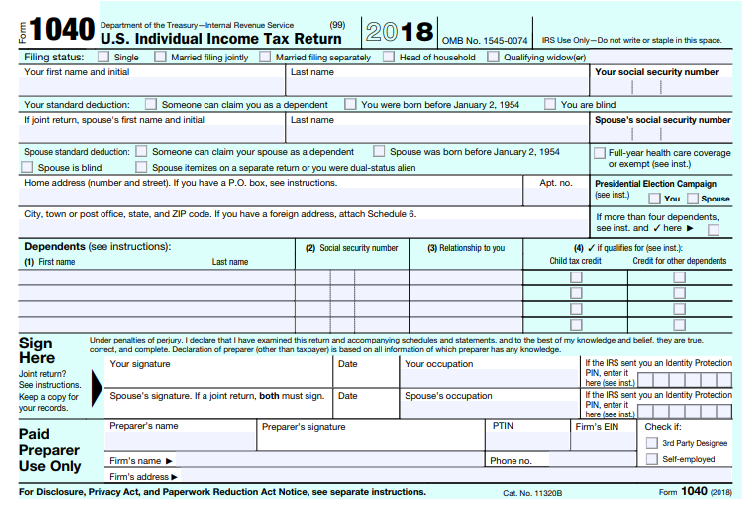

The form contains sections that require taxpayers to disclose. At the end of the year you simply fill out Schedule C Form 1040 using your records that match the schedule line-for-line.

Meet Your New Tax Season Headache Obamacare Ways And Means Republicans

If you or someone in your family was an employee in 2021 the employer may be required to send you Form 1095-C.

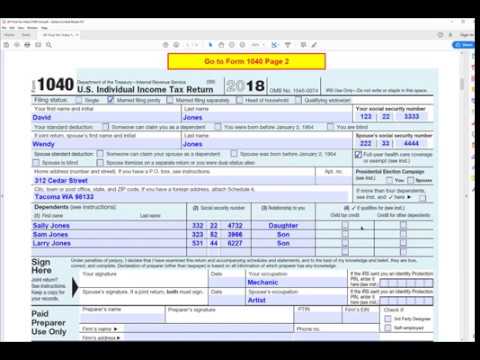

1040 form breakdown. While most taxpayers use Form 1040 to file taxes this form is also relevant for small businesses with assets under 10 million. Form 1040-EZ is a short-version tax form for annual income tax returns filed by single filers with no dependents. Reading the guide below you will not.

