How Does a Tax Treaty Work. Form W-8BEN or if.

5 Us Tax Documents Every International Student Should Know

For instructions and the latest information.

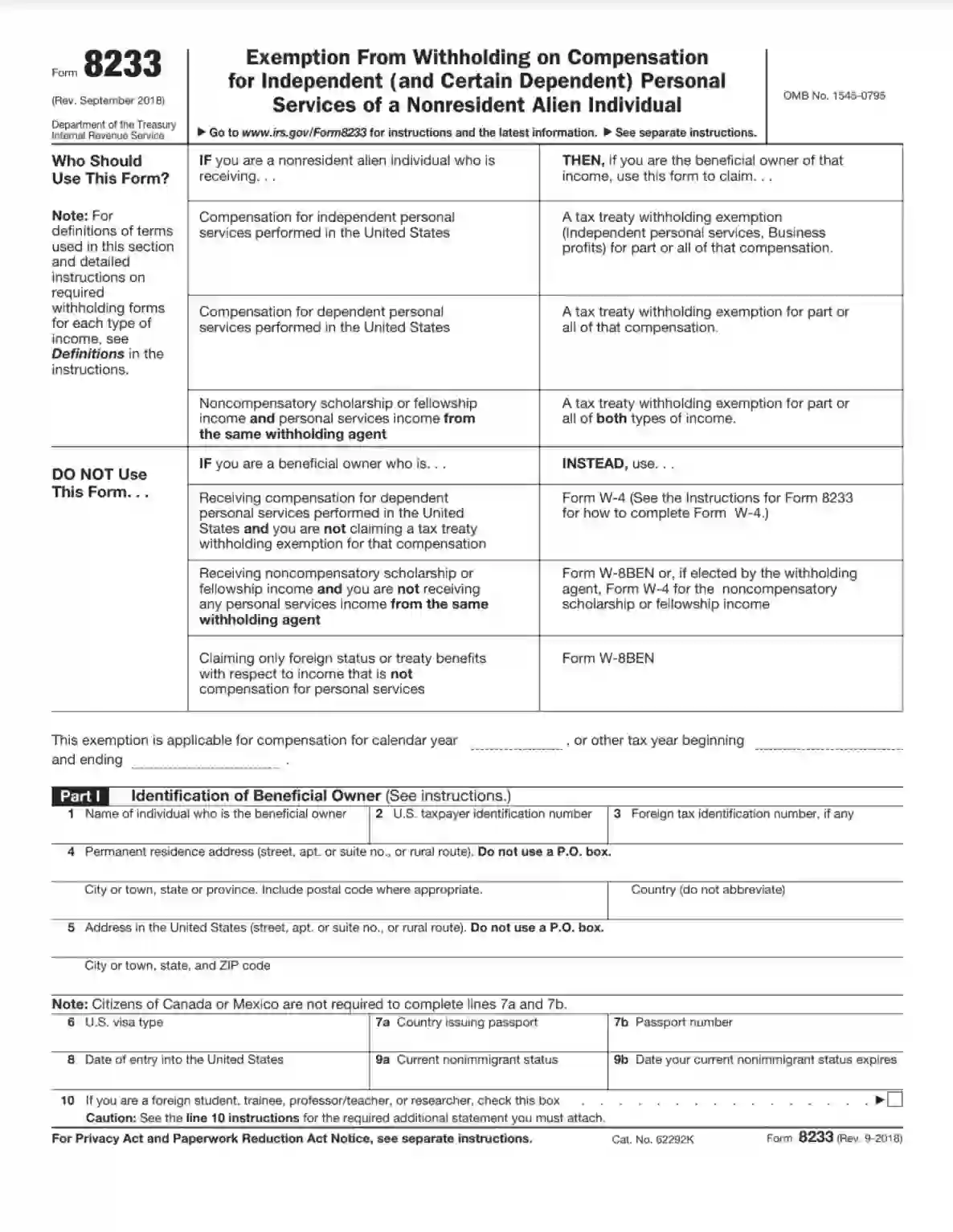

Form 8233 or form w-4. Any personal services income from the same. Fellowship income and you are not receiving. Form instructions are also available.

