You can determine the value of your adjusted gross income from different lines on various forms. Employees Social Security number.

Update untaxed income reported on both your tax return and your W-2 form.

W2 form line 8b. Where do I find line 8b on my w2. Report Inappropriate Content. I didnt calculate the items using form 2555 or 2555-EZ.

How To Find AGI On W2. What line on taxes is adjusted gross income. Enter the number of returns you are ordering in line 8b.

What is DD on w2. Line 37 is your Adjusted Gross Income which for 2019 is line 8b. Many employers are required to report the cost of an employees health care benefits in Box 12 of Form W-2 using Code DD to identify the amount.

This is the part most people think of regarding an IRS W-2 form. If part of your benefits are taxable for 2002 and they include benefits paid in 2002 that were for an earlier year you may be able. I went back to a 2016 1040 form to figure out what they want.

What does Box 3 on W-2 include. For the tax year 2020 check the line 8b on the form 1040. If you want Form W-2 explained dive into each boxs purpose below.

The IRS uses W-2s to track employment income youve earned during the prior year. Line 9 columns d e g and h are calculated when you add Form 8949 and have Radio Button E is checked on Form 8949. On your 2019 return you can find your AGI on Line 8b of IRS Form 1040 or Line 35 of IRS Form 1040NR.

Attach Form 8995 or Form 8995-A. For the tax year 2020 check the line 8b on form 1040-SR. 10 Qualified business income deduction.

Your personal and employer information This type of W2 form information includes tax identification numbers addresses etc. Enter the smaller of line 9 or line 10 12. The transcript will contain the Adjusted Gross Income that can then be entered in the current year return.

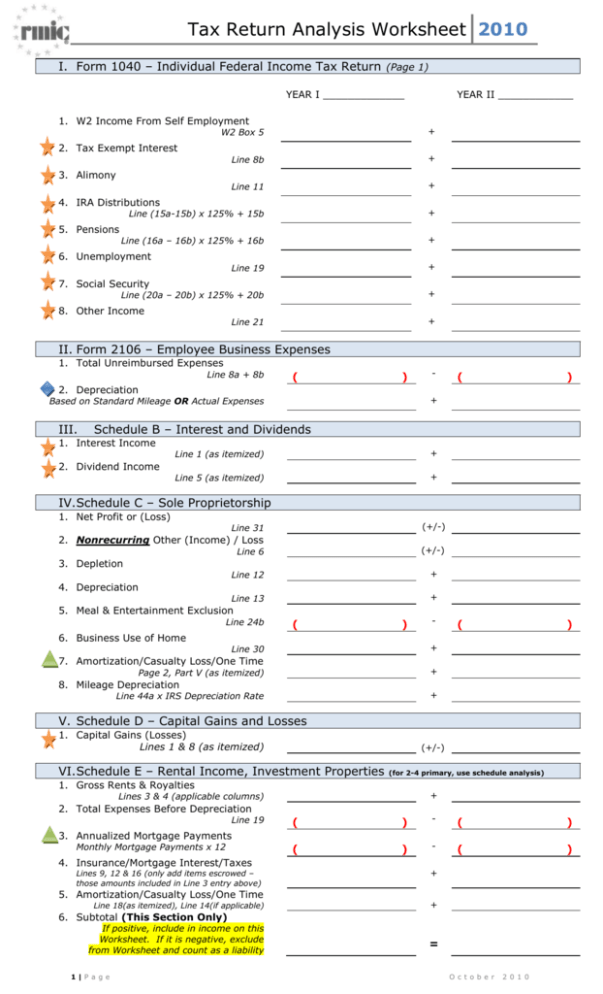

Update Income tax PAID. 1040 - line 56 minus line 46 or 1040A - line 28 minus line 36 1040EZ - line 10. If you and your spouse filed separate tax returns calculate your total AGI by adding line 8b.

The line 8b of Form 1040 should be used to report exemptions and deductions from this income. Line 37 is your Adjusted Gross Income which for 2019 is line 8b. If zero or less enter -0- 11b For Disclosure Privacy Act and Paperwork Reduction Act Notice see separate instructions.

Social Security numbers are nine digits that are formatted like XXX-XX-XXXX. Subtract line 8 from line 7 11. County Tax Withheld on W2 8C.