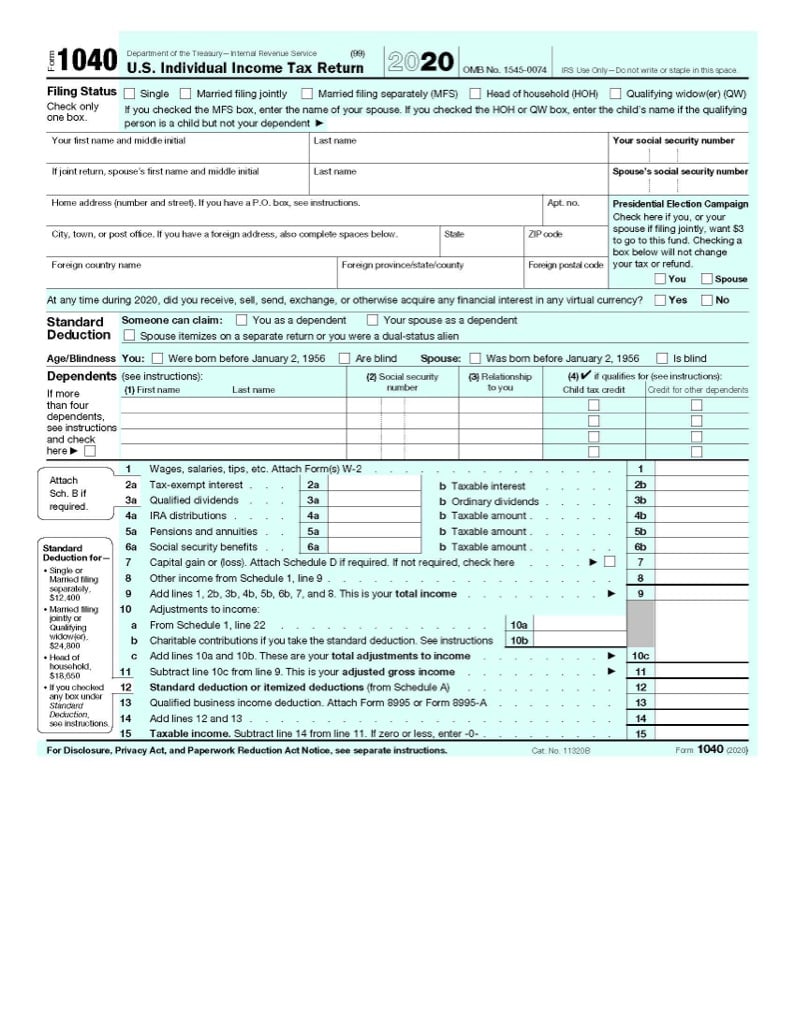

These lines need to be used to report distributions from Roth accounts and from Traditional accounts which means Lines 4a and 4b capture both. Taxable Interest Line 8a 8b Report amounts from form 1099-INT. However most taxpayers also need to fill out and attach other forms.

Include Form 8962 with your Form 1040 Form 1040-SR or Form 1040-NR. Form 1040 is the standard Internal Revenue Service IRS form that individual taxpayers use to file their annual income tax returns. A Breakdown Of The Proposed IRS 1040.

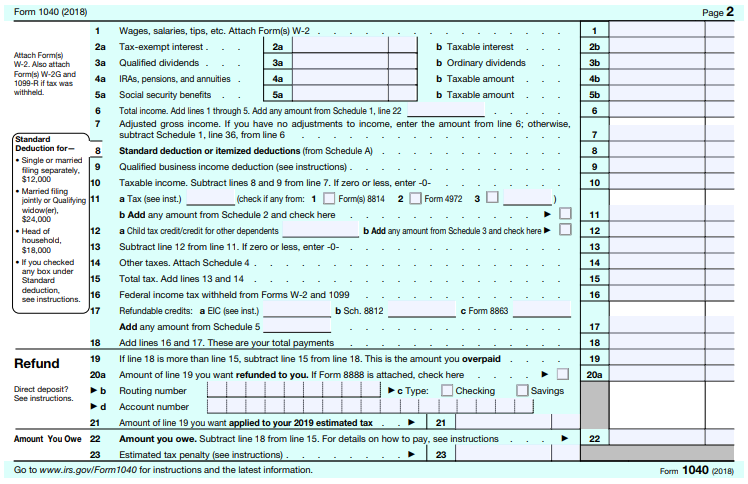

Although the administration insists that it has simplified the process of preparing your tax return a few minutes of comparing the old 1040 to the new draft version shows that the redesign did little more than change it from the previous two-page form to two half-size pages with six schedules. This book covers the most common scenarios for filling out Schedule C Form 1040. Form 1040 is the main tax form used to file a US.

Schedule 6 Taxpayers who have foreign addresses were once able to enter those addresses directly at the top of the 1040 form but under the new design that information is reserved for Schedule 6. Form 1040 is a two-page document used for annual income tax returns. All but four of the 79 lines from the old version remain on the new Internal Revenue tax.

The same form will be used to enter the contact information of any third party whom the IRS should reach out to if they have questions about certain items on the. You can also claim certain deductions and credits right on Form 1040 such as the recovery rebate credit which you claim if you didnt receive your 2021 coronavirus stimulus checks. If you own real estate as an investment youll need to report your income for each individual property at the end of the tax year.

The Form 1040 is a two-page form thats greatly simplified from years past because of the 2017 tax reform. Other IRS Tax Forms and Schedules Used. Schedule 6 Taxpayers who have foreign addresses were once able to enter those addresses directly at the top of the 1040 form but under the new design that information is reserved for Schedule 6.

The line for capital gains and losses has been moved from Schedule 1 to Form 1040 line 6. Written by Chuck Woodson Posted in Charles Woodson Form 1040. The same form will be used to enter the contact information of any third party whom the IRS should reach out to if they have questions about certain items on the.

