What is section 125 in box 14. What is D and DD on W2.

Nars Goulue Mini Blush New Travel Size Travel Size Products Nars Nars Makeup Blush

Contributions to your 403b plan.

What is d and dd on my w2. Box 12 amounts with the code DD signify the total cost of what you and your employer paid for your employer-sponsored health coverage plan. What does DD mean on w2. Is code DD on w2 deductible.

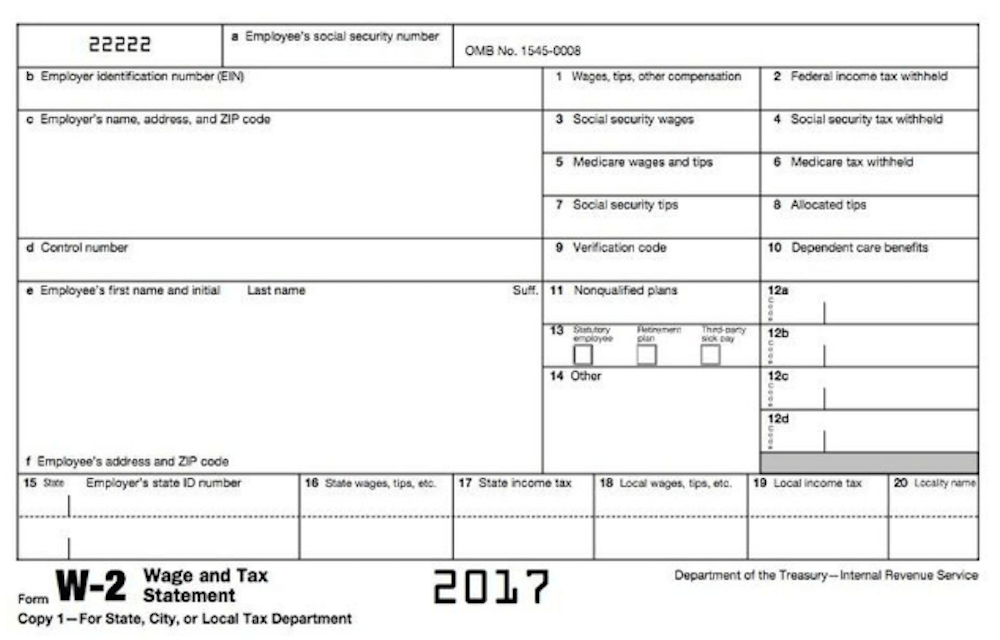

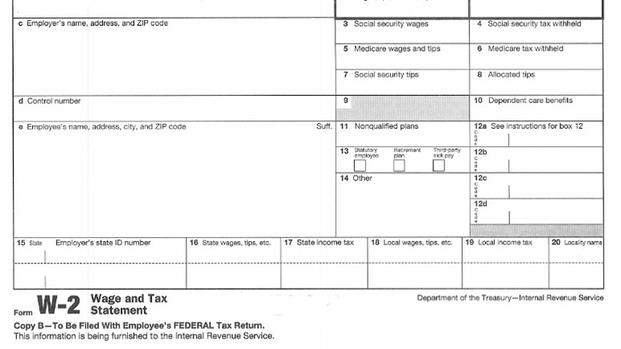

The two most commonly seen codes are D and DD. On the W-2 form box 12 has a number of sub-categories ranging from A to HH. What do the letter codes in box 12 of my W-2 mean.

What is Box 12d D on W2. Regarding this is code DD on w2 deductible. The amount shown on your W-2 Box 12 using Code DD represents the of the cost of pre-tax employer-sponsored health coverage and is for your information only.

The Box D Control Number is a code that uniquely identifies your particular W-2 document in your. The amount reported with Code DD is not taxable but neither can it be claimed as a tax deduction medical expense by an individual taxpayer. I began seeing it last year.

This amount doesnt apply to contributions under a tax-exempt organization Section 457b plan. You may have noticed Section 12 of your W2 contains alphabetic codes and amounts. The amount reported with Code DD is not taxable but neither can it be claimed as a tax deduction medical expense by an individual taxpayer.

Contributions to your 401k plan. It is usually located below or near the Employers Name and Address. Some of the most common ones are Code D for contributions to a 401k plan and Code DD for the cost of employer-sponsored health care.

