private info redacted. RCashApp is for discussion regarding Cash App on iOS and Android devices.

That is because a 1099-K form will be sent out to app users who receive more than 600 in total transactions beginning in 2022. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. The 1099 B I received only shows the cash proceeds from a merger cash stock in the new company was received for stock of the old company.

I recently received a 1099-B from cashapp and the proceeds are only 32214. If you did not sell stock or did not receive at least 10 worth of dividends you will not receive a Composite Form 1099 for a given tax year. How is the proceeds amount calculated on the form.

Idk what to do because I asked a tax specialist and he told me this amount cant be taxed since its so small. See the Instructions for Form 8938.

How To Read Your 1099 Robinhood

How To Read Your Brokerage 1099 Tax Form Youtube

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

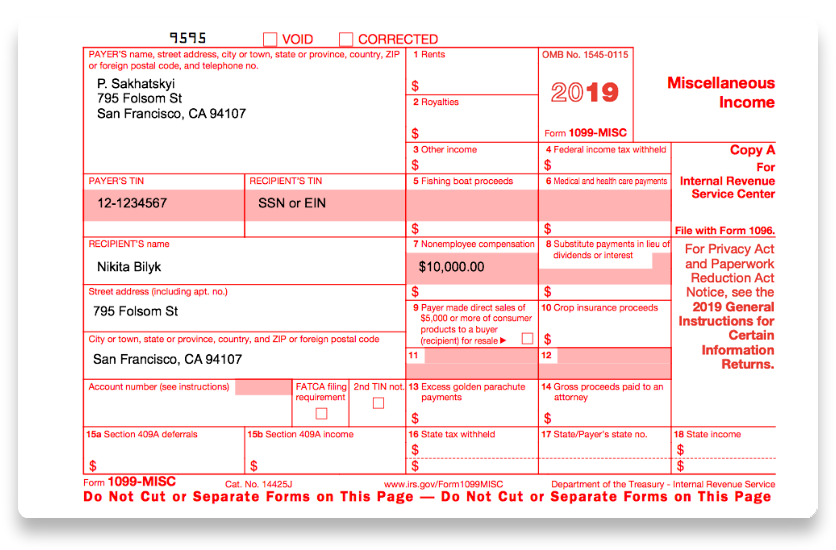

Form 1099 Misc 2018 Credit Card Services Electronic Forms Form

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Irs Form 1099 Reporting For Small Business Owners In 2020

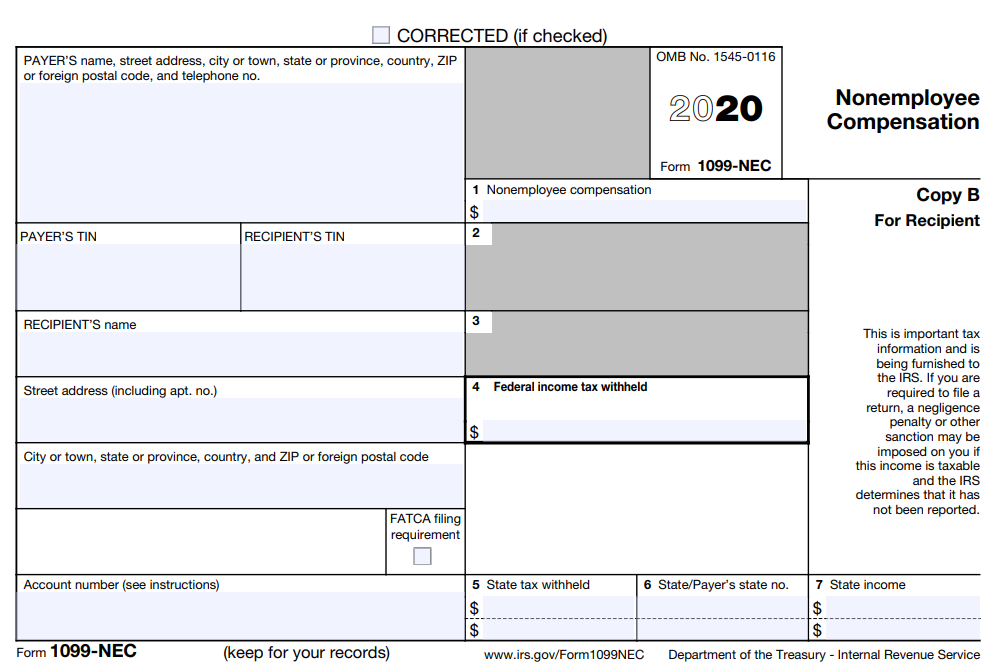

Form 1099 Nec For Nonemployee Compensation H R Block

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

What To Do With A Crypto 1099 Tokentax

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

No comments:

Post a Comment