United States provide Form W-9 to the partnership to establish your US. 10231X Check appropriate box.

W9 Form Download Free W9 Form Free Fillable Forms 3428 Fillable Forms Blank Form Irs Forms

What is a W-9 Form.

U.s. government form w-9. Us Federal Government W 9 Form Irs - Usage Us Federal Government W 9 Form Irs to offer your proper Taxpayer Identification Number TIN to the individual who is required to file an info return with the IRS using Us Federal Government W 9 Form Irs. If youre asked to fill one that means your employer needs to know your Social Security number and other personal data. Print E-File - Free.

A gov website belongs to an official government organization in the United States. Person including a resident alien to provide your correct TIN to the. 10-2018 By signing the filled-out form you.

See What is backup withholding later. Owner of a disregarded entity and not the entity. It is for US.

United States provide Form W-9 to the partnership to establish your US. 10231X Form W-9 Rev. Free Federal 2017 W-9 Tax Form - Fill Out Print In 7 Minutes.

1-2003 Part I Part II Business name if different from above Cat. 2 In the cases below the following person must give Form W. In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US.

If you need to get Us Government W9 Tax Form 2022 please check the link below. See What is backup withholding later. State of Texas Fillable W9 Request for Taxpayer Identification Number and Certification is among the most typically used IRS forms.

If you do not return Form W-9 to the requester with a TIN you might be subject to backup withholding. Capitol H Streets NW Washington DC 20401 53 60 0 2 5 0 9 2 B. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it.

Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. Request Form W-9 from an account holder that is a US. Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file.

The W-9 or Request for Taxpayer Identification Number and Certification form provides a business with relevant personal information about an independent contractor IC or freelancer for tax purposes in the United States. Person Date Purpose of Form Form W-9 Rev. Create Federal W-9 Tax Form With Easy Online Tool.

Form Ca7uscourtsgov Show details. Us Government W9 Tax Form 2022 A W-9 form is a tax return from the IRS called the Request for Taxpayer Identification Number and Certification. W-9 tax form is a document required by the Internal Revenue Service.

Use Form W-9 only if you are a US. 10-2018 Page 2 Form W-9 Rev. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States is in the following cases.

Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS. The form asks for information such as the ICs name address social security number SSN and more. Us Federal Government W 9 Form Irs - Usage Us Federal Government W 9 Form Irs to provide your appropriate Taxpayer Identification Number TIN to the person who is required to submit an information return with the IRS using Us Federal Government W 9 Form Irs.

We last updated Federal W-9 in April 2021 from the Federal Internal Revenue Service. Make a Payment. Secure gov websites use HTTPS A lock A locked.

In the cases below the following person must give Form W-9 to the partnership. Form W9 Request For Taxpayer United States Court. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States is in the.

10-2018 US Government Publishing Office US Federal Government N. People or resident aliens who freelance or work as independent professionals. Instructions for the Requestor of Form W-9 Request for Taxpayer Identification Number and Certification 1018 10292018 Form W-9 SP Solicitud y Certificacion del Numero de Identificacion del Contribuyente 1018 11072018 Inst W-9 SP.

Finished a Form W-9 assuming that you have actually This entry was posted in W9 on September 13 2021 by tamar. If an account is jointly held the PFFI should request a Form W-9 from each holder that is a US. Status and avoid section 1446 withholding on your share of partnership income.

If you do not return Form W-9 to the requester with a TIN you might be subject to backup withholding. It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. 1 hours ago Form W-9 Rev.

8-2013 Form W-9 Rev. Under penalties of perjury I certify that. Person that is a partner in a partnership conducting a trade or business in the United States provide Form W-9 to the partnership to establish your US.

9 form 2020 free printable form 2018 blank w9 form free fillable 2020 w-9 freewebarcade government forms printable irs w9 form 2021 printable pdf w-9 form 2021 fillable free webarcade This entry was posted in W9 on October 13 2021 by tamar. This info goes to IRS so the government knows how much money you make annually. 1-2011 Page 2 The person who gives Form W-9 to the partnership for purposes of establishing its US.

Status and avoid section 1446 withholding on your share of partnership income. 1-2011 Page 2 The person who gives Form W-9 to the partnership for purposes of establishing its US. Advise foreign persons to use the appropriate Form W-8 or Form 8233 Exemption From Withholding on Compensation for.

Certify that the TIN you are giving is correct or you are waiting for a number to be issued 2. Where is My Refund. Department of the Treasury Share This Page.

Status and avoid section 1446 withholding on your share of partnership income.

