May 17th is the filing deadline for organizations whose Calendar tax year ended on December 31 2021. Form W4 is typically filled by employees once they begin a new job.

That is the absolute last day to send out W-2s.

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

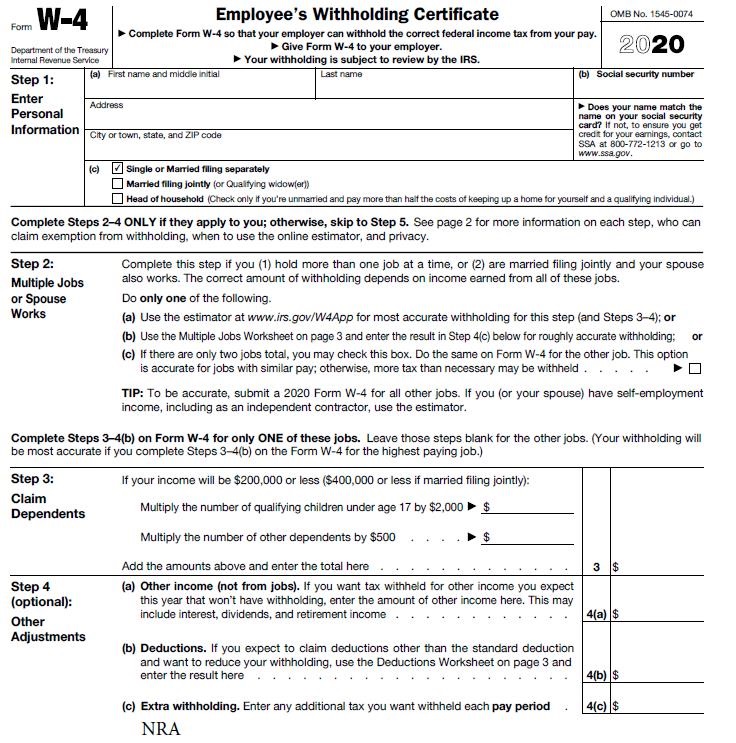

W4 form deadline. However employees need to fill out the form again anytime if their financial situation changes. The 2021 Form W-4P can continue to be used until that time. IRS IRS Guidance Defined Contribution Plan.

Note also that the deadline for filing calendar year 2019 Forms W-2 by these employers is January 31 2020. The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday April 18 2022 for most taxpayers. The penalty is increased to 110 per W-2 filed late if it wasnt filed within 30 days after the initial deadline.

