You will need to enter the 1099-MISC under Other Common Income. Form 1099-MISC box 6 Medical and Health Care Payments is made like institutions like insurance companies to report payments to medical facilities doctors health care providers etc.

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

Box 6 reports 6 Medical and health care payments to providers of medical or health care services - that doesnt include payments to insurance providers.

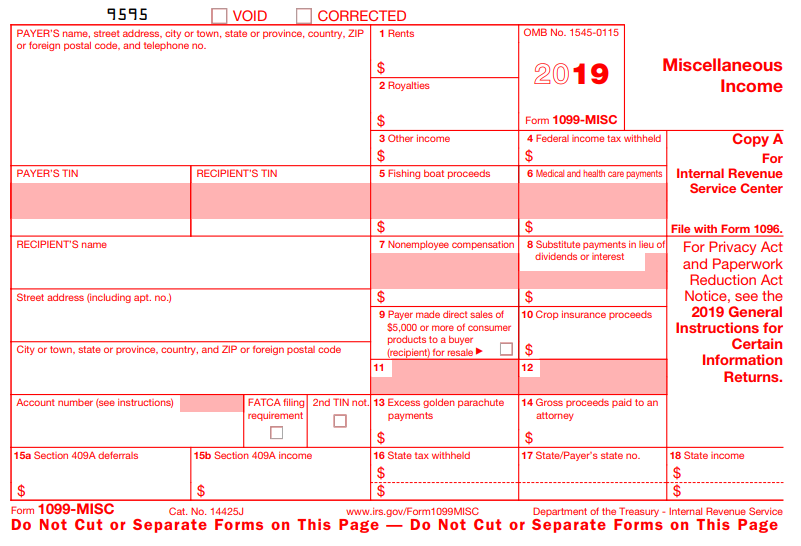

Box 6 form 1099 misc. From the instruction for Forms 1099-MISC by the IRS Form 1099-MISC box 6 is where you enter payments made to each physician or other supplier or provider of medical or health care service. Printable 1099 MISC box 11. Box 2 - Royalties - Report any amounts over 10.