See Other Taxes in the Form 1040 Instructions. EE Designated Roth contributions under a governmental Section 457b plan. Code D is the amount of salary deferrals to a 401k plan.

You do nothing with than either other than enter it on the W-2 screen in box 12 just like it is on the paper W-2. Contributions to your 401k plan. The amount reported with Code DD isnt taxable.

This amount is reported for informational purposes only and is NOT taxable. Most employees only see a few codes in Box 12. Can you claim Box 12 dd.

Code DD is only information to you to tell you how much your employer spend for health coverage you do nothing with it. The amount reported with Code DD is not taxable but neither can it be claimed as a tax deduction medical expense by an individual taxpayer. The amount shown on your W-2 Box 12 using Code DD represents the of the cost of pre-tax employer-sponsored health coverage and is for your information only.

Code DD is only information to you to tell you how much your employer spend for health coverage you do nothing with it. The total listed could. What are boxes D and DD on w2.

What is D and DD on W-2. The amount shown on your W-2 Box 12 using Code DD represents the of the cost of pre-tax employer-sponsored health coverage and is for your information only. Contributions to your 401k plan.

Cost of employer-sponsored health coverage. DD Cost of employer-sponsored health coverage. Form W-2 wage statement Box D is called the Control Number field.

Code DD is a more recently established and utilized code. It is included in Box 12 in order to provide comparable consumer information on the. The amount reported with Code DD is not taxable but neither can it be claimed as a tax deduction medical expense by an individual taxpayer.

The following list explains the codes shown in Box 12 of Form W-2. Which W2 box is health insurance premiums. If your Box 12 has any strange codes or you dont know why your employer reported certain amounts check with your payroll department.

Uncollected social security or RRTA tax on tips. Code D is the amount you have contributed to a retirement plan such as a 401K. Many employers are required to report the cost of an employees health care benefits in Box 12 of Form W-2 using Code DD to identify the amount.

You do nothing with than either other than enter it on the W-2 screen in box 12 just like it is on the paper W-2. Each W-2 Form box 12 code is either a single or double letter code. What does DD mean on W2 in Box 12.

Cost of employer-sponsored health coverage. Health Insurance Cost on W-2 Code DD Many employers are required to report the cost of an employees health care benefits in Box 12 of Form W-2 using Code DD to identify the amount. The amount reported with Code DD is not taxable but neither can it be claimed as a tax deduction medical expense by an individual taxpayer.

However if any amount is gross income its already included in W-2 Box 1. Most employees only see a few codes in Box 12. The DD code is not only what your employer payed for your health insurance plan but it includes your share your premium payments as well as the IRS points out.

Where is Box D on w2. Code D is the amount of salary deferrals to a 401k plan. What does DD mean on w2.

You may need this information to complete the tax return. What does D and DD stand for on w2. This amount is reported for informational purposes only and is NOT taxable.

The amount shown on your W-2 Box 12 using Code DD represents the of the cost of pre-tax employer-sponsored health coverage and is for your information only. Code DD is only information to you to tell you how much your employer spend for health coverage - you do nothing with it. Code DD amounts are for informational purposes only they dont affect the numbers in your tax return.

What is DD in box 14 on w2. The amount shown on your W-2 Box 12 using Code DD represents the of the cost of pre-tax employer-sponsored health coverage and is for your information only. Health Insurance Cost on W-2 - Code DD.

Cost of employer-sponsored health coverage. What is Included in the W2 DD code total. Code D is the amount of salary deferrals to a 401k plan.

Long story short the W-2 box 12 codes provide more information and determine if the amount is income. Include this tax on Form 1040.

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Understanding Your W 2 Controller S Office

How To Read Your Form W 2 Taxgirl

How To Read Your Military W 2 Military Com

Learn How To Draw Realistic Bricks Or Create A Realistic Brick Texture Using Co Interior Design Sketches Architecture Drawing Sketchbooks Architecture Drawing

Wage Tax Statement Form W 2 What Is It Do You Need It

Fear Of Failure Essay Essay Narrative Essay Photo Essay

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

The Cost Of Health Care Insurance Taxes And Your W 2

Upcycled Packaging Recycle Design Clever Packaging Upcycle

No comments:

Post a Comment