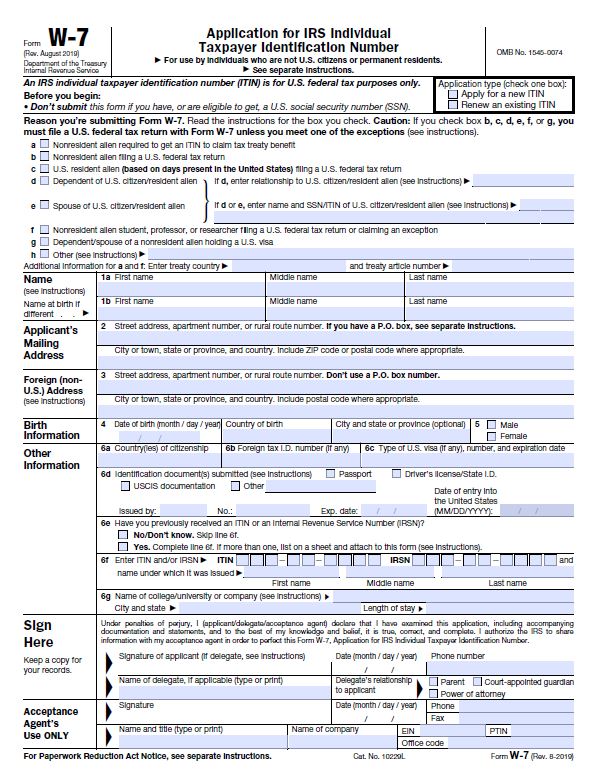

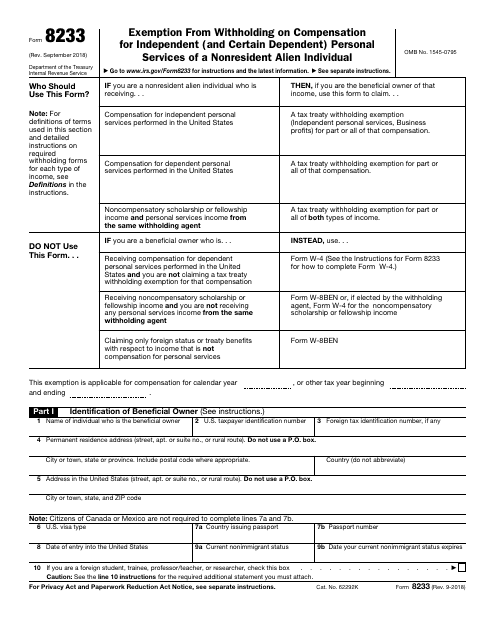

Every J1 participant must complete this form when they start working. Do not use a PO. Form 8233 Exemption from Withholding on Compensation for Independent and Certain Dependent Personal Services of a Nonresident Alien Individual Form 8233 is used to claim a tax treaty exemption for compensation payments.

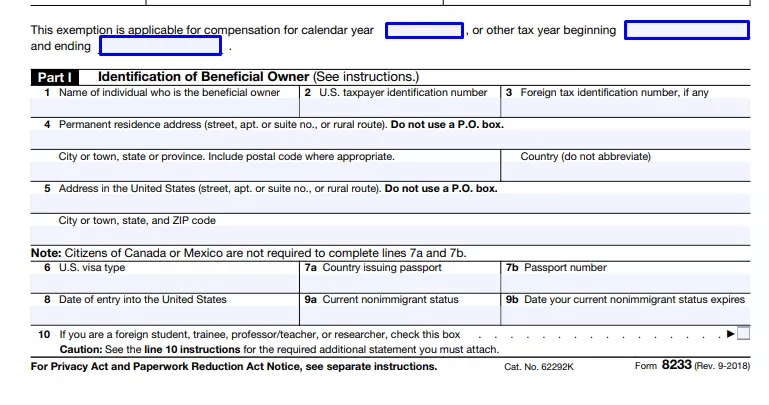

IRS Form 8233 Exemption From Withholding on Compensation for Independent and Certain Dependent Personal Services of a Nonresident Alien Individual is available on the IRS Web site as a fill-in PDF form. For how to complete Form W-4 Receiving noncompensatory scholarship or. Identification of Beneficial Owner See instructions 1 Name of individual who is the beneficial owner 2 US.