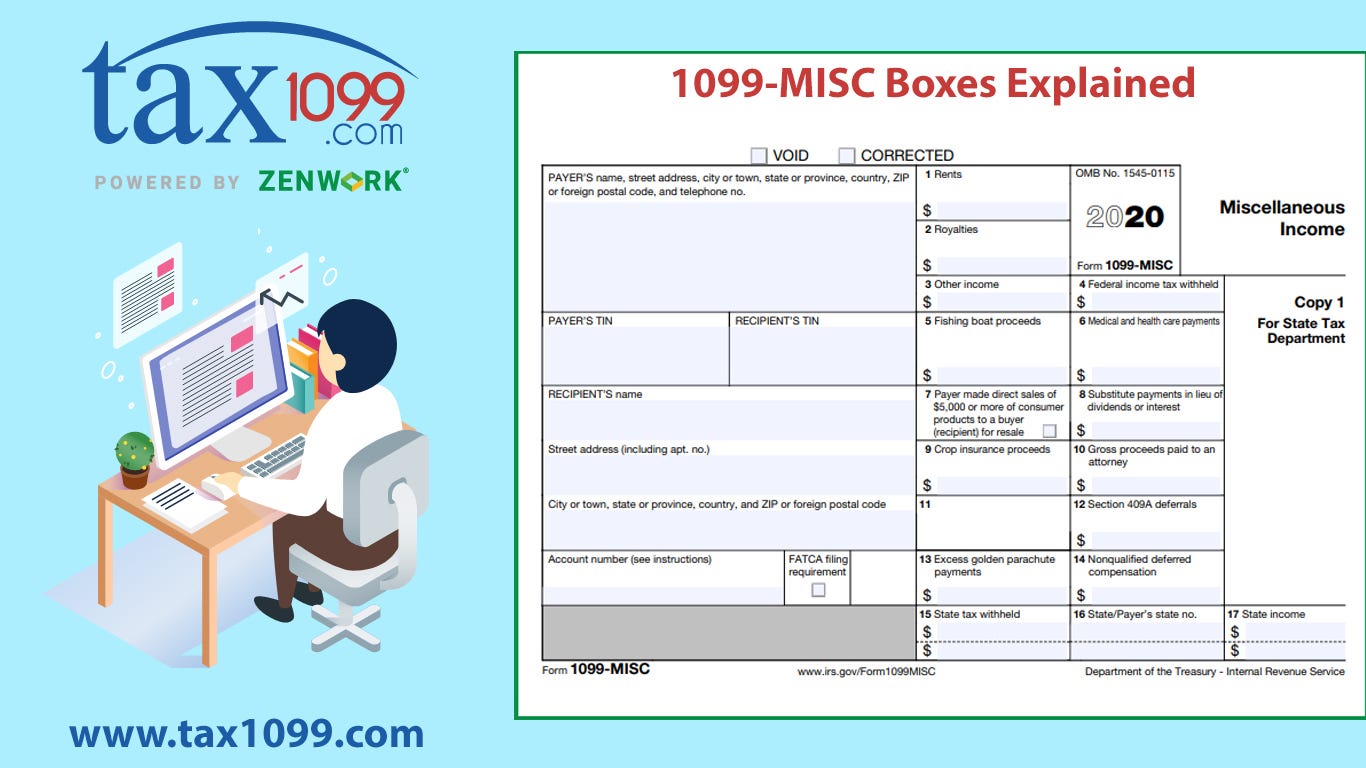

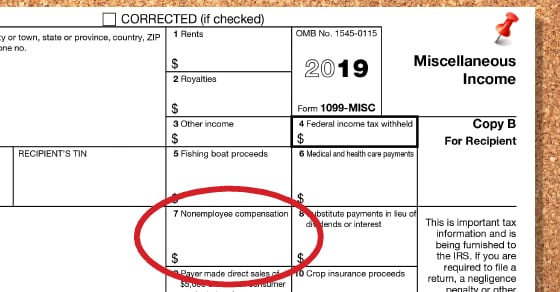

The 1099-MISC is used to report miscellaneous income and has long been the most common form provided to independent contractors. Go to Tools 2. Substitute payments in lieu of dividends or tax-exempt interest reported in box 8.

Department of the Treasury - Internal Revenue Service. Select Update Box 6 State Payers state for multiple 1099-NEC recipients Note. To enter or review the information for Form 1099-MISC Box 6.

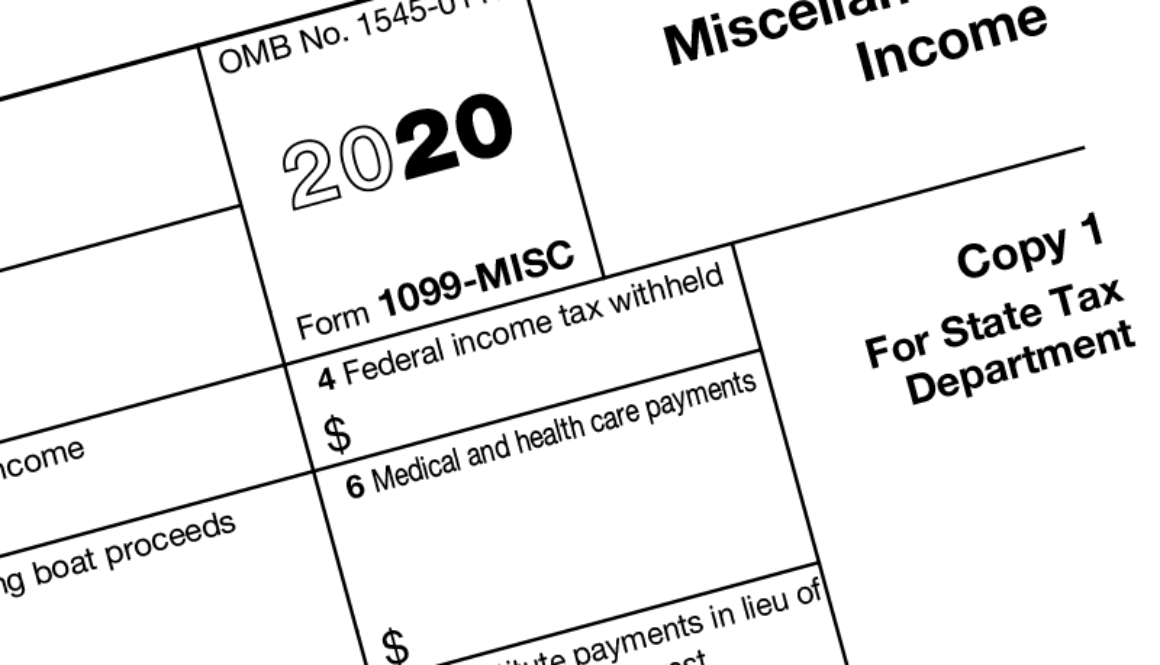

Per IRS Instructions for Forms 1099-MISC and 1099-NEC an entry in Box 6 for medical and health care payments is reported as income on Schedule C Form 1040 Profit or Loss from Business. These boxes report state taxes withheld your state identification number and the amount of income earned in the state. Box 6 on the 1099-MISC has always been difficult to understand for taxpayers in a variety of situations.