8b would be the line that would show your Tax exempt interest which for 2019 form would be line 2a. Your Form W-2 should be sent by January 31st of each year and be used to prepare your tax return. You can find your AGI on Box No 1 of your W2 this income is a combination of your Wages Tips Compensation and also addition of boxes of 2 to 14.

Multiply line 8b by 50 and enter the result in line 8c. On a Form 1040 your AGI will be on Line 37. Box A shows your employees Social Security number.

Subtract line 10 from line 9. This form has various versions. You can find your AGI-Adjusted Gross Income on Form 1040-page 1.

If your employee applied for a Social Security card and has not received it dont leave the box blank. Question 45 student or Question 94. Update earned income from wages as reported on your W2 forms.

Once you find your AGI use our stimulus calculator to. On a Form 1040EZ your AGI will be on Line 4. If you and your spouse filed separate tax returns calculate your total AGI by adding line 8b from both tax returns and entering the total amount.

Money and taxes related to your wages This includes your actual income federal income taxes Social Security and Medicare taxes. If you used a paid preparer last year you might obtain a copy of last years tax return from that preparer. 10 11a Add lines 9 and 10 11a b Taxable income.

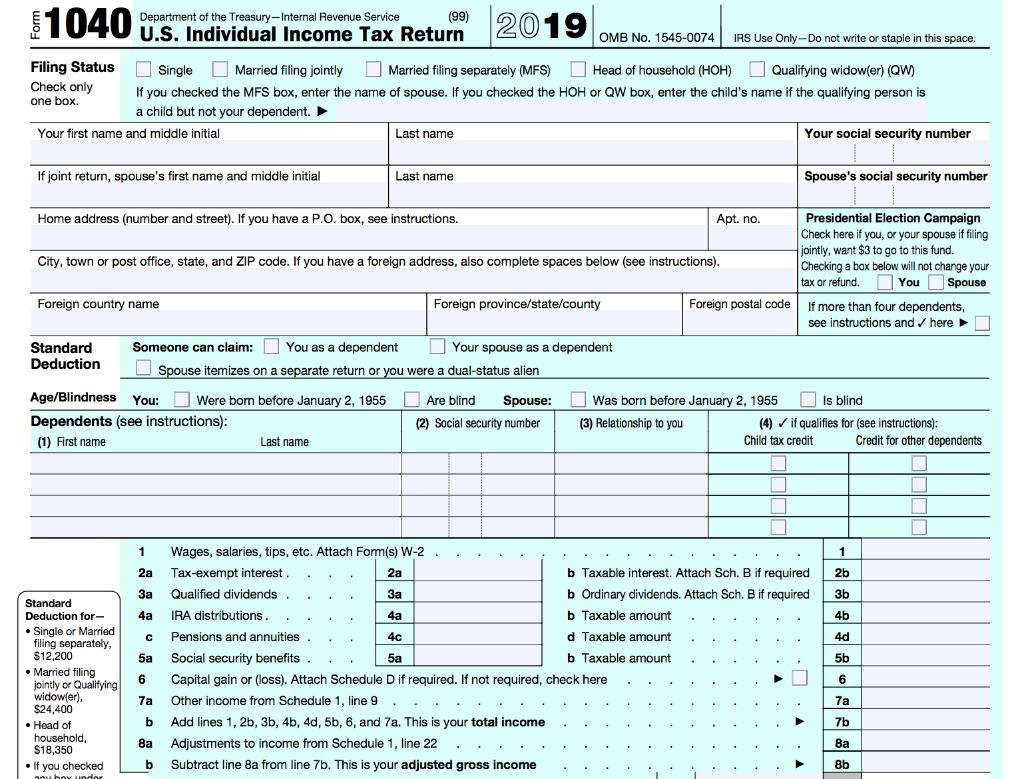

In the United States form 1040 is used for federal income tax returns. The Adjusted Gross Income can be found on line 8b of the 2019 1040 Form. 11320B Form 1040 2019.

This line will total amounts from all copies of completed 8949 forms. 8b would be the line that would show your Tax exempt interest which for 2019 form would be line 2a. Question 37 student or Question 86 parent.

On a Form 1040A your AGI will be on Line 21. Subtract line 11a from line 8b. Form W-2 provides important tax information from your employer related to earnings tax withholding benefits and more.

If zero or less enter -0- 11. On your 2019 tax return your AGI is on line 8b of the Form 1040. Enter the amount if any from Form 1040A line 8b 4.