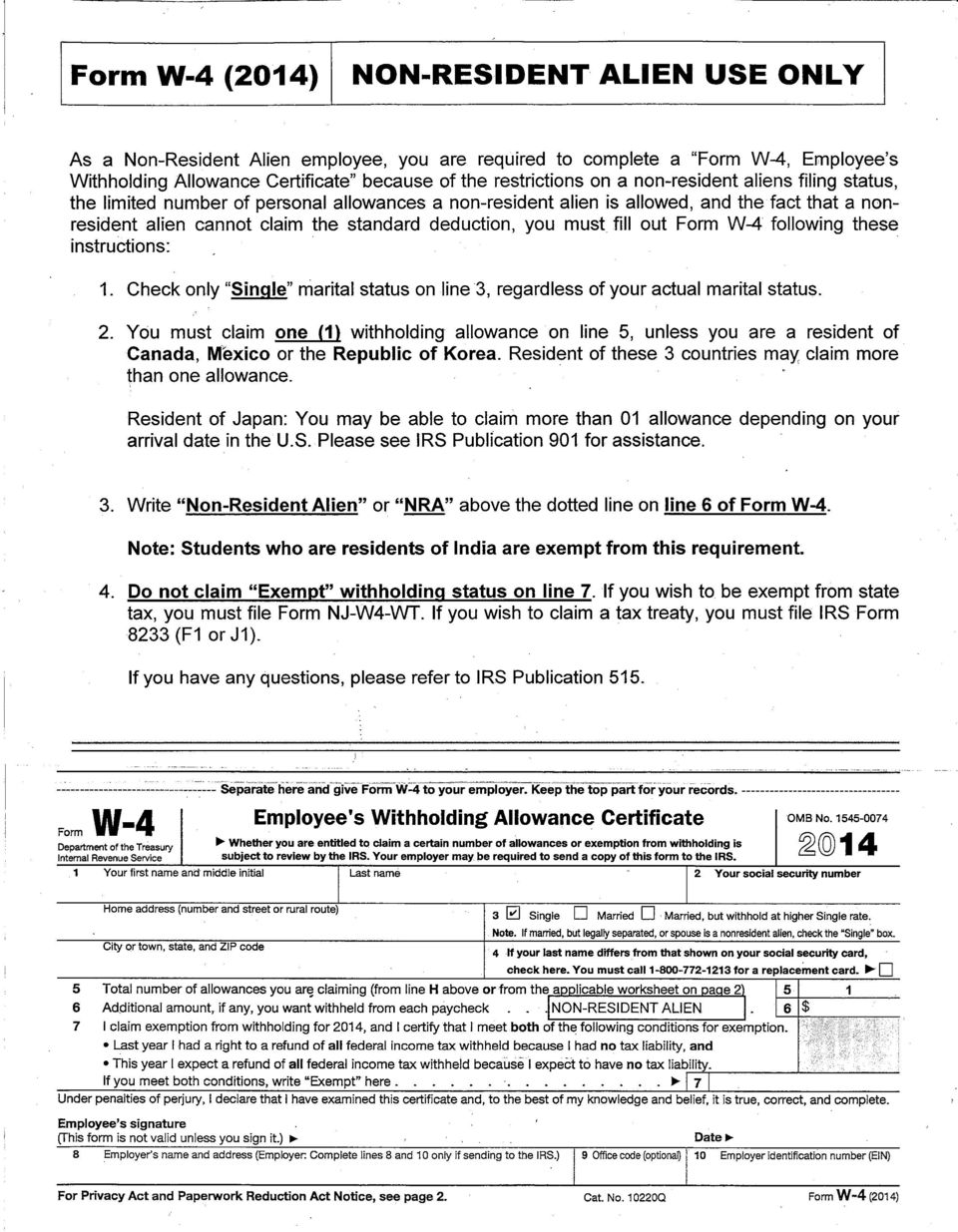

Use Form W-4 Employees Withholding Allowance Certificate to claim the personal exemption amount. This includes forms W-4 8233 W-8BEN and more. These forms may include the Form 8233 8233 attachment Form W-8BEN Form W-9 W-4 and MI-W4.

Daily personal exemption amount. Taxpayer identifying number 3 Foreign tax identifying number if any optional 4 Permanent residence address street apt. The form must be reviewed signed and submitted to the IRS.

You should For any part of this compensatory agent. September 2018 Department of the Treasury Internal Revenue Service. Has tax treaties with multiple countries.