The following payments made to corporations generally must be reported on Form 1099-MISC. Take note that these payments have to be made in the course of doing your trade or business. Do not use this box to report health insurance premiums paid to the insurance company.

Updated on December 13 2021 - 1030 am by TaxBandits The IRS allows filers to submit 1099 MISC through paper or electronically. Form 1099 MISC - Mailing address for 2021 Tax year. Generally Form 1099-MISC is used to report payments over 600 to a specific payee.

Sign into your TurboTax account and click Take me to my return. But for 2021 Form 1099 MISC box 11 includes any reporting under section 6050R. Forms 1099-A and 1099-C.

Select Other Recipient1099 Tools 3. Per the IRS Instructions for Form 1099-MISC an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business. If you have not already entered the applicable Schedule C information.

A document published by the Internal Revenue Service that identifies a taxpayers rights and outlines the processes followed by the IRS when it examines a taxpayer issues a. For State Tax Department. Form 1099-MISC - Medical and Health Care Payments.

Gross proceeds paid to an attorney reported in box 10. Reportable payments to corporations. Medical and health care payments reported in box 6.

No scan print required. Send 1099 copy A to the IRS and copy B recipient copy to independent contractors through USPS mail using our service. This will include payments made by medical and health care insurers under health accident and sickness insurance programs.

The Box numbers used on the form are subject to change from year to year. Or else payments are made to purchase fish from an individual who is engaged in the trade of catching fish etc. Ad PDF signer to quickly complete and sign any PDF document online.

The 1099-M with an amount in box 6 is supposed to be issued to the Medical Services Provider. What Defines a Verbal Contract. What is included in medical and healthcare payments to be reported in Box 6 of Form 1099-MISC.

Rent leases prizes and awards hotel payments recognize which boxes to report attorney and settlement payments decode what damages payments mean for AP purposes identify the difference between box 6 and Form 1099-NEC box 1 medical service provider payments discover when the reporting does not always follow the. Medical and health care payments include payments of 600 or more to each physician or other supplier or provider of medical or health care services. What can you report as medical and health care payment under form 1099.

Comparatively electronic filing is the best option. That said even with the new form-1099-NEC medical and health care payments still belong in box 6 of form-1099-MISC. Its for reflecting that business transpired expense between a business needing medical services and the person providing those services.

To enter or review the information for Form 1099-MISC Box 6 Medical and Health Care Payments follow the steps below. Select Federal Taxes top of program Select the Wages Income sub-tab. The exceptions to this requirement are as follows.

IRS Publication 1. Guide to IRS Tax 1099 MISC Form Box 5 and Box 6 January 4 2015 1099-MISC Box-5 Fishing Boat Proceeds-this is about the money proceeds as payable by the owner of the fishing boats to the each working fishing crews as individuals who can be a mate engineer or cook where earnings are based on providing a portion of the catch itself proceeds of the catch. 1545-0115 For calendar year.

In the prior years form box 11 was empty. 1099-misc form box 6. So insurance premiums to insurance companies are NOT reported here.

As background box 6 of Form 1099-MISC is typically used by institutions to report payments to medical facilities. Other forms ie 1099 K 1099 R 1099 INT 1099 DIV 1099 A deadlines for the tax year 2021 are here. File Form 1099 MISC with the recipient by January 31st 2022 e-file 1099 MISC by March 31st 2021.

But payments to physicians pharmacies and other providers of medical or health care services - are reported here. This includes cash payments made for purchasing fish for resale purposes. A verbal contract formally called an oral contract refers to an agreement between two parties thats made you guessed it verbally.

January 2022 Miscellaneous Information. PAYERS name street address city or town state or province country ZIP or foreign postal code and telephone no. Identify the Form 1099-MISCs trickiest boxes.

What Is Form 1099 Misc E File Group Professional Tax Services Software

1099 Misc Box 6 What You Need To Know Fundsnet

How To Read 2020 Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

Form 1099 Requirements Deadlines And Penalties Efile360

1099 Misc Box 6 What You Need To Know Fundsnet

Form 1099 Misc 2020 Instructions 1099 Forms Zrivo

1099 Misc Box 6 What You Need To Know Fundsnet

1099 Misc 2018 Public Documents 1099 Pro Wiki

1099 Misc Instructions Irs Form 1099 Misc 1099 Misc Contractor

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

1099 Misc 2020 Public Documents 1099 Pro Wiki

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

1099 Misc 2019 Public Documents 1099 Pro Wiki

No comments:

Post a Comment