Part II of Form 1095-C shows whether your employer offered you health insurance coverage and if so information about the offer. Although the administration insists that it has simplified the process of. Below you can read a set of detailed instructions that will help guide you through this complex but very useful form.

Form 1040 and its schedules. If it finds you have underreported your income you could get a CP2000 notice which tells you that you owe additional taxes. Total salary from Box 1 of W-2s.

The Form 1040 is the form that you use to file your annual tax return The IRS will match the amount in your 1099-MISC form with your 1040. The 1040 can be used by any applicant. Youll likely do this on a Schedule E form part of the IRS form 1040 that deals with supplemental income and losses.

Although Schedule E is also used for other. On the 2020 1040 these fields are instead subdivided into line 4a line 4b line 5a and line 5b. A Breakdown of your Schedule E Expense Categories.

It may take longer than any other form to fill out but this form covers many possible circumstances. The 1040 shows income deductions credits tax refunds or tax owed to the IRS. Beginning with its 2019 revision Form 1040 will have three numbered schedules Schedules 1 2 and 3 instead of six.

It answers basic questions and gives guidance for each line. The reality of the new 1040 form is a far cry from a postcard. Excludes tax-deferred 401 k contribution that shows up on W-2 taxed when withdrawn.

The same form will be used to enter the contact information of any third party whom the IRS should reach out to if they have questions about certain items on the. Form 1040 is probably the most difficult IRS form that you as a taxpayer will ever fill in. Line references to Form 1040 and its schedules have been updated to reflect the new line numbers.

Married taxpayers have two options when filing their 1040 or 1040-SR tax returns. Up your record keeping to reflect each line on Schedule C Form 1040. Don t include Form 1095-A Health Coverage Reporting.

The reality of the new 1040 form is a far cry from a postcard. The first and most frequently used filing status is married filing joint MFJ where the incomes and allowable expenses of both spouses are combined and reported on one tax return. Profit or Loss From Farming.

Form 1040 should be filed on April 15. However due to extended deadlines in 2020 this date is subject to change. Remember the IRSs promise about being able to file your income tax return using a postcard.

1040 Household Employment Taxes. Schedule 6 Taxpayers who have foreign addresses were once able to enter those addresses directly at the top of the 1040 form but under the new design that information is reserved for Schedule 6. Individual income tax return.

Income tax return filed by certain citizens or residents of the United States. Other than change the IRS 1040 from the previous two-page form to two half-size pages you will learn there are six schedules that will require separate filing. Although the administration insists that it has simplified the process of preparing your tax return a few minutes of comparing the old 1040 to the new draft version shows that the redesign did little more than change it from the previous two-page form to two half-size pages.

About Form 1040-EZ Income Tax Return for Single and Joint Filers With No Dependents Internal Revenue Service. Long-term Care Insurance Premiums in Schedule A Form 1040 Taxes You Paid Schedule A Form 1040 Interest You Paid in Schedule A Form 1040 Donations to charity in Schedule A Form 1040 Personnel expenses and other miscellaneous expenses in Schedule A Form 1040 Total itemized deduction limit for each item in Schedule A Form 1040. May be required to file Schedule B if taxable income is more than 1500 or.

The reality of the new 1040 form is a far cry from a postcard. The joint status almost always results in the lowest overall tax.

1040 For Dogs And Other Tax Forms Langer Victor 9798647534248 Amazon Com Books

How To Fill Out Irs Form 1040 For 2020 Youtube

Form 1040 U S Individual Tax Return Definition

Fill Free Fillable Irs Pdf Forms

What Is The 1040 And What S The Difference Between The 1040 1040a And 1040ez

How To Fill Out Irs Form 1040 For 2018 Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

Financial Services Platform What Is A 1040 Form

Form 1040 Instructions For Freelancers 7 Step Guide

Form 1040 1040 Sr Everything You Need To Know

Understanding Income Tax Returns White Coat Investor

Instructions For Filing The New 2018 Form 1040 Priortax Blog

Know Your Tax Forms Janus Henderson Investors

Instructions For Filing The New 2018 Form 1040 Priortax Blog

No comments:

Post a Comment