With signNow it is possible to eSign as many files daily as you require at a reasonable cost. That means that you may download it or simply print out a blank copy to enter information by hand.

W9 Forms 2021 Printable Calendar Template Template Printable Calendar Printables

Use the second link to open a basic form that can be used on a mobile device.

I 9 form 2021 download. On the website while using the form click on Get started Now and go to your editor. W 9 form 2021 download Fill in Modify or Print Tax Forms Instantly. How to accomplish a Form I-9 2021 internet.

Verifying the information on this form and keeping it up-to-date ensures you collected accurate personal information. Form I-9 OMB No. Citizenship and Immigration Services.

Fill out a W-9 in minutes using a step-by-step template. Must complete Form I-9 Employment Eligibility Verification. Click the arrow that displays in the PDF file download box that will appear in the bottom left-hand corner.

Fill out a W-9 in minutes using a step-by-step template. Read instructions carefully before completing this form. The instructions must be available either in paper or electronically during completion of this form.

1615-0047 Expires 10312022 Department of Homeland Security US. The instructions must be available either in paper or electronically. Use the clues to complete the pertinent fields.

Form W-9 should be reviewed and updated yearly. If you want to share the i 9 forms with other people it is possible to send the file by email. Begin automating your eSignature workflows today.

Citizenship and Immigration Services Form I-9 10212019 Page 1 of 4. US Citizenship and Immigration Services Form I-9. City or Town.

Employers are liable for errors in the completion of this form. StateAddress ZIP Code. Simple instructions and PDF Download.

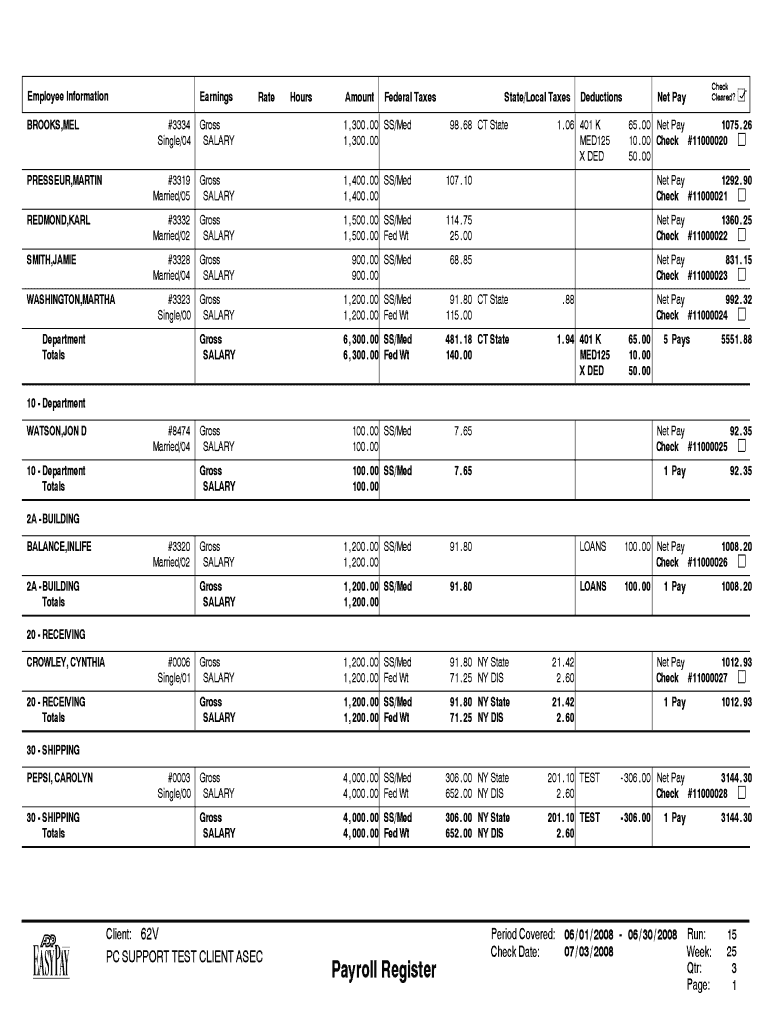

Social Security Number - Date of Birth mmddyyyy Employees E-mail Address. When using a. A W-9 is a tax document released to independent specialists and.

Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file. Read instructions carefully before completing this form. You may also request paper Forms I-9 from USCIS.

A W-9 is a tax file provided to independent specialists and freelancersInfo about Form W-9 Request for. Read instructions carefully before completing this form. Employers must complete Section 3 when updating andor reverifying Form I-9 Employers must reverify employment authorization of their employees on or before the work authorization expiration date recorded in Section 1 if any Employers CANNOT specify which documents they will accept from an employee.

Expires 10312022 START HERE. Make absolutely sure that you choose to enter appropriate data and quantities in acceptable fields. Form I-9 is one of the forms thats mandatory for all new employees.