Where Is Your Adjusted Gross Income On From 1040. So please do not add boxes 2-14 to box 1 of your w2 once again. The IRS has formulated a set of special rules wherein the elements such as seller-financed mortgages nominees accrued interest from bonds Original Issue Discount OID and Amortizable Bond Premium need to be reported quite differently as per the special rules.

This is the total cost of ordering copies of your tax returns with all attachments including W-2s. If you filed a tax return or if married you and your spouse filed a joint tax return the AGI can be found on IRS Form 1040Line 8b. Mental Health Tax withheld on W2 Total gross wages per W2 form including deferred compensation Total amount of wages earned outside Boone County Line 3 Line 4 Line 6 005 Line 6 008 verify annual cap amount Line 60015 not to exceed 2500 7C.

School Board Tax Withheld on W2 8B. Line 8b columns d e g and h are calculated when you add Form 8949 and have Radio Button D is checked on Form 8949. If you do not have access to the 2020 return you can Request a Transcript of your return on the IRS website.

If you filed a tax return or if married you and your spouse filed a joint tax return the AGI can be found on IRS Form 1040Line 8b. On your 2019 tax return your AGI is on line 8b of the Form 1040. Calculate the fee in line 8 for form 4506.

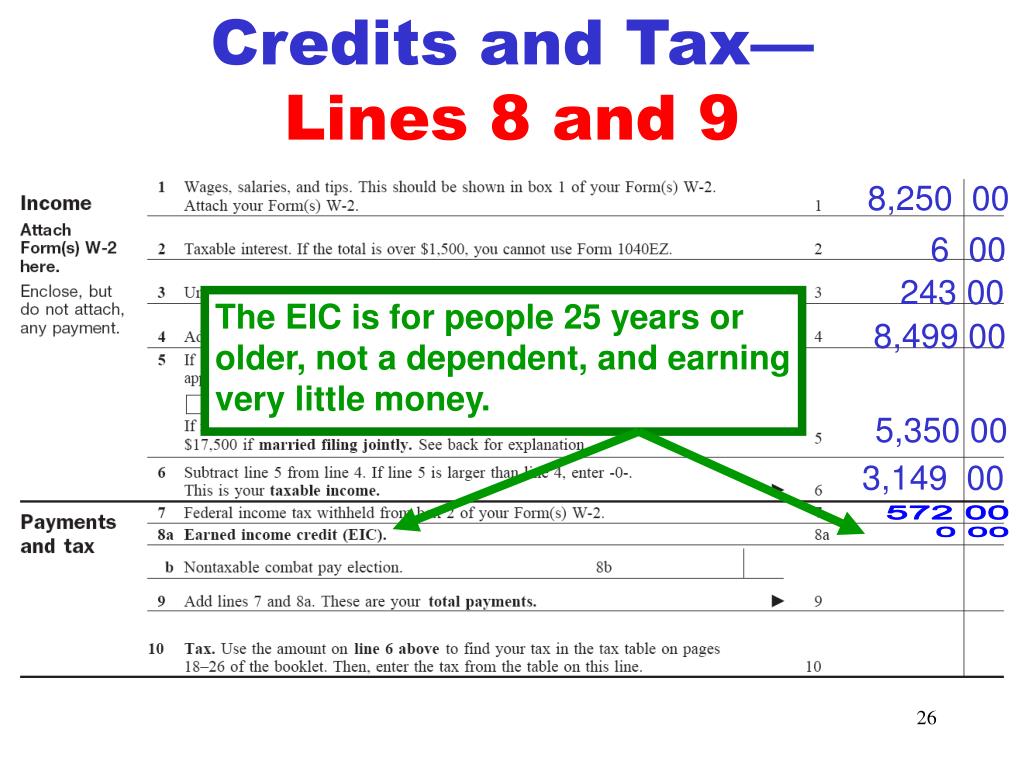

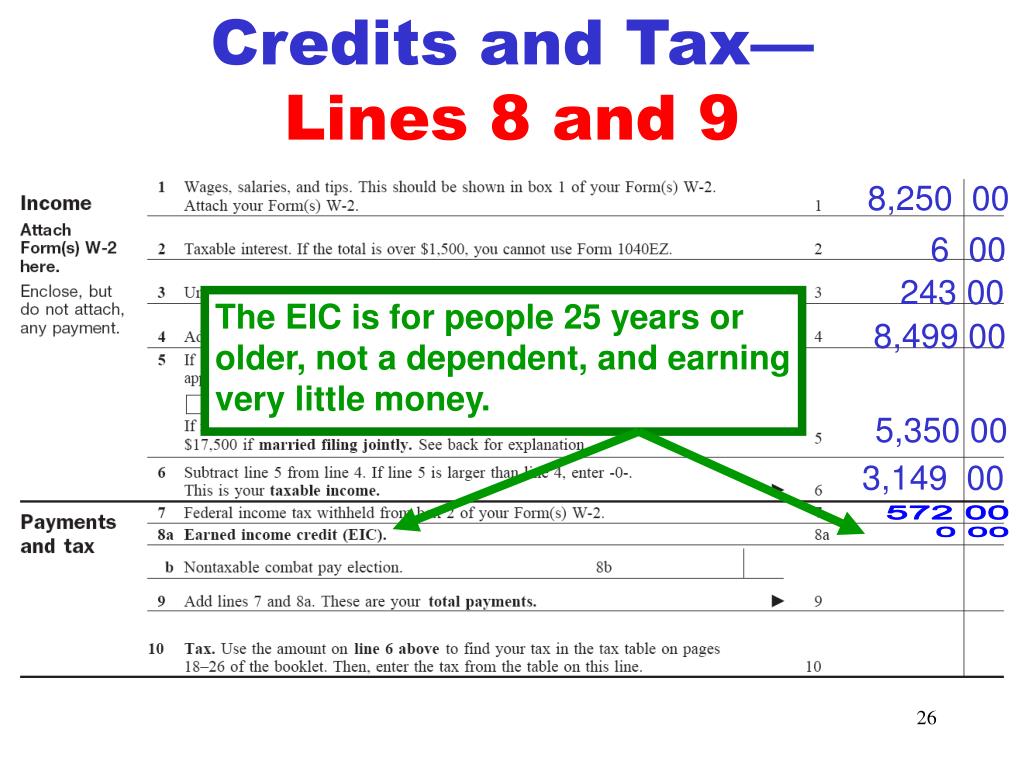

Understanding Taxes Simulation Completing A Tax Return As A Dependent