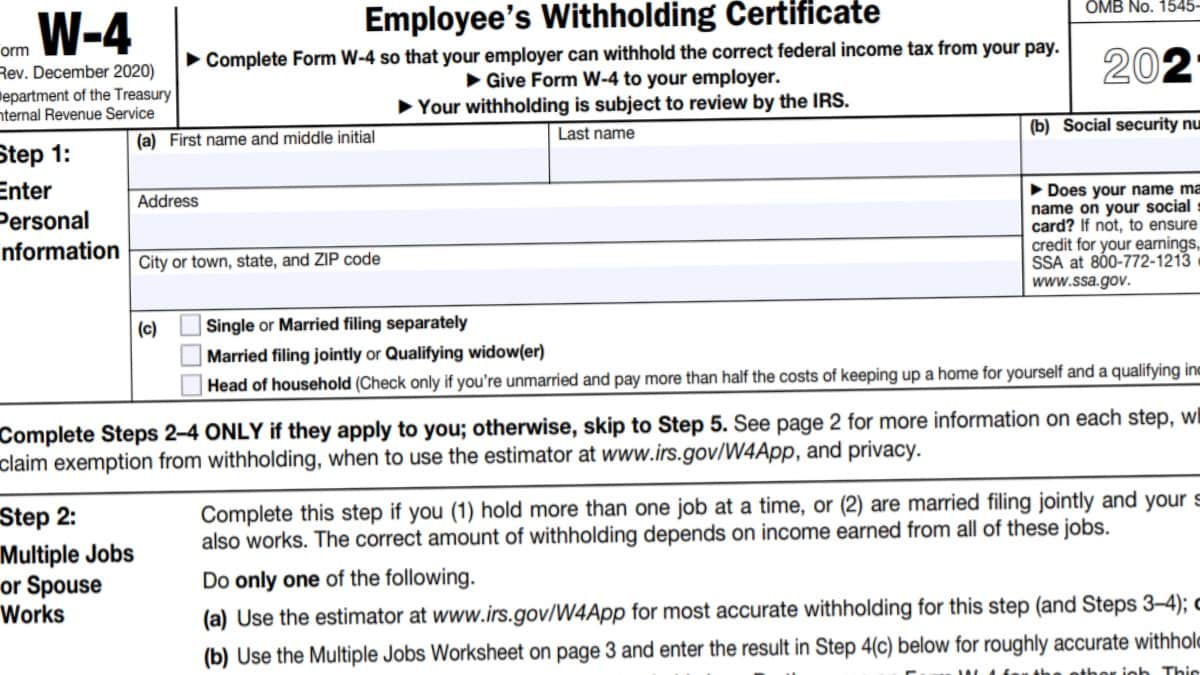

December 2020 Department of the Treasury Internal Revenue Service. Monthly Remittance Form of Tax Withheld on the Amount Withdrawn from the Decedents Deposit Account. The IRS has postponed requirements to begin using these forms until January 1 2023.

You can also distribute Form W-2 electronically. It reflects money earned over the last twelve months and how much payroll tax has been covered. Monthly Remittance Form for Creditable Income Taxes Withheld Expanded 0619-F.

Employees must give you consent to receive their Forms W-2 electronically. The IRS defines a dependent as. In regards to the conversation around W2 vs W4 the W-2 recaps past events and payments.

This additional withholding goes toward your income taxes and helps you right-size your taxes so that you arent underpaying over the year. Claiming dependents on w-4 is a way to get more money from your employer. All employers regardless of how many employees working for them are required to file Form W-2 by January 31st.

You can also check our database to find your W-2 online and have it available at any HR Block tax office. January 31st is the deadline to file W-2s using Business Services Online or to submit paper Form W-2. In case of Form W-4 isnt filed your employer will withhold tax regardless.

IRS Form 1094 1095-BC March 31 2022. When is the Form W4 deadline. A W-2 form is an annual wage and tax statement that is issued by an employer.

Payment Form Under Tax Compliance Verification DriveTax Mapping. IRS Form 1094 1095-BC March 31 2022. The law states that employers are required to furnish copies of all W2 forms and W-3s by January 31 st 2022.

Employees arent presented with a deadline to file Form W4 like the work authorization form Form I9However just because there isnt a deadline to file doesnt mean that you should wait on filing the form. Same as any other year the tax filing deadline in 2021 is April 15 so as the tax payment deadline. IRS Form 1094 1095-BC March 31 2022.

Each person you claim as a dependent will reduce the amount of tax taken out of your paycheck each month and will increase the size of the tax refund at the end of the year. If this date falls on a Saturday Sunday or legal holiday the deadline will be the next business day. The 1st Quarter filing deadline for 2022 Form 941 Employers Quarterly Federal Tax Return is May 2 2022.

Form MA-1099 HC March 31 2022. Monthly Remittance Form for Final Income Taxes Withheld. If Forms W-2 are filed after the deadline the employer will incur late-filing penalties which is 50 per violation.