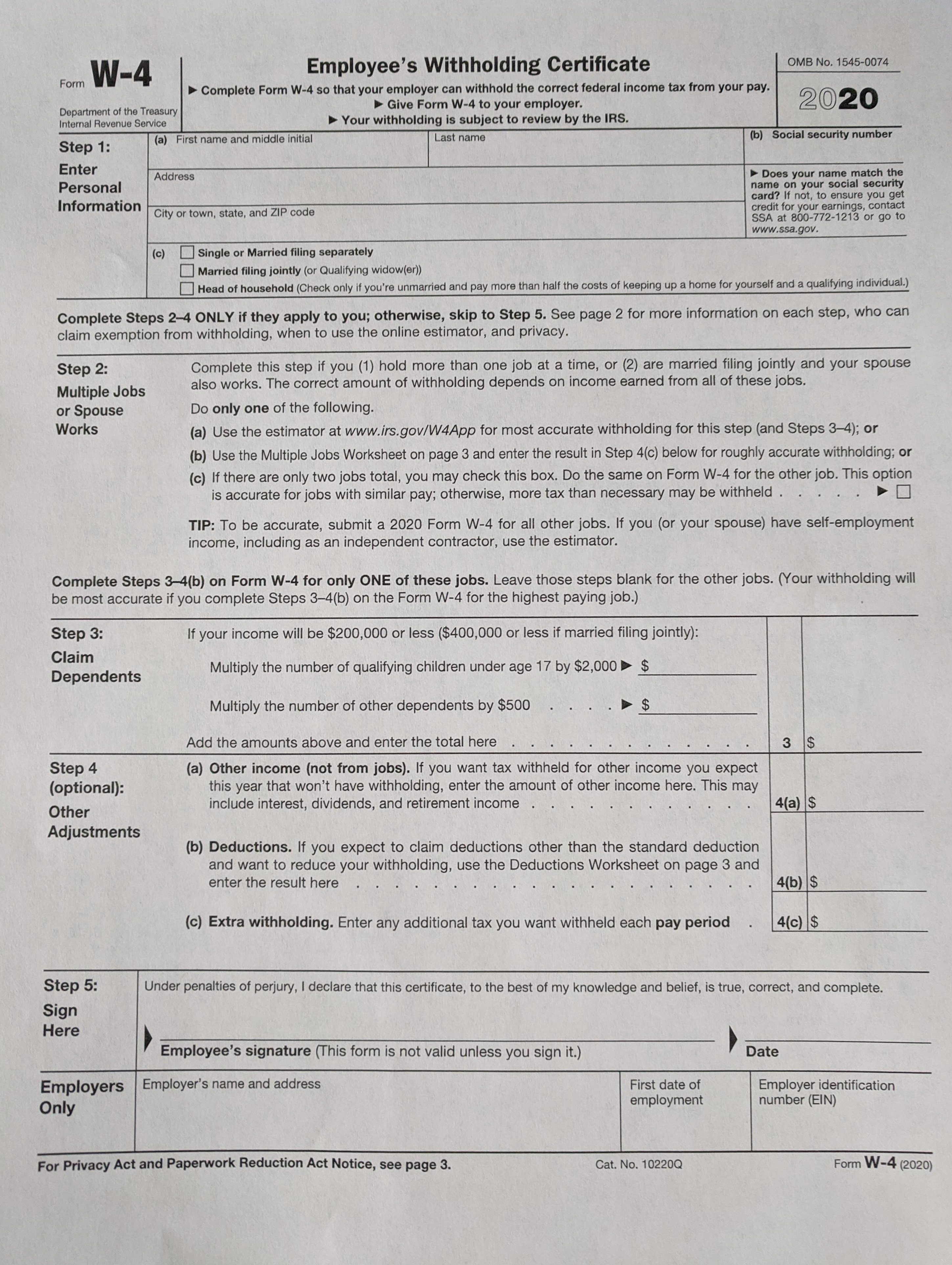

Its the first day for your brand new employee and theres an alphabet soup of forms for them to fill out before they can start work. Employers must retain completed Forms I-9 for three 3 years after the date of hire or one 1 year after the date employment ends whichever is later. Certain features of Form I-9 that allow for data entry on personal computers may make the form appear to be more than two pages.

Fill out a W-9 in minutes utilizing a detailed template. Form I-9 10212019 Page 1 of 3 Employment Eligibility Verification Department of Homeland Security US. Include your own info and get in touch with details.

To download the form from the Chrome web browser. Form I-9 OMB No. Download the resulting document.

Open the form that appears in your Download folder. W 9 form 2021 print free Submit Modify or Print Tax Forms Instantly. 1615-0047 Expires 08312019 Form I-9 11142016 N Page 1 of 4 STARTHERERead instructions carefully before completing this form.