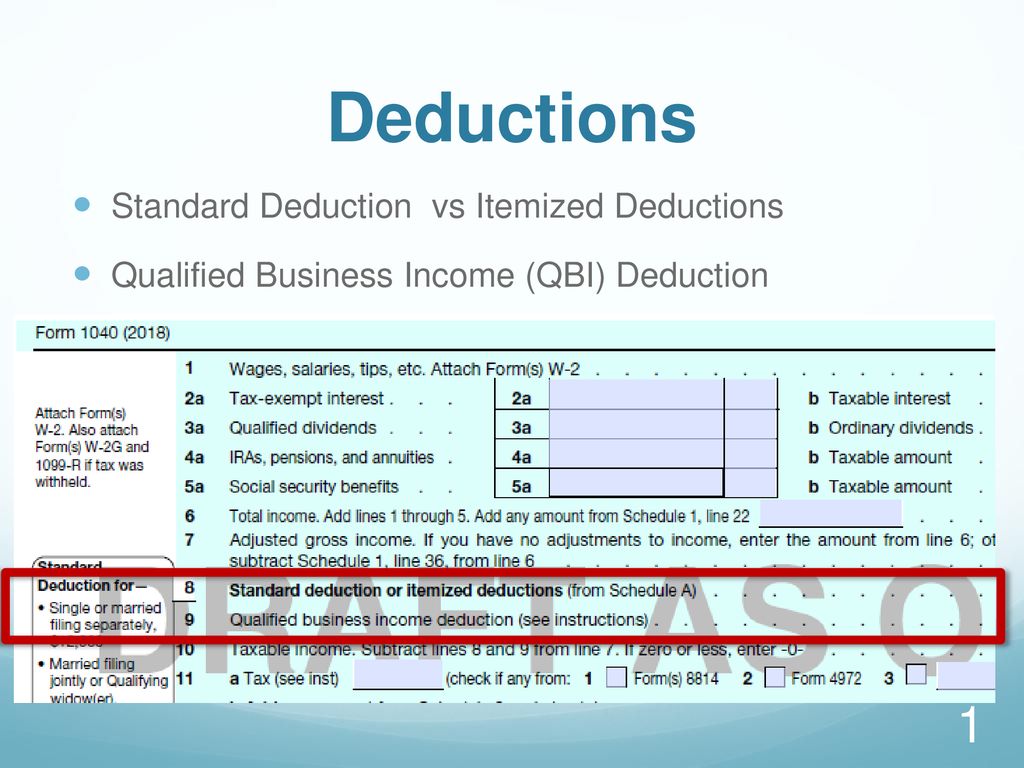

Deductions Standard Deduction Vs Itemized Deductions Ppt Download

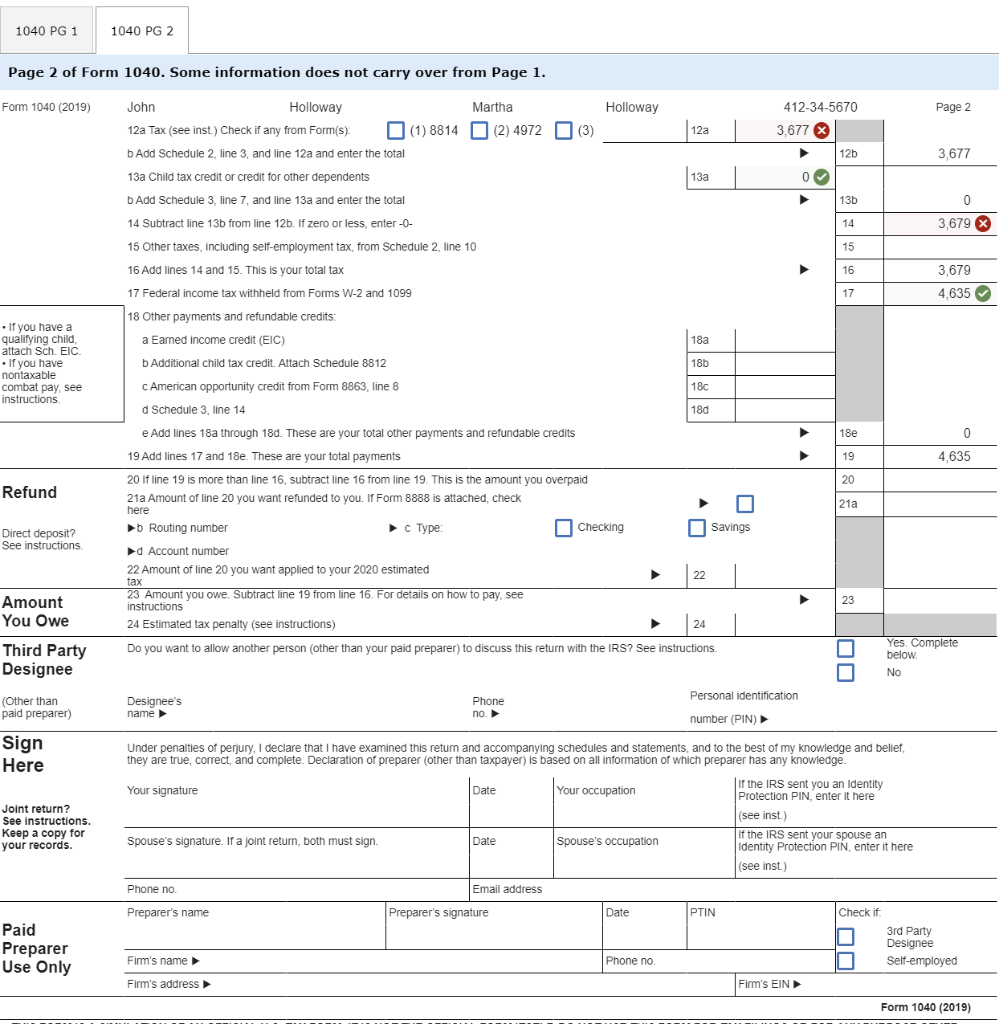

Solved John And Martha Holloway Are Married Filing Jointly Chegg Com

Magi Modified Adjusted Gross Income Exact Legal Definition

Solved Complete Page 1 Through Line 8b Of Form 1040 For Chegg Com

What Were Your Total Untaxed Portions Of Ira Distributions Federal Student Aid

Understanding Taxes Simulation Completing A Tax Return Using Married Filing Separately Filing Status

What Were Your Total Untaxed Portions Of Ira Distributions Federal Student Aid

Ppt How To Fill Out A Tax Return Powerpoint Presentation Free Download Id 4506162

No comments:

Post a Comment