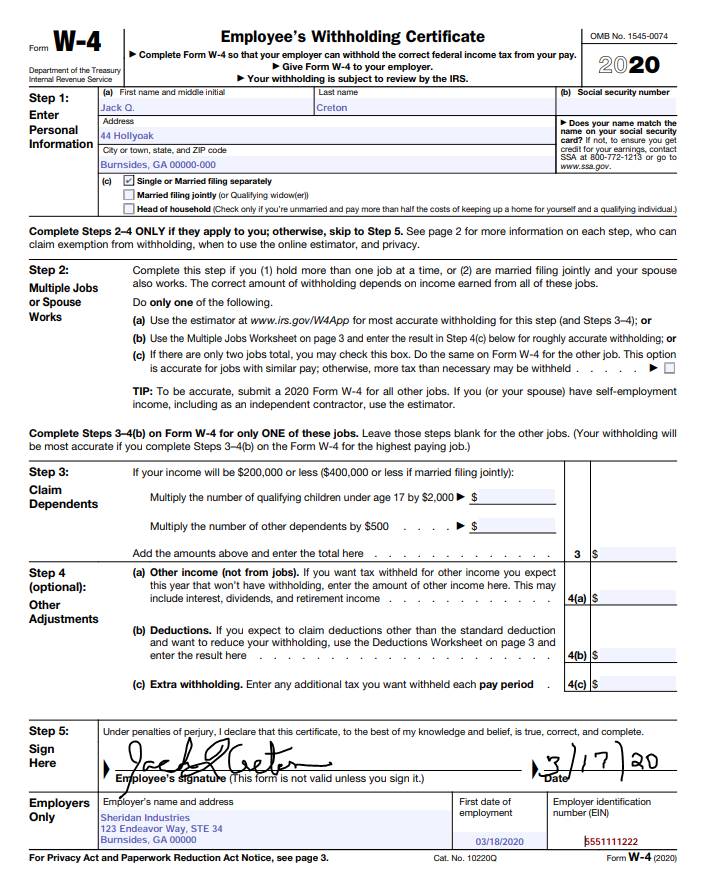

If the date coincides with a weekend or a legal holiday its necessary to submit the document on the following business day. When the Tax Cuts and Jobs Act TCJA was signed into law in December 2017 sweeping changes to Form W-4 became a matter of when not if Those changesarguably the biggest since the form debuted in 1943are finally materializing for the 2020 tax year after a one-year implementation delay prompted by feedback from payroll and tax communities. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it.

ACA 1094 and 1095-BC Reporting Deadline for E-Filing is April 30 2022 for the state District of Columbia. While you must wait for January 27th to file and submit your tax return to the IRS you have a deadline. This is the same date employees can expect to get their Form W-2s to file their tax returns.

As said earlier the W2 form is filled each year by employers. The deadline for these employers to file electronically or on paper or magnetic media is February 28 2020. Ideally youll neither owe a significant amount of money nor get a big refund when you file your tax return in April note that for 2021 the tax filing deadline was extended until May 17.

This year Employers are required to send out their 2021 W2 forms and other related wage statements by February 1 st 2022. A W-2 doesnt make adjustments for the current tax season. Employers filing fewer than 250 Forms W-2 for calendar year 2019 may file electronically or on paper CD or flash drive.

There isnt a specific deadline to file Form W4. A qualifying child or qualifying relative. Deadline Dates to File W-2s.

Also they need to be more or less withheld from a paycheck. Form to file Deadline. In fact there is no deadline to file Form W-4 but you should file one as soon as you can.

Your employees dont have to physically have the forms by that date but the deadline to mail W-2 forms is January 31. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan. First Required Minimum Distribution RMD by Individuals Who Turned 72 in 2021.

Your withholding is subject to review by the IRS. IRS Form 1094 1095-BC April 30 2022. Give Form W-4 to your employer.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Tips for March 2022 Reported to Employer Form 4070 April 18. The rate of income tax withholding is whats going to be troubling you in the long run.

The IRS requires employees to submit their printable W-4 forms to employees by February 15. Employers would need to submit a copy of the W2 form. By law Washington DC holidays impact tax deadlines for everyone in the same way federal holidays do.

Send Copies B C and 2 of Form W-2 to each employee by January 31.

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

How To Help Employees Understand And Fill Out Form W 4 Cpa Practice Advisor

What Is A W4 Form And How Does It Work Form W 4 For Employers

What Is Form W 4 And How To Fill It In In 2022

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

W 4 Form How To Fill It Out In 2022

Irs Extends Tax Deadlines For Victims Of Kentucky Tornadoes News Wdrb Com

How To Help Employees Understand And Fill Out Form W 4 Cpa Practice Advisor

:max_bytes(150000):strip_icc()/w-4formmarriedfilingjointly-b61794485b5e44beab0ee2cfc3c9ae6e.png)

W 4 Form How To Fill It Out In 2022

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Fill Out The New W 4 Form Correctly 2020

Form W 4 How To Adjust Your Income Tax Withholding On Your Paycheck

No comments:

Post a Comment