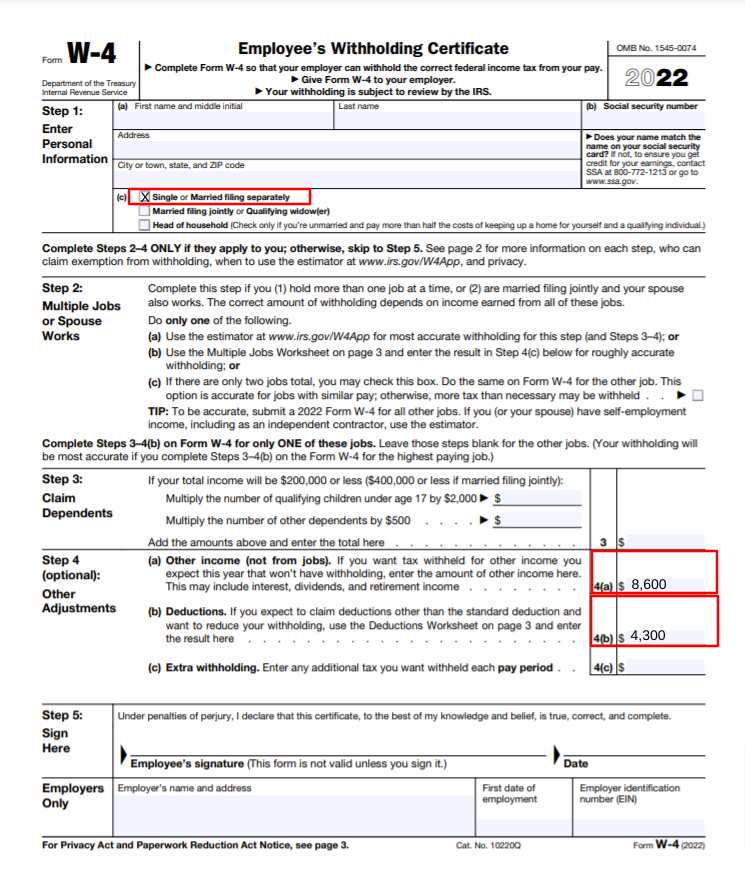

Information about W 9 form for 2021 printable Request for Taxpayer Identification Number TIN and Certification consisting of recent updates related forms and guidelines. Request for Taxpayer Identification Number 2021 Form W-9 is used for requesting the correct taxpayer identification number of individuals and businesses. Updated January 28 2021.

Select Show in folder from the drop-down that appears. Details about Free printable 2021 w 9 form Request for Taxpayer Identification Number TIN and Certification including recent updates associated forms and directions. Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS.

The instructions must be available either in paper or electronically. Info about W 9 form 2021 print free Request for Taxpayer Identification Number TIN and Certification including current updates associated kinds and instructions. To use the enhanced features of Form I-9 use the first link to download the form and save it your computer.

The instructions must be available either in paper or electronically during completion of this form. Details about W 9 form 2021 download Request for Taxpayer Identification Number TIN and Certification including current updates associated types and instructions. A W-9 is a tax file provided to independent specialists and freelancersDetails about Form W-9.

Form I-9 will help you verify your employees identity and employment authorization. Federal law requires that every employer who recruits refers for a fee or hires an individual for employment in the US. Form I-9 is a fillable form which means you can type your answers directly on the form instead of writing them by hand.

Document format pdf that is fillable and savable. Click the link to the Form I-9 you wish to download. 1615-0047 Expires 10312022 Employment Eligibility Verification Department of Homeland Security US.

Fill out a W-9 in minutes using a step-by-step template. A W-9 is a tax document issued to independent specialists and freelancersDetails. A W-9 is a tax file provided to independent contractors and.

Info about Irs w 9 2021 Request for Taxpayer Identification Number TIN and Certification consisting of recent updates related forms and directions. The W-9 Form is an essential tool for employers to gather information about contractors for income tax purposes. Kalvisolai job alert 2021 kalvisolai current affairs 2021 pdf tnpsc video materials tnpsc audio materials forms download tamil fonts download rh.

W 9 form for 2021 printable Submit Change or Print Tax Forms Instantly. Expires 10312022 START HERE. Fill out a W-9 in minutes utilizing a step-by-step design template.

Assume you hired someone to do. Employers are liable for errors in the completion of this form. Citizenship and Immigration Services Form I-9 10212019 Page 1 of 3 START HERE.

The data is used to generate a 1099-MISC. Form I -9 OMB No. Irs w 9 2021 Complete Modify or Print Tax Forms Instantly.

The Form I-9 may be signed and retained electronically as authorized in Department of Homeland Security regulations at 8 CFR 274a2. It is used in any given situation where the requester needs the taxpayer identification number of whom requested. Employees Telephone Number Street Number and Name Apt.

Photocopying and Retaining the Form I-9. Free printable 2021 w 9 form Submit Modify or Print Tax Forms Instantly.