And remember Sprintax Formsformerly Sprintax TDS helps J1 participants to complete their Form 8233 easily online. Form W-4 See the Instructions for Form 8233 for how to complete Form W-4 Receiving noncompensatory scholarship or fellowship income and you are not receiving any personal services income from the same withholding agent Form W-8BEN or if elected by the withholding agent Form W-4 for the noncompensatory scholarship or fellowship income. Yes just submit the Form 8233 without Form W-4.

Under these treaties residents of foreign countries who receive. Form 8233 is an IRS-issued form filed by a non-resident alien NRA employee. Employees Witholding Certificate W-4 The latter option still asks me whether I am a Nonresident Alien and completes the Form W-4 whereas the first one takes me to Form 8233 and asks me for the US.

If you arent claiming such an exemption W-4 is the way to go. A letter or statement describing your eligibility for the tax treaty exemption See IRS Pub 519 Appendix A B a copy of your most recent Form I-20 DS-2019 or I-797. Tions for amounts paid to an employee.

And your home country. In order to apply for tax treaty benefits you must complete Form 8233 correctly and attach. Therefore complete Form 8233 for this income if you are claiming a tax treaty withholding exemption for part or all of that income.

Instead complete Form 8233 Exemption from Withholding on Are you a nonresident alien. For any part of this compensatory income for which you are not claiming a tax treaty withholding exemption use Form W-4 or the Tax Withholding Estimator at IRSgovIndividualsTax-Withholding-Estimator. Taxpayer identifying number.

When you create your Sprintax account our software will ensure you complete your W-4 correctly and that you pay the right amount of tax on your income. Many states have separate versions of their tax returns for nonresidents or part-year residents - that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year. Exemption From Withholding on Compensation for Independent and Certain Dependent Personal Services of a Nonresident Alien Individual.

The most important things for the institution to remember about Form 8233 are. Form I-9 Form W-4 Form 8233 Social Security Number Individual Taxpayer Identification Number ITIN Foreign National Information Form Windstar. A copy of your most recent I-94 record.

For definitions of terms used in this section and detailed instructions on required withholding forms for each type of income see on pages 1 and 2 of 9a 9b. How to Submit Form 8233. Form 8233 is a Federal Individual Income Tax form.

If you have received a payment from the University of Michigan but have not yet been contacted by the Payroll Office please email taxpayrollumichedu with your UMID for login access to FNIS. Form W-4 See the Instructions for Form 8233. The withholding agent may be an.

If you paid any estimated taxes you can include those amounts on your 1040NR 0. What Is Form 8233. By filing Form 8233 they are looking to claim an exemption from Federal Income Tax Withholding FITW based on a tax treaty.

The purpose of this form is to determine how much tax should be withheld from your income. Exemption use Form W-4 Employees Do not complete Form 8233 to claim the disburse or make payments of an amount Withholding Allowance Certificate. Independent personal services complete claimed on the Form W-4 for the fellowship income that is not Form 8233 to claim a tax treaty highest-paying job and zero allowances compensatory scholarship or fellowship withholding exemption for part or all of are claimed on the others.

He should fill out and submit another W-4 when he gets his LPR card because then his employer will start deducting social security and medicare taxes on the same basis as. Form 8233 is used to obtain certain exemptions from tax withholding based on the tax treaty between the US. For services in 2 above use Form 8233 only to claim a tax treaty exemption for any part of your compensation that is exempt from withholding.

Form 8233 is valid for the entire tax year after it is given to the employee. Subject to withholding is a withholding Completing Form W-4. Above use Form 8233 to claim a tax treaty exemption andor the personal exemption amount.

Treaty withholding exemption do not complete Form W-4. Form W-4 See page 2 of the Instructions for Form 8233 for how to complete Form W-4 Form W-8BEN or if elected by the withholding agent Form W-4 for the noncompensatory scholarship or fellowship income Note. Or suite no or rural route.

Place the original forms in the persons file. Its very important that this form is completed correctly.

Form 8233 Line 10 Instructions

Irs Form 8233 Fill Out Printable Pdf Forms Online

5 Us Tax Documents Every International Student Should Know

Form 8233 Line 10 Instructions

2018 2022 Form Irs 8233 Fill Online Printable Fillable Blank Pdffiller

Form 8233 Rev December 2001 Pps University Of California

Irs Form 8233 Exemption From Federal Tax Withholding

Form 8233 Line 10 Instructions

Irs Form 8233 Fill Out Printable Pdf Forms Online

No comments:

Post a Comment