Faq 039 S On Form W9 W 9 Forms Intended For 2021 W9 Form In 2021 Irs Personal Calendar Getting Things Done

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

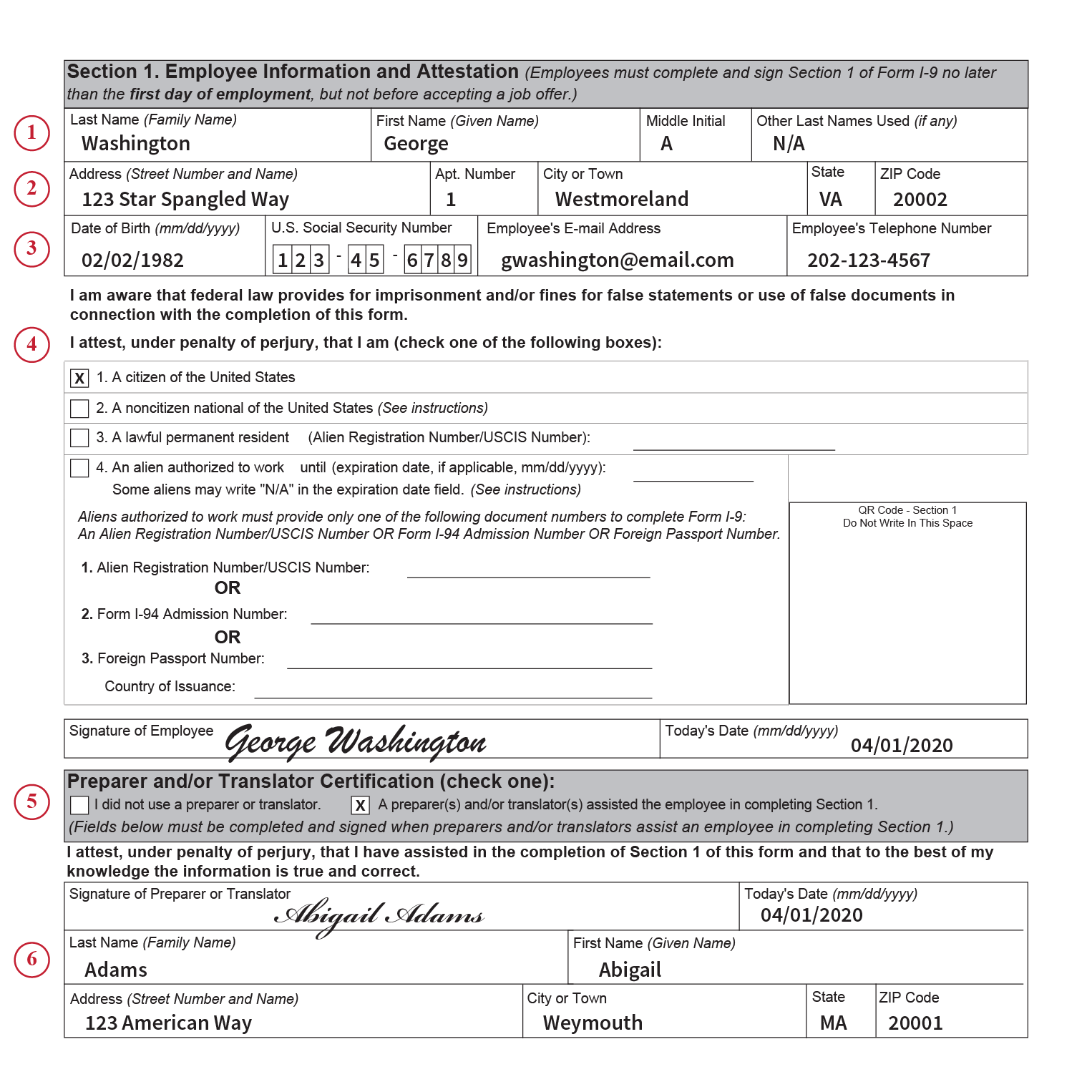

3 0 Completing Section 1 Of Form I 9 Uscis

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form

Downloadable Form W 9 Printable W9 Printable Pages Fillable Forms Blank Form Irs Forms

Do Llcs Get 1099 S During Tax Time Fundsnet

/w-9_118877047-5bfc344146e0fb00517d8bd0.jpg)

What Is A W 9 Form And How Is It Used A Guide

W9 Form 2021 W 9 Forms With Regard To 2021 Blank W 9 Form In 2021 Calendar Template Personal Calendar I 9 Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

W 9 Wire Transfer Instructions Zoom Support

What Is A W 9 Form And How Is It Used A Guide

Completed W 12 Form Example 12 Mind Blowing Reasons Why Completed W 12 Form Example Is Using Employee Tax Forms Form Example Irs Forms

No comments:

